“In trading, profit isn’t profit until you take it.”

Most beginners spend hours studying entry signals — when to buy a stock, crypto, or forex pair. But the truth is that the hardest and most profitable skill isn’t just knowing when to enter… it’s knowing when to exit.

Selling at the right time is what separates consistent traders from gamblers.

Get it wrong, and you risk turning a winning trade into a painful loss.

Get it right, and you can build wealth steadily while keeping your stress low.

This blog will walk you through the psychology, strategies, and technical tools that traders use to decide when to sell after making a profit.

👉 If you want ready-to-use tools, templates, and candlestick training, you can learn candlesticks here.

1. What Is Profit-Taking in Trading?

Before we dive into timing, let’s define profit-taking.

When you open a trade, your gains are only on paper — these are called unrealized gains. The moment you sell, those profits become realized gains. That small click of the “Sell” button is what makes the difference between fantasy money and actual capital in your account.

The Two Common Mistakes

- Selling too early.

- Many traders panic at the first sign of green and sell, leaving large moves behind.

- Example: buying Bitcoin at $20k, selling at $21k… then watching it rally to $40k.

- Holding too long.

- On the other hand, some traders get greedy. They refuse to sell at +30%, hoping for +100%. More often than not, the price retraces, and they end up with nothing.

This is called “round-tripping” — taking a winning trade full circle back to breakeven or even a loss.

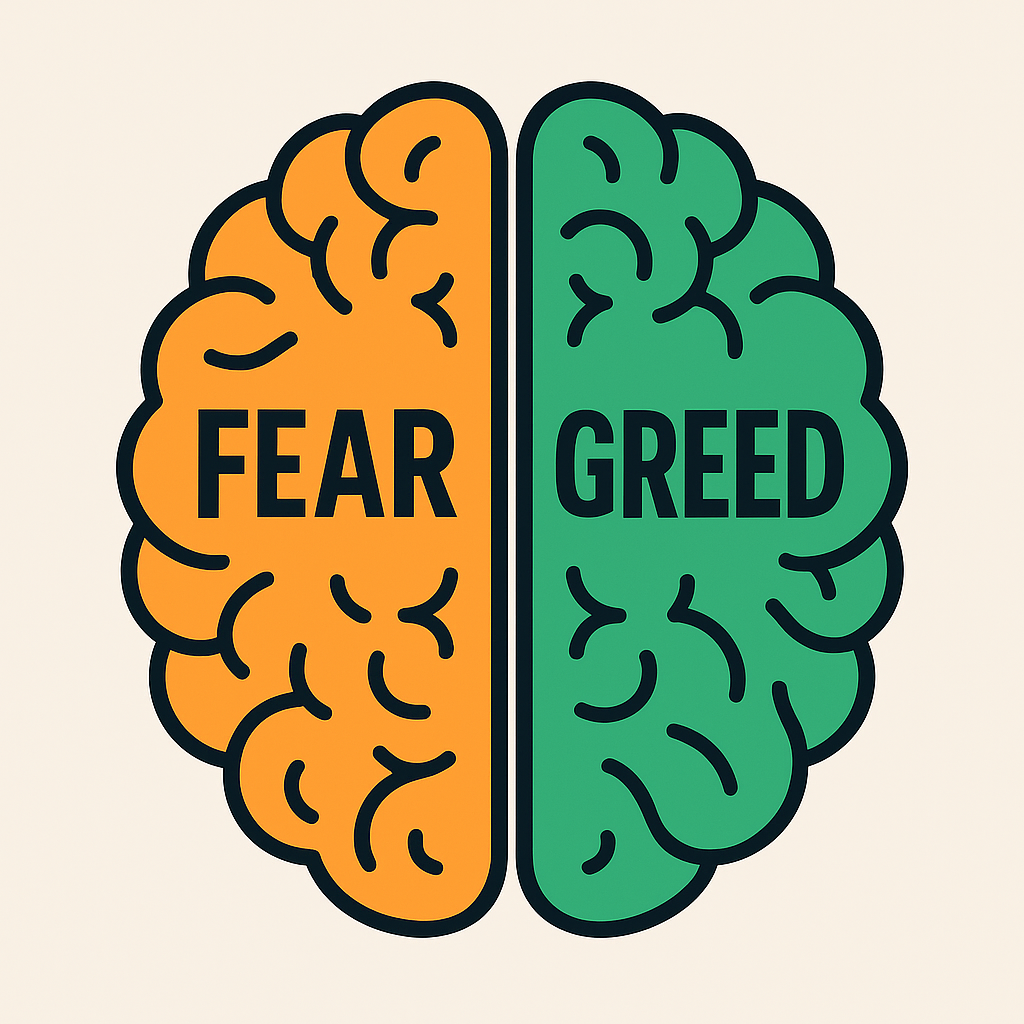

Why Is Profit-Taking So Hard?

