If you’ve ever stared at a trading chart filled with green and red candles and felt lost, you’re not alone. Japanese candlesticks are the language of the market, and once you understand them, you’ll see exactly when to buy, sell, take profit, or protect yourself with a stop loss.

This guide breaks candlesticks down step by step, in a way that any beginner can understand.

📌 Pro tip: If you want a deeper dive with examples and strategies, I’ve put together a complete resource here.

What Are Japanese Candlesticks?

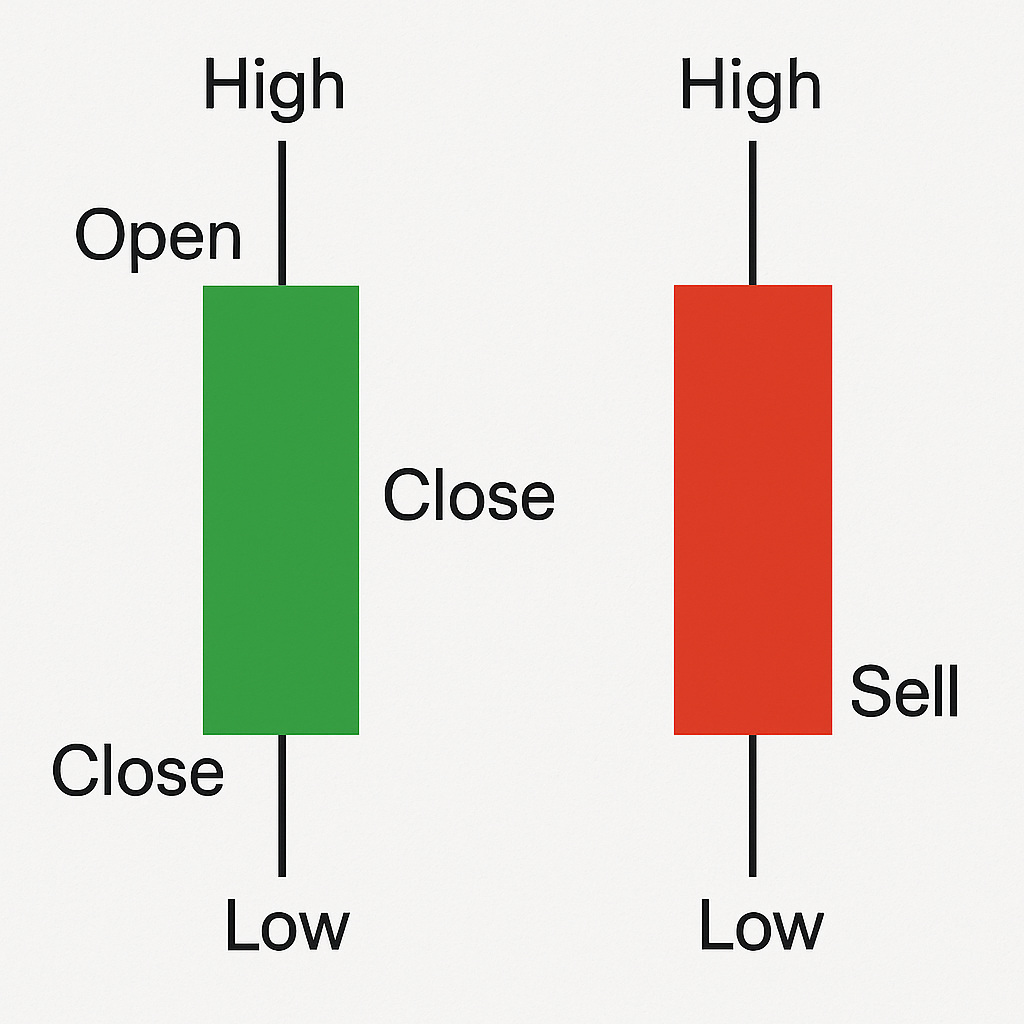

- Open = where the price started.

- Close = where the price ended.

- High = the highest price reached.

- Low = the lowest point.

A green candle = buyers stronger (bullish).

A red candle = sellers stronger (bearish).

