Easing Into EasyLanguage Academy Module #1

Introducing Easing into EasyLanguage Academy

I’m excited to announce my latest project: Easing into EasyLanguage Academy! Last month, I completed the final installment of my Easing into EasyLanguage book series with the release of the Trend Following Edition. Now, I’m embarking on a new journey—teaching EasyLanguage concepts and exploring additional tools that traders can use to refine their algorithms.

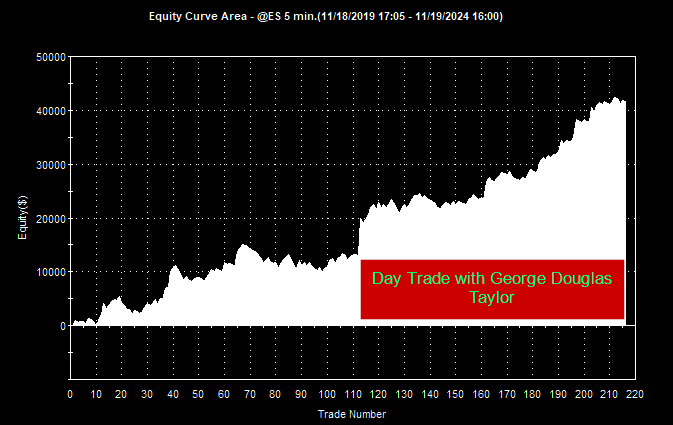

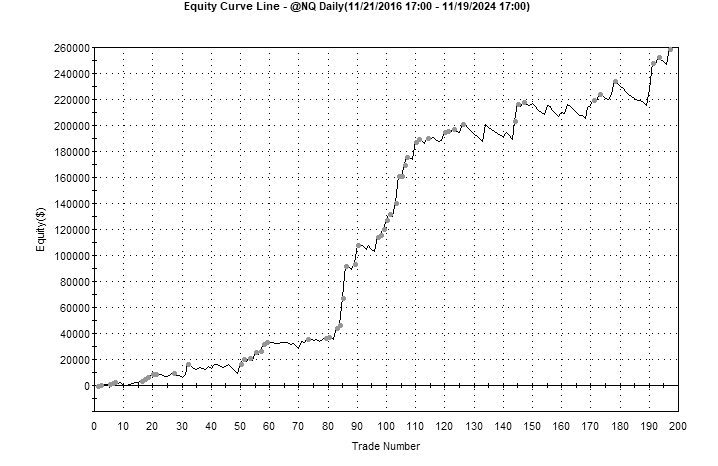

Programming intraday strategies, such as day trading systems, might seem straightforward on the surface, but beneath that simplicity lies a world of esoteric challenges. In this first course, Module #1, I take a comprehensive, hands-on approach to guide you through both the conceptual and technical aspects of creating a robust day trading system.

My favorite way to learn is by watching videos at my own pace while following along with a book filled with examples—and that’s exactly the format I’ve adopted for this course. Module #1 focuses on integrating George Douglas Taylor’s Buy Day and Short Day patterns into a practical day trading strategy. This system enters long, or short positions based on the day type and uses risk management techniques like:

- A maximum dollar loss or significant chart level for exits when trades move unfavorably.

- An end-of-day exit (minutes before the close).

- A trailing stop to manage active trades.

The videos in this module total nearly three hours and walk you step-by-step through the algorithm and its implementation in EasyLanguage.

