1.0 Introduction: The Hidden Path to Financial Freedom

For most of us, the dream of financial independence isn’t about yachts or mansions; it’s about owning our time. It’s the freedom to decide what our days look like, to pursue passions without financial constraint, and to no longer trade our finite life energy for a paycheck. This desire for control is universal, yet the path to achieving it is often obscured by decades of flawed financial advice.

The conventional wisdom—save 10-15% of your income, work for 40 years, and hope for the best—is a blueprint for a conventional life. It works, but it’s slow and leaves little room for deviation. Through years of research and practice, I discovered that the principles driving early retirement and true financial freedom operate on a different plane. They are often counter-intuitive, requiring a fundamental shift in how we view the relationship between income, spending, and time.

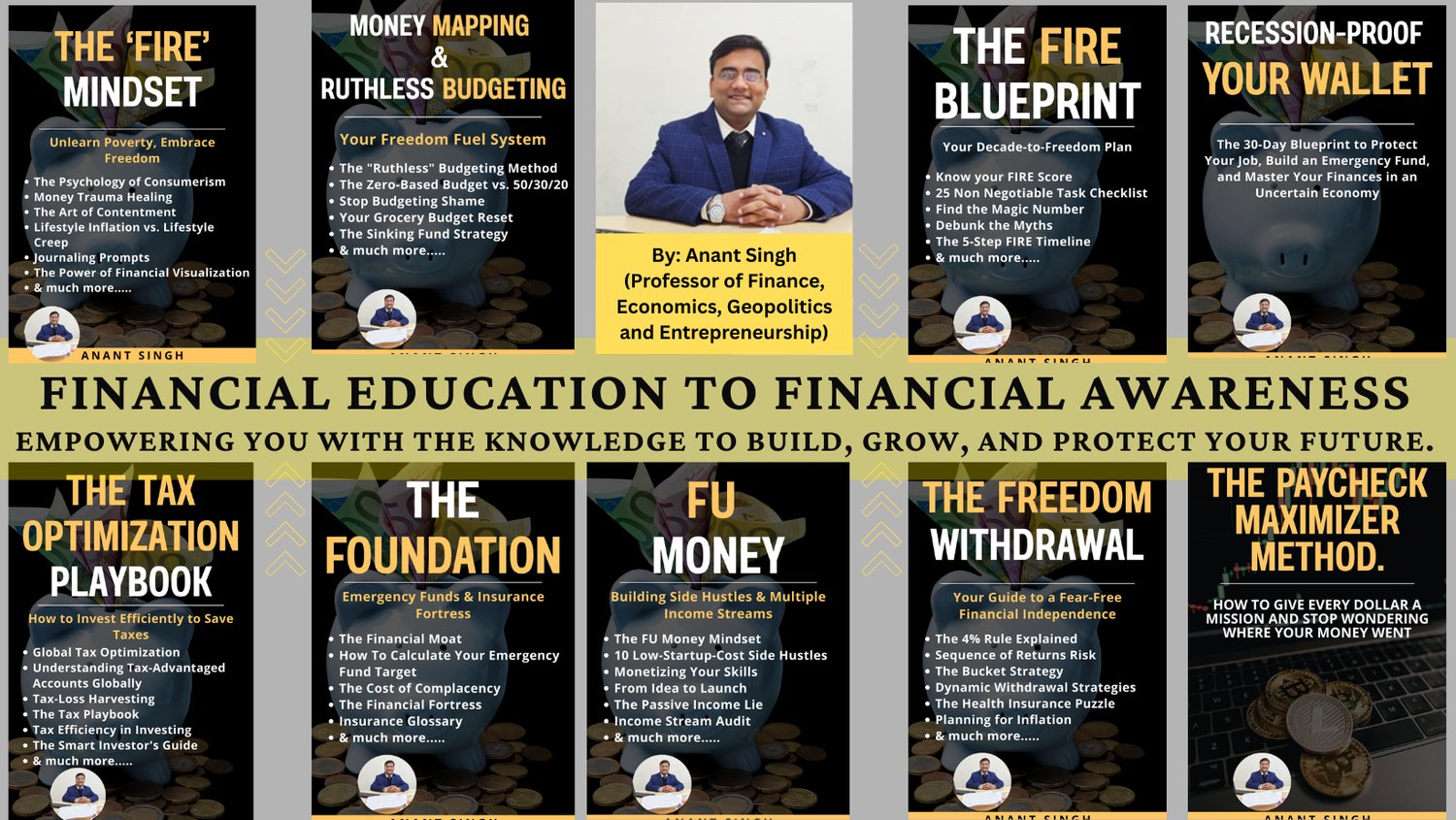

These non-obvious principles became the foundation for my book, 'The FIRE Mindset'. It’s a culmination of my work distilling the mathematical and psychological frameworks that allow ordinary people to achieve extraordinary financial goals. To give you a glimpse into this different way of thinking, I’m sharing four of the most impactful and surprising takeaways from the book.

2.0 Takeaway 1: Your Savings Rate, Not Your Income, Dictates Your Retirement Date

This is the central, unshakable truth of the Financial Independence, Retire Early (FIRE) movement. The timeline to financial freedom is determined almost exclusively by the percentage of your income you save, not the absolute dollar amount you earn.

Someone earning $50,000 and saving 50% of their income will reach independence dramatically faster than someone earning $200,000 and saving only 10%.

The power of this concept lies in its dual benefit. A higher savings rate not only grows your investment portfolio faster, but it also simultaneously lowers the amount of money you’ll need to live on in the future.

This dual effect dramatically compresses the time required to reach your goal. The relationship isn't linear; as you can see below, increasing your savings rate from 10% to 20% shaves 14 years off your working career, while jumping from 50% to 60% shaves off another 4.5 years.

Savings Rate Estimated Working Years to Retirement

10% 51 Years

20% 37 Years

30% 28 Years

40% 22 Years

50% 17 Years

60% 12.5 Years

