Black Friday 2025 Bundle

Black Friday and Cyber Monday Special 2025

Bundle and Save - All this for just $99

SAVE $117 that is over 54% off!

Pattern Smasher 2025 - Major upgrade VIDEO

PatternSmasher 2025

- Doesn’t just test one pattern – it opens up an entire universe of them.

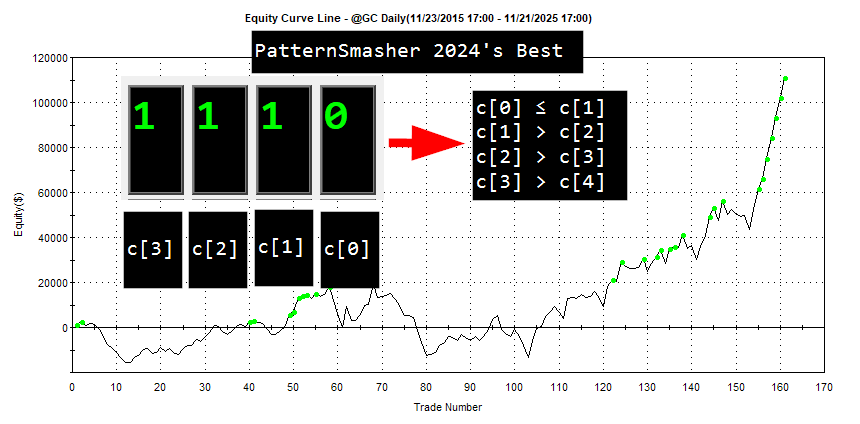

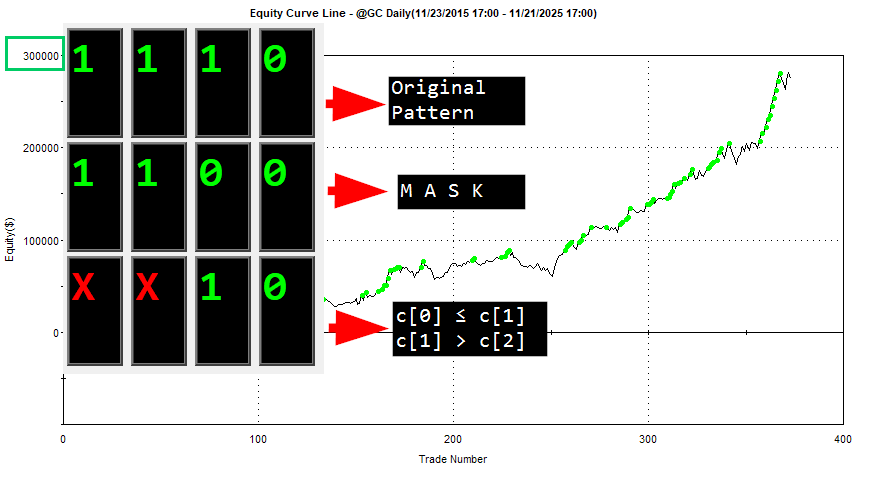

- You define up to eight True/False conditions in EasyLanguage – they can be candles, indicator crossovers, volatility filters, regime flags, time-of-day, whatever you want. PatternSmasher encodes those into multi-bar binary patterns and then exhaustively tests what happens after every pattern that actually occurs in your data.

- With the built-in masking technology, you’re not limited to one “perfect” pattern definition. You can switch individual conditions on or off and instantly roll many detailed patterns up into broader families. Want to know how all patterns behave where the last three conditions are true, regardless of what happened earlier? Mask out the early bits and PatternSmasher shows you the combined stats. Zoom in for highly specific setups, or zoom out to see big-picture tendencies – without rerunning a single test.

- The result is a playground for pattern research. You can explore short-term continuation vs. reversal, strong closes after volatility expansions, behavior after gaps, trend-vs-range regimes, long-only vs. short-only patterns, and much more – across any market and timeframe you can chart in TradeStation or MultiCharts. Instead of arguing about which setup “looks good,” PatternSmasher 2025 lets you map and measure an entire landscape of patterns and their forward returns, all from simple True/False formulas you already know how to write.

- PatternSmasher-2025 includes

- PatternSmasher_2025_Match - Strategy : Match exact pattern or optimize all combinations of a pattern

- PatternSmasher_2025_AllMasks - Indicator : Output csv file of all Patterns and their associated Masks

- PatternSmasher_2025_Match_AI - Strategy : Formula are expressed as variables so you can modify them internally without worrying about Inputs.

- PatternSmasher_2025_AllMasks_AI - Indicator : Formula are defined inside the code...

- 45 page manual

- Automatic enrollment in PatternSmasher Lab : Updated research and upgrades performed by George once per month

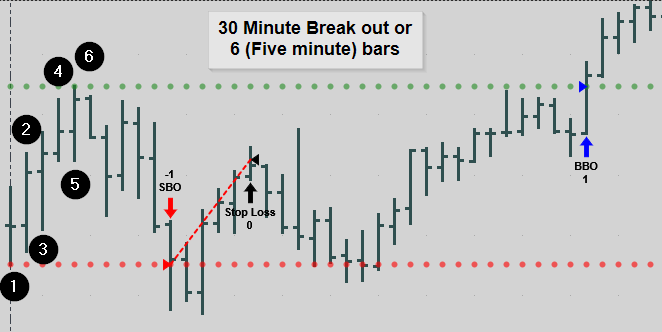

Open Range Breakout Framework

The open range break out has been used for decades. Not for just trading the stock indices, but for many different markets. The algorithm lost some of its luster when the markets transition from open outcry to fully electronic. However, where there is volatility there are breakouts. The end result of Module #3 is the highly customizable ORBO framework. The tool itself is quite powerful. However, learning how to program such a research tool that can test millions of different combinations of inputs, is even more powerful. In this module, you will get the following.

