Easing into EasyLanguage - ORBO Day Trade Framework

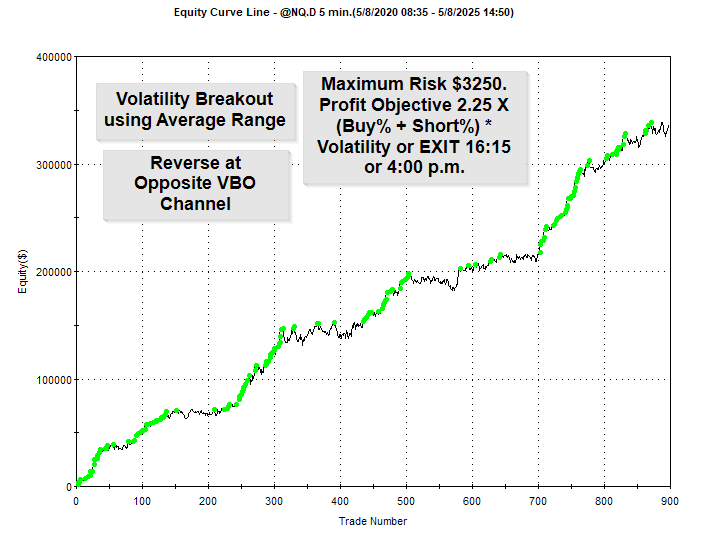

The open range break out has been used for decades. Not for just trading the stock indices, but for many different markets. The algorithm lost some of its luster when the markets transition from open outcry to fully electronic. However, where there is volatility there are breakouts. The end result of Module #3 is the highly customizable ORBO framework. The tool itself is quite powerful. However, learning how to program such a research tool that can test millions of different combinations of inputs, is even more powerful. In this module, you will get the following.

- 2+ house of video instruction [3 videos in all]

- 40-page manual that details almost every line of code

- Two strategies that can be optimized/customized to test anything you can dream up

- Buy after two down closes

- Buy Mondays and Sell Shorts on Fridays

- Only trade after and inside day or a narrow range

- 5, 10, 15, 20, 25... minute breakouts [made famous by Jake Bernstein]

