This is the scenario for EURUSD starting next week.

Let me be clear from the start: this is not a prediction.

It’s not a forecast but rather my trading plan of "if this happens, I’ll do this."

I don’t predict the market, and this is not that kind of thing, so please understand that in advance.

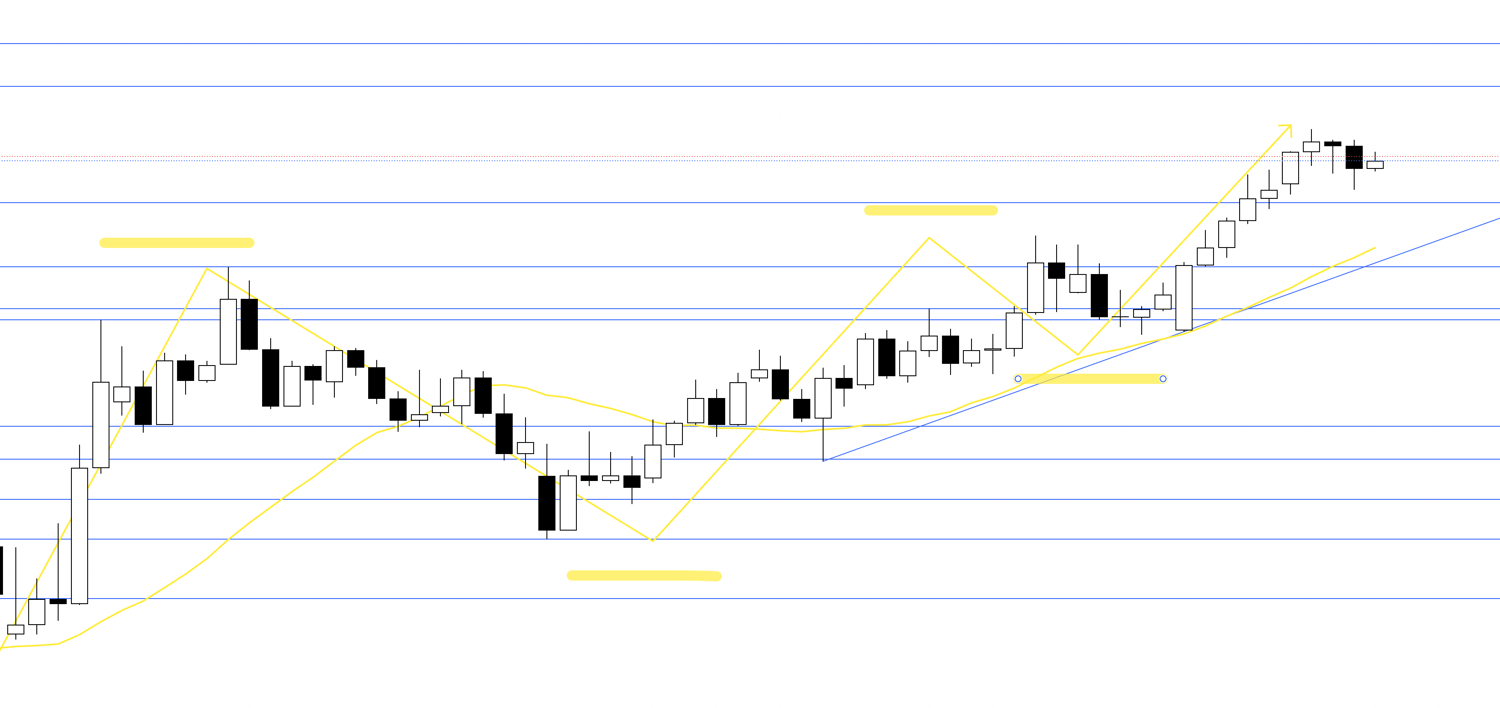

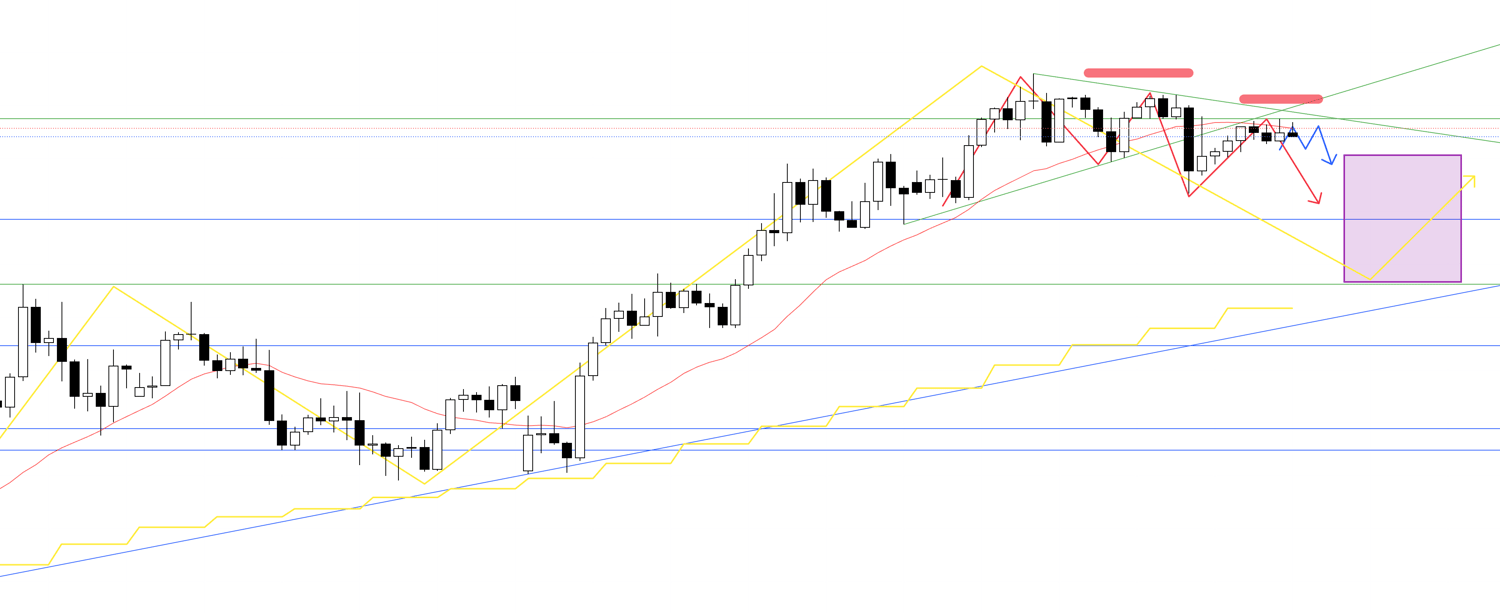

Let’s start by checking the daily chart.

On the daily chart, the price is in an uptrend, raising lows and updating highs.

Since it’s already in a high-price zone, profit-taking sales from traders on the 4-hour or lower timeframes are likely to come in short-term.

With this in mind, I’ll build scenarios for next week using the 4-hour chart.

