DIGITAL Monthly Budget Planner

GET READY FOR FINANCIAL GROWTH AND SUCCESS!

- Are you determined to save more this year?

- Do you feel frustrated by not being able to track your expenses?

- Do you find yourself running out of money at the end of each month?

- Do you want to build financial freedom and success this year?

If your answer is yes, then this budget planner is definitely what you need!

It's time to take control of your finances and make your money work for you.

Budgeting is the foundation of all financial planning and effective money management!

This budget planner is a zero-based budget which will help you to easily monitor your spending, identify areas where you can cut back, and save money for the things that matter most to you.

What is it a zero-based budget? This budgeting method means your income - expenses = zero. With a zero-based budget, every pound you have assigned a job. Some of your pounds will be assigned to paying expenses, and some of them will go towards your savings, investments, or paying off debt.

Start 2024 by using this digital budget planner!

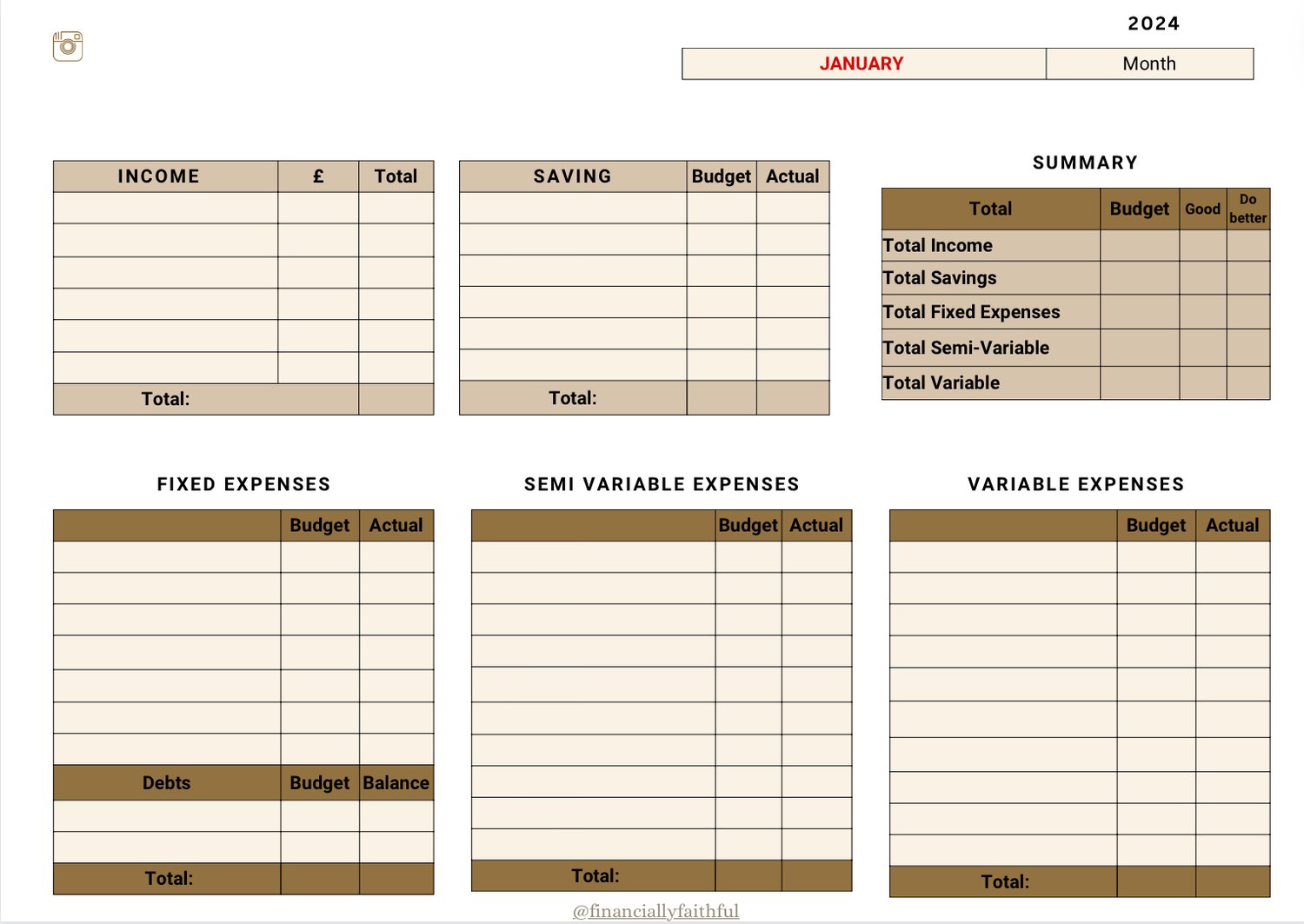

With Canva's intuitive platform, you’ll receive a sheet divided into 6 sections: income, savings, fixed expenses, semi-variable expenses, variable expenses, and a summary.

FIXED EXPENSES: Items that are NECESSARY (NEED) and cannot be changed as is the amount that you pay every time. There are NONE-negotiable. Ex. Rent, insurance, mobile payment, bills, etc.

SEMI-VARIABLE EXPENSES: Expenditure items that are NECESSARY to your day-to-day life and living and can likely be changed as the amount can vary, decrease or increase. Ex. Groceries, transport, etc.

VARIABLE EXPENSES: Expenditure items that can be changed and you have control over they are NOT necessary to day-to-day living (WANT). Ex. Eating out, self-care, shopping, takeaways...