Self Employment or Side Hustle Spreadsheet

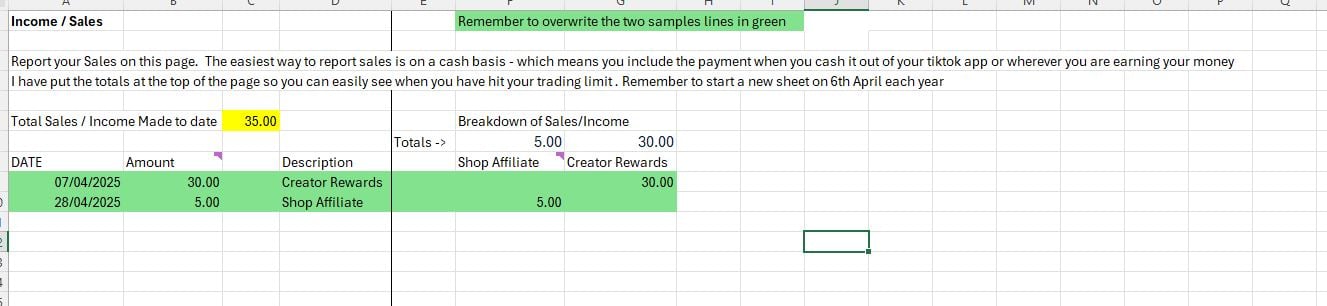

If you are starting to earn money through tiktok or other affiliate schemes and need to keep track of your sales so you know if you need to register as self employed and start paying tax in the UK this spreadsheet is for you.

It includes some tips on what you need to do, a link to a super useful HMRC guide and sheets ready for you to start entering your income and expenses today, plus a summary sheet which will pull in your profit figures and give examples of the tax which could be due.

The April 2025 sheet has an additional page about calculating what National Insurance would be due on your side hustle earnings if you do not pay your National Insurance through a Pay As You Earn (PAYE) job.

There is a .xlxs version for excel and a .ods version which can be imported into Google Sheets or other spreadsheet products.

The only way you will know if you are reaching the £1000 trading allowance threshold is if you are keeping a record of your earnings, and this simple spreadsheet will keep you on track.

April 2026 sheet is prepped and ready for April 2026 for the new tax year - there is a .xlsx and a .ods version. There is new information on this sheet, so if you have already downloaded my spreadsheets, I recommend you take a look at this new one too.

Free Samples

The latest version includes my personal take on how you should deal with 'free' samples sent to you in return for content creation. I cannot get clear guidance on exactly how free samples should be dealt with in your self assessment tax return or in double entry bookkeeping so I have developed a method which makes sense to me but cannot guarantee that should HMRC ever look at your accounts, you won't have additional tax to pay. My view is do your own research and follow what you believe is correct based on the information given, and keep good records so if anyone needs to look at what you have done you have the information to explain your calculations.

Disclaimer - if you are at all in doubt as to what numbers you should enter on your tax return, then find a qualified accountant experienced in social media businesses. As a bookkeeper I advise and help people on how to keep good records - but if you need specific tax advice, always contant an accountant. Your self-assessment is your responsibility and I accept no liability if my advice is not 100% correct.