Navigating the realm of financial decisions, I've encountered my share of hurdles:

⛔ I've found myself ensnared in credit card debt.

⛔ I've felt the suffocating grasp of living paycheck to paycheck.

⛔ I've turned to borrowing money from family.

⛔ I've experienced the anxiety of having just $20 and praying that nothing would go wrong before payday.

But those experiences, however daunting, shaped my path in profound ways. They illuminated the importance of financial literacy and the significance of turning missteps into valuable lessons. Those weren't just mistakes; they were crucial chapters in the story of how I learned to take control of my financial destiny.

Eight years ago, I was at that point in my life that I realized I needed more than just a temporary fix for my financial struggles. The weight of my decisions was starting to feel heavier with each passing day, and I knew it was time to make a change. As I reflect on those challenging times, I can't help but be grateful for the lessons they brought into my life.

Embracing the Power of Financial Education

The journey from those financial missteps to where I am today was no walk in the park. It required a shift in perspective and a commitment to learning. I dove headfirst into the world of financial education, determined to understand the mechanics of money and how it could work for me, rather than against me. The more I learned, the more I realized that the real currency of financial success isn't just dollars; it's knowledge.

The Turning Point: Lessons from Mistakes

Each stumble became an opportunity for growth. The credit card debt served as a lesson in the cost of convenience, the paycheck-to-paycheck lifestyle illuminated the importance of budgeting, and borrowing money from family underscored the value of self-sufficiency. Having $20 to my name before payday was a stark reminder that financial stability is a goal worth pursuing.

From Mistakes to Milestones

Fast forward to today, and those mistakes have transformed into milestones. The journey from uncertainty to empowerment has been transformative. The decision to gain control over my finances didn't just impact my bank account; it rewired my mindset. With newfound knowledge and determination, I set out to rewrite my financial story.

In a minute, I'll delve deeper into the lessons I've learned and how they've become the foundation of my approach to financial coaching. From planning and mindful spending to financial confidence and building a support network, I'll share insights that have the power to transform the way you think about money.

Join me as we explore the power of turning financial mistakes into stepping stones toward a brighter, more secure future. The path to financial empowerment is lined with lessons, and I'm excited to guide you along the way.

The 8 Transformative Money Lessons

✅ Planning Matters. Simply put, your money needs direction. It needs you to tell it what to do. Creating a financial plan is like setting the GPS for your money. Without it, your finances may wander aimlessly. By setting clear financial goals, such as building a $1,000 emergency fund, you're giving your money purpose and direction. Just like a journey needs a destination, your finances need a goal to work toward. This goal becomes a guiding star for every financial decision you make.

✅ Small Steps Matter. Even small consistent efforts in budgeting, saving, and setting financial goals can lead to significant improvements over time. Financial success doesn't require giant leaps. Consistently allocating a portion of your income to savings, practicing disciplined budgeting, and setting achievable financial goals may seem modest on its own, but the growing impact over time is substantial. Each small step builds the foundation for a secure financial future.

✅ Mindful Spending. I decided each purchase I made had to align with My $1,000 savings goal. Mindful spending is basically managing your spending habits and connecting your purchases to your goals. When you associate each expense with your $1,000 emergency fund target, you're making intentional choices. Before making a purchase, ask yourself if it aligns with your financial goals. This approach turns spending into a thoughtful choice that helps your financial health.

✅ Financial Confidence.The more I understood money, the more my savings grew. This made me feel more confident and empowered, knowing I controlled my financial path. As you discover better ways to handle money, you take charge of your financial future. As you become more financially savvy, you'll notice improvements in your bank balance. This real progress boosts your confidence and strengthens your position as the leader of your financial journey.

✅ Support Network. I initially sought help from my family, but then realized I needed more help, so I connected with a finance coach. At the time, I didn't even know what a finance coach did. But I recognized that the need for help was a sign of wisdom, not weakness. While family and friends can offer valuable support, sometimes a specialized expert is needed. Getting help from a finance coach gives you custom strategies, accountability, and a neutral viewpoint. Having a support network helps you conquer challenges and navigate complex money situations.

✅ Consistency Is Key. You hear it all the time, but sometimes it’s hard to stay consistent and motivated. But here's where my coach came in to remind me of my goals and to help me adjust them, if needed. Consistency is the heartbeat of financial success. However, maintaining consistency can be challenging. A finance coach serves as a guiding light during moments of doubt or wavering motivation. A finance coach can help you stick to your financial plan, make adjustments when necessary, and keep your eyes fixed on your long-term goals.

✅ Emergency Preparedness. My #1 deal with my clients is that you have to have an emergency fund — it's your safety net. An emergency fund is the financial safety net that cushions you during unexpected circumstances. The main reason for having a financial reserve ensures that you're not caught off-guard by sudden expenses, job loss, or medical emergencies. It offers peace of mind and financial security, allowing you to navigate challenges without resorting to high-interest debt or derailing your financial progress.