70% 8.5 Years

This is incredibly empowering because it puts control back into your hands. Regardless of your career, salary, or background, the primary variable you control is the gap between what you earn and what you spend. Widening that gap is the accelerator pedal for financial independence.

Mastering your savings rate is the engine of financial independence. But building wealth is only half the battle; you also have to protect it during the most vulnerable part of your journey—the transition into retirement. This brings us to the most misunderstood risk retirees face.

3.0 Takeaway 2: The Biggest Retirement Risk Isn't a Market Crash—It's When It Crashes

Most aspiring retirees focus on achieving a sufficient average investment return over the long term. But the real, often overlooked danger is the timing of those returns. Having a string of poor returns in the first few years of retirement, when you begin withdrawing money, can be catastrophic. This is known as Sequence of Returns Risk (SORR).

Imagine two sailors setting off on the same long voyage with identical ships and supplies. The first launches into calm seas and makes excellent progress. The second sails directly into a raging storm, burning through precious fuel and supplies just to stay afloat in the first few weeks. Even if the weather is perfect for the rest of the journey, the second sailor’s voyage is permanently compromised. Withdrawing money from a portfolio while it's falling in value is a recipe for retirement disaster.

It turns out that withdrawing from a portfolio at the same time it is falling in value from market fluctuation is a recipe for retirement disaster. This was the point of the famous Trinity study and the 4% rule.

A powerful, counter-intuitive strategy to mitigate this risk is the "bond tent." This technique involves reducing your stock-to-bond ratio a few years before retirement to create a more stable portfolio. Then, after weathering the first few crucial years of retirement, you actually increase your stock allocation again to ensure long-term growth—a move that feels counter-intuitive but is essential for protecting against inflation over a long retirement.

This shifts the focus from merely accumulating a big enough nest egg to engineering a resilient portfolio structure. A successful retirement isn't just about having enough supplies for the voyage; it's about building a ship that can withstand the inevitable storms you might face at the start.

