Introduction: The Worn-Out Path to Retirement

For generations, the roadmap to retirement has been the same: work for 40 years, save 10-15% of your income, and hope it’s enough to carry you through your golden years. It’s a slow, frustratingly linear path that leaves little room for a life of freedom before you’re too old to fully enjoy it. Many of us dream of something different—a way to reclaim our time and live life on our own terms, decades earlier than tradition allows. This is the promise of the Financial Independence, Retire Early (FIRE) movement.

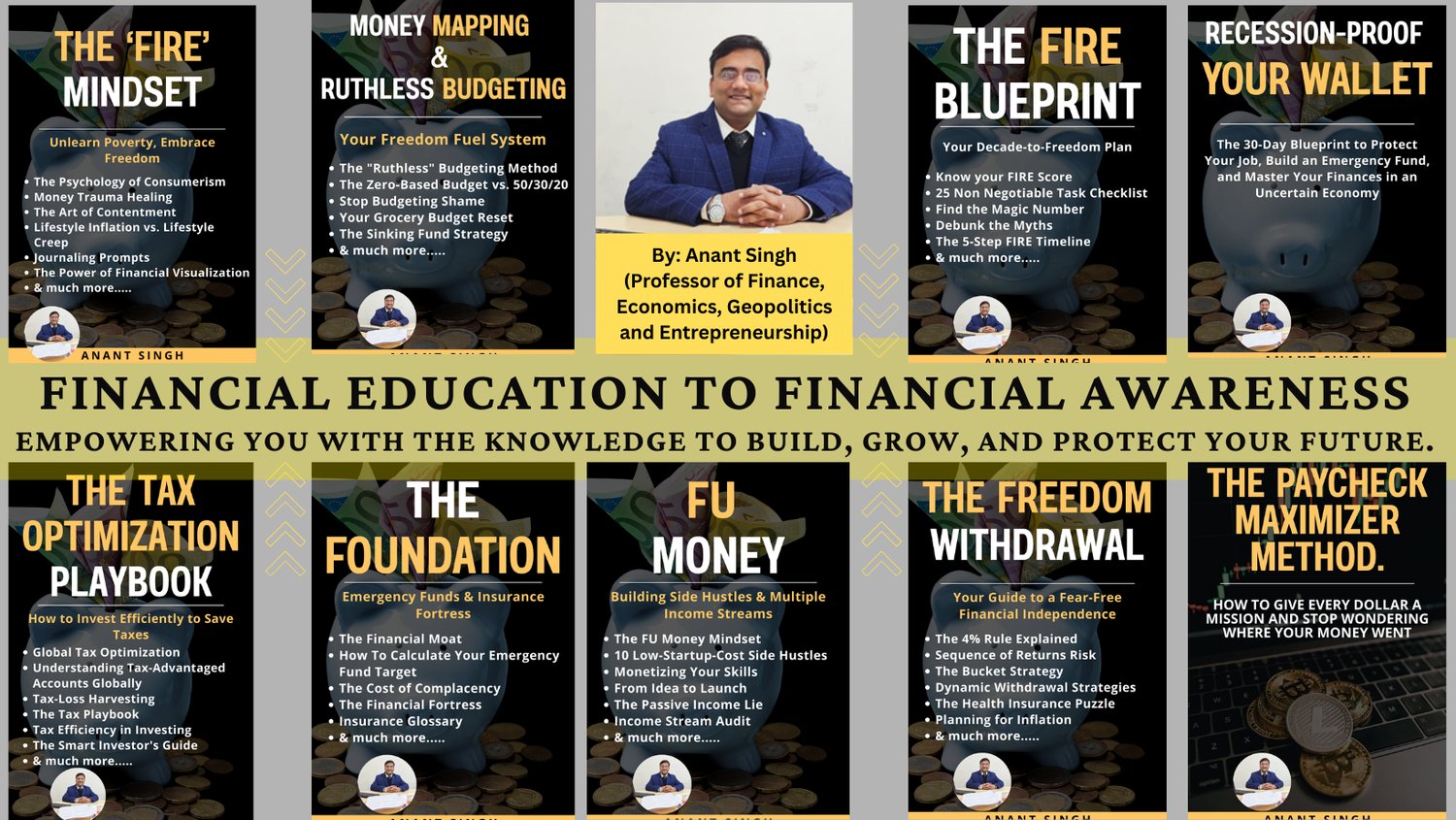

But the conventional wisdom peddled by the financial industry is fundamentally misaligned with the goal of early retirement. In my book, 'The FIRE Blueprint', I detail a new roadmap that challenges these outdated principles. It’s a framework built on mathematical truths and strategic, counter-intuitive actions that empower you to take control of your financial destiny. This isn't about earning more; it's about investing differently and understanding the rules that truly govern wealth creation.

This post will reveal five of the most impactful and surprising takeaways from the book. These aren't minor tweaks to your budget; they are foundational shifts in thinking that can shave decades off your working career and put you on the fast track to financial freedom.

1. Your Savings Rate is More Powerful Than Your Income

The most liberating principle of the FIRE movement is also the simplest: your timeline to financial independence is determined almost exclusively by your savings rate, not your absolute income. Someone earning $50,000 per year and saving 50% of it will reach financial freedom decades before someone earning $200,000 and saving only 10%.

This mathematical certainty is the engine of early retirement. As your savings rate increases, two things happen simultaneously: you accumulate more capital to invest, and you train yourself to live on less, which reduces the size of the nest egg you'll ultimately need. This creates a powerful, non-linear acceleration toward your goal.

The table below, based on core research in 'The FIRE Blueprint', illustrates this dramatic effect. The leap from a 10% to a 50% savings rate doesn't just cut your working years in half—it cuts them by nearly two-thirds.

Savings Rate Estimated Working Years to Retirement