Because trading is not only technical — it’s psychological.

- Greed makes you hold longer than you should.

- Fear makes you sell too soon.

- Regret makes you second-guess every decision.

That’s why having a clear exit strategy in trading is essential.

2. Why Timing Matters in the Market

The saying goes: “Timing the market beats time in the market” — especially for short- and medium-term traders.

Knowing when to sell after profit means you:

- Lock in gains before they disappear.

- Reduce stress by following a system instead of emotions.

- Avoid the deadly habit of “hoping” the market turns back in your favor.

Candlestick Patterns and Market Psychology

Candlestick charts are the language of the market. Each candle shows the battle between buyers and sellers:

- A long green candle = strong buyer momentum.

- A long red candle = sellers dominating.

- A doji = indecision.

By studying candlestick patterns, traders can spot moments of weakness (time to exit) or continuation (time to hold).

👉 If you want a step-by-step guide on candlestick trading, you can learn candlesticks here.

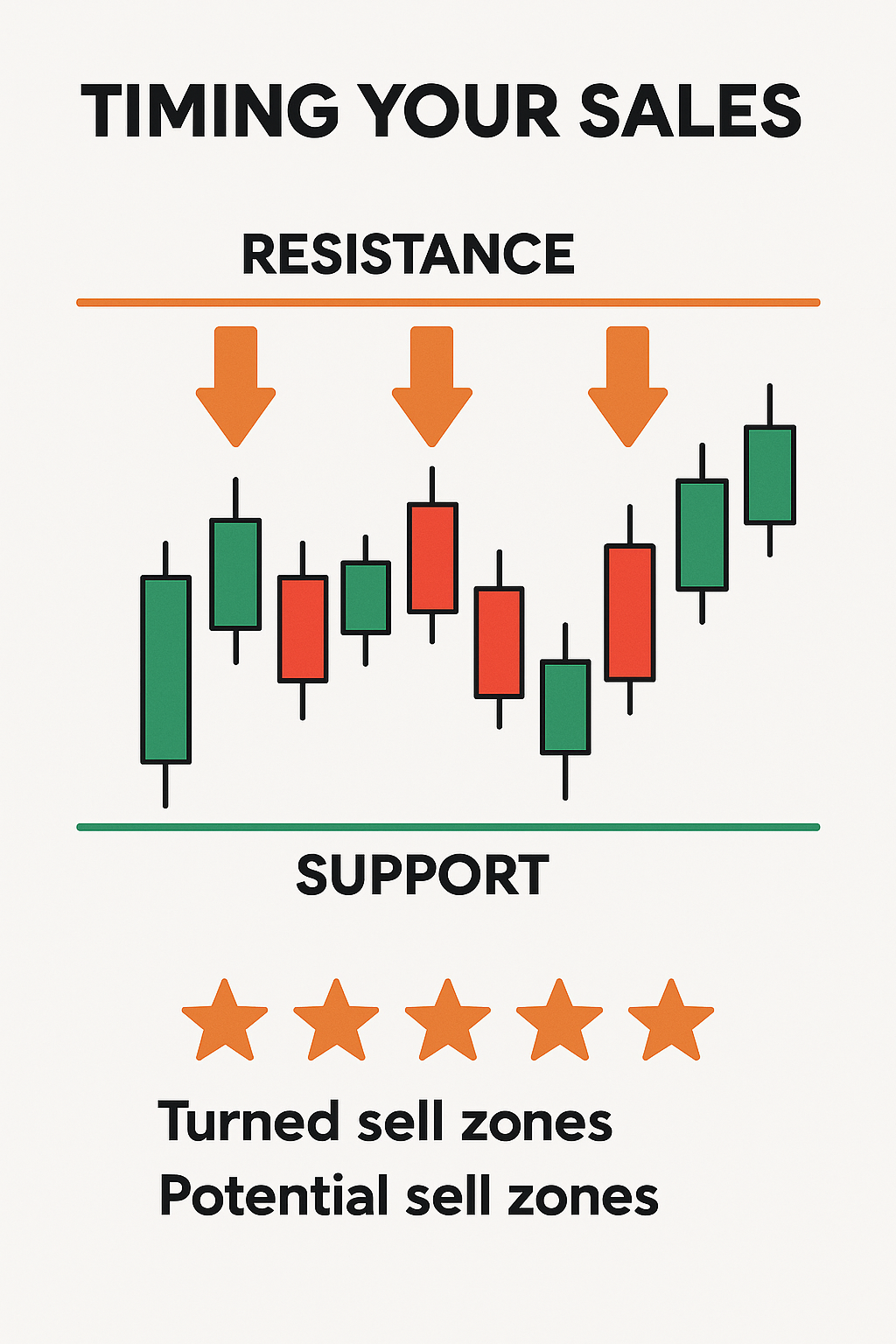

Support and Resistance Levels

Another key to timing exits is watching support and resistance:

- If price reaches a major resistance level and struggles to break through, it may be the right time to take profit.

- Conversely, if price is bouncing off support and still showing strength, you might hold a little longer.