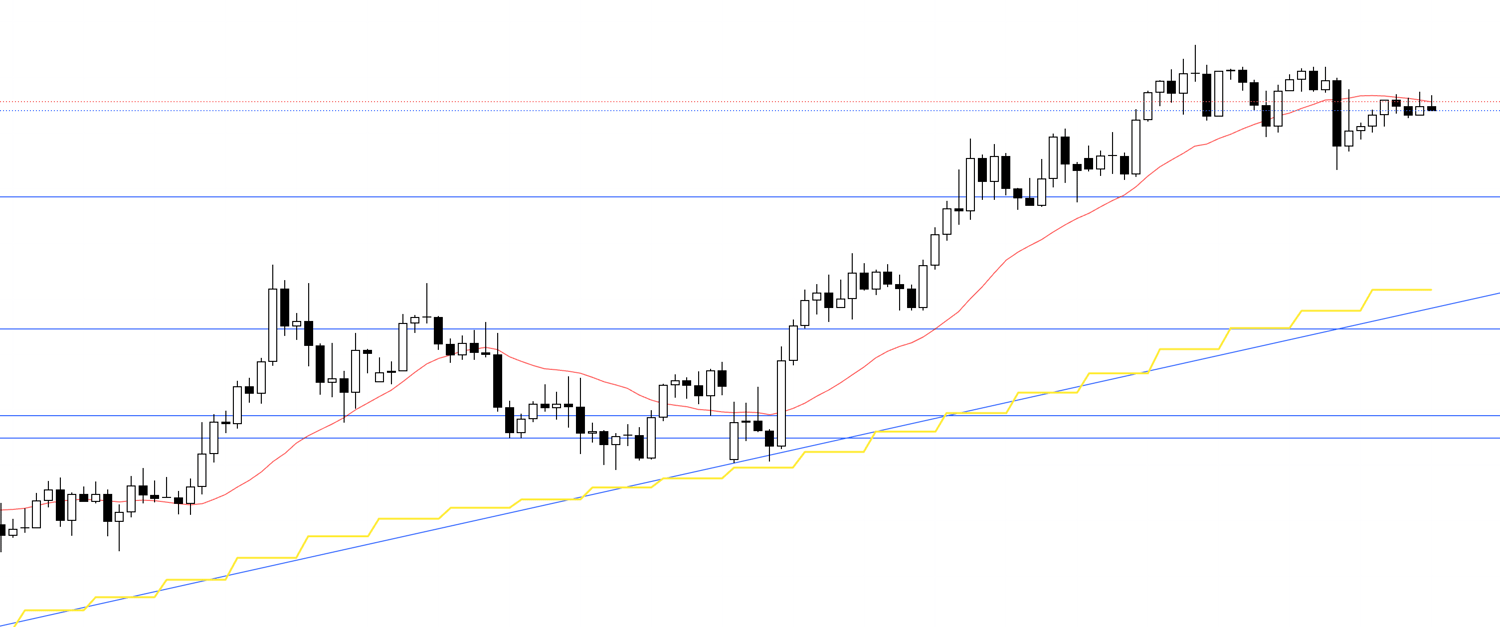

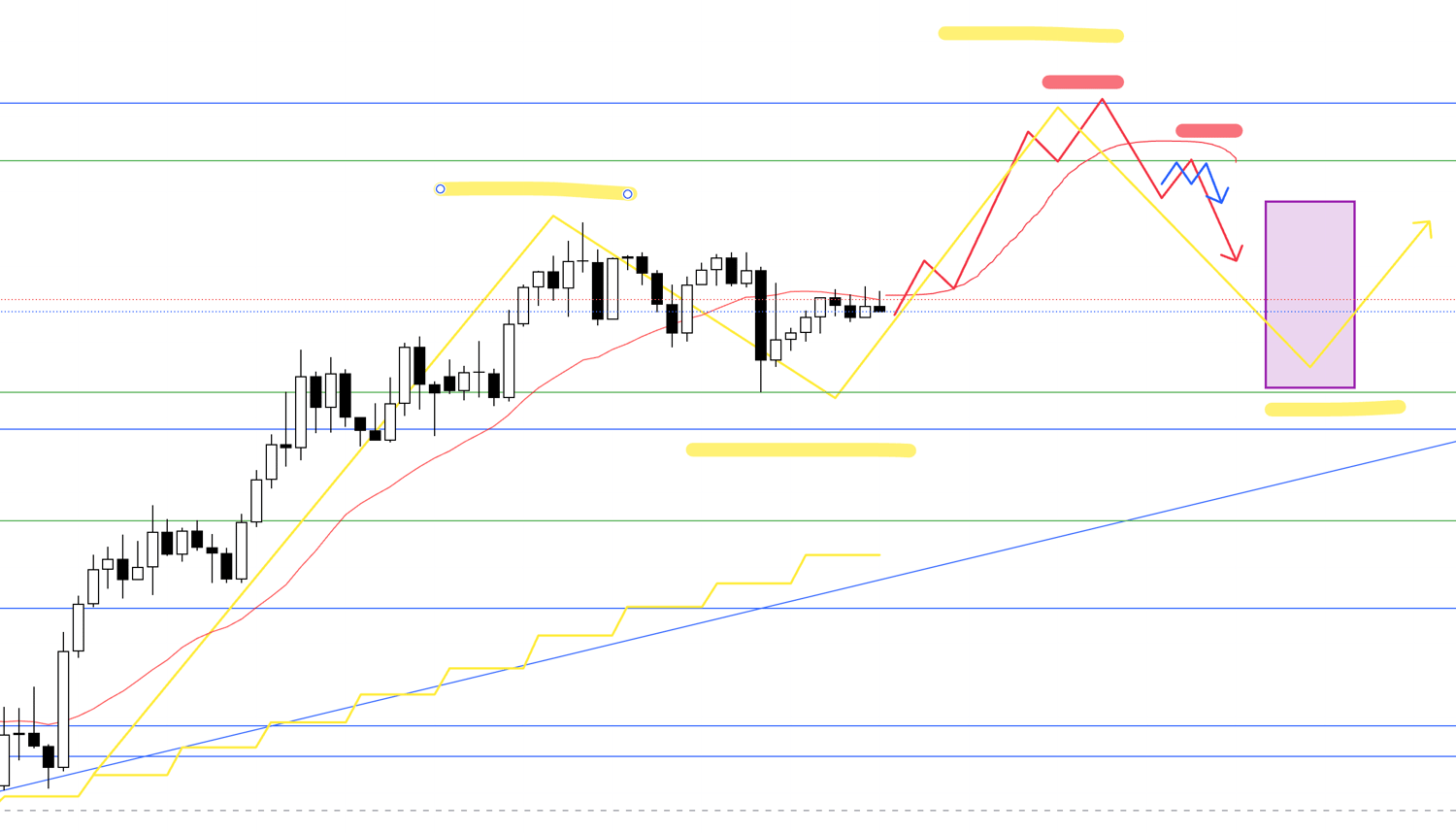

The following figure is the 4-hour chart for EURUSD.

I analyze the market using multiple timeframes, aiming to trade at points where the direction of traders across different timeframes aligns.