10% 51 Years

20% 37 Years

30% 28 Years

40% 22 Years

50% 17 Years

60% 12.5 Years

70% 8.5 Years

This concept is powerful because it shifts the locus of control entirely to you. It’s not about waiting for a promotion or chasing a higher salary. It’s about widening the gap between what you earn and what you spend. Master that, and you master your timeline to freedom.

2. The Wealthy Invest “Factory Direct,” Not “Retail”

Traditional financial advice guides the average person toward a narrow slice of the investment world. As detailed in 'The FIRE Blueprint', there are three levels of investing, and the wealthy operate on a completely different plane from everyone else.

Retail Investing is the most common path. It includes publicly available products like mutual funds and Real Estate Investment Trusts (REITs). While accessible, these are designed to deliver the lowest rate of return and the fewest tax benefits. This path is safe, but it will not help you retire early.

Wholesale Investing is the next level up, composed of syndicated investments available only to accredited investors (those with a net worth over $1 million or high annual incomes). This tier offers better returns and tax advantages, but it remains an exclusive club that most people cannot access.

The real secret lies in Factory Direct Investing. This is the level where you’ll find the biggest returns and the best tax benefits because you are making direct investments into businesses, real estate, or commodities. This is where wealth is truly created. This path requires a fundamental shift from being a passive investor to an active, educated owner. It means picking one specific niche—like self-storage facilities or multi-family apartment buildings—and becoming a subject-matter expert. It also requires assembling a "dream team," including a CPA to build a tax strategy and a lawyer to ensure your assets are protected. While it demands more effort, the rewards are exponentially greater and can dramatically accelerate your journey.

3. The Biggest Financial Threat in 2026 Isn’t a Market Crash

For early retirees in the U.S., one of the biggest and most overlooked financial risks has nothing to do with the stock market. It's a legislative time bomb set to go off at the end of 2025: the expiration of enhanced Affordable Care Act (ACA) subsidies.

