The investment landscape is constantly evolving, and investors are always on the lookout for new opportunities to maximize returns. One such option that has gained popularity in recent years is to buy unlisted shares. These are shares of companies that are not listed on any recognized stock exchange, such as NSE or BSE. Instead, they are traded privately, often through brokers, employees, or digital platforms. While investing in unlisted shares comes with certain risks, it can also provide access to promising businesses before they go public.

What Are Unlisted Shares?

Unlisted shares represent ownership in companies that are privately held and not available for trading in the open market. Buy unlisted shares Unlike listed stocks, these shares do not have daily price movements or market-determined valuations. Instead, their prices are set based on negotiations between buyers and sellers.

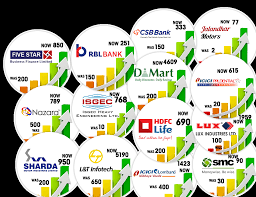

Many well-known companies were once available in the unlisted space before their IPOs. Businesses like Reliance Retail, HDFC Securities, and Paytm offered shares privately, and those who invested early often enjoyed substantial gains once the companies listed publicly.

Why Do Investors Buy Unlisted Shares?

There are several reasons why investors are drawn to the unlisted market:

- Early-Stage Investment – Buying unlisted shares gives investors an opportunity to invest in companies before their IPOs, often at lower valuations.

- High Growth Potential – Many unlisted firms operate in emerging sectors such as fintech, renewable energy, and e-commerce.

- Diversification – Adding unlisted shares to a portfolio helps reduce reliance on traditional stocks and mutual funds.

- Subsidiary Exposure – Some large corporations sell shares of their subsidiaries in the unlisted market, giving investors early access to strong brands.

How to Buy Unlisted Shares in India

Purchasing unlisted shares is different from investing in listed stocks. The most common methods include:

- Specialized Brokers – Brokers and dealers facilitate transactions between buyers and sellers in the unlisted space.

- Employee Stock Options (ESOPs) – Employees often sell vested shares, giving investors direct access.

- Private Placements – High-net-worth individuals (HNIs) may be invited to participate in funding rounds directly by companies.

- Online Platforms – Fintech platforms now allow investors to browse, research, and purchase unlisted shares conveniently.

Risks to Consider

As with any investment, unlisted shares carry risks that must be evaluated carefully:

- Liquidity Concerns – Since there is no organized exchange, selling unlisted shares quickly may be difficult.

- Unclear Valuations – Prices are not transparent, making valuation less reliable than listed stocks.

- Regulatory Risks – Unlisted firms face less scrutiny, which increases the chance of misinformation.

- Business Uncertainty – Many private firms are in early stages, and some may not succeed.

Taxation of Unlisted Shares

Taxation rules for unlisted shares differ from listed stocks. If you sell them within 24 months, the gains are classified as short-term and taxed as per your income tax slab. If held for more than 24 months, they are treated as long-term capital gains and taxed at 20% with indexation benefits. This makes understanding taxation crucial for investors in the unlisted space.

Tips for Investing in Unlisted Shares

- Conduct thorough research into the company’s fundamentals and business model.

- Start with smaller amounts before committing heavily.

- Diversify your portfolio by mixing listed and unlisted assets.

- Use trusted brokers or platforms with a strong track record.

- Have patience, as unlisted investments generally take time to deliver strong returns.

Conclusion

Unlisted shares provide unique opportunities to participate in the growth journey of companies before they hit the stock market. While they carry higher risks, they also offer the potential for significant rewards, especially for long-term investors. By doing proper research, understanding the risks, and diversifying effectively, you can make the most out of this emerging investment segment.

Choosing to invest in unlisted shares could be the right step for investors seeking diversification and early access to high-potential companies.