On The Job Training Guide - Audit Loans and Borrowings

If you’re an audit supervisor, a practitioner in a Small & Medium Practice (SMP), or an accounting professional involved in audit engagements, the On-the-Job Training Guide: Audit Loans and Borrowings is an essential resource designed to streamline and enhance your audit procedures. Available as a digital product on Payhip, this comprehensive guide equips you with the necessary skills and knowledge to audit loans and borrowings effectively, ensuring compliance with relevant audit and financial reporting standards.

Who Is This Guide For?

This training guide is tailored for:

- Audit Supervisors: Oversee your team’s work with confidence and ensure they adhere to best practices.

- Small & Medium Practices (SMPs): Elevate the quality and efficiency of your audits with a structured approach that simplifies complex areas like loans and borrowings.

- Audit Staff and Professionals: Whether you’re a new auditor or have years of experience, this guide will help you navigate the intricacies of loans and borrowing audits with precision.

- Accounting Professionals: Refine your audit knowledge and ensure your work meets the highest standards.

Key Areas Covered

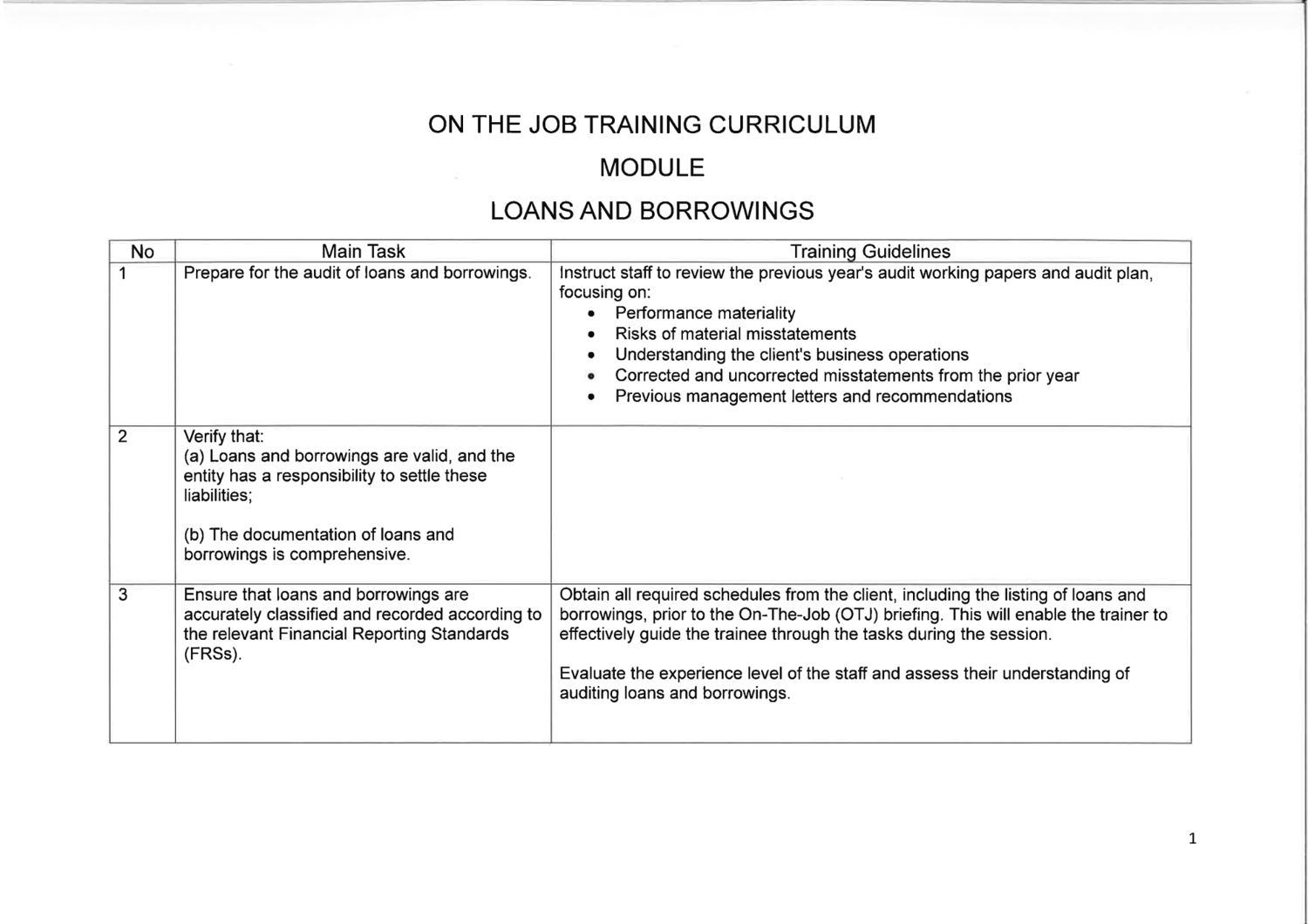

The guide is built on a thorough Task Analysis, covering all aspects of auditing loans and borrowings. It highlights the key Competencies Required and aligns with Singapore Audit Standards to ensure you're conducting your audits in line with professional expectations.

Here’s a breakdown of the core areas covered:

- Initial Measurement: Gain step-by-step instructions on how to audit new loans and borrowings, verifying loan agreements, interest rates, amortization schedules, and more.

- Subsequent Measurement: Learn how to apply the effective interest method for loan valuations, translate loans in foreign currencies, and measure the amortized cost of loans.

- Disclosures: Ensure that all necessary disclosures about loans and borrowings are made accurately in the financial statements, and that these are classified properly as either current or non-current liabilities.

- Audit Findings: Understand how to conclude your audit, resolve any outstanding issues, and implement adjustments, ensuring that your findings are well-supported by appropriate audit evidence.

Additionally, the guide covers critical elements such as:

- How to classify loans and borrowings correctly

- How to handle convertible loans and compound financial instruments

- Procedures for handling foreign currency loans and checking compliance with debt covenants

Practical Outcomes

This guide is designed to improve both audit processes and training effectiveness in the following ways:

- Streamlined Audit Procedures: The guide offers a systematic approach, reducing the time spent on manual research and audit planning. You’ll have a clear, structured process to follow, enhancing the speed and quality of your audits.

- Enhanced Training for Audit Staff: With its practical task analysis and focus on real-world audit tasks, this guide is an excellent training tool. Supervisors can use it to develop their audit team’s competencies and ensure that staff are fully prepared to tackle the audit of loans and borrowings.

- Compliance with Audit Standards: You’ll be equipped to ensure that your audit work complies with all relevant Singapore Standards on Auditing (SSA), giving you peace of mind and confidence in your audit findings.

- Improved Audit Quality: The guide encourages a focus on high-quality audit outcomes by covering complex areas such as convertible loans, foreign currency loans, and initial measurement discrepancies. It helps auditors ensure that all key audit areas are thoroughly covered, minimizing the risk of oversight.

Why Purchase This Guide?

By investing in the On-the-Job Training Guide: Audit Loans and Borrowings, you are providing yourself and your team with a proven, detailed resource that improves the overall quality of your audits. It’s designed for immediate use, meaning you can apply the techniques and insights from the guide directly into your current audit engagements, saving you time and reducing errors.

Whether you’re looking to sharpen your skills or provide effective training for your staff, this guide will help you achieve your audit goals faster and with greater accuracy.

Get Your Guide Today!

Start improving your audit of loans and borrowings by purchasing the On-the-Job Training Guide on Payhip today. Don’t miss this opportunity to enhance your audit processes, train your team effectively, and ensure compliance with audit standards. Click here to buy now!

✅ Format: Digital PDF

✅ Where to Purchase: Available on Payhip

✅ Instant Download: Get access immediately after purchase