In 2026, the pre-pandemic "subsidy cliff" is scheduled to return. This means that individuals and households earning more than 400% of the federal poverty level (FPL) will instantly lose all eligibility for premium tax credits. The income thresholds are surprisingly low:

• Single Person: $62,600

• Couple: $84,600

• Family of Four: $128,600

The financial impact is staggering. Earning just one dollar over these thresholds can trigger a catastrophic loss of subsidies. For a 60-year-old couple, this cliff can cause their monthly premium to skyrocket from just over $100 to more than $1,100—a sudden annual expense of over $12,000 triggered by earning a single extra dollar. This makes strategically managing your Modified Adjusted Gross Income (MAGI), which is essentially your Adjusted Gross Income with certain tax-free income streams like municipal bond interest and untaxed Social Security benefits added back in, one of the most critical tasks for any early retiree.

This is where the investment strategies in 'The FIRE Blueprint' become critical. Understanding how to generate income from sources that don't inflate your MAGI—like tax-free Roth withdrawals or pulling principal from a taxable account—is a key defense against this cliff.

4. Your Real Estate Can Be an Income Engine, Not Just an Asset

Most people view real estate as a passive asset that hopefully appreciates over time. 'The FIRE Blueprint' details advanced strategies that transform property into an active machine for building wealth and generating cash flow. Two of the most effective methods are House Hacking and the BRRRR Method.

1. House Hacking: This is one of the most efficient ways to eliminate your largest monthly expense. The strategy involves purchasing a multi-unit property (two to four units), living in one unit, and renting out the others. In many cases, the rental income from the other units is enough to cover the entire mortgage, property taxes, and insurance. You live for free while your tenants build your equity.

2. The BRRRR Method: This acronym stands for Buy, Rehab, Rent, Refinance, Repeat. It is a powerful system for recycling your capital to scale a portfolio quickly. An investor buys an undervalued property, renovates it to force appreciation, and rents it out. Then, they do a cash-out refinance based on the new, higher appraised value, pulling their initial investment back out. That capital is then used to fund the next purchase, allowing for rapid expansion without needing large amounts of new cash.

These strategies turn real estate from something you own into something that works for you, actively accelerating your path to financial independence.

5. The First Few Years of Retirement Are More Dangerous Than the Last

Most people worry about outliving their money in their 80s or 90s. But the greatest threat to a long retirement is actually at the very beginning. This is due to a phenomenon called Sequence of Returns Risk (SORR)—the risk that poor investment returns in the first few years of retirement can be catastrophic, even if your average returns over 30 years are strong. Withdrawing money from a portfolio while its value is falling permanently cripples its ability to recover and grow.

The following analogy perfectly captures the danger:

Picture two sailors getting ready for the same long voyage. They both have identical ships, the same skilled crew, and the exact same amount of supplies.

The first sailor launches into calm seas and fair winds, making excellent time from day one. The second sailor isn't so lucky. He sails directly into a raging storm, burning through precious fuel and supplies just to stay afloat in the first few weeks.

A powerful defense against this risk is the "Bucket Strategy," which segments your portfolio by time horizon to protect you from having to sell assets at the wrong time.

• Bucket 1 (Cash Reserve): Holds 1-3 years of living expenses in safe, liquid assets like a high-yield savings account. You draw from this bucket during market downturns, so you never have to sell your stocks when they are low.

• Bucket 2 (Stability): This bucket holds 4-10 years of expenses in bonds and other conservative assets. Its job is to provide stability and refill the cash bucket after a market recovery.

• Bucket 3 (Growth): Containing the rest of your portfolio, this bucket is invested in stocks and other growth assets for the long term (11+ years). Its purpose is to outpace inflation and ensure your money lasts for decades.

Your Blueprint to Freedom

The path to early retirement isn’t paved with conventional wisdom. It requires a different way of thinking—a blueprint based on financial truths, not outdated traditions. The five principles outlined here are just a glimpse into the actionable, and often surprising, strategies detailed in 'The FIRE Blueprint'.

Financial independence isn't about hoarding money; it's about buying back your time and building a life of freedom on your own terms. It’s a goal that is more achievable than you think, but it requires the right roadmap.

Ready to build your own life of freedom? Get your complete, step-by-step guide. Order your copy of 'The FIRE Blueprint' today: Click here to get your Copy.