Estate planning is an essential process for securing your financial future and ensuring your assets are distributed according to your wishes upon your death. In 2024, the landscape of estate planning continues to evolve with changes in laws, tax codes, and the increasing complexity of financial instruments. In this post, we'll delve into the critical components of estate planning in 2024, highlight a detailed table that encapsulates vital aspects, and answer some frequently asked questions to help you navigate this complex field.

Understanding Estate Planning in 2024

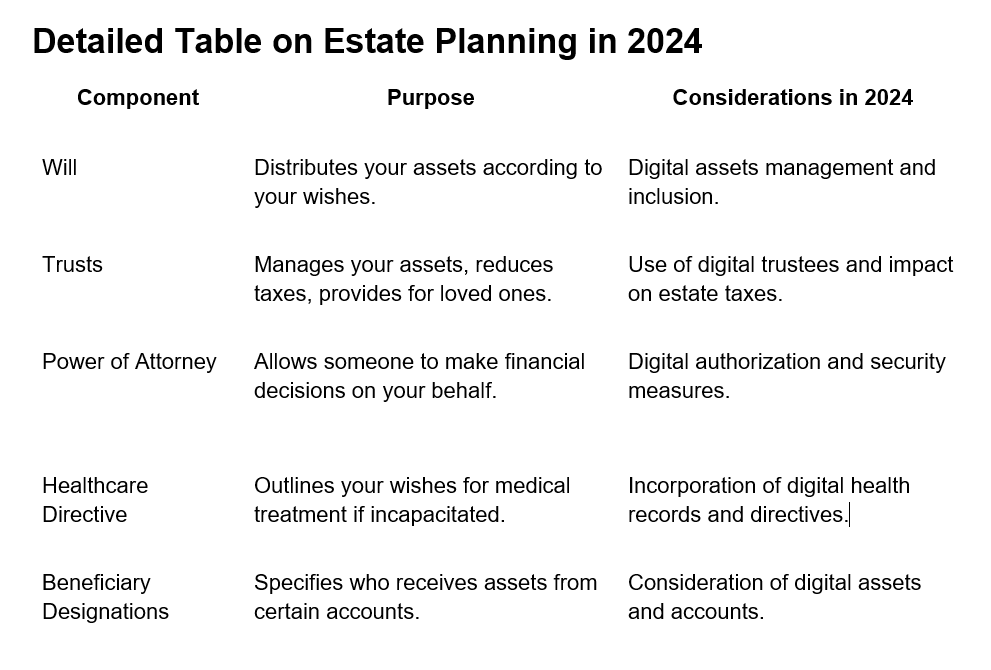

Estate planning in 2024 is not just about writing a will. It encompasses a range of documents and strategies designed to protect your assets, reduce taxes, and provide for your loved ones after you're gone. The process involves wills, trusts, power of attorney, healthcare directives, and more. Each component plays a unique role in safeguarding your estate and ensuring your wishes are honored.

The Components of a Comprehensive Estate Plan

A comprehensive estate plan includes several key elements:

● Will: A legal document that outlines how you want your assets distributed after your death.

● Trusts: Tools for managing your assets, providing for your loved ones, and potentially reducing estate taxes.

● Power of Attorney: A document that allows someone else to make financial decisions on your behalf if you're unable to do so.

● Healthcare Directive: Also known as a living will, it outlines your wishes for medical treatment if you become incapacitated.

● Beneficiary Designations: Specifies who will receive assets from accounts like life insurance, retirement plans, and bank accounts.

The Importance of Estate Planning

Estate planning is crucial for several reasons. Firstly, it ensures that your assets are distributed according to your wishes. Without a plan, state laws will determine how your assets are divided, which might not align with your desires. Secondly, it can significantly reduce taxes for your heirs, ensuring they receive a larger portion of your estate. Finally, it provides peace of mind, knowing that your financial affairs are in order and your loved ones are taken care of.

Estate Planning in the Digital Age

In 2024, the digital age has brought new challenges and considerations for estate planning. Digital assets, including social media accounts, digital currencies, and online businesses, require careful consideration in your estate plan. It's essential to include these assets in your will or trust and provide access information for your digital executor.

Frequently Asked Questions

How has estate planning changed in 2024?

Estate planning in 2024 has adapted to include digital assets more comprehensively. Laws and regulations have evolved to address the management and inheritance of digital currencies, online accounts, and virtual properties. Additionally, the rise of artificial intelligence has introduced new tools for managing estate plans, making the process more efficient and tailored to individual needs.

What are the tax implications of estate planning in 2024?

In 2024, estate taxes remain a significant consideration. The thresholds for estate and gift taxes have been adjusted, impacting how much of your estate can be transferred tax-free. Trusts continue to be a strategic tool for minimizing tax liabilities, but the rules around them have evolved. It's crucial to stay informed about current tax laws and work with a financial advisor, such as Strickland Capital Group Tokyo Japan, to optimize your estate plan for tax purposes.

How can I ensure my digital assets are properly included in my estate plan?

To ensure your digital assets are included in your estate plan, you should first make an inventory of all digital assets, including accounts, passwords, and digital currencies. Next, include specific instructions in your will or trust about how these assets should be managed and who should have access to them. It's also advisable to appoint a digital executor, someone who is tech-savvy and can manage the digital aspects of your estate according to your wishes.

Conclusion

Estate planning in 2024 is more complex than ever, necessitating careful consideration of both traditional and digital assets. By understanding the components of a comprehensive estate plan and staying informed about the latest changes in laws and technology, you can ensure your assets are protected and your loved ones are provided for. Remember, estate planning is not a one-time task but an ongoing process that should be reviewed and updated as your life circumstances and the legal landscape change. With the right approach and guidance from experts like Strickland Capital Group Tokyo Japan, you can navigate the complexities of estate planning and secure your financial legacy.