eCommerce Accountant - sales tax expert

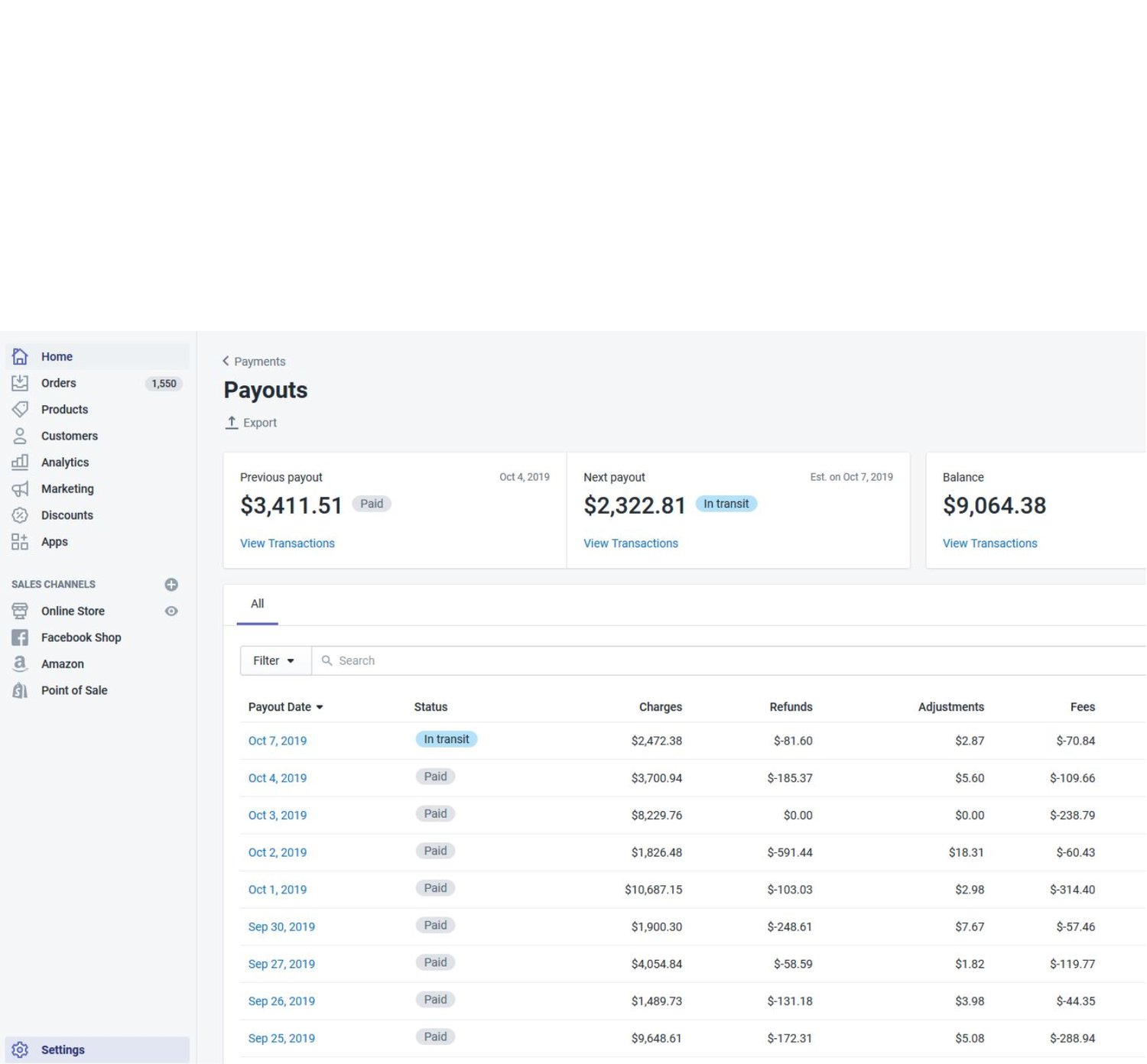

Bookkeeping work:

our firm balances your sales platforms Shopify, Amazon, Etsy, Facebook with your bookkeeping software QuickBooks online, and each of your merchant account payment platforms Paypal, Square, Stripe, without using expensive 3rd party apps.

Sales tax work:

we can file your sales tax returns with all states or jurisdictions including home-rulers.

when it comes to sales tax laws

Sales tax nexus

Do you need a sales tax nexus analysis? We can help! We'll look at all your sales channels transactions, prior and present, then analyze each channel for sales tax nexus. Next, we'll provide a list of nexus states that will need implementation or voluntary disclosure.

Who's liable

You are! When you process a sale online shipping to a destination sourced address, you are liable to collect sales tax by state, county, city, and special jurisdictions based on each states threshold requirements. Do you know your states nexus laws?

Facing an Audit?

States are now looking at eCommerce platforms to confirm sales tax is being collected accurately. Are you prepared? Do you know what platforms are correctly collecting on you’re behalf, and which ones are not?

a sales tax account is required!

You must obtain a sales tax license in hand before you are allowed to collect sales tax in any state!

collecting without a license = illegal in all states

You must obtain a sales tax license before your first sale that meets a states nexus threshold.

For your home state, you must obtain a sales tax license before your first sale on any platform.

Deb Fletcher - eCommerce Accountant

dual MBA's in Accounting & CIS

over 40 years hands on experience

Deb@yourremoteaccountant.com

located in Colorado

text only: 719-888-9731