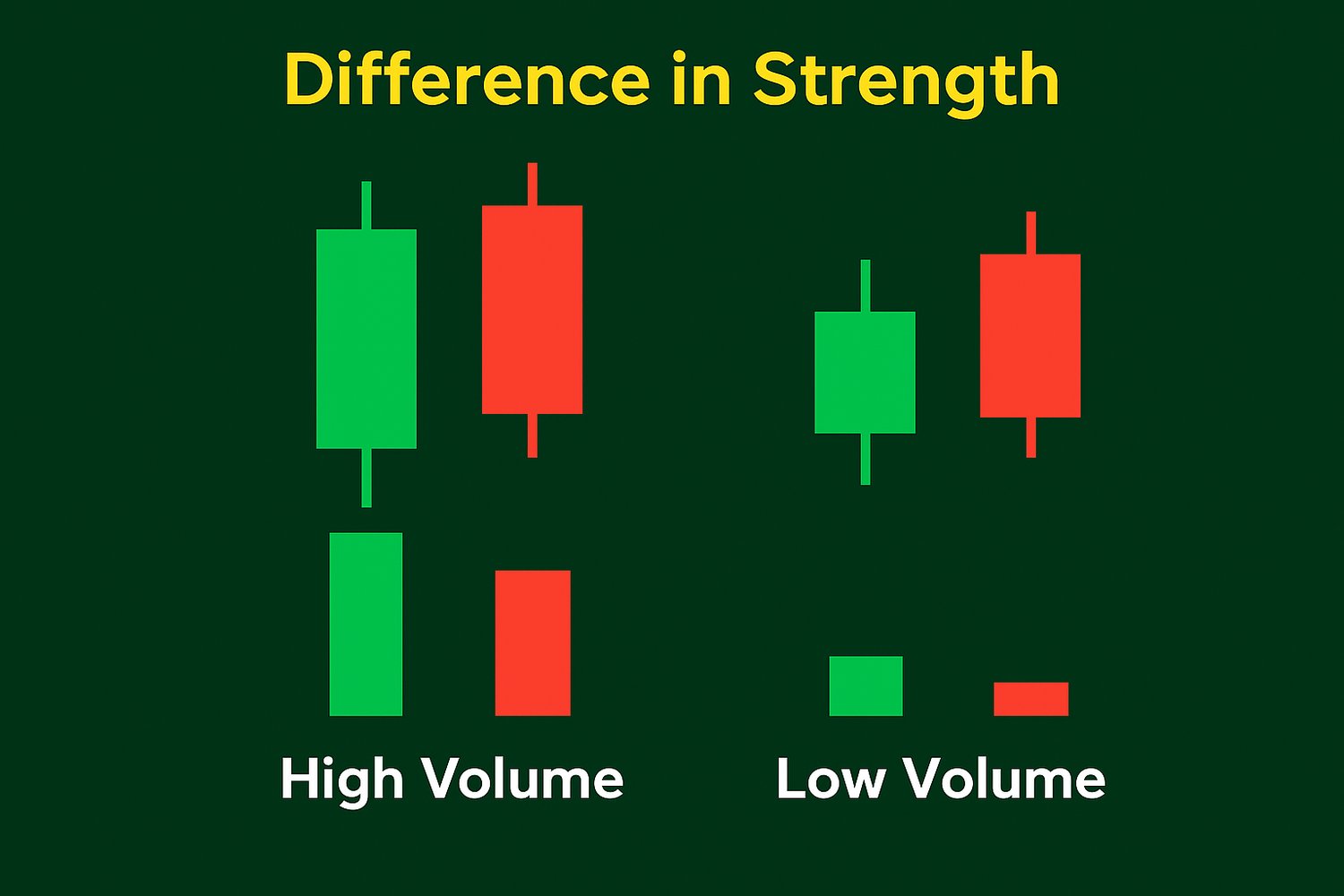

Volume as Confirmation

Volume tells you how much conviction is behind a move.

- High volume on a green candle = buyers strongly committed.

- Weak volume on a rally = the move may not last.

Combining candlestick patterns with support, resistance, and volume gives traders powerful clues for profit-taking.

3. Proven Profit-Taking Strategies

Once you understand the basics of profit-taking, the next step is to choose a repeatable