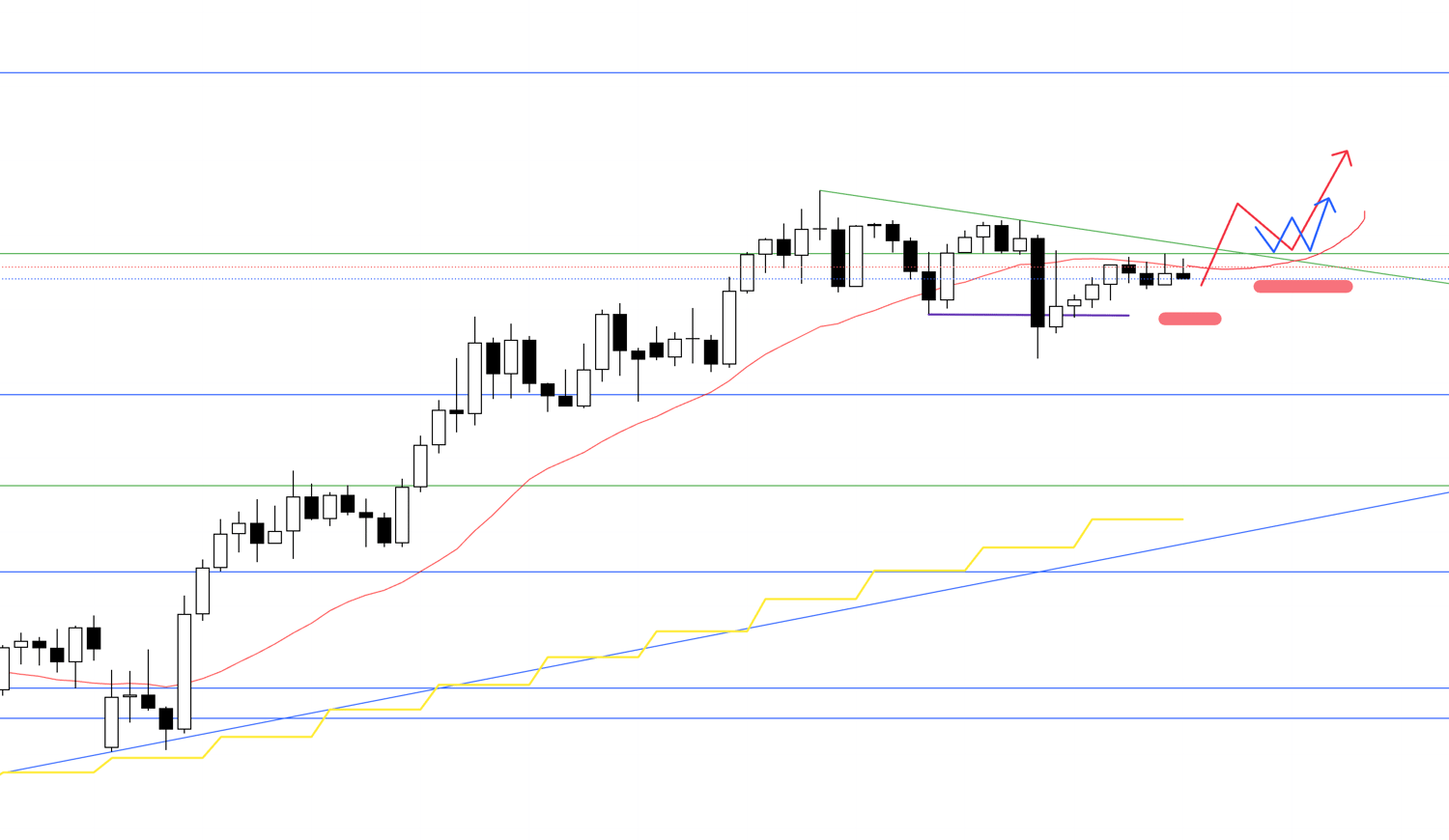

Let’s first look at some buy scenarios.

Buy Scenario 1

The yellow lines represent the daily chart movements, red for the 4-hour chart, and blue for the 1-hour chart.

The MA displayed is the 20 SMA.

On the 4-hour chart, the price has updated the recent low (short purple line), making it a point where pullback selling is likely to occur.

It’s also suppressed by the green trendline, and since the daily chart is already extended, if the price fails to break this trendline, traders holding profitable buy positions are likely to take profit with sell orders.

To buy in this situation, the price needs to break above the trendline or the MA suppressing it from above and create a new pullback point.

As shown in the figure, at a point where the 4-hour chart raises its lows, and the lower timeframe, such as the 1-hour chart, forms a double bottom or is supported by the green line, I’ll consider buying.

Buy Scenario 2

Next is another buy scenario.

If the price is suppressed by the trendline and falls due to sell orders liquidating the recent uptrend, this would form the next pullback on the higher timeframe daily chart.

At a point on the 4-hour chart where the daily pullback is formed (indicated in yellow), if the 4-hour chart stops falling and raises its lows while being supported by a meaningful line, I’ll consider buying on the lower timeframe.

The key is that the price breaks above the suppressing trendline, and the 4-hour MA that was suppressing it now supports it from below.

