Force Your Income To Obey You

On Sale

$11.00

$11.00

You don’t have to earn a financial degree to force you money to behave and listen to you

In less than 2 hours, learn all money knowledge that took financial advisors 10 years to learn

Here, I want to help you build financial knowledge about money to take the correct decision at the right time

When you picture yourself, you probably seeking to spend your income wisely and still have money left to save and invest for future

I bet you don’t picture that person inside you who prays to pay all monthly bills hoping not to be in deficit as every month is different than the other

You know you spend your income haphazardly without any solid plan for investing your money but you don’t know what to do about it

All these messes regarding money knowledge are stealing your peace of mind and the joy of your happy moments, it’s an instant mood killer

What do you do? restore your life back to a better one financially and emotionally with your beloved one (Yes, #1 dispute to your relationship are due to money issues)

Or worse, start to get annoyed incurring debt and continue to lose hours of sleepless nights

What makes things worse, during your last visit you and your wife to a couple of friends, they decide to show you their pictures taken on recent trip to Hawaii

Your curiosity urges you to know how they paid for the trip, especially you know they work in decent jobs not like yours

On your way back home, your wife tells you on her side chat with your friend’s wife, she confirmed this trip was paid in full, they manage to save for these trips to avoid credit cards debt

What is the solution to this lingering money issue?

With Turn Extravagant Into Investor eBook, It is not going to teach you how to save money but it is going to change your mindset about money

You’ll stop thinking that money is a struggle all the time

Also, you don’t have to deprive yourself from buying things that satisfy your hobby or avoid taking your wife to restaurants so as not to make things worse

You’re going to end those days, I am going to show you the true purpose of saving money and investing

Especially when you understand the core behind avoiding debt and the deep meaning behind saving money especially for retirement and kids’ education

For 11 years, I was saving money just to avoid feeling guilty and now I am following these techniques with the intention of having “a future financial life that is heading into the right direction”

What is inside this toolkit?

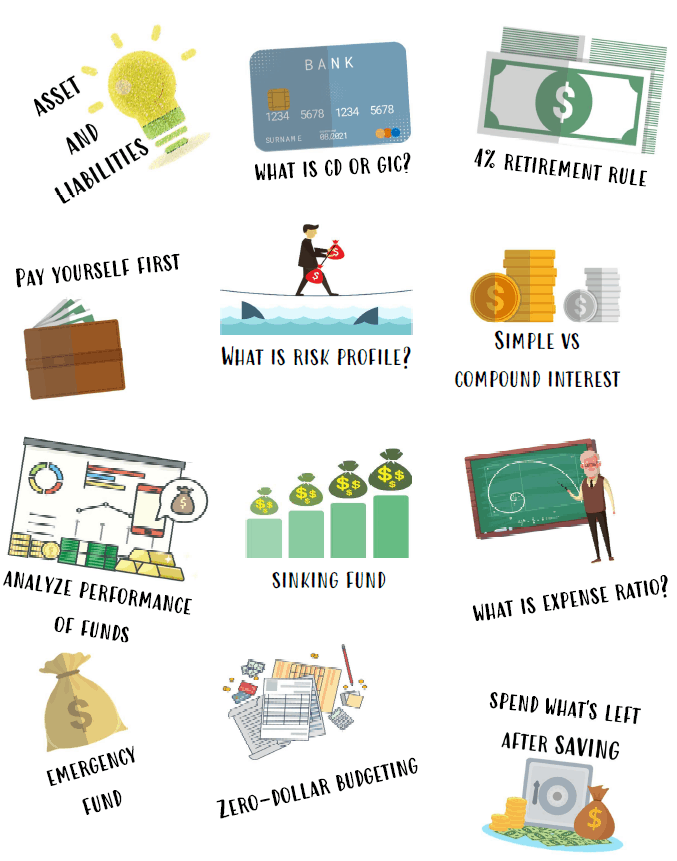

Inside Turn Extravagant Into Investor eBook, consists of 5 chaptersBelow is a summary of important topics of what to expect to see inside, there is way more than that

Chapter 1 is about understanding Money

- Why people fall in debt while others don't

- Difference between Liabilities and Assets - if you understand the difference between them, I am sure it will make a huge difference regarding your perspective about possession

- How to guarantee your money saving task on monthly basis

- Why you need a budget?

- How to reduce your expenses?

- Reducing expenses vs increasing your income

- Starting your first budget

- How to effectively track all expenses?

- How retirement works for you?When you will be able to retire?

- What is the saving rate?

- What is the 4% rule?

- How much to invest annually to reach $1,000,000?

- What is the worst luck for a novice investor?Golden rules of Investing.

- What is your investment plan?

- What is your risk profile?

- What are the various investment types?

- How to know your risk profile?

- What are the main issues facing every investor?

- What is the solution to the above issues facing investors?

- Why mutual funds and not any other investment?

- Let us begin analyzing all mutual funds

- Let us analyze performance of funds

Bonus included with your purchase

Tracking Your Bills – PDF

You will get Tracking your Bills - PDF file of value $7

This is a step by step guide on how to reduce your bills with tested methods

It includes control your bills PDF where you can list all of your bills

and

Bills on your calendar to mark your bills due date on monthly basis

This product is not for these buyers

- This product will show you the way on saving money, budgeting and investing the right way, but it will not magically force you to take any action

- If you think, it teaches trading in stocks, it doesn't do that

- This product is not designed to brainwash your mind into taking any action, it shows you the right steps to take for your life towards money

Frequently Asked Questions

How will I receive this product?

Once you purchase this ultimate budget, you will receive an email containing the digital downloadYou will also receive lifetime access to any updates I make to this ultimate bundle

Is there a money back guarantee?

This is a digital product, this means you already have it so it cannot be returnedAnyway if you still feel that you wasted your money

Just email me and I will refund you