strategy. The key is to avoid emotional decisions and rely on rules that protect your gains.

3.1. Fixed Percentage Targets

One of the simplest methods is to set a target profit before you enter a trade. For example:

- Exit at +10% for short-term trades.

- Exit at +20–30% for swing trades.

This way, you don’t need to guess when to sell — you already have your plan.

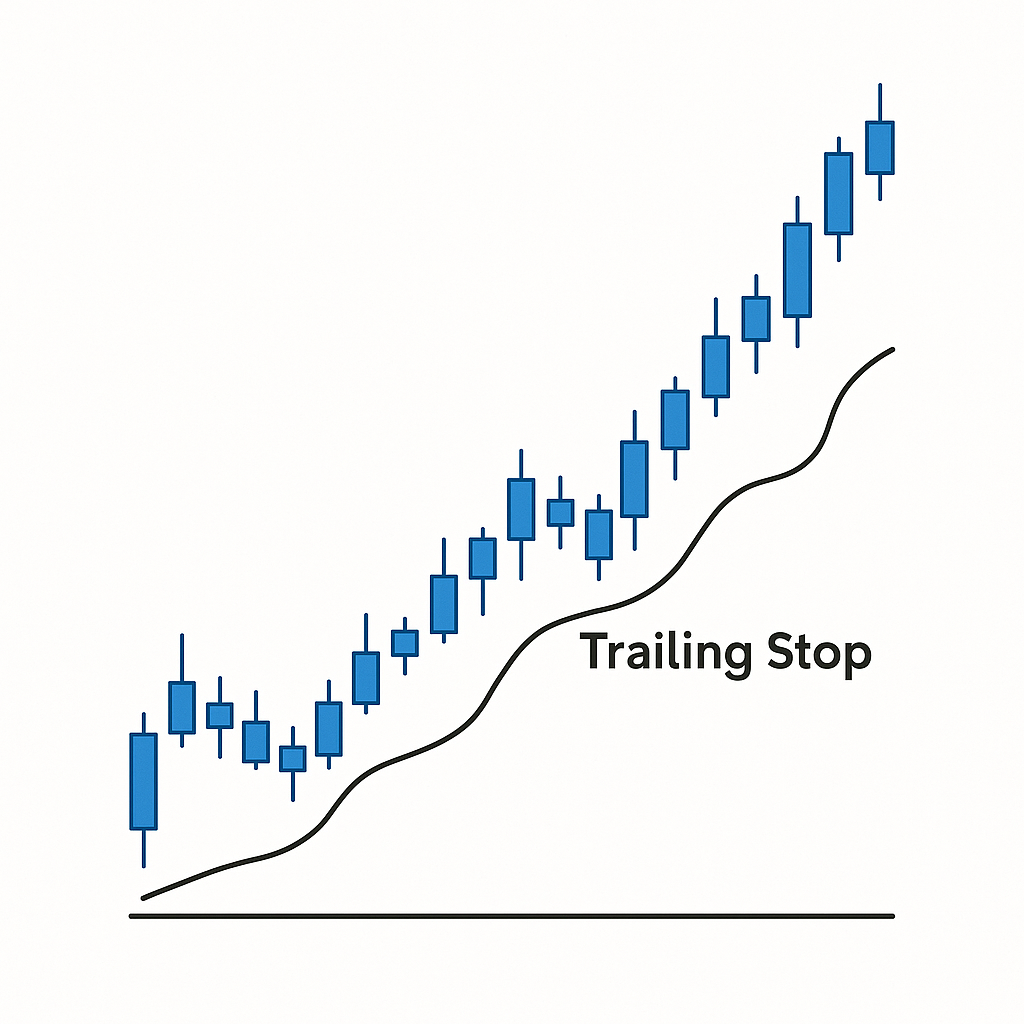

3.2. Trailing Stop-Loss

A trailing stop-loss is like a moving safety net.

