Digital Marketer's Tax Prep Checklist

Most digital marketers don’t struggle with taxes because they’re “bad at numbers”…

They struggle because they don’t know what they should be tracking in the first place.

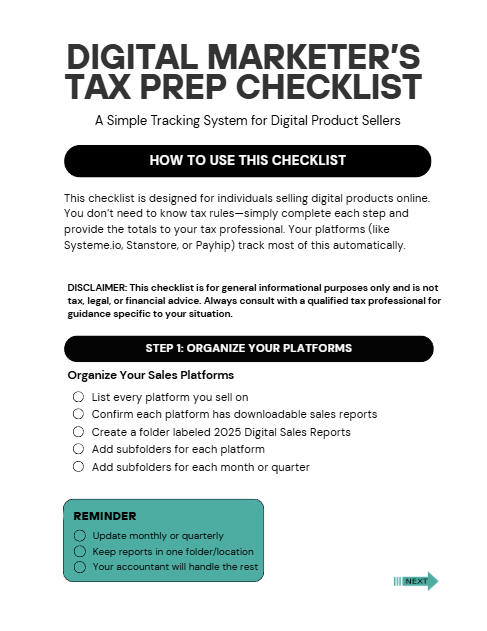

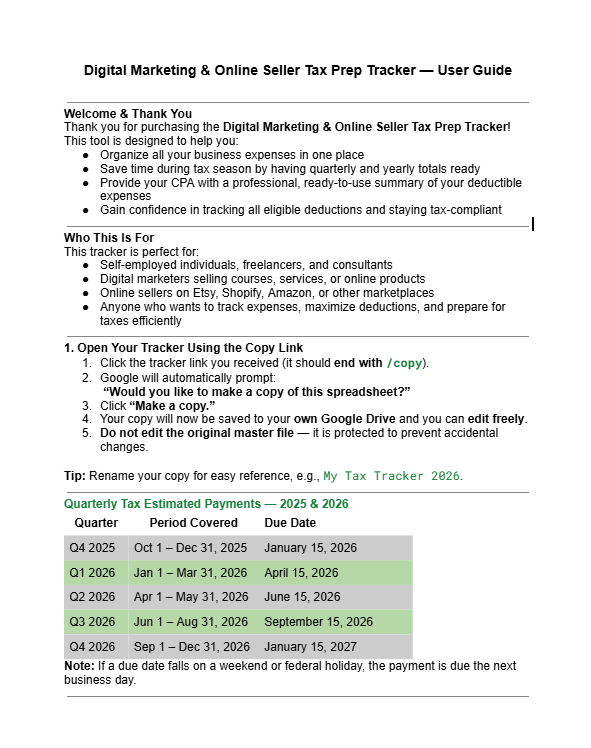

The Digital Marketer’s Tax Prep Checklist gives you a simple, beginner-friendly system to stay organized all year long — without needing tax knowledge, accounting software, or complicated spreadsheets.

This checklist is designed specifically for digital product sellers, PLR/MRR resellers, template creators, and affiliate marketers who use platforms like Stanstore, Payhip, Shopify, Etsy, or Systeme.io. Your platforms already track your earnings — this checklist shows you how to properly review, summarize, and prepare those numbers so tax season is fast, clean, and painless.

What’s Inside (Perfect for Beginners):

- 9-pages of action ready guidance to prepare for taxes

- Step-by-step monthly/quarterly routine to stay organized

- Quarterly reporting example so you know exactly how to summarize your totals

- A simple checklist of what income to track

- What documents to save (every month and every quarter)

- What to gather before tax season

- How to prep clean totals for your tax professional

- A polished Monthly & Quarterly Summary Box template

- A list of common digital-business expenses

(Full explanation of deductions is inside the Digital Marketer’s Tax Playbook)

Everything is focused on reviewing platform exports, summarizing your income, and preparing clean numbers — no accounting, no tax filing, no jargon.

Who This Checklist Is For:

Perfect for:

✨ Digital marketers

✨ PLR / MRR sellers

✨ Template designers

✨ Course creators

✨ Affiliate marketers

✨ Online sellers with multiple income streams

Even if your tax professional files for you, you still need to hand them accurate totals. This checklist makes it effortless.

Why You Need This Checklist

Every year, digital sellers run into the same problems:

⚠️ Missing income they forgot to report

⚠️ Not saving monthly totals from their platforms

⚠️ Not separating fees from revenue

⚠️ Losing receipts and deductible expense information

⚠️ Handing their tax pro incomplete or messy data

This $7 checklist fixes all of it.

It keeps you organized, compliant, and stress-free — in under 10 minutes a month.

Start Organized. Stay Ready.

This checklist gives you the foundation you need to confidently prepare your digital-income totals each year — even if you’re a complete beginner.

Grab the Digital Marketer’s Tax Prep Checklist today and get your digital business tax-ready the simple way.

No Refund Disclaimer

Due to the digital nature of this product, all sales are final.