✅ Delayed Gratification. Instant gratification can sabotage long-term financial goals. What you don't want to do is to set yourself back by giving in to your impulses. Learning to delay gratification involves recognizing that resisting short-term desires leads to greater rewards down the road. When you avoid impulsive spending, you save your money for important goals like reducing debt, making investments, and reaching financial milestones.

These lessons form a powerful roadmap for anyone looking to transform their financial journey. They remind us that every financial decision, no matter how small, holds the potential to shape our financial future. By applying these insights, you're not just avoiding past mistakes but actively paving the way for a more secure, confident, and prosperous financial life.

A Special Gift

If you've made it this far on the blog, thank you for joining me on this journey. Your commitment to learning and growing in your financial understanding is commendable. But don't leave just yet because there's something special I'd like to offer you.

Reflecting on my own experiences, I realize that I would still be wandering in the maze of financial uncertainty if I hadn't taken the crucial step of evaluating my financial choices. It's this very step that led to the profound transformation I experienced — and it's the foundation upon which I've guided my clients to transform their lives too.

The 8 lessons I've shared above are not just anecdotes; they are the cornerstones of financial empowerment. Each lesson holds the potential to reshape your approach to money, guiding you toward a brighter and more secure future. If you're ready to take the next step on your journey, I have something that could propel you even further.

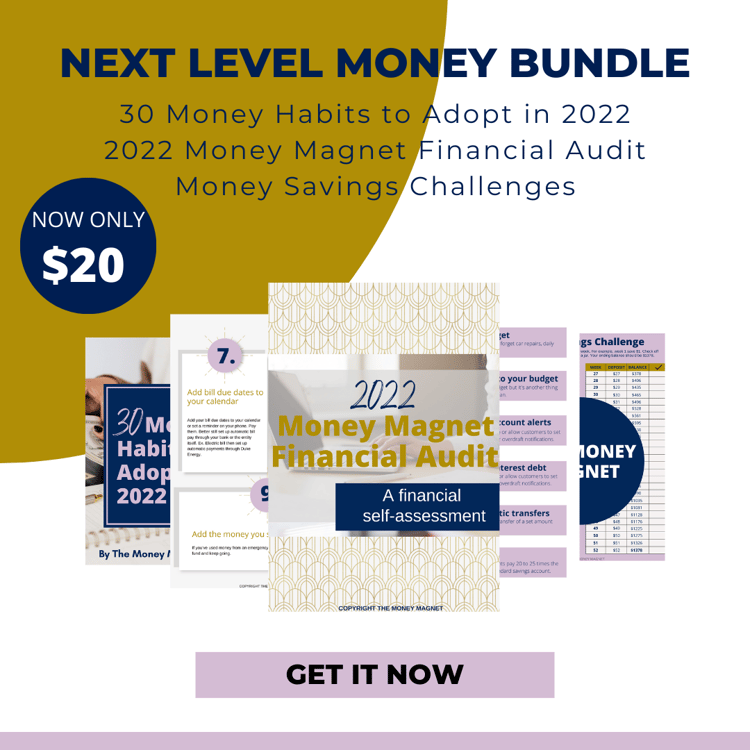

It's the Level Up Money Bundle, a self-guided financial package that includes an audit, money savings challenges, 30 money habits you can adopt this month, a no-spend challenge and how to build an emergency fund fast. There's no gatekeeping here. I tell you exactly what to do in the audit.

This in-depth assessment will identify areas for improvement and provide actionable strategies to enhance your financial health. And the best part? As a gesture of appreciation for your dedication, I'm offering this bundle at a heavily discounted rate.

These offerings aren't just about quick fixes; they're about equipping you with tools and insights that will create lasting change. I believe in your potential, and I'm here to guide you every step of the way.

So, before you leave this blog, consider the transformative power that lies within your grasp. Seize this opportunity to take control of your financial destiny, and let's set sail toward a future that's enriched by knowledge, empowerment, and unwavering financial success.

The bundle is typically $100, and I can't believe I'm doing this, but because of the 8 lessons I learned, I'm going to give it to you for 80% off. So that's just $20. The sale ends when the weekend ends. So get it now.

So again, here's what you're getting:

💰 The 30 Money Habits to Adopt in 2023 toolkit has tips you can use to tackle one-a-day or one habit once a month. Here's an example, set up bank account alerts to remind you to pay your bills or avoid overdrafting your account.

💰 The Money Magnet Financial Audit is a self-assessment designed to help you check off items to get your "bad" money habits back on track. In the audit I tell you exactly what you need to do including how to rework your budget.

💰 Two straight-forward money challenges that you can do all year long or break up into a month at a time. If you use these money challenges I guarantee you can save as little as $300 and upwards of $3600 in a year.

You'll also receive these bonuses:

💰 4 Steps to Build an Emergency Fund FAST

💰 A No Spend Challenge (31 Days)

💰 No Spend Challenge questions that lead you to ask yourself how you spend your money, determine what worked and what didn't.

Tap in right here.

Comments ()