- As the price rises, your stop-loss moves up with it.

- If the price reverses, the stop-loss triggers and secures your profit.

Example:

- You buy at $100 with a 10% trailing stop.

- Price rises to $150 → your stop moves to $135.

- If price falls, you exit automatically with profit.

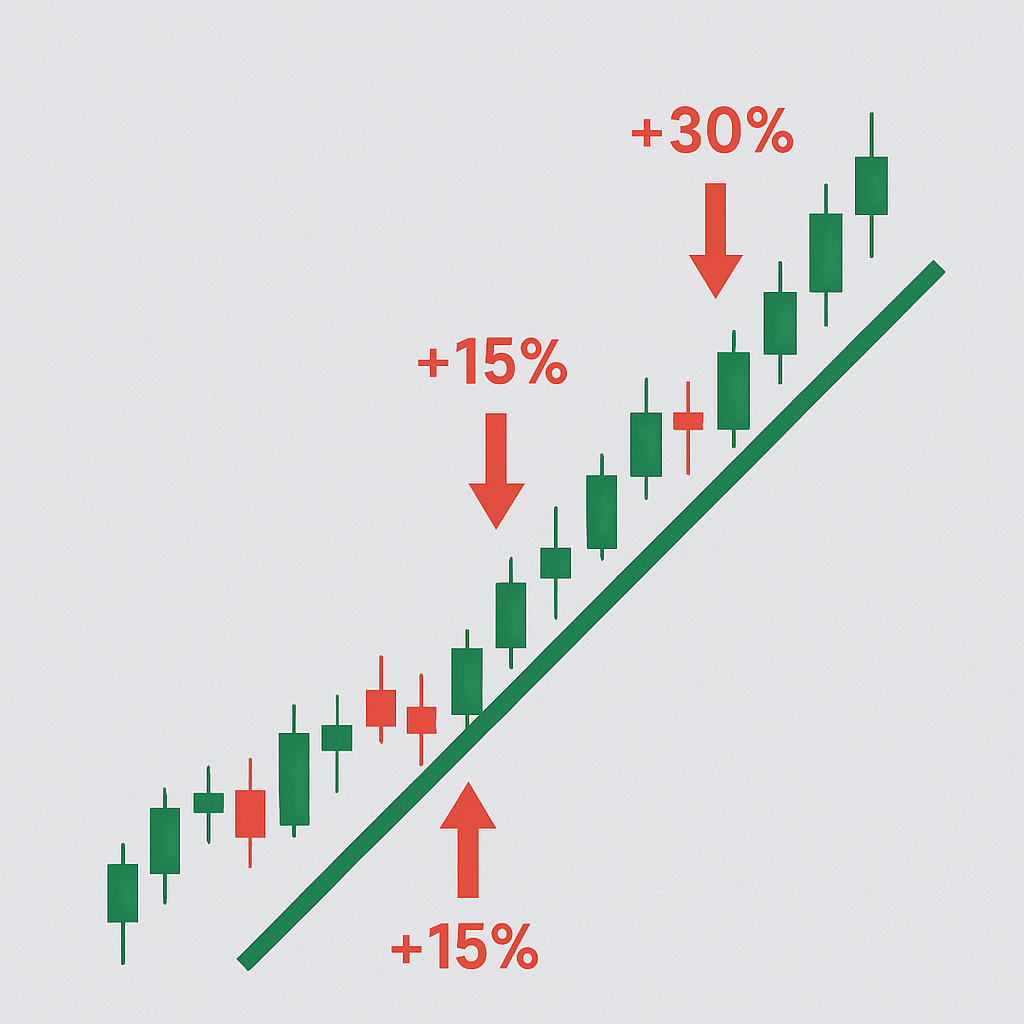

3.3. Scaling Out in Portions

Instead of selling everything at once, many traders sell in stages.

- Sell 50% of your position at +15%.

- Keep the other 50% running in case the trend continues.

