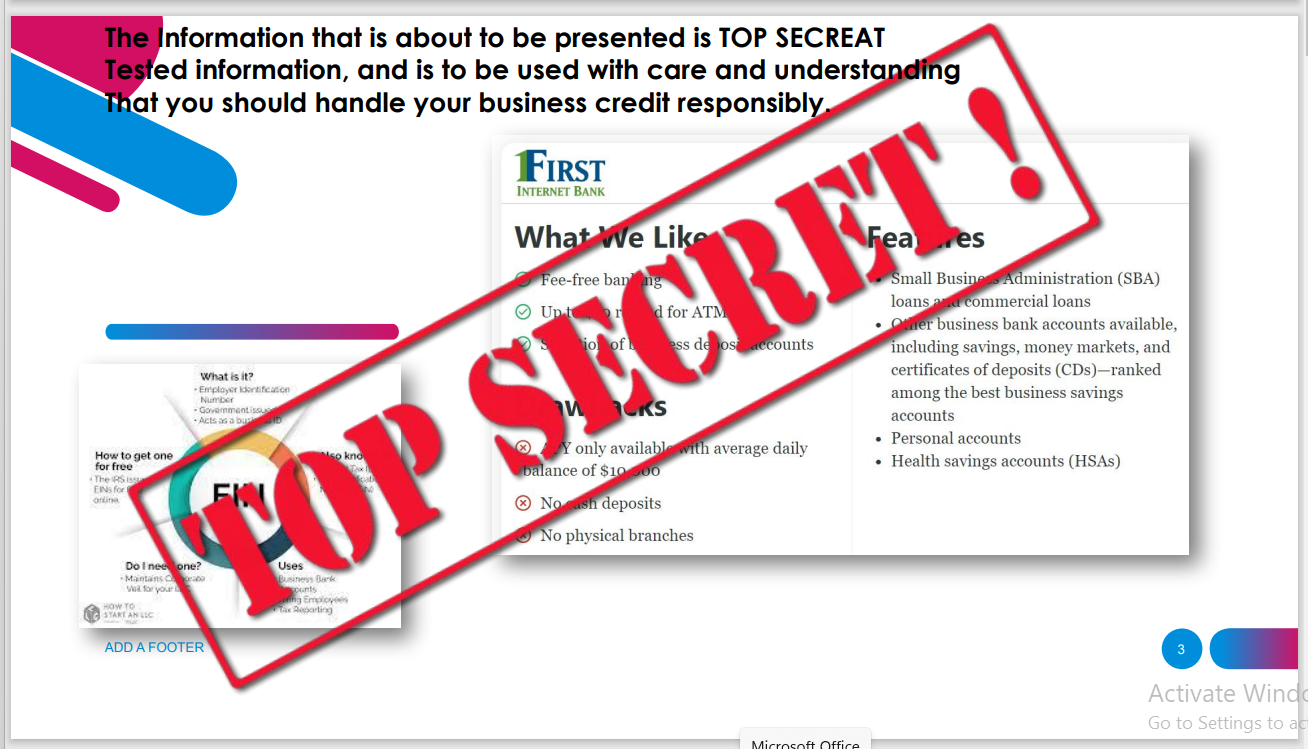

4 Guarenteed Ways to Open a Business Account With Your EIN ONLY!

On Sale

$10.00

$10.00

Having access to business credit is the lifeline for a business. It enables you to obtain the capital you need to expand, cover day-to-day expenses, purchase inventory, hire additional staff, and allows you to conserve the cash on hand to cover your cost of doing business.

Taking the necessary steps to build business credit means your business will have more financial opportunities. Banks, lenders, and suppliers rely on business credit reports to assess a company's creditworthiness. You create a safety net with strong business credit for your business, so you should have no trouble gaining access to the business funding you need.

The main reason why business banking is an important step in establishing business credit: If you don’t have any accounts with payment history, you’ll likely have no business credit report or a report with a low credit score.

Taking the necessary steps to build business credit means your business will have more financial opportunities. Banks, lenders, and suppliers rely on business credit reports to assess a company's creditworthiness. You create a safety net with strong business credit for your business, so you should have no trouble gaining access to the business funding you need.

The main reason why business banking is an important step in establishing business credit: If you don’t have any accounts with payment history, you’ll likely have no business credit report or a report with a low credit score.