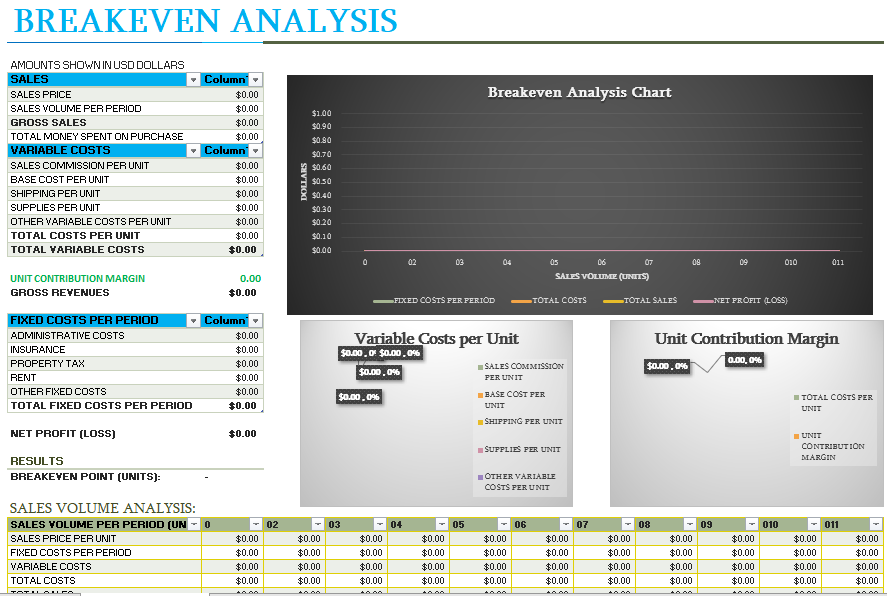

Breakeven Model Template

A breakeven analysis is a financial tool used to determine the sales volume required for a business to cover its total costs, resulting in neither a profit nor a loss. This analysis is crucial for understanding a business's financial viability and making informed decisions about pricing, production levels, and cost-cutting measures.

The breakeven point is calculated by dividing the total fixed costs by the contribution margin per unit. The contribution margin is the difference between the selling price per unit and the variable cost per unit. Fixed costs are expenses that remain constant regardless of the level of production, such as rent, salaries, and insurance. Variable costs are expenses that change in proportion to the level of production, such as raw materials and direct labor.

By calculating the breakeven point, a business can assess its financial health and determine the minimum sales volume needed to survive. If a business is unable to achieve its breakeven point, it may need to adjust its pricing, reduce costs, or increase sales volume to avoid financial losses.

Breakeven analysis can also be used to evaluate the impact of changes in pricing, costs, or sales volume on a business's profitability. For example, a business can use breakeven analysis to determine the minimum price increase needed to cover a rise in variable costs or to assess the impact of a marketing campaign on sales volume.