This balances locking in profit and riding potential upside.

3.4. Combining Strategies

Smart traders often combine these methods:

- Take partial profits at a fixed target.

- Keep the rest with a trailing stop.

👉 Remember: Taking profit is never a mistake. Even if the market keeps going, you’ve secured gains — and that’s what matters.

4. The Role of Risk Management

Profit-taking is not just about maximizing gains — it’s about protecting your capital.

4.1. Stop-Loss Orders

Every trade should have a stop-loss. Without it, you risk turning one bad trade into a portfolio disaster.

- Place your stop below support in long trades.

- Place it above resistance in short trades.

4.2. Avoiding Round-Trips

The worst feeling for a trader is watching a winning trade go all the way back to zero or even negative.

This happens when traders refuse to sell because of greed.

👉 Protect yourself: Always move your stop-loss higher as profits grow.

4.3. Diversification After Profit-Taking

When you take profit, don’t just sit on cash.

- Reinvest into diversified assets.

- Spread risk between stocks, crypto, forex, or bonds.

- Secure long-term growth while still trading short-term.

4.4. Risk-to-Reward Ratio

A professional trader always thinks in terms of risk-to-reward (R:R).

- If you risk $100, aim for at least $200 profit (2:1 ratio).

- This ensures long-term profitability even with 50% win rate.

👉 If you want pre-built templates to manage trades and exits, you can learn candlesticks here.

5. Case Studies: Real-World Profit-Taking

Theory is good, but nothing beats real examples. Let’s look at how profit-taking works in stocks, crypto, and forex.

5.1. Stock Trading: Tesla Example

Tesla’s stock exploded in 2020–2021. Traders who sold at +50% gains secured real profits, while those who held too long often watched their gains collapse when the stock retraced.

5.2. Crypto Trading: Bitcoin Cycles

Bitcoin has famous boom-and-bust cycles.

- 2017: Bitcoin hit $20,000 then crashed to $3,000.

- 2021: Bitcoin soared to $60,000 then back to $20,000.

Traders who used profit-taking strategies (scaling out, trailing stops) locked in life-changing gains. Those who didn’t, often rode their profits back to zero.

