Thirteen types of REIT stocks and how to invest in them offer important insights for potential REIT buyers.

Thirteen types of REIT stocks and how to invest in them offer important insights for potential REIT buyers.

Types of REIT Stocks

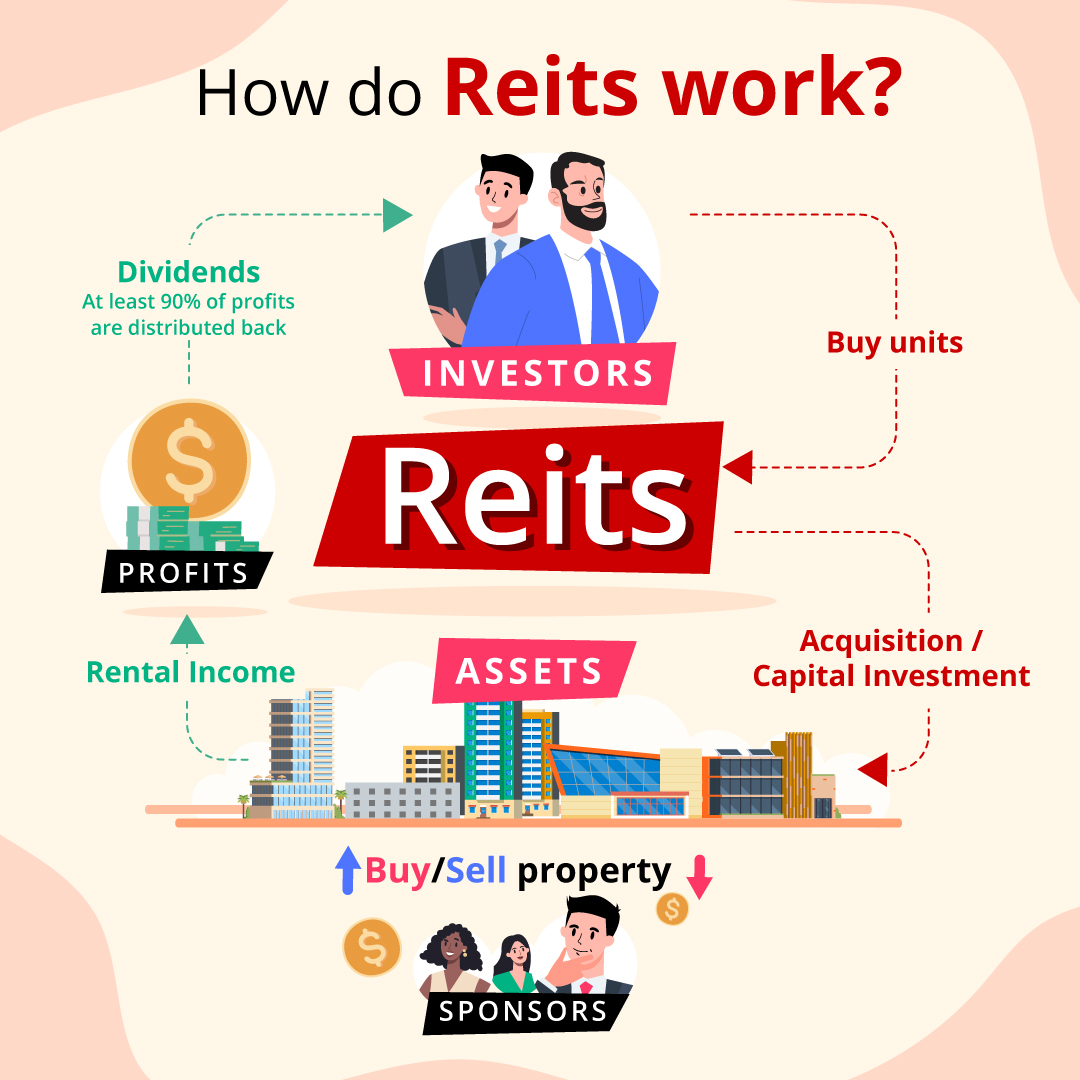

A REIT owns, operates, or finances income-producing real estate. There is a wide range of property types that REITs invest in, including apartment buildings, warehouses, offices, retail centers, medical facilities, data centers, hotels, cell towers, timber and farmland.

Generally, REITs follow a straightforward business model: the company buys or develops properties and then leases them to collect rent as its primary source of income. However, some REITs do not own property, choosing the other route of financing real estate transactions. These REITs generate income from the interest earned on the financing.

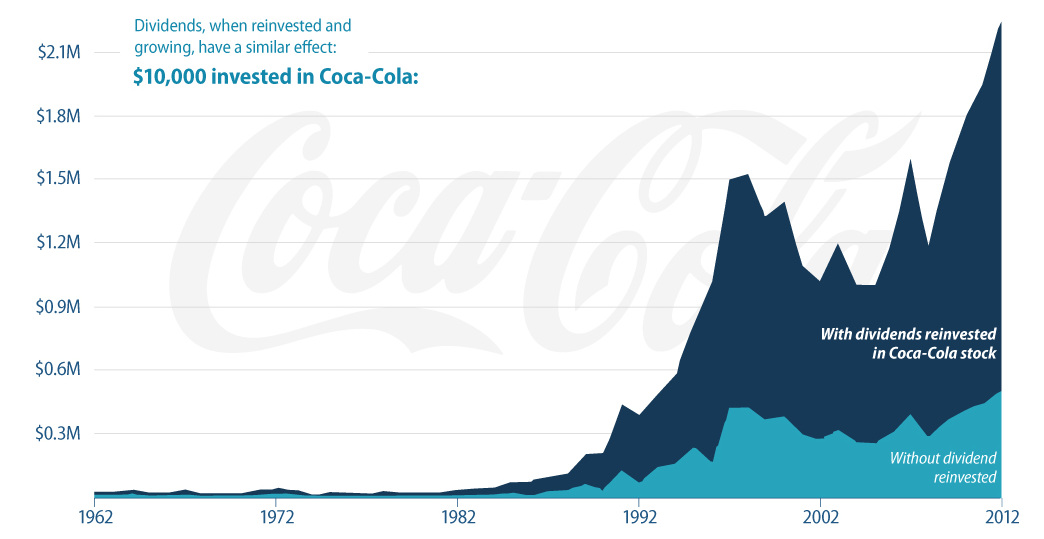

REITs are required by law to distribute more than 90% of their earnings via dividends. This can make them incredibly profitable for investors and provide a steady stream of cash flow via regular, high dividends.

Investors can buy shares in a REIT company, the same way shares can be purchased in any other public company. Investors can buy REIT shares on major public exchanges such as the NYSE or NASDAQ.