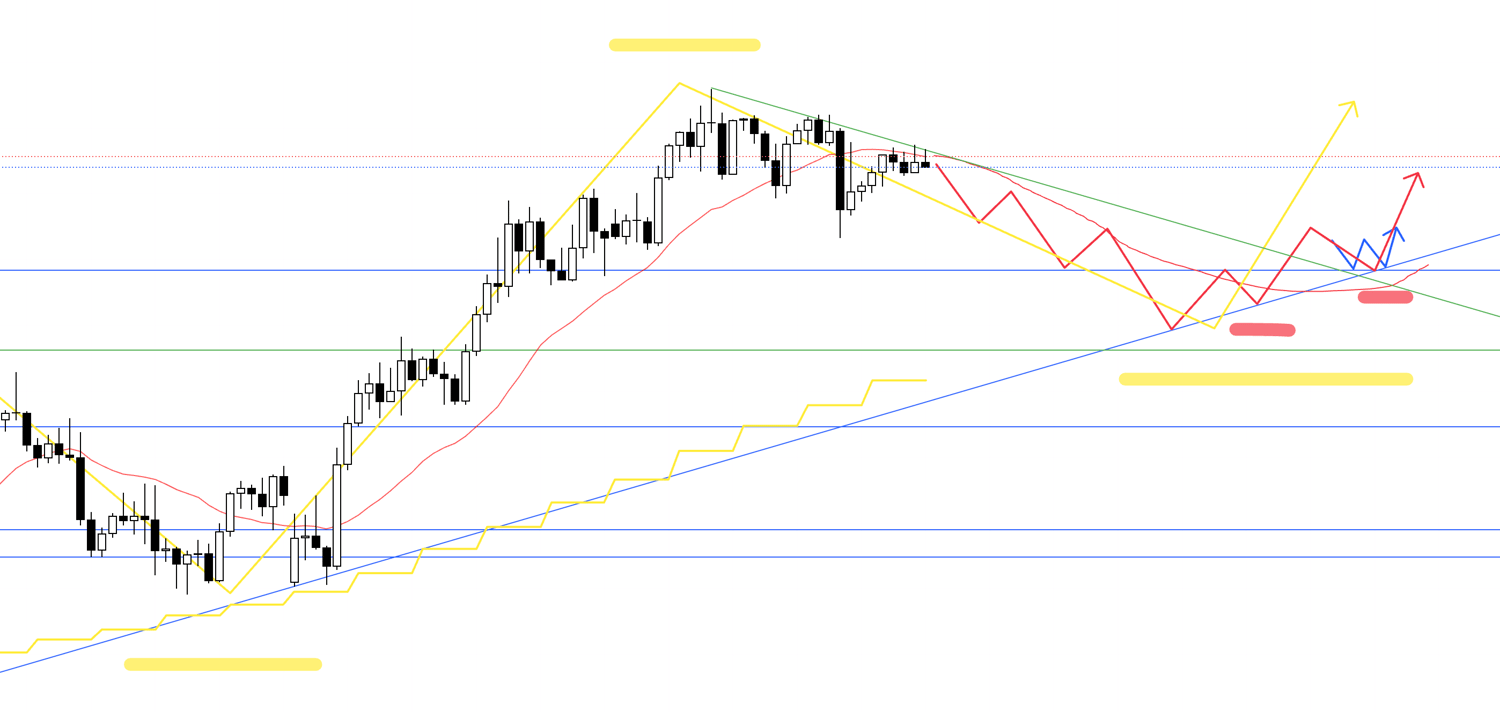

Next is a sell scenario.

Sell Scenario 1

This is the scenario for trading the decline seen in Buy Scenario 2.

Currently, the 4-hour chart has already broken its low and is trying to form a high-lowering point.

The trendline and MA are forming a suppressing structure, and if the lower timeframe, such as the 1-hour chart, is suppressed by a double top, I’ll consider selling.

As mentioned earlier, this is a phase on the daily chart where a pullback is forming for buy orders, so the lower it goes, the higher the risk of buy orders coming in, which needs to be kept in mind.

This is a sell targeting the price movement to fill the space indicated by the purple rectangle.

Next is another sell scenario.

Sell Scenario 2

This is a point where, after rising in Buy Scenario 1, the market switches to selling.

I’ll aim for the point where the price declines due to the liquidation of the prior uptrend on the lower timeframe.

Since the 4-hour chart is in the middle of an uptrend, I can’t sell just because the price stalls.

It’s critical to wait for the formation of a low-lowering point and for the price to break below the supporting MA, now suppressed from above.

This decline, like the previous sell scenario, targets the pullback formation on the daily chart.

The lower it goes, the more likely daily buy orders will come in, so caution is needed.

If the entry point doesn’t align with a good risk-reward, I’ll skip it or use partial profit-taking to manage the trade.

That’s all.

These scenarios are just examples, and I’ll update the plan based on actual movements, but the basic approach remains the same.

This is purely my trading plan, so if you haven’t yet solidified your trading approach, you might use it as a reference for building your strategy. However, if you already have a solid trading method, please stick to your own rules without being swayed by my plan.

I hope this can be of some help.