Stop Losing Money, Start Growing Wealth

Investing is one of the best ways to grow your money and achieve financial freedom. But let’s be honest — most beginners make the same mistakes again and again. These mistakes cost time, money, and motivation.

The good news? They’re easy to avoid with the right tools. That’s why we created the Investment Simulator Pack – a simple, interactive way to understand how your money really grows over time.

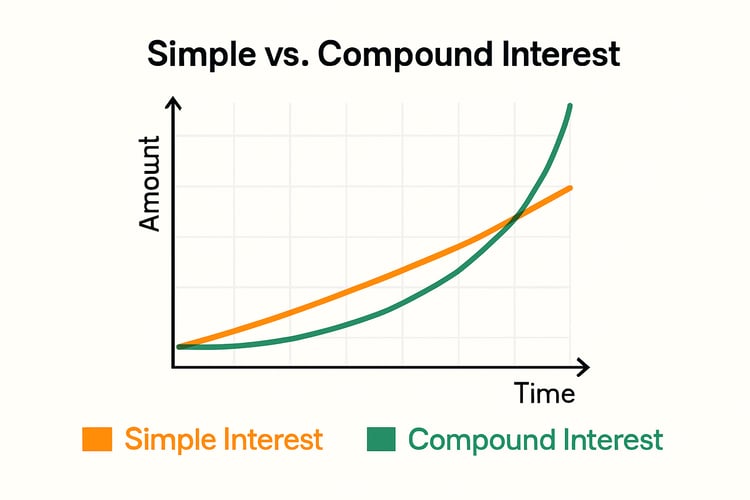

❌ Mistake #1: Not Understanding Compound Interest

Compound interest is the foundation of wealth-building. It’s not just “extra money” — it’s exponential growth. Your money earns interest, and that interest earns more interest. Over time, this creates a snowball effect.

🔑 Example: If you invest $100/month at 8% for 20 years → you get $59,000. But with compound interest → it grows to $59,000 vs $48,000 simple interest. That’s a massive difference!

👉 With our compound interest simulator, you can see this growth instantly — no complicated formulas required.

❌ Mistake #2: Investing Without a Clear Strategy

Many beginners invest randomly — buying crypto one week, stocks the next, without a plan. This often leads to frustration and losses.

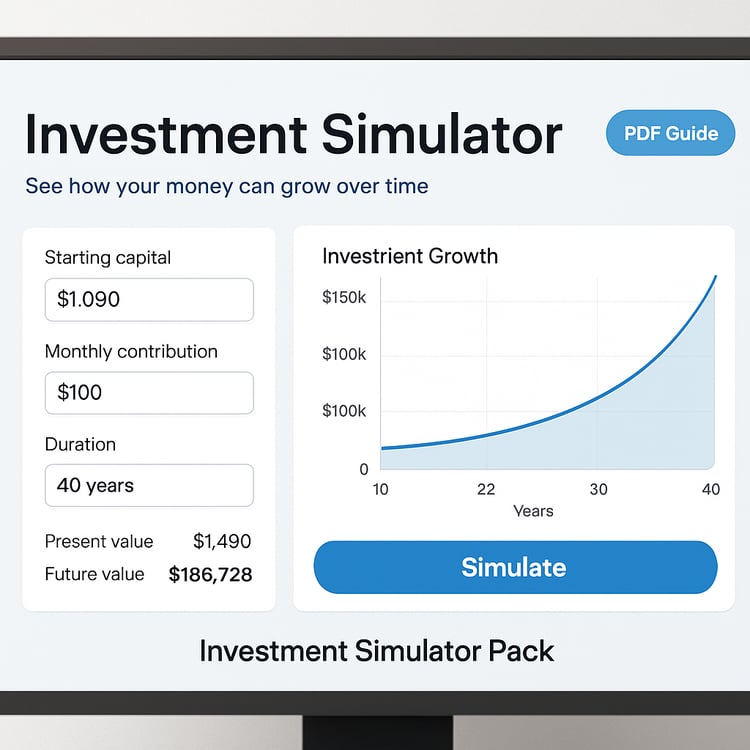

Smart investing is about consistency and strategy:

How much will you invest monthly?

For how many years?

At what expected return?

👉 Our Investment Calculator Tool helps you build a clear strategy. Just enter your numbers and instantly see how your wealth could look in 10, 20, or 30 years.