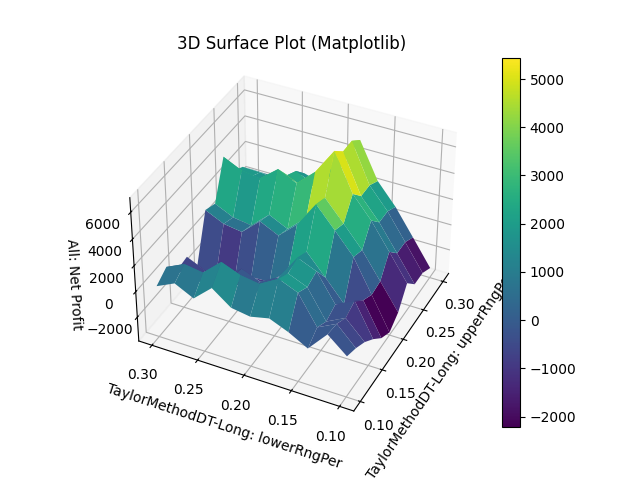

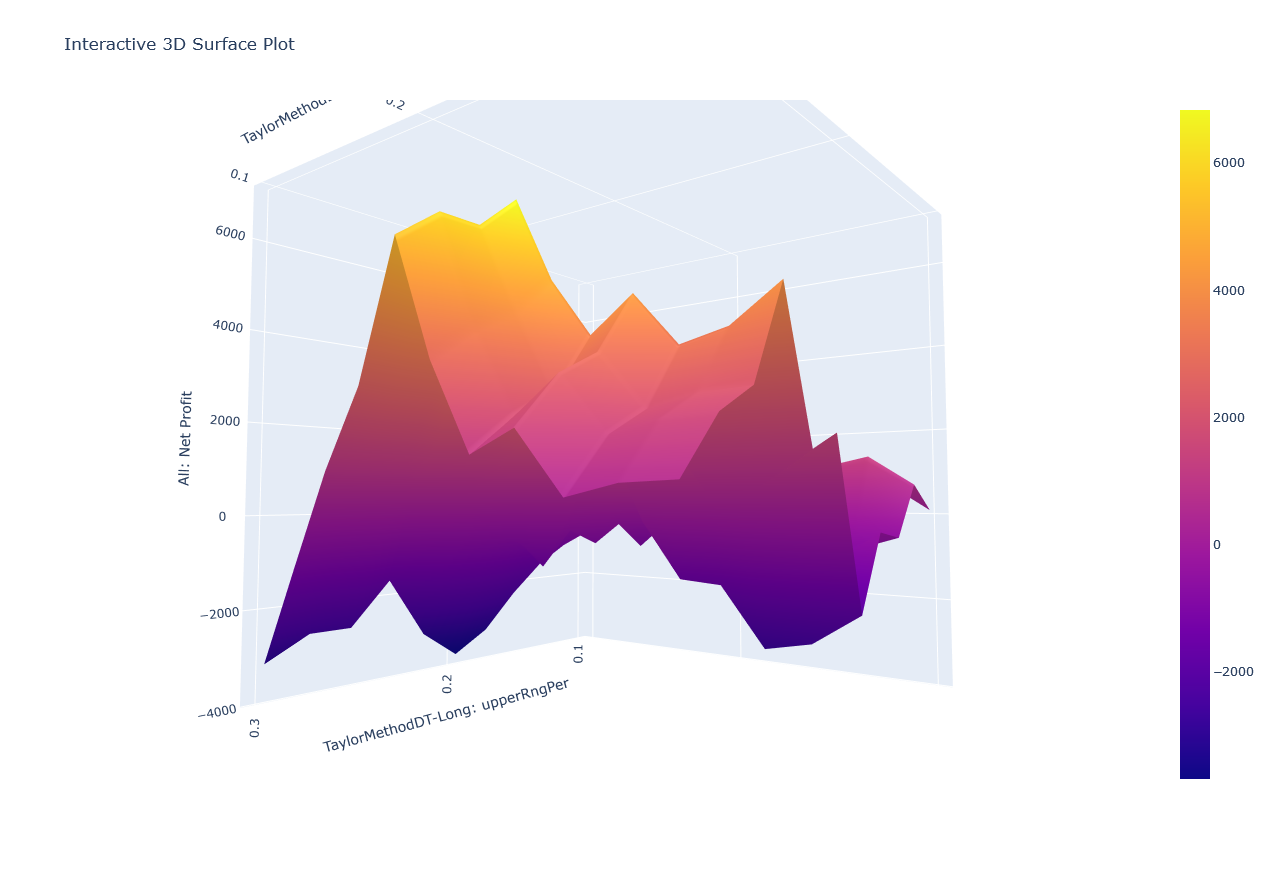

But it doesn’t stop there—I consider myself an OQ (Original Quant), and this course reflects my passion for going beyond the basics. After programming the Taylor-based strategy, we explore free tools that help us visualize and analyze data. Using Python, its powerful libraries, Google Colab, and VBA for Excel, I demonstrate how to incorporate Bob Pardo’s Sequential Optimization technique to refine system parameters.

This optimization process enables us to identify parameter combinations that yield robust performance across a wide range of conditions—what I like to call the “high plateau.” By creating 3D surface plots, we can easily spot these optimal zones without relying on the market to repeat itself exactly. Parameters are optimized two at a time, locking in the best combinations sequentially, until all parameters are fine-tuned to deliver a promising solution.

Whether you’re a novice trader or an experienced quant, Module #1 offers practical techniques, advanced tools, and actionable insights to elevate your trading system development.