- 2+ house of video instruction [3 videos in all]

- 40-page manual that details almost every line of code

- Two strategies that can be optimized/customized to test anything you can dream up

- Buy after two down closes

- Buy Mondays and Sell Shorts on Fridays

- Only trade after and inside day or a narrow range

- 5, 10, 15, 20, 25... minute breakouts [made famous by Jake Bernstein]

- Does the Crabel Stretch still apply

- Is volatility a good value to base the breakout

- Fixed $ stop or profit objective or break even

- Market derived stop or profit objective or break even

- Buy the breakout and sell short at the other side if it fails

All these "What-Ifs" are programmed for you. Learn how George can optimize on each day of the week. See how a mini–Pattern Smasher has been included to test prior day closing relationships. Control the number of times you go long and go short within the trading day.

Pick robust parameter sets by utilizing Robert Pardos Prioritized Step Search. You can only do this if you can visualize a surface plot of a 2X2 optimization. A python script and its associated executable are also included.

Ezng N2 EzLang : Module #1 - Introducing Easing into EasyLanguage Academy

I’m excited to announce my latest project: Easing into EasyLanguage Academy! Last month, I completed the final installment of my Easing into EasyLanguage book series with the release of the Trend Following Edition. Now, I’m embarking on a new journey—teaching EasyLanguage concepts and exploring additional tools that traders can use to refine their algorithms.

Programming intraday strategies, such as day trading systems, might seem straightforward on the surface, but beneath that simplicity lies a world of esoteric challenges. In this first course, Module #1, I take a comprehensive, hands-on approach to guide you through both the conceptual and technical aspects of creating a robust day trading system.

My favorite way to learn is by watching videos at my own pace while following along with a book filled with examples—and that’s exactly the format I’ve adopted for this course. Module #1 focuses on integrating George Douglas Taylor’s Buy Day and Short Day patterns into a practical day trading strategy. This system enters long, or short positions based on the day type and uses risk management techniques like:

- A maximum dollar loss or significant chart level for exits when trades move unfavorably.

- An end-of-day exit (minutes before the close).

- A trailing stop to manage active trades.

The videos in this module total nearly three hours and walk you step-by-step through the algorithm and its implementation in EasyLanguage.

But it doesn’t stop there—I consider myself an OQ (Original Quant), and this course reflects my passion for going beyond the basics. After programming the Taylor-based strategy, we explore free tools that help us visualize and analyze data. Using Python, its powerful libraries, Google Colab, and VBA for Excel, I demonstrate how to incorporate Bob Pardo’s Sequential Optimization technique to refine system parameters.

This optimization process enables us to identify parameter combinations that yield robust performance across a wide range of conditions—what I like to call the “high plateau.” By creating 3D surface plots, we can easily spot these optimal zones without relying on the market to repeat itself exactly. Parameters are optimized two at a time, locking in the best combinations sequentially, until all parameters are fine-tuned to deliver a promising solution.

Whether you’re a novice trader or an experienced quant, Module #1 offers practical techniques, advanced tools, and actionable insights to elevate your trading system development.

Ezng N2 EzLang : Module #2 - Why EasyLanguage isn't EASY!

The Easiness factor (E) in EasyLanguage is tied to complexity—when complexity increases, ease

decreases. In this module, however, I argue that there are additional elements that can make

EasyLanguage challenging, even without a corresponding rise in algorithm complexity. A system might

have a simple algorithm, but if you don’t understand the language's inner workings, programming it can

still be a struggle. Mastering the subtle tricks and understanding what occurs beneath the surface is

essential before you can create anything meaningful. Once you’ve worked through this module, you

might consider exploring my Easing into EasyLanguage series for further insights. This module covers

topics from both the Foundation and Hi-Res editions.

Keeping things really simple to uncover basic stumbling blocks.

We are going to be using a very simple algorithm, the "Hello World" program for trading systems, the

Donchian break out throughout this installment. Following the equation above, the ease factor should

be quite low. Just as the meaning of a phrase in a spoken language can change with context, a single

line of EasyLanguage code can have different interpretations and effects depending on its

surroundings, and much like the butterfly effect, even the smallest, seemingly insignificant tweaks can

lead to dramatic, system-wide changes. This flexibility allows for creative and efficient coding, but it

also means that understanding the underlying context and nuances is crucial. Recognizing that a line

of code is more than just a static command—it’s a dynamic element whose impact can vary based on

how and where it's used—empowers you to write more effective and adaptable programs.

Look at the images of the product page and see if you have seen these issues. Get Module #2 and figure out why these scenarios happen and more importantly find out how to fix them. Work your way through the course along with George and almost 2 HOURS of video instruction. He will show a total of 12 potential solutions to the problem and then explain why they will or will not work.