BANK PRODUCTS & TAX LOANS TRAINING WORKBOOK $ ANSWERS

This training workbook provides an overview of key bank products and tax loan services commonly offered in the tax preparation industry. It is designed to help tax professionals understand how these financial products function, how to explain them to clients, and how to comply with regulatory guidelines.

Included Topics:

- Overview of refund transfer products (RTs), refund advances, and prepaid cards

- Explanation of tax loan options: eligibility, terms, and repayment

- Compliance and disclosure requirements

- Client communication best practices

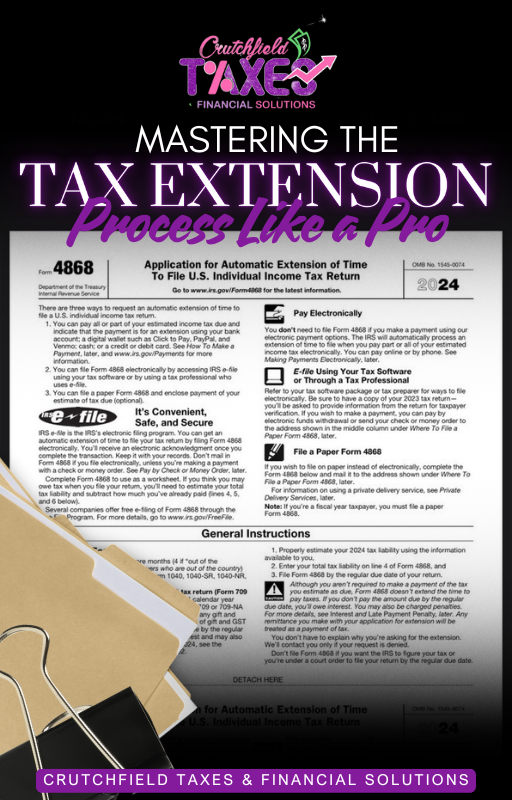

- Step-by-step guidance for product setup in tax software

- Frequently asked questions (FAQs) and troubleshooting tips

Purpose:

To equip tax preparers with the knowledge and confidence to responsibly offer bank products and tax loans, ensuring a smooth client experience during tax season.