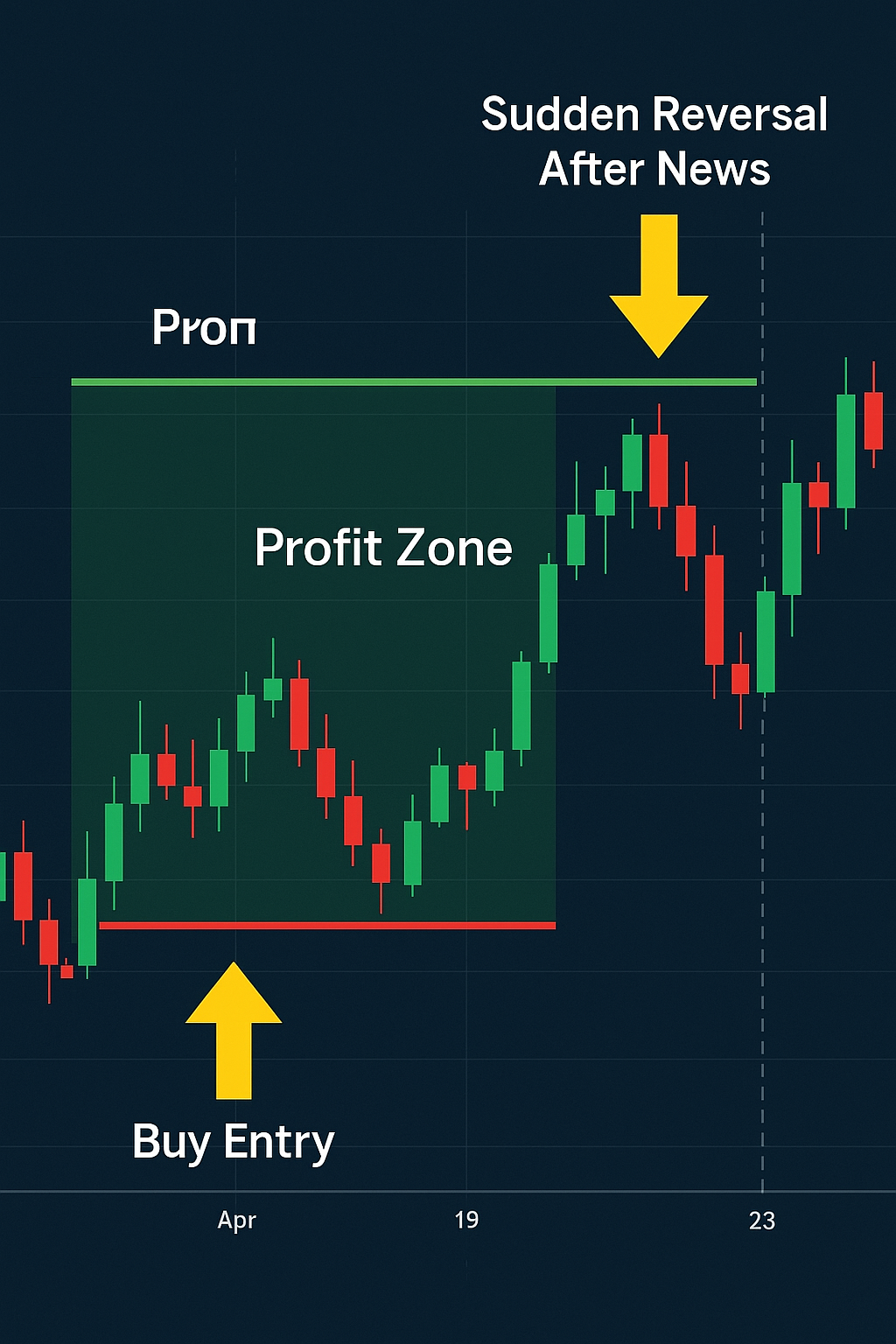

5.3. Forex Trading: EUR/USD Example

In forex, timing is even faster.

A trader buying EUR/USD at 1.05 and exiting at 1.08 secures a solid gain.

But if they hold too long, news events (like central bank decisions) can reverse the entire move in minutes.

👉 Lesson: Profit-taking is not about predicting the top. It’s about locking in gains before the market takes them back.

6. Advanced Exit Techniques

For traders who want to go beyond the basics, there are advanced strategies to refine your timing.

6.1. Using RSI (Relative Strength Index)

The RSI shows when a market is overbought (too high) or oversold (too low).

- RSI above 70 = overbought → time to take profit.

- RSI below 30 = oversold → time to prepare for entry.

6.2. MACD (Moving Average Convergence Divergence)

MACD helps identify momentum shifts.

- When MACD crosses down from above, it’s often a good signal to sell.

6.3. Moving Averages

Simple moving averages (SMA) or exponential moving averages (EMA) can act as dynamic support/resistance.

- When price closes below the 50-day EMA, many traders take profit.

6.4. Volume Analysis

Volume confirms price action.

- A rally with weak volume = time to sell.

- A breakout with strong volume = time to hold.

👉 These advanced tools are powerful, but they work best when combined with candlestick patterns and clear rules.

If you want pre-built templates for tracking and learning these strategies, you can learn candlesticks here.

7. Mastering Trading Psychology

Even with the best strategy, many traders fail because of psychology. Knowing when to sell is not only technical — it’s emotional.

7.1. Fear

Fear makes traders sell too early, afraid the profit will vanish. This often results in missing out on larger gains.

7.2. Greed

Greed makes traders hold too long, chasing “just a little more.” This often ends with losing all profits.

7.3. Regret

Regret traps traders in a cycle of second-guessing — “I should have sold earlier… I should have held longer.”

7.4. How to Overcome Trading Emotions

- Write down your exit strategy before entering a trade.

- Stick to your rules, no matter how tempting it feels.

- Keep a trading journal to learn from mistakes.

👉 Trading discipline is built with practice. The more you follow a plan, the easier it becomes.