Building a resilient portfolio with a bond tent protects the wealth you've accumulated. But how do you build that wealth rapidly in the first place? For that, we need to challenge another piece of conventional wisdom: the role of diversification.

4.0 Takeaway 3: For True Wealth, Focus Beats Diversification (At First)

This advice directly contradicts one of the most sacred tenets of personal finance: "diversify, diversify, diversify." While diversification is an essential tool for protecting wealth, it is not the most effective tool for building it rapidly.

The fastest path often involves what I call "Factory Direct Investing." This means moving away from diversified "retail" products like mutual funds and ETFs and instead investing directly in a single niche where you can become a subject-matter expert. There are four primary asset classes for this strategy:

• Business

• Real Estate

• Paper (stocks, bonds, and mutual funds)

• Commodities (food, water, oil & gas, coal)

The key is to pick not just an asset class, but a hyper-specific niche within it. Don’t just invest in "real estate"; become an expert in "renting out 2 bedroom, 1 bathroom units in a specific region." Don't just buy "stocks"; become a professional at analyzing a particular industry. This intense focus allows you to identify opportunities and mitigate risks that generalists will miss.

This specificity is what sets professionals apart from amateur investors. Amateur investors are generalists... Professional investors become experts in one niche investment type.

This is a professional strategy that requires a professional support system. True "Factory Direct Investing" relies on building a "Dream Team"—a CPA for tax strategy, a bookkeeper for accurate records, and a lawyer for asset protection—to manage the complexities that generalists avoid. This mindset is transformative. While broad diversification protects you from being wrong, focused expertise is what gives you the highest probability of being very right. Once significant wealth is built through concentration, you can then diversify to preserve it.

5.0 Takeaway 4: How a Single Dollar of Income Can Cost You $12,000

For early retirees in the United States, navigating the healthcare landscape before Medicare eligibility at age 65 is one of the biggest financial hurdles. The Affordable Care Act (ACA) marketplace is the only option for many, and it contains one of the most punishing financial traps in the entire U.S. tax code.

Scheduled to return in 2026 is the "subsidy cliff." Under these rules, households earning just one dollar over 400% of the Federal Poverty Level (FPL) lose all of their premium tax credits. The financial consequences are staggering. For a 60-year-old couple, the 2026 income threshold is projected to be around $84,600. If their income is $84,600, they might receive a subsidy that keeps their monthly premium manageable. But if their income hits $84,601, their premium could jump by over $1,100 per month. That single extra dollar of income would cost them more than $12,000 in additional insurance premiums over the year.

Surviving this requires precise financial engineering. The key is managing your Modified Adjusted Gross Income (MAGI), which is used to determine subsidy eligibility. Key strategies include:

• Making pre-tax contributions to retirement accounts (401k, Traditional IRA) and Health Savings Accounts (HSAs).

• Strategically timing business income and expenses if you are self-employed.

• Funding living expenses by withdrawing from Roth or taxable brokerage accounts, as these withdrawals (which are treated as a return of your original contributions and principal) do not count toward MAGI.

This is a prime example of why 'The FIRE Mindset' is about more than just earning and saving. It’s about understanding the systems you operate in and architecting your finances to navigate them with intention, avoiding the hidden traps that derail most people's plans.

6.0 Conclusion: It's Time to Adopt a New Mindset

Achieving financial independence on an accelerated timeline is not about following the same old rules more intensely. It requires questioning conventional wisdom and adopting a more strategic, analytical, and sometimes radically different mindset. It’s about understanding that your savings rate is your speedometer, that the timing of risk is as important as the amount, that focus builds wealth, and that navigating the system's hidden rules is paramount.

The four takeaways discussed here are just a glimpse into the principles that can reshape your financial future. They are designed to shift you from a passive saver to an active architect of your own freedom. To get the complete blueprint for reclaiming your time, mastering your money, and building a life of financial independence, it's time to adopt the FIRE mindset.

You can find your copy of 'The FIRE Mindset' here