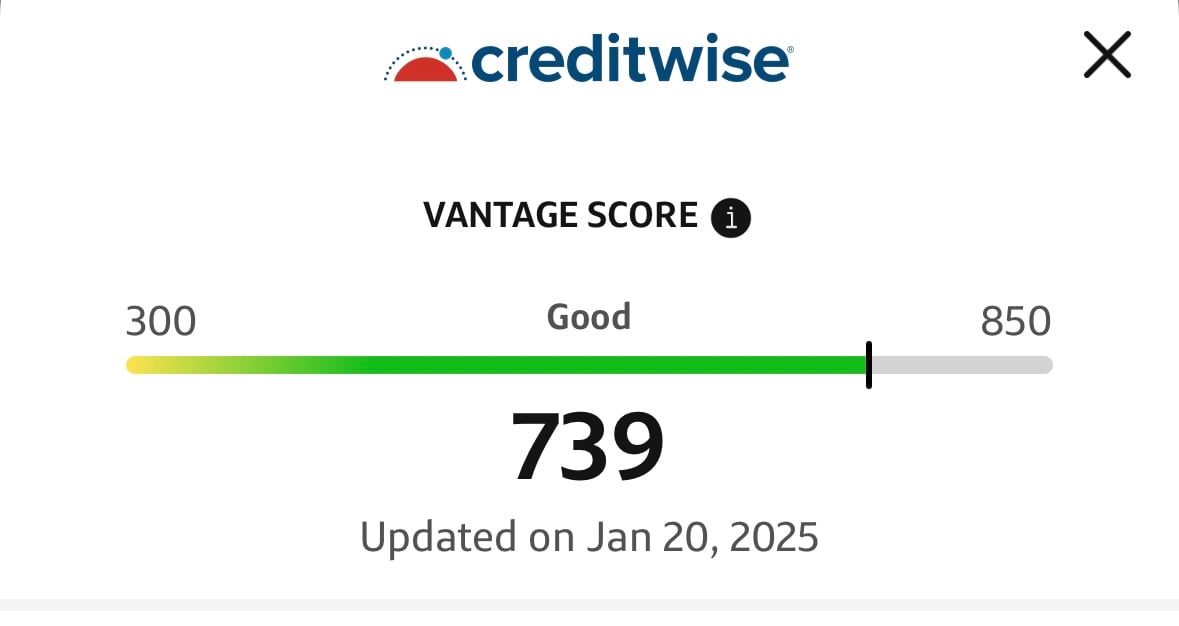

Today, I randomly checked my credit score and learned I was in the 700 club! 🎉 Cue up the music, because I can finally say I got great credit! It took some patience and dedication, but I’m here to tell you it can be done!

Fixing your credit doesn’t have to feel overwhelming. Here’s the step-by-step plan I followed to turn things around:

1. Pay the Minimum and Double Up on One Card

Make at least the minimum payment on all your credit cards each month to avoid late fees. Pick one card to focus on paying down faster. I would say the card that has the lowest balance to pay it off quick. Split that card’s minimum payment in half and pay it biweekly (align it with your pay schedule). Doing this reduces interest and chips away at the balance.

2. Live Below Your Means

It’s time to cut back. For three months:

• Cook at home.

• Drop down to one streaming service.

• Skip buying clothes or unnecessary items.

Use the savings to pay off debt faster.

3. Pick Up a Side Hustle

Every extra dollar counts. Try gig apps like Instacart, DoorDash, or Uber Eats. Use your side hustle income to throw extra money at your credit card debt or savings.

*I enjoy shopping, grocery shopping specifically, so Instacart is my side hustle of choice. On the weekends, yes both Saturday and Sunday, I’d dedicate at least 4 hours. On average, I’d close the weekend with $150 depending on business volume and season (Thanksgiving, of course is truly the money making time on Instacart). That extra money was allocated to paying down a credit card faster or save for a special occasion.

4. Organize Your Money with Multiple Bank Accounts

I used three accounts to stay on track:

• Bills Account: For necessary bills like mortgage, HOA, and utilities.

• Extras Account: For smaller recurring bills like streaming and car insurance.

• Fun Money Account: For eating out and treating myself—but only spending a third of what was in it.

I also had a Savings Account, where I automatically saved $30 per pay period. Start small with a savings amount that you can automate without hurting for it every pay cycle.

5. Stick to the Plan

It’s about consistency. Keep your spending intentional and focus on progress over perfection. The Credit Repair Planner helped with tracking the progress of debt reduction, while the Better Budget workbook helped me keep track of my monthly expenses and how I was spending my money. Check out both workbooks on the Building Blocks Financial storefront, www.payhip.com/bbfs

Over time, your credit will improve, and you’ll build healthier money habits.

If I did it, so can you!

-Candace