Done-For-You UK Payroll System in Excel (2025/26) – PAYE, NIC & Payslips

Run UK payroll in under 20 minutes — every month — with this fully automated Excel Payroll System (2025/26).

Built for UK schools, small businesses, and finance teams, this template handles all the complex work for you:

✔ PAYE

✔ NIC (Employee + Employer)

✔ Tax codes

✔ Payslips

✔ Monthly summary

✔ Year-to-date totals

✔ Dashboard reports

All with no VBA, no macros, and no complicated setup.

What’s Included

1️⃣ Staff Setup + Tax Codes

Add employees in seconds with ready-made dropdowns for:

- Tax codes

- NI categories

- Pension settings

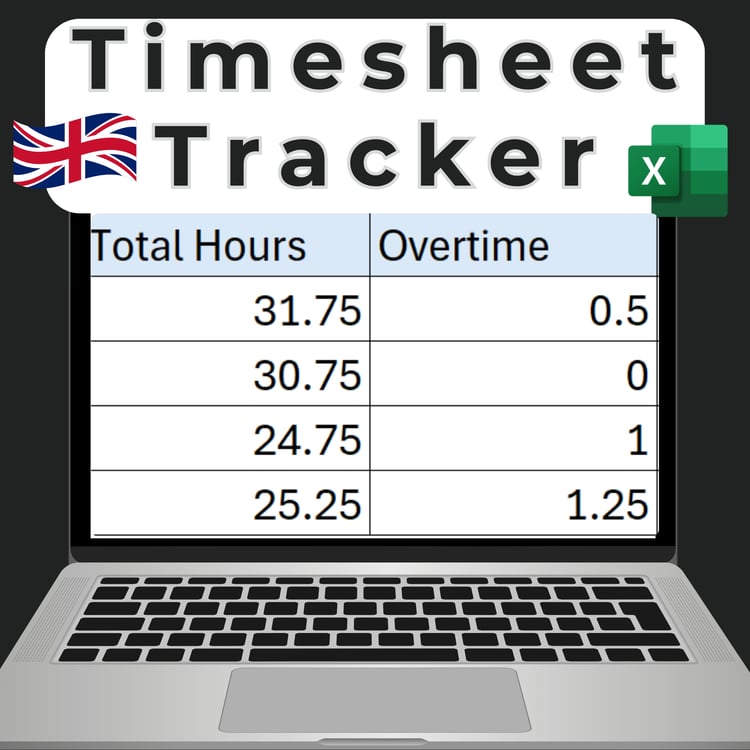

- Pay type (salary/hourly)

- Contracted hours

Everything is pre-structured and ready to go.

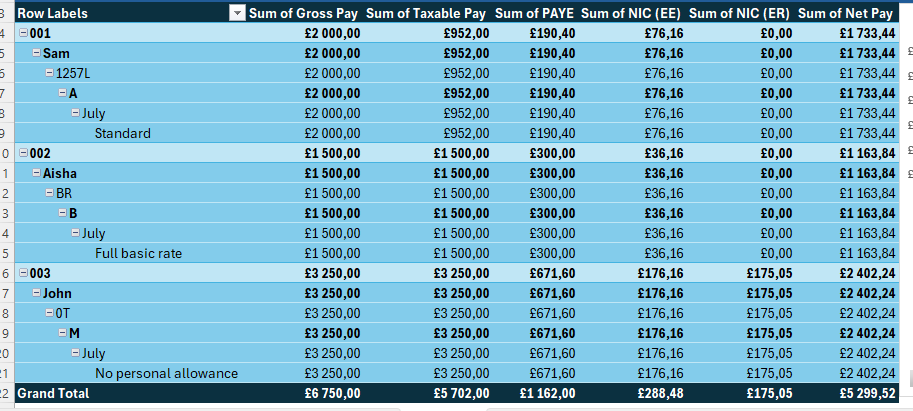

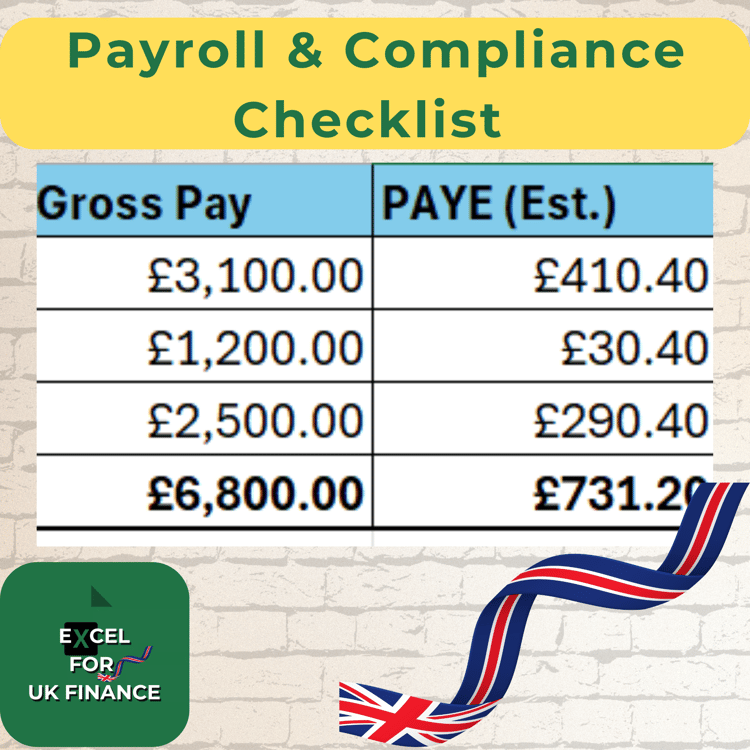

2️⃣ Monthly Payroll Calculator (2025/26 Rates Built In)

Enter hours or salary → the template automatically calculates:

- Gross pay

- PAYE

- Employee NIC

- Employer NIC

- Pension deductions

- Net pay

All formulas already set up using the 2025/26 HMRC thresholds.

3️⃣ Automated Payslip Generator

Generate a clean, professional payslip for each employee using:

- XLOOKUP

- Pre-built formatting

- Automatic pay + deduction fields

Just choose an employee → the payslip fills itself.

4️⃣ Dashboard + Reports

A ready-made reporting hub showing:

- Total payroll cost

- Employer NIC

- Employee NIC

- Net pay

- Department or cost-centre totals

- Monthly trend charts

Perfect for School SLT reports, owners, and accountants.

Why This System Works

🔹 No need to build anything from scratch

🔹 No knowledge of payroll formulas required

🔹 Uses real 2025/26 tax-year thresholds

🔹 Fully unlocked Excel file

🔹 Works in Microsoft Excel (Windows/Mac)

This template is designed to save you hours every month and reduce calculation mistakes.

Bonus: 4-Part YouTube Training Series Included

You’ll get a link to a full video series covering:

- Staff Setup

- Payroll Calculator

- Payslip Generator

- Dashboard Reports

Perfect for beginners and experienced Excel users.

Who This Is For

Ideal for:

- UK School Bursars

- Small Business Owners

- Payroll Admins

- Finance Officers

- Excel learners wanting real HMRC-based examples

📥 Instant Download – Start Running Payroll Today

Open the file → enter your data → payroll is done.