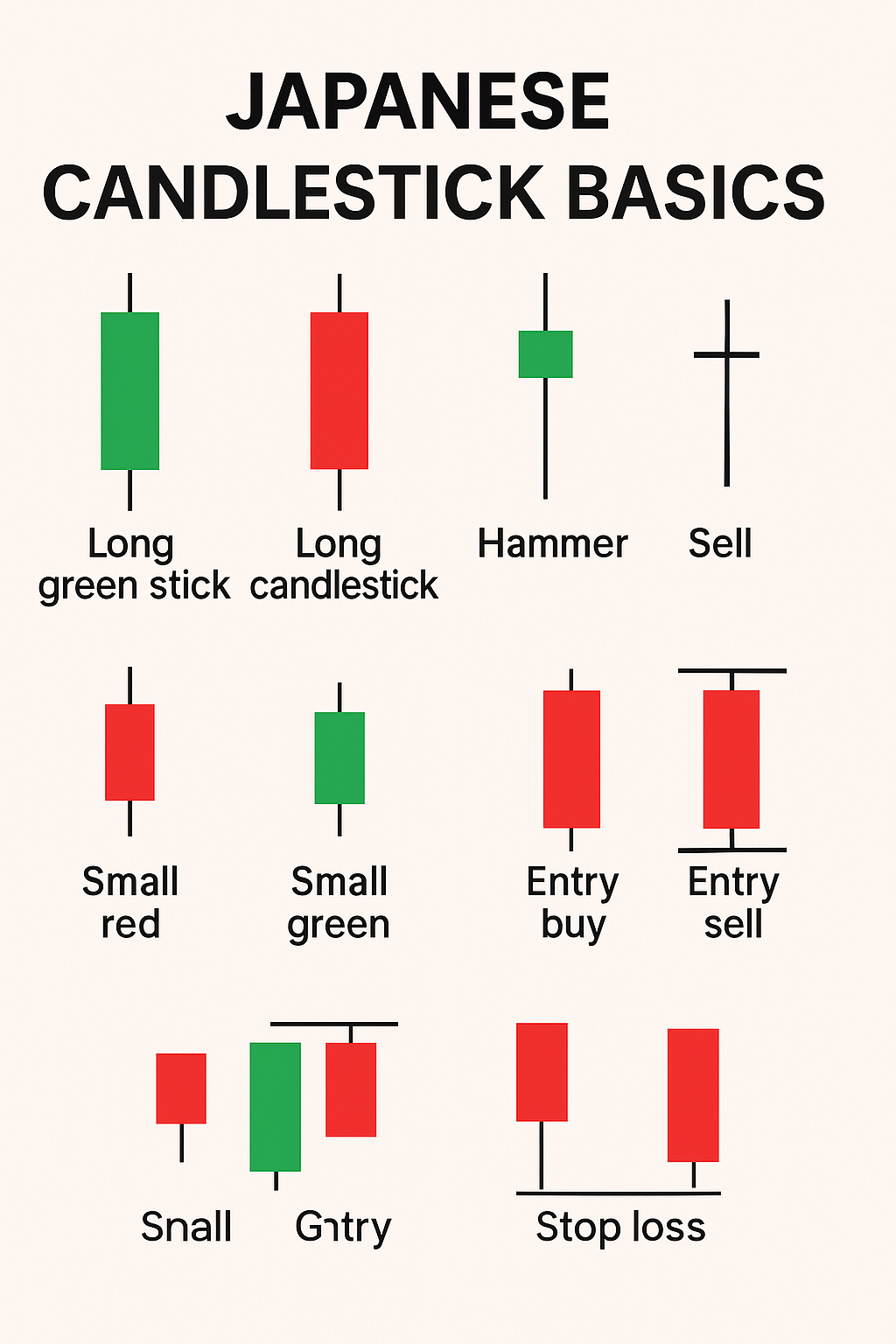

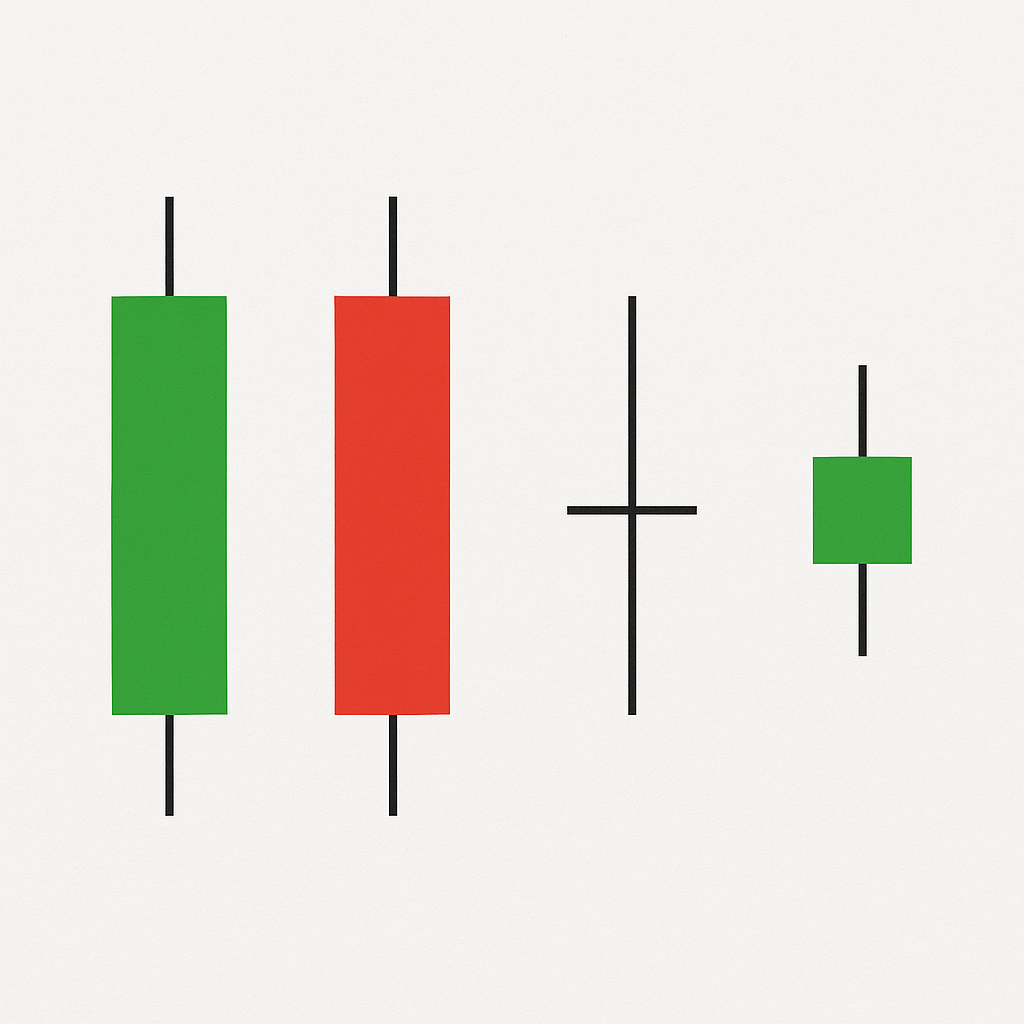

Reading Candle Size and Shape

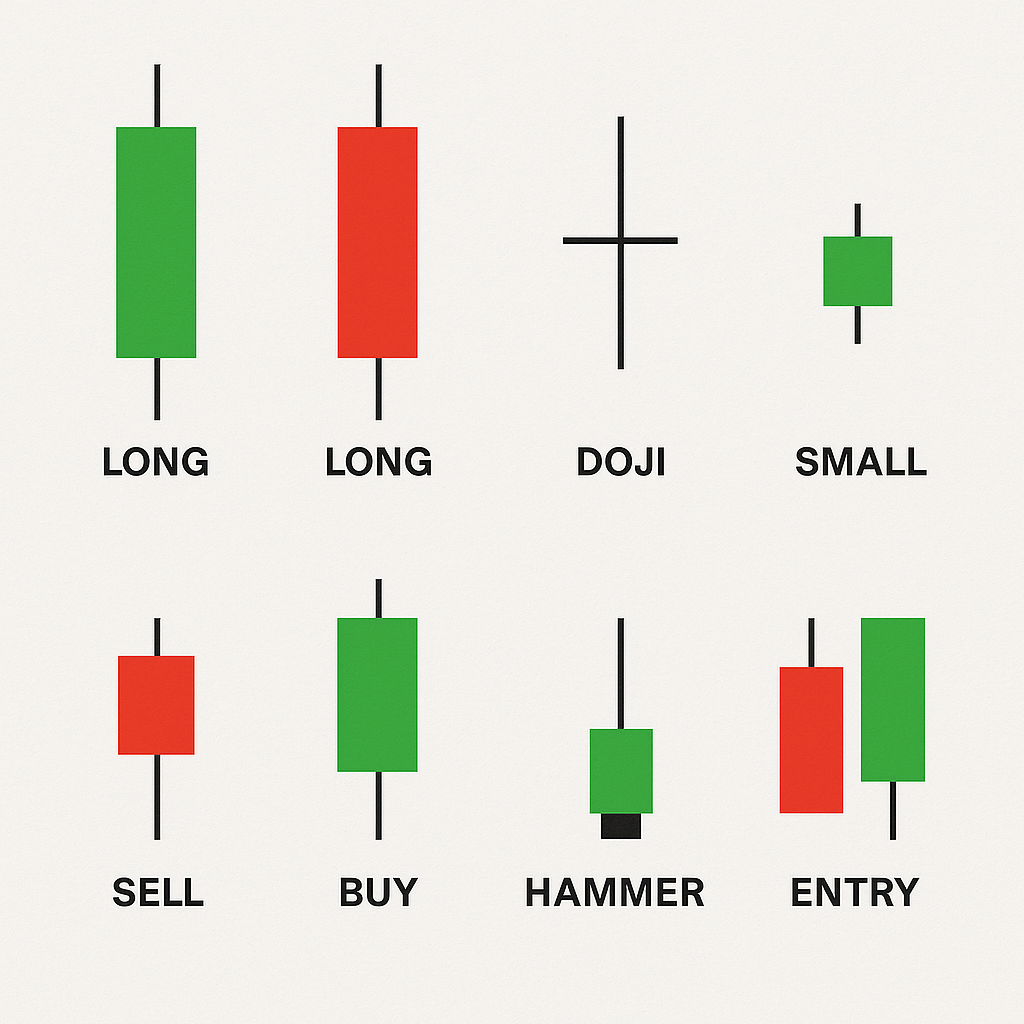

- Long green candle → strong buying.

- Long red candle → strong selling.

- Doji (tiny body, long wicks) → indecision.

- Short candles → low activity, consolidation.

Key Candlestick Patterns Beginners Should Know

- Hammer → bullish reversal at the bottom.

- Inverted Hammer → potential reversal (needs confirmation).

- Doji → indecision, wait for the next candle.

- Bullish Engulfing → buy signal.

- Bearish Engulfing → sell signal.

- Shooting Star → bearish reversal at the top.

- Marubozu → strong momentum (trend continuation).

When to Buy

- Look for reversal patterns at the bottom (hammer, bullish engulfing).

- Always wait for confirmation (next candle + volume).

- Breakouts after consolidation often signal strong buying.

✅ Rule: Buy after confirmation, and set your stop loss below the recent low.

When to Sell

- Look for bearish patterns at the top (shooting star, bearish engulfing, doji).

- A sudden long red candle after a rally signals profit-taking.

- Multiple failed attempts to break resistance = exhaustion.

✅ Rule: Sell at resistance, and set your stop loss above the recent high.

Stop Loss & Take Profit Basics

- Stop Loss: Protects you from large losses.

- Buy → set stop below recent support.

- Sell → set stop above resistance.

- Take Profit: Locks in gains before the market reverses.

- Place at resistance (when buying) or support (when selling).

- Use 1:2 risk/reward ratio (risk $50 to gain $100).

Spotting Strong Buying vs Selling Pressure

- Long green candle + high volume = strong buying.

- Long red candle + high volume = strong selling.

