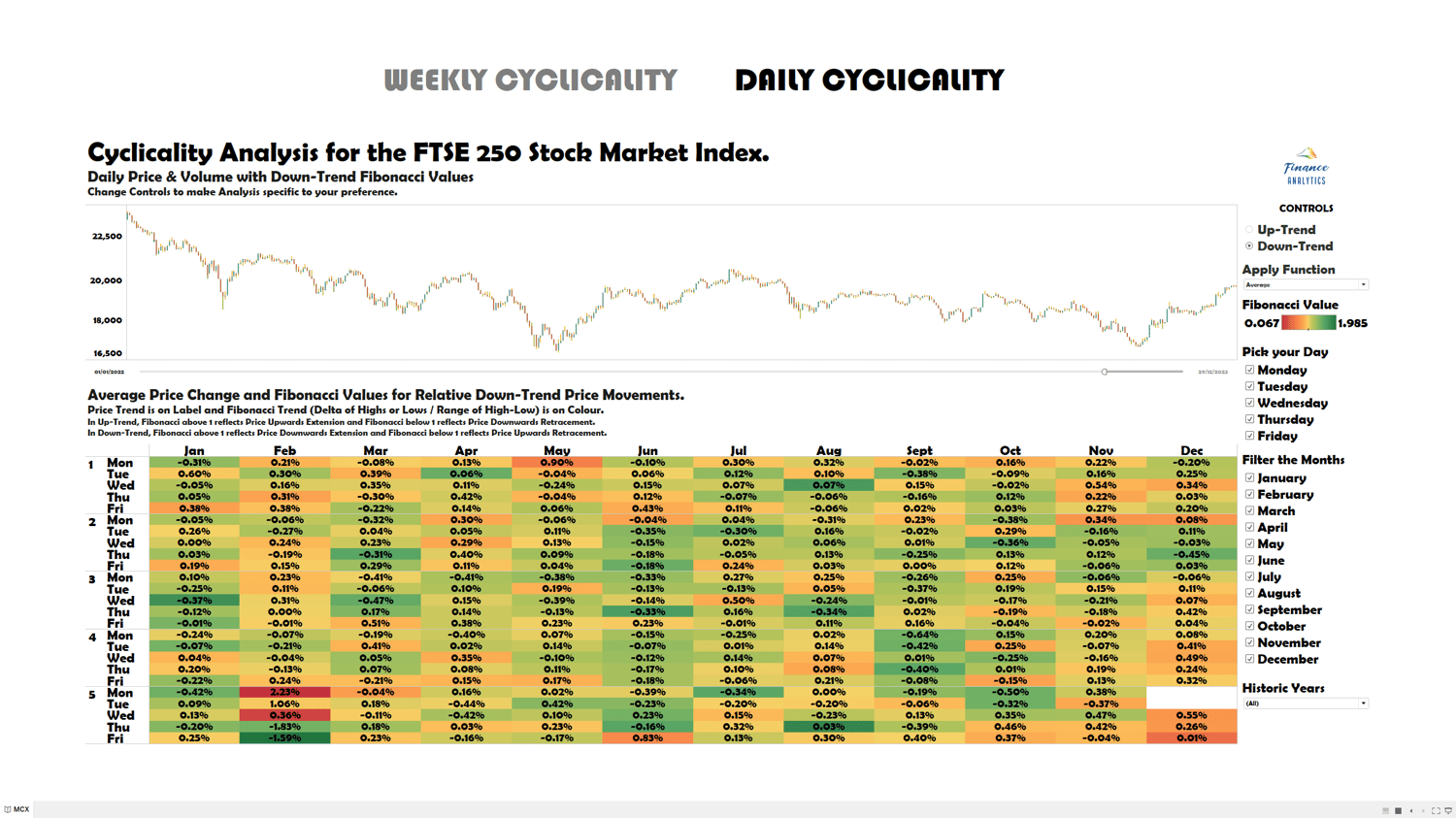

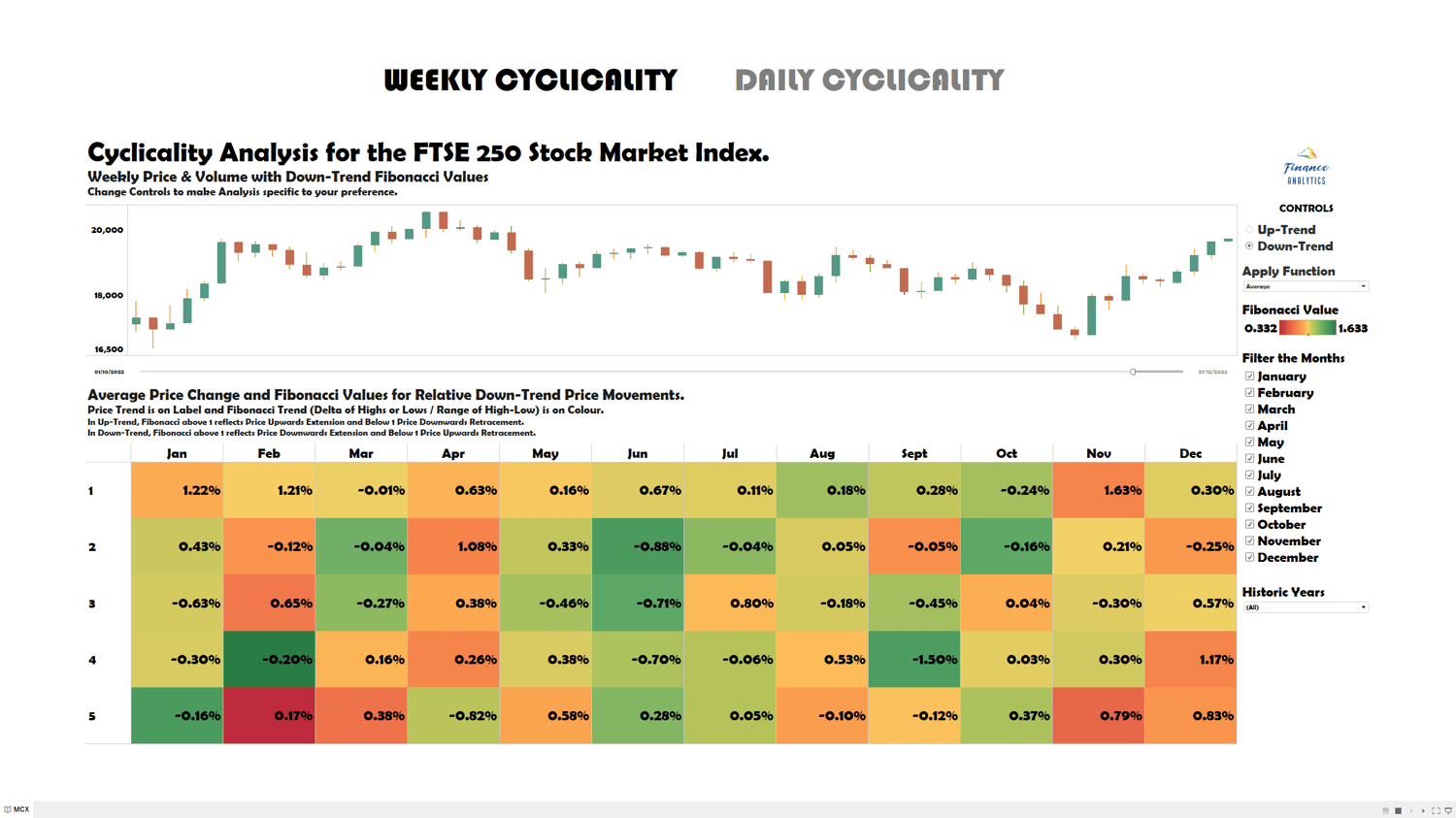

Cyclicality Analytics - MCX Index FTSE 250

Cyclicality Analytics for FTSE250 Stock Market Index.

How to Interact with the Weekly and Daily Price-Volume Chart and investigate the Fibonacci Values?

The Heat-Map Labels Historical Price Performance, while presents favourable entry point periods with a Green Colour based on Fibonacci Values.

- Toggle Up-Trend | Down-Trend conditions depending on your market bias Long or Short

- In Uptrend/Long conditions, favourite periods where Fibonacci is Above 1 for Extension

- In Downtrend/Short conditions, favourite periods where Fibonacci is Above 1 for Extension

- Filter for Days, Weeks, Months and Years since Inception, to the latest records in Google Finance

- Apply 7 Mathematical Functions (Average, Median, Minimum, Maximum, Sample Size, Standard Deviation, Variance)

How Fibonacci is Calculated

During Up-Trend the Price needs to be BELOW Previous Day's HIGH for a Fibonacci Retracement and ABOVE Previous Day's HIGH for a Fibonacci Extension Value.

During Down-Trend the Price needs to be ABOVE Previous Day's LOW for a Fibonacci Retracement and BELOW Previous Day's LOW for a Fibonacci Extension Value.

In Up-Trend, Fibonacci above 1 reflects Price Upwards Extension and Below 1 Price Downwards Retracement.

In Down-Trend, Fibonacci above 1 reflects Price Downwards Extension and Below 1 Price Upwards Retracement.