Disclaimer:

I am not a tax professional, accountant, or attorney. This guide is shared for informational purposes only and reflects general best practices for year-end organization within a small publishing business or self-publishing operation. It does not constitute legal, financial, or tax advice. For guidance specific to your situation, please consult a qualified tax professional or legal advisor.

For Small Presses, Micro-Publishers, and Self-Published Authors

Whether you run a small independent publishing company or operate as an indie author managing your own catalog, closing out your books at the end of the year is essential for staying tax-compliant, understanding your financial performance, and preparing for a stronger publishing year ahead.

This guide includes tasks, checklists, and critical reports you should generate at year-end.

1. GATHER ALL FINANCIAL & SALES DATA

Before analyzing anything, collect all relevant documents.

Documents to Gather

- Bank statements for business accounts

- Credit card statements

- Bookkeeping software exports (QuickBooks, Wave, FreshBooks, etc.)

- Platform sales reports:

- Amazon KDP

- IngramSpark

- Barnes & Noble Press

- Kobo

- Draft2Digital

- ACX/Audible

- Etsy (printables)

- Payhip/Gumroad (direct sales)

- Shopify store reports

- Royalties received from other publishers or collaborations

- Contracts with authors (if you publish others)

2. BOOK SALES RECONCILIATION

For Small Publishers

✔ Make sure all royalty statements received match the deposits in your accounts.

✔ Check for incorrectly paid royalties, missing payments, or duplicate entries.

✔ Reconcile:

- Direct sales (website, in-person events)

- Wholesale orders

- ARC/review copies (not income, but trackable)

- Bulk sales to bookstores or libraries

- Returns from distributors

For Indie Authors

✔ Reconcile sales from every platform.

✔ Check for:

- Missing royalties

- Not-yet-disbursed royalties

- Exchange rate discrepancies

- Chargebacks on eBook sales

- Print cost changes impacting net royalties

Reports to Generate

- Yearly sales summary (all platforms)

- Monthly sales breakdown

- Sales by title

- Sales by format (ebook, paperback, hardcover, audio)

- Refund/return report

- Pending royalty report

3. DIRECT SALES & SHIPPING RECONCILIATION

If you sell signed copies, merch, bundles, or digital downloads:

Tasks

✔ Reconcile Shopify/Etsy/Payhip/Gumroad sales

✔ Verify shipping expenses recorded accurately

✔ Confirm tax collection matches state requirements

✔ Log any unpaid invoices or manual orders

Reports to Generate

- Direct-sales P&L

- Shipping cost summary

- Tax collected by jurisdiction report

- Inventory shipped vs. remaining

4. SALES TAX REVIEW

This is extremely important for publishers who sell direct.

Tasks

✔ Determine economic nexus in other states (based on sales volume thresholds)

✔ Verify sales tax was correctly charged and remitted for:

- Direct online sales

- Event sales (book signings, markets, fairs)

- ✔ Ensure digital product tax is applied correctly (varies by state)

Reports

- Taxable vs. non-taxable sales

- Totals remitted per filing period

- Exemption certificates (if wholesale buyers purchased from you)

5. EXPENSE REVIEW & DEDUCTIBLE CATEGORIZATION

Publishing/business-related expenses often go unclaimed.

Deductible Expenses to Review

- ISBN purchases

- Editing fees

- Formatting and design services

- Illustrations or cover art

- Advertising and marketing

- Book printing costs

- Review copies / promo copies

- Event expenses (tables, travel)

- Shipping supplies

- Software subscriptions (BookFunnel, Canva, ProWritingAid, Vellum, etc.)

- Domain, hosting, and website fees

- Audiobook production costs

- Business coaching or consulting

- Office supplies

- Home office deductions (if eligible)

Reports to Generate

- Year-to-date expense report

- Categorized expense summary

- Mileage log export (for events, post office trips)

- Depreciation schedule for equipment (computers, cameras)

