Data Analysis in Financial Modeling

Data analysis is the engine that powers effective financial modeling. Without accurate and insightful analysis, even the most sophisticated models risk becoming unreliable. In today’s data-driven world, mastering data analysis is essential for professionals in investment banking, corporate finance, and entrepreneurship. It ensures that models are not only technically sound but also grounded in real-world evidence.

At its core, data analysis involves collecting, cleaning, and interpreting financial information to uncover trends and patterns. Raw data often contains inconsistencies, missing values, or irrelevant details. Analysts must refine this information to ensure accuracy before integrating it into financial models. This process enhances the reliability of forecasts, valuations, and investment decisions.

One of the most important aspects of data analysis is data cleaning. This step involves removing errors, standardizing formats, and ensuring consistency across datasets. For example, when analyzing revenue streams from multiple regions, discrepancies in currency or reporting standards must be corrected. Clean data forms the foundation for meaningful insights.

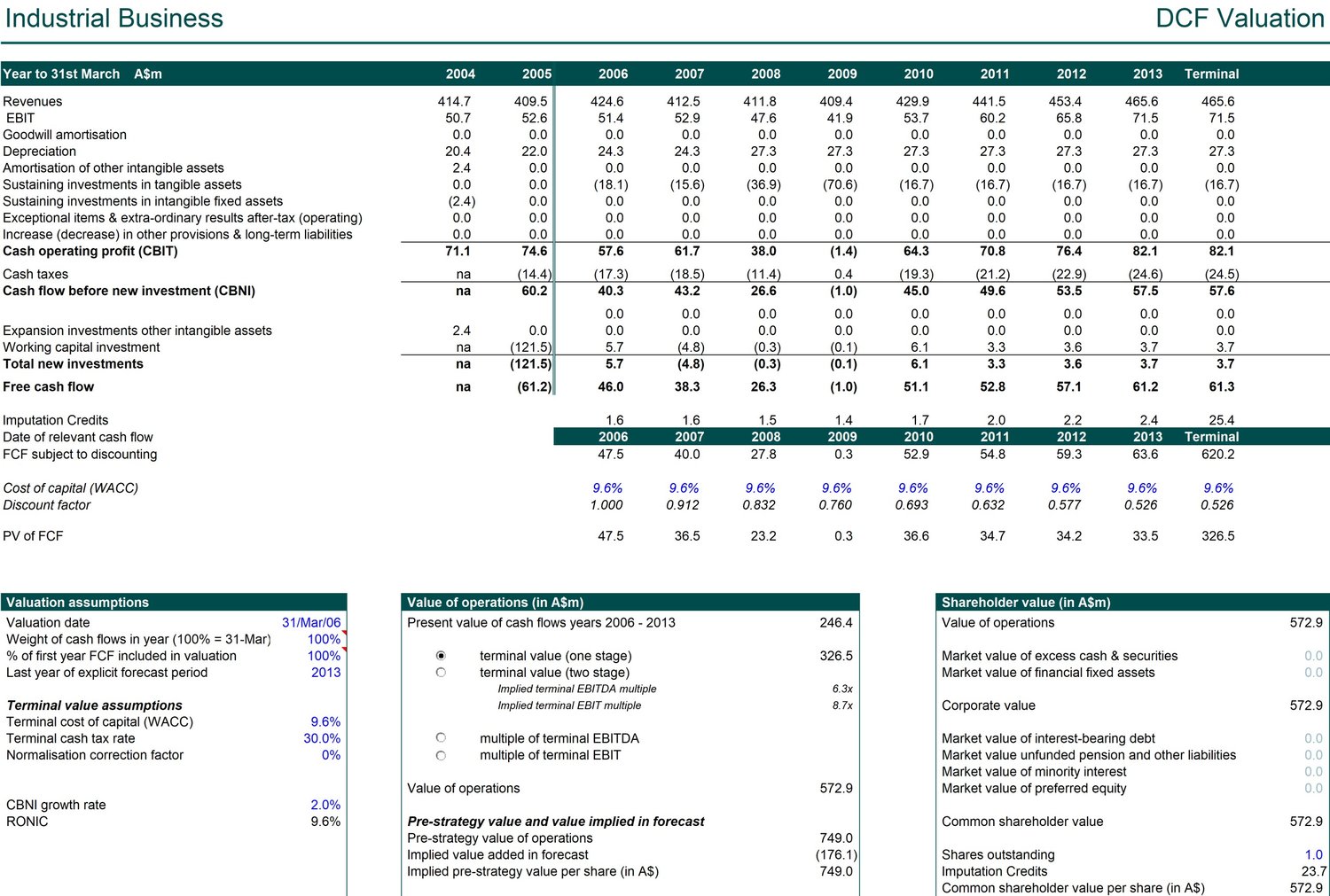

Another critical component is data visualization. Charts, graphs, and dashboards help professionals identify trends and communicate findings effectively. Visualization transforms complex datasets into clear, actionable insights. For instance, a line chart showing revenue growth over time can highlight seasonal fluctuations or long-term trends that may not be obvious in raw numbers.

Advanced data analysis also incorporates statistical techniques such as regression analysis, correlation studies, and variance analysis. These methods allow professionals to identify relationships between variables, test assumptions, and measure risk. For example, regression analysis can reveal how marketing spend influences sales growth, providing valuable input for forecasting models.

Consider a venture capital firm evaluating a startup. By analyzing customer acquisition data, retention rates, and revenue growth, the firm can identify whether the startup’s business model is sustainable. Data visualization highlights trends in user engagement, while statistical analysis tests the impact of pricing changes on profitability. This comprehensive approach ensures that investment decisions are based on evidence rather than intuition.

Expert-led courses in financial modeling emphasize data analysis as a core skill. Learners are guided through practical exercises involving real-world datasets, teaching them how to clean, interpret, and visualize information. These courses also highlight common pitfalls, such as relying on incomplete data or misinterpreting correlations. By mastering data analysis, professionals gain the ability to build models that are both accurate and insightful.

The career impact of strong data analysis skills is profound. Professionals who excel in this area are trusted to provide clarity in complex financial environments. They can identify opportunities, mitigate risks, and guide organizations toward sustainable growth. For entrepreneurs, data analysis strengthens their ability to present credible financial models to investors, increasing their chances of securing funding.

Ultimately, data analysis is more than a technical skill — it is a strategic advantage. It transforms raw information into actionable insights, ensuring that financial models reflect reality and support sound decision-making. In the fast-paced world of finance, mastering data analysis is essential for anyone seeking to excel.