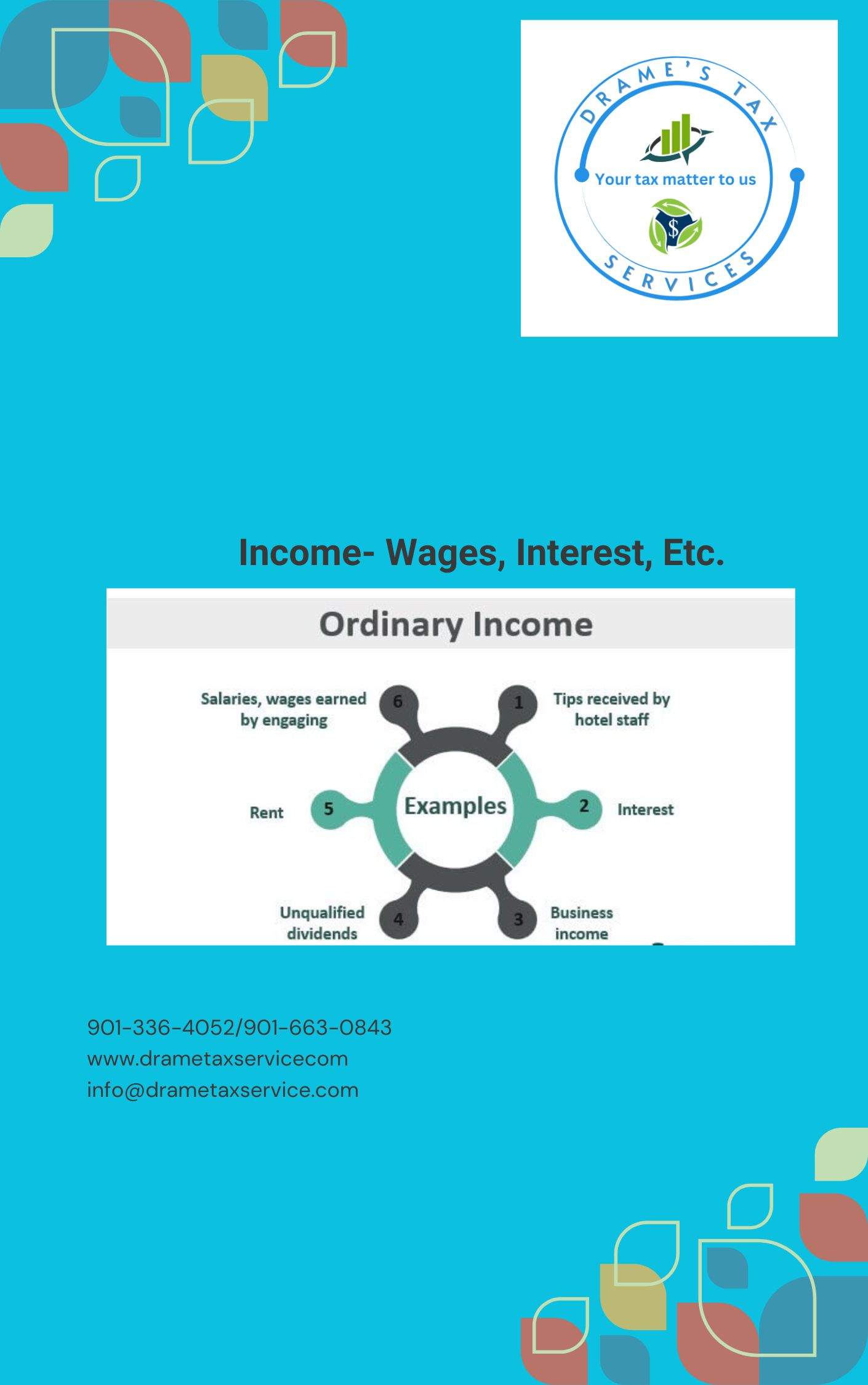

Income-Wages, Interest, Etc

This lessons covering the Income section of the taxpayer’s return. A critical component of completing the taxpayer’s return is distinguishing between taxable and nontaxable income and knowing where to report the different types of income on Form 1040.

At the end of this lesson, using your resource materials, you will be able to:

• Distinguish between taxable and nontaxable income

• Distinguish between earned and unearned income

• Report income correctly on Form 1040