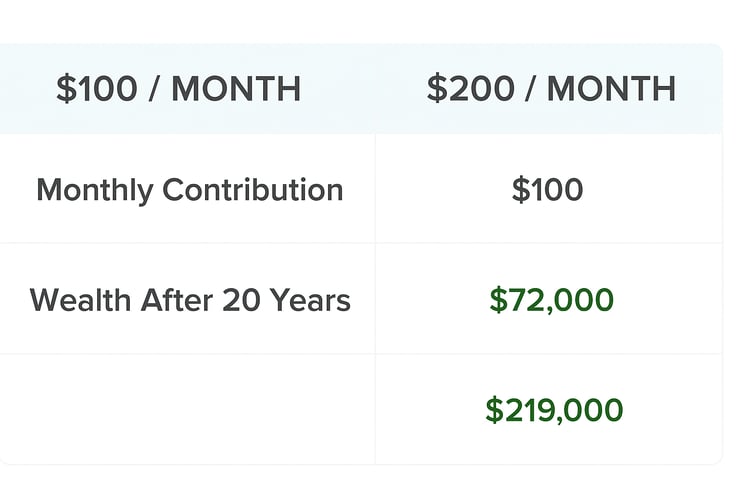

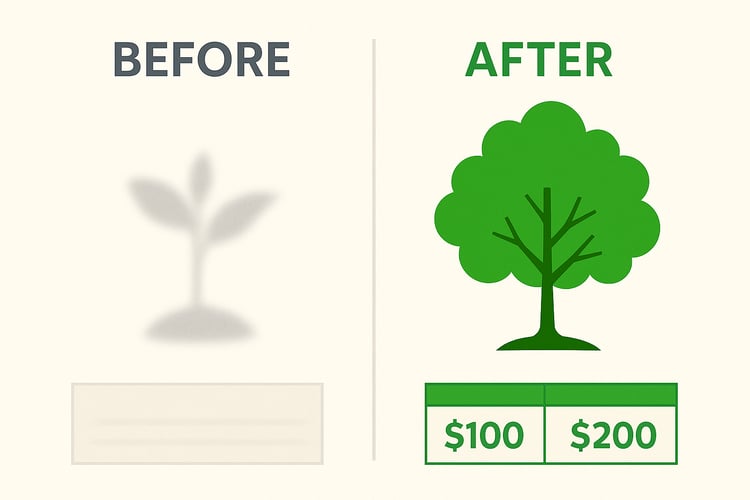

❌ Mistake #3: Ignoring Small Contributions

Many people think you need thousands of dollars to start investing. This is false. Even $50, $100, or $200 per month can change your financial future.

🔑 Example:

$100/month → $148,000 in 30 years.

$200/month → $296,000 in 30 years.

👉 The simulator proves it with numbers: small contributions compound into something meaningful.

❌ Mistake #4: Relying on Luck Instead of a System

Investing is not gambling. It’s not about luck. It’s about making informed decisions and sticking to a plan.

Too many beginners “hope” their investments will grow, but hope is not a strategy. A systematic plan with compound interest works every time.

👉 With our Wealth Growth Planner, you can test different scenarios, factor in inflation and fees, and avoid the guesswork.

✅ Why the Investment Simulator Pack is Different

Here’s what makes our pack stand out:

📘 A clear step-by-step PDF guide with visual explanations.

📊 An interactive Excel simulator to test your own numbers.

💡 Beginner-friendly design – no jargon, no complicated math.

🚀 Motivating results – once you see compound interest in action, you’ll never look at money the same way.

💬 What Customers Are Saying

“This simulator made investing finally click for me.” – Tom

“I started with just $100/month and now I actually have a plan.” – Sacha

“Seeing my future wealth projected gave me confidence.” – Richard

🛡 Trust and Security

When you buy the Investment Simulator Pack, you get:

🔒 Secure checkout

💵 Money Back Guarantee

⚡ Instant Download

🎯 Conclusion: Start Planning Smarter

Investing is not about luck. It’s about strategy, discipline, and consistency. By avoiding beginner mistakes and using the right tools, you can build serious wealth.

👉 Don’t guess your financial future – simulate it today.

➡️ Try the Investment Simulator Pack today and start planning your wealth the smart way.