Cumulative Tax & NI Calculator – UK Payroll 2026/27 (Excel Template)

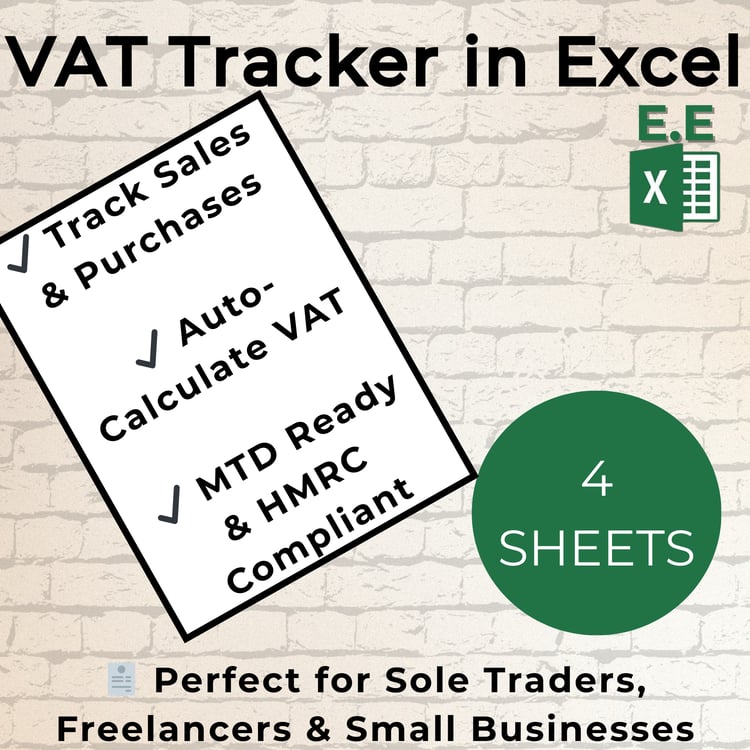

Take the stress out of payroll with this ready-to-use Excel template designed for UK small business owners, bursars, and payroll administrators. Track monthly Gross Pay, Income Tax, Employee NI, and cumulative totals automatically for each employee. Visualise deductions with a clean dashboard and stay compliant with the 2026/27 payroll thresholds.

✅ Key Features:

- Automatic calculation of Tax This Month and NI This Month

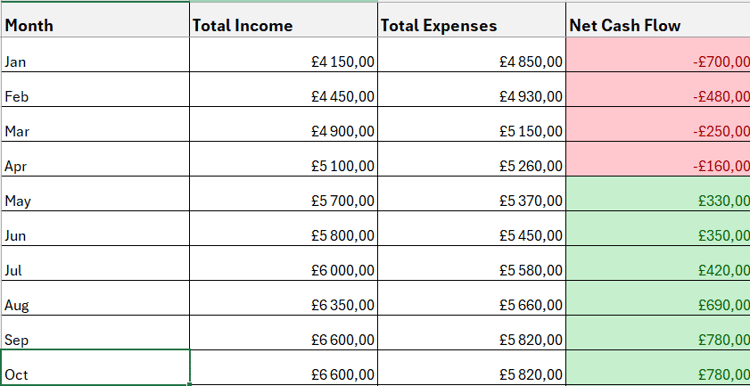

- Running totals with Cumulative Tax & NI per employee

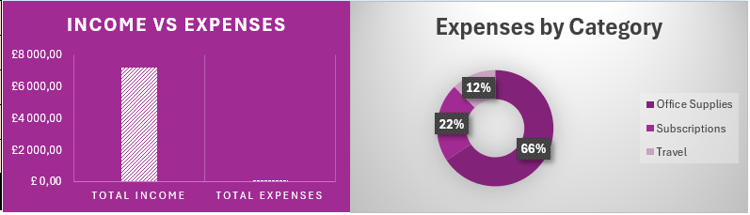

- Monthly payroll dashboard for quick visual insights

- Handles multiple employees in one workbook

- Includes a bonus reference sheet for thresholds and rates

- Fully editable – adjust formulas to suit your payroll setup

📊 Why You’ll Love It:

- Save time each month with accurate, automated calculations

- Reduce payroll errors and simplify HMRC reporting

- Perfect for schools, small businesses, and finance professionals

- Works for any payroll year — just update thresholds if needed

💾 What You Get:

- 1 x Excel Template (.xlsx)

- Payroll Summary sheet

- Cumulative Dashboard sheet

- Tax & NI Reference sheet

📥 How to Use:

- Enter employee names and monthly gross pay.

- Formulas automatically calculate monthly Tax & NI.

- View cumulative totals and dashboard charts to monitor payroll.

💬 Note:

This is a digital download. No physical product will be shipped.