Tax Deduction Guide For Digital Marketers | Online Sellers | Freelancers | Affiliate Marketers

Stop guessing what you can write off. Start saving real money.

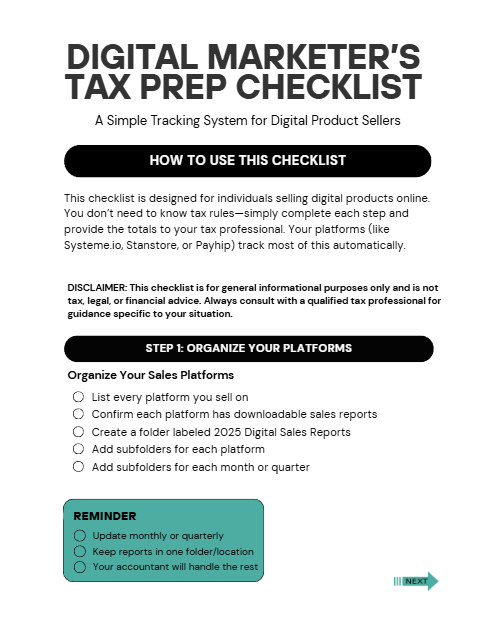

his powerful 80-page guide breaks down every tax deduction available to digital marketers, online sellers, content creators, and anyone earning money online. If you’re making income from Etsy, TikTok, Shopify, digital products, affiliate marketing, UGC, or any online hustle — your business has deductible expenses you’re probably missing.

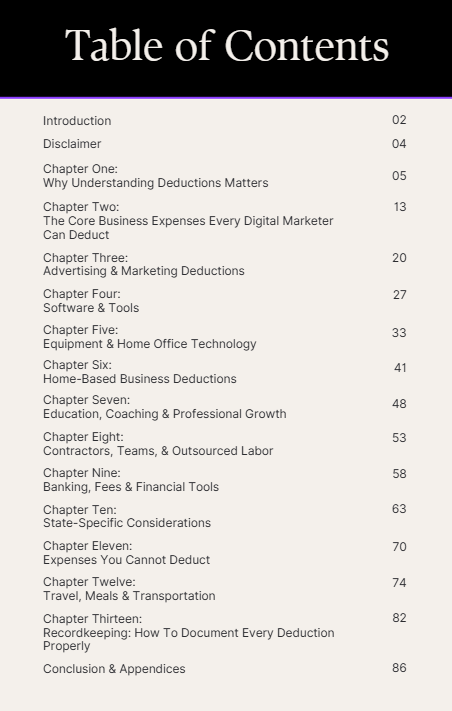

Inside, you’ll learn:

- Exactly what the IRS allows you to deduct (and what they don’t)

- The difference between legitimate business expenses vs. personal

- Deductions for home office, software, equipment, supplies, travel, meals, contractors, and more

- State-specific rules, including no-income-tax states

- How to properly track and document everything

- What expenses can put you at risk during tax season

Whether you’re brand new or scaling fast, this guide shows you how to maximize your write-offs, keep more profit, and operate like a real business — without feeling overwhelmed by tax rules.

Perfect for: Online sellers, digital marketers, content creators, coaches, UGC creators, and freelancers.

This is a digital download. Due to the digital nature of this product, all sales are final.