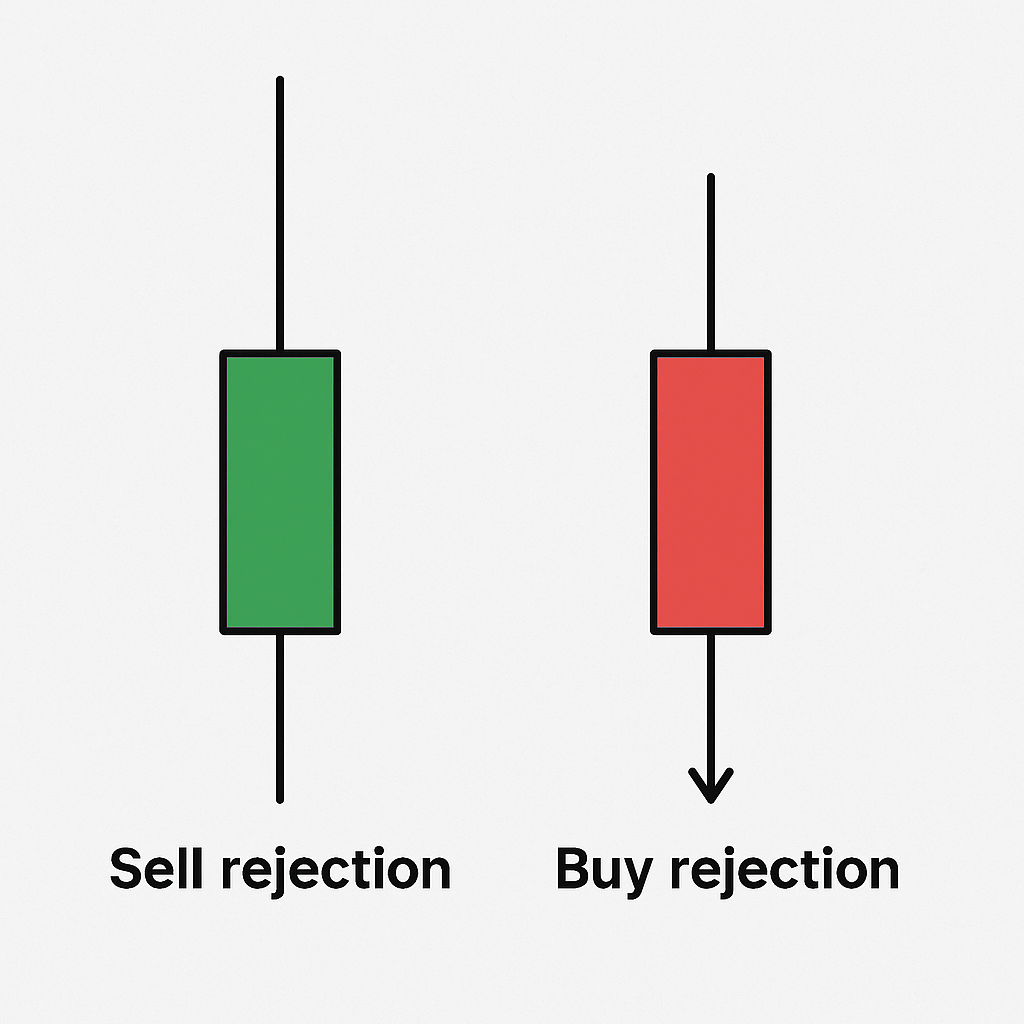

- Wicks = rejection:

- Long upper wick → sellers rejected higher prices.

- Long lower wick → buyers rejected lower prices.

Common Mistakes to Avoid

- Trading every pattern without context.

- Ignoring confirmation.

- Trading without stop loss.

- Being greedy and missing profit-taking signals.

- Overtrading small movements.

📌 Golden Rule of Candlesticks 🕯️

Candlesticks are guides, not guarantees.

Conclusion: Mastering the Market’s Language

Candlestick charts may look complex at first, but once you understand them, they become a simple map showing you when to act.

- Buy when reversal patterns appear at the bottom.

- Sell when exhaustion appears at the top.

- Always protect yourself with stop loss and take profit.

With time, practice, and discipline, candlesticks will turn confusion into confidence.

💡 Want to go deeper? I’ve created a complete candlestick trading guide packed with strategies and examples → check it out here.