6. AUTHOR ROYALTIES (FOR SMALL PUBLISHERS)

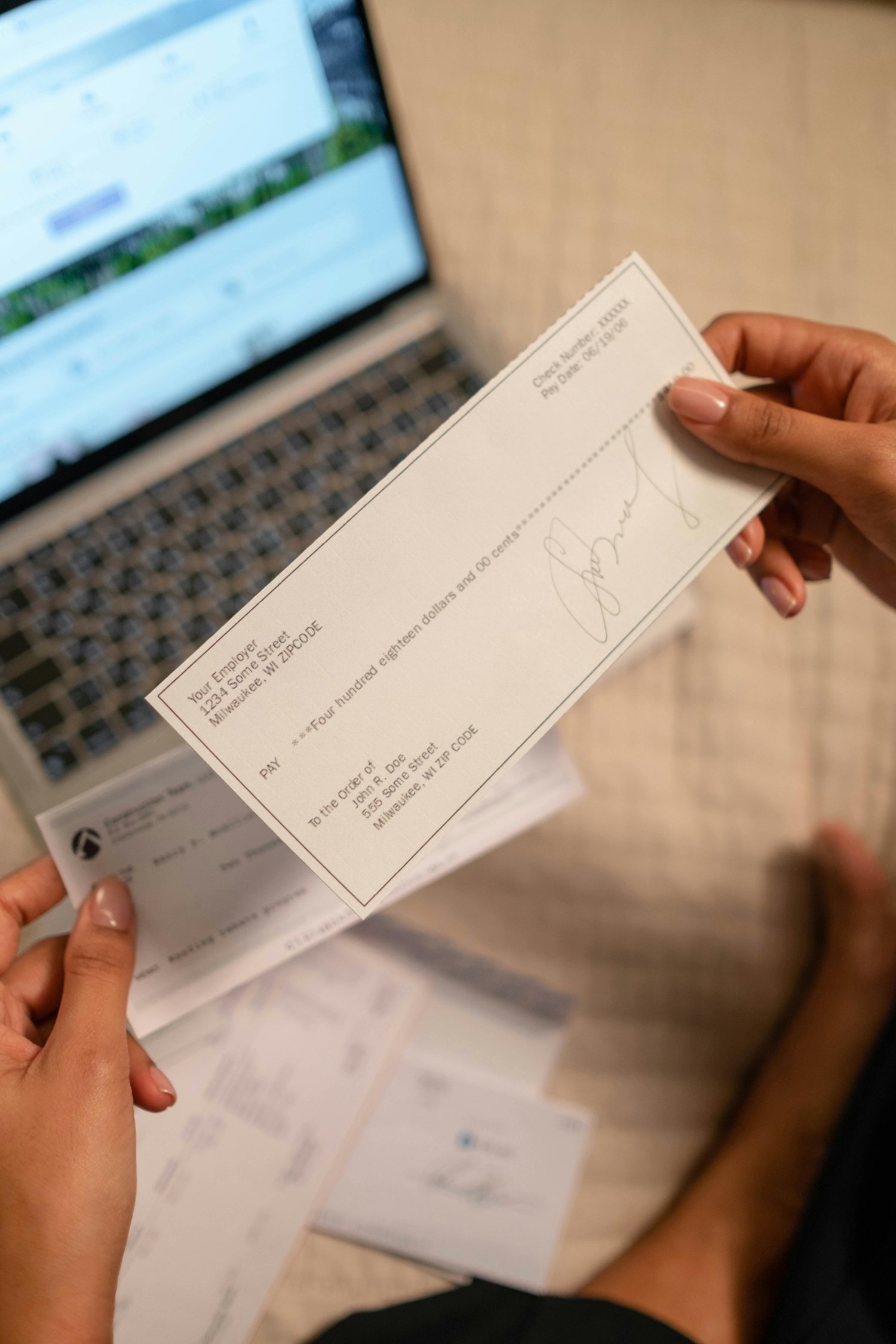

If you publish other authors, year-end is royalty season.

Tasks

✔ Reconcile royalty earnings by title and format

✔ Deduct printing costs, distributor fees, and returns

✔ Generate royalty statements for each author

✔ Issue payments (check, ACH, PayPal)

✔ Prepare 1099-NEC forms for authors earning $600+

Reports

- Royalty summary report

- Title-by-title earnings

- Cost deductions summary

- Year-end 1099 log

7. INVENTORY & PRINT STOCK CHECK

For both publishers and selling authors:

Tasks

✔ Count remaining copies of each title

✔ Note damaged or unsellable books

✔ Reconcile printed inventory to sales and free copies

✔ Update inventory in your bookkeeping system

✔ Evaluate what stock is worth writing off

Reports

- Inventory-on-hand summary

- Free/review copies report

- Write-offs and damaged stock report

8. WEBSITE, EMAIL, & BUSINESS SYSTEM AUDIT

Year-end is a good time to tighten your digital operations.

Tasks

✔ Archive old email campaigns

✔ Clean subscriber lists (GDPR/compliance check)

✔ Verify automations and welcome sequences still function

✔ Update product descriptions, pricing, and availability

✔ Renew domain names

✔ Check that store tax settings are up to date

9. FINAL FINANCIAL REPORTS FOR TAX PREPARATION

These documents should be ready for your accountant or CPA.

Required Reports

🧾 Financial Statements

- Profit & Loss (cash and accrual if possible)

- Balance Sheet

- Cash Flow Statement

🧾 Sales & Royalties

- Platform royalties summary (all platforms combined)

- Distributor sales

- Direct sales

- Refunds

🧾 Expenses

- Categorized expense summary

- Software and subscription fees

- Advertising/marketing breakdown

- Travel & event expenses

🧾 1099 Forms (if applicable)

- Authors

- Contractors (editors, designers, narrators, VAs)

- Freelancers paid > $600

🧾 Documentation

- Home office deduction worksheet (if used)

- Mileage records

- Receipts archive (digital and physical)

10. YEAR-END CLEANUP & ARCHIVING

Tasks

✔ Download and store year-end KDP, D2D, IngramSpark, ACX, Shopify reports

✔ Save PDF copies of all financial statements

✔ Backup manuscripts, covers, and formatted files

✔ Store all contracts and agreements in labeled folders

✔ Review your publication schedule for next year

✔ Update operating procedures based on lessons learned

11. STRATEGIC NEXT-YEAR PLANNING

Review Your Year

- Which titles performed best?

- Which marketing efforts produced ROI?

- Which formats (audio, print, ebook) deserve focus next year?

- Which ads underperformed?

- What were your largest expenses?

Plan Ahead

✔ Set production schedule for next 12 months

✔ Create marketing calendar (book launches, promos, events)

✔ Decide on new ISBN purchases or bulk buys

✔ Set sales and revenue goals

✔ Review subscription renewals and cancel what you no longer need

This list is not extensive and you should still consult a tax professional with any questions. However, staying on top of your paperwork is the best way to know how profitable you are. If you don't know where you stand profit-wise, you can't properly plan to increase those profits and hit your targets. We all dream of being able to earn a full-time income as writers. Knowing where you are in your journey gets you one step closer to attaining that dream!

Need a printable checklist? No problem! Grab it here. Printable Checklist.

Photo by cottonbro studio: https://www.pexels.com/photo/a-person-s-hand-holding-a-cheque-6862457/