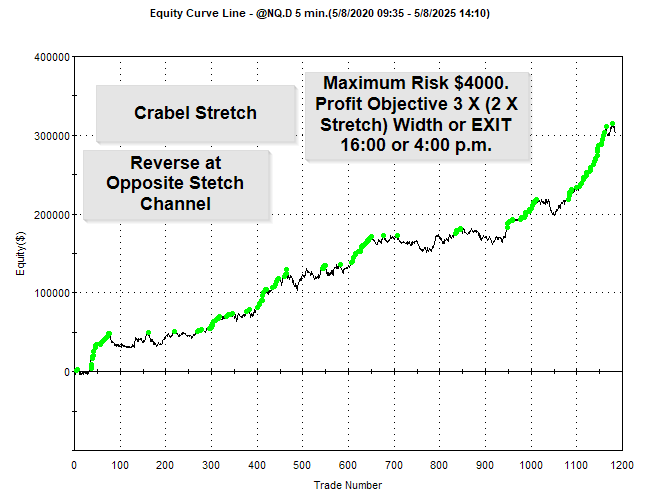

- Does the Crabel Stretch still apply

- Is volatility a good value to base the breakout

- Fixed $ stop or profit objective or break even

- Market derived stop or profit objective or break even

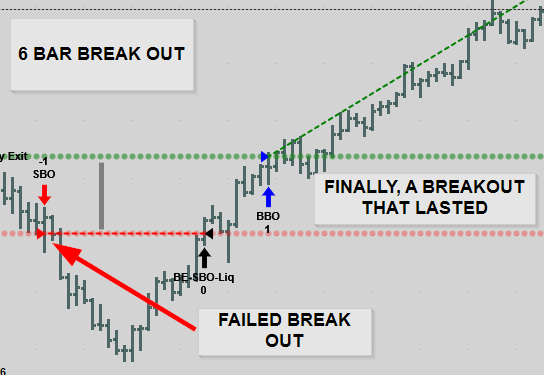

- Buy the breakout and sell short at the other side if it fails

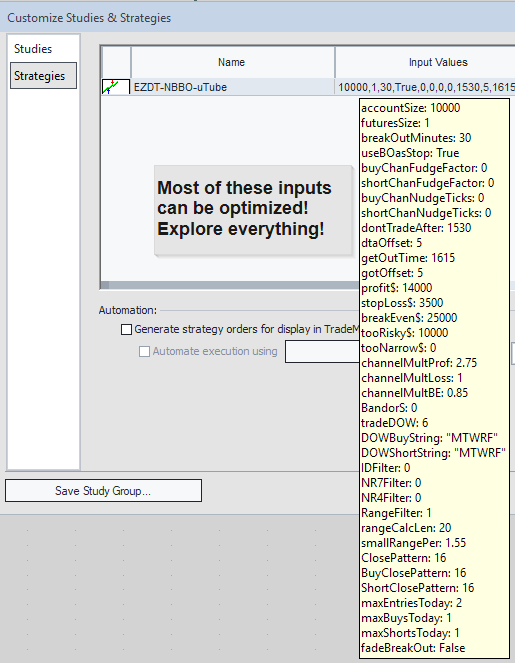

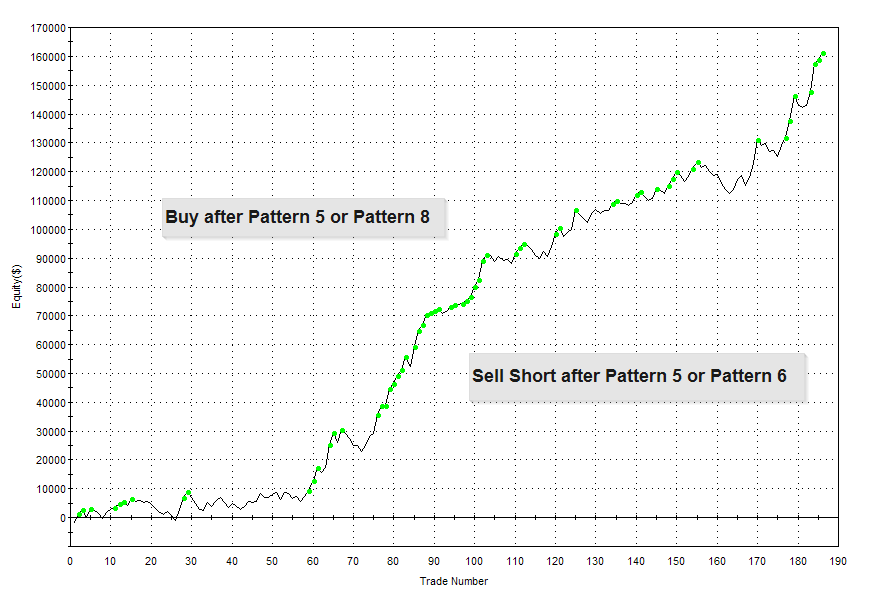

All these "What-Ifs" are programmed for you. Learn how George can optimize on each day of the week. See how a mini–Pattern Smasher has been included to test prior day closing relationships. Control the number of times you go long and go short within the trading day.

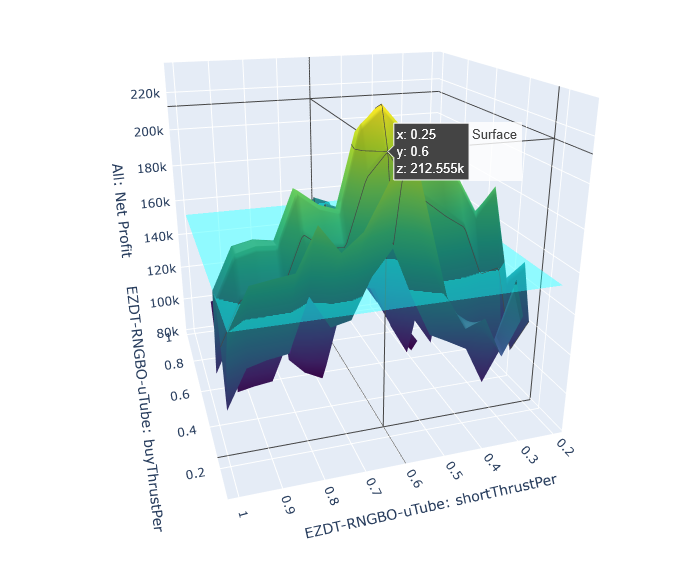

Pick robust parameter sets by utilizing Robert Pardos Prioritized Step Search. You can only do this if you can visualize a surface plot of a 2X2 optimization. A python script and its associated executable are also included.

Add to your day trading knowledge by reading George Easing into EasyLanguage Daytrade Edition. The book and its associated tools and videos are also included.