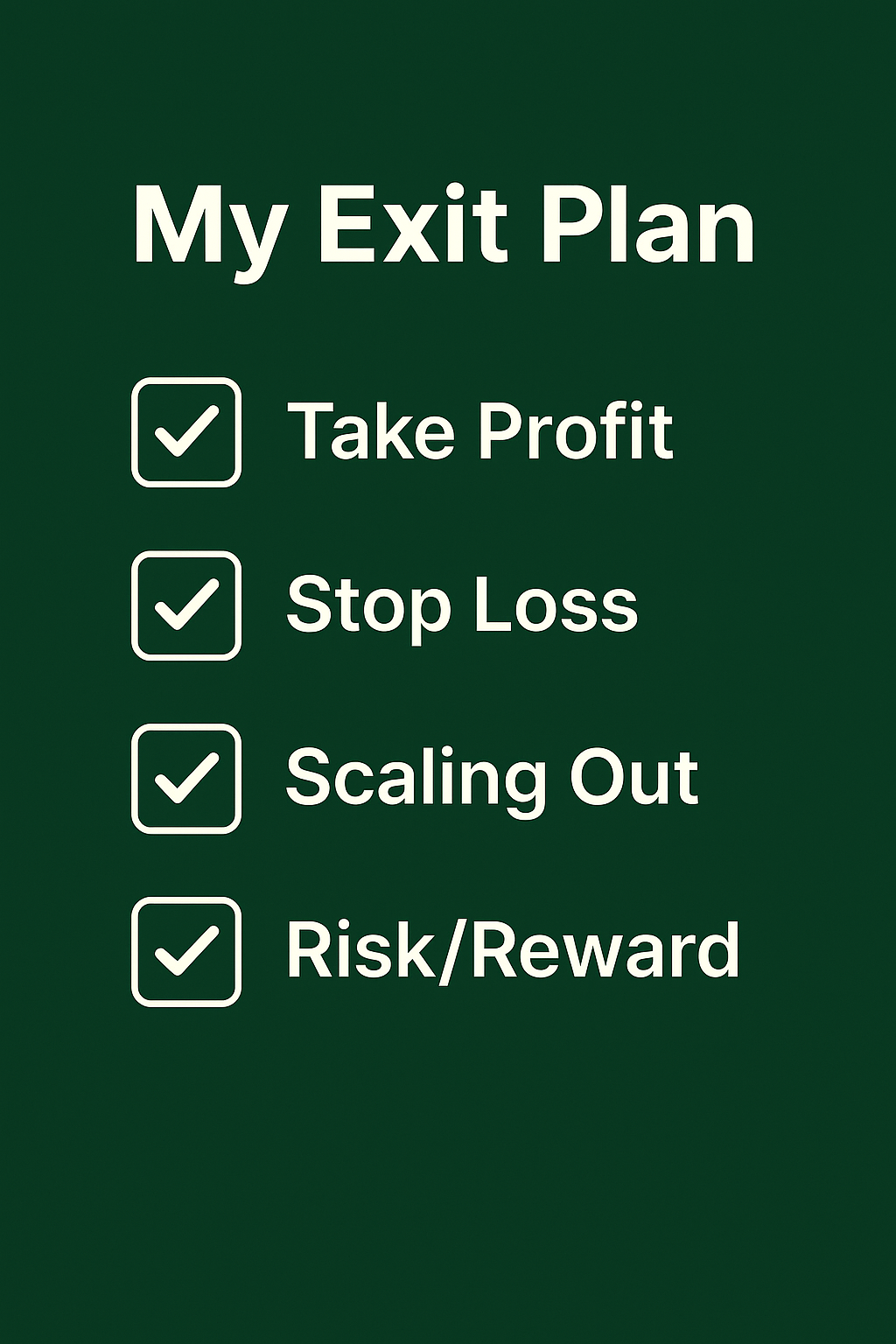

8. Building a Personal Exit Plan

Every trader needs a personalized plan for when to sell. Without one, emotions take over.

8.1. Define Your Rules in Advance

- Where will you take profit? (fixed target or trailing stop)

- Where will you place your stop-loss?

- Will you scale out of positions?

8.2. Balance Long-Term and Short-Term

Not every trade is the same.

- Short-term trades may require quick exits.

- Long-term investments can be held through volatility.

Having clarity between these two prevents mistakes.

8.3. Make It Repeatable

The best traders don’t guess — they repeat a system.

Your exit plan should be simple enough that you can apply it to every trade.

👉 If you want step-by-step frameworks and ready-to-use templates, you can learn candlesticks here.

Conclusion

Profit is only real when you take it.

The difference between beginners and professionals is not the entry — it’s the exit discipline.

- Lock in profits before they vanish.

- Protect your capital with stop-loss and risk management.

- Control your emotions with a repeatable exit plan.

Remember: You don’t need to sell at the very top. You just need to sell at a point where you secure profits and protect your growth.

👉 Stop guessing. Start trading smarter today.

For tools, strategies, and candlestick mastery, you can learn candlesticks here.