Unlocking Financial Freedom with Unsecured Loans from CapitalBoost

In today's ever-evolving financial landscape, access to capital can often be the key to achieving one's dreams and ambitions. Whether it's pursuing higher education, starting a business, or addressing unexpected expenses, having the right financial support can make all the difference. CapitalBoost, a prominent financial loan brokerage firm based in Sydney, Australia, understands the significance of such opportunities. They specialize in offering personalized unsecured loans that empower individuals to take control of their financial future.

Unsecured loans, as the name suggests, do not require borrowers to pledge collateral such as property or assets to secure the loan. Instead, they are approved based on the borrower's creditworthiness, financial stability, and ability to repay. CapitalBoost excels in this domain by providing tailored unsecured loan solutions that cater to a wide range of financial needs.

CapitalBoost's Commitment to Personalized Solutions

One of the standout features of CapitalBoost is their commitment to personalized financial solutions. They understand that every individual's financial situation is unique, and a one-size-fits-all approach simply doesn't work. This is where their team of experienced financial experts comes into play. They work closely with clients to assess their financial goals, credit history, and current financial standing to design loan packages that are perfectly suited to their needs.

Advantages of Unsecured Loans from CapitalBoost

No Collateral Required: Unlike secured loans, unsecured loans from CapitalBoost do not require borrowers to put up collateral, making them accessible to a wider audience.

Flexibility: CapitalBoost's unsecured loans are versatile and can be used for various purposes, including debt consolidation, home improvement, medical expenses, or even a dream vacation.

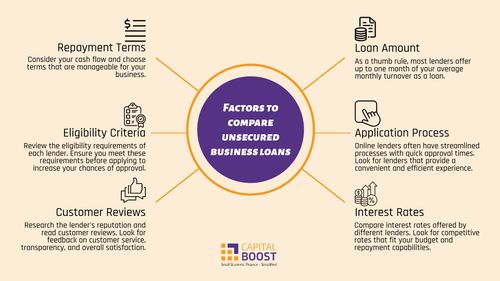

Competitive Interest Rates: CapitalBoost is known for its competitive interest rates, ensuring that borrowers get the most value out of their loans.

Quick Approval: With streamlined processes and efficient evaluation, CapitalBoost aims to provide quick approval for unsecured loans, helping clients address their financial needs promptly.

Repayment Options: CapitalBoost understands that everyone has a different financial capacity. They offer flexible repayment options, allowing borrowers to choose a plan that fits their budget.

The Application Process

Applying for an unsecured loan from CapitalBoost is a straightforward process. Prospective borrowers can start by filling out an online application, which typically takes only a few minutes. Once the application is submitted, CapitalBoost's team reviews it promptly, striving for a swift approval process. Upon approval, funds can be disbursed quickly, ensuring that clients can start using the money for their intended purpose without unnecessary delays.

CapitalBoost's dedication to providing personalized unsecured loans has earned them a reputation as a trusted financial partner in Sydney, Australia. Their commitment to flexibility, competitive rates, and efficient processes sets them apart in the world of unsecured lending. Whether you're looking to consolidate debt, fund a dream project, or address an unexpected financial need, CapitalBoost's unsecured loans can help you unlock the potential of your financial future.