PREMIUM BUDGET PLANNER 2026 – Your Ultimate Financial Tool

GET READY FOR FINANCIAL GROWTH AND SUCCESS IN 2026!!

- Are you determined to save more this year?

- Do you feel frustrated by not being able to track your expenses?

- Do you find yourself running out of money at the end of each month?

- Do you want to build financial freedom and success this year?

If your answer is yes, then this budget planner is definitely what you need!

It's time to take control of your finances and make your money work for you.

Budgeting is the foundation of all financial planning and effective money management!

WHY THIS PREMIUM BUDGET PLANNER? 🤔

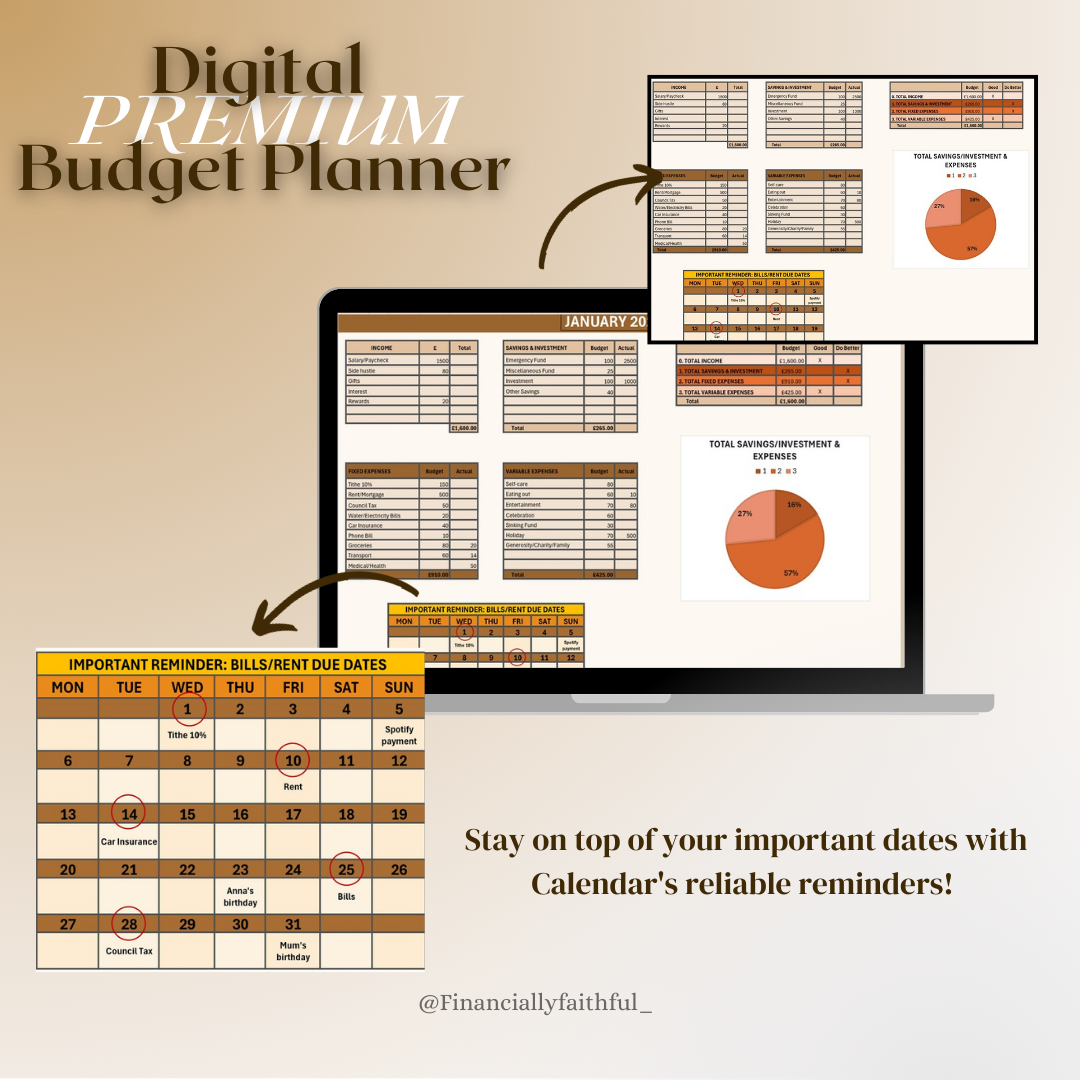

✅ User-Friendly & Automated – No complex formulas, just clear, structured budgeting that does the calculations for you

✅ Designed for Young Adults – Created by a young person, for young people, tailored to fit your lifestyle and financial goals

✅ All-in-One Financial Hub – Track income, expenses, savings, and investments in one place

✅ Simple Yet Powerful – No overwhelm, no guesswork—just a straightforward system that helps you stay on top of your finances

✅ Faith-Based Stewardship – Rooted in biblical financial principles, helping you manage money faithfully and wisely (Luke 16:10)

A QUICK GUIDE TO UNDERSTANDING THE BUDGET PLANNER

FIXED EXPENSES: Essential elements (NEEDS) of your financial obligations that you cannot change. They represent non-negotiable costs that must be paid regularly. These expenses are crucial for your day-to-day life, and while the amounts can vary, decrease, or increase, they are necessary for maintaining your lifestyle.

Ex. Rent, insurance, mobile payment, bills, Groceries, transport, etc.

VARIABLE EXPENSES: Expenditure items that can be changed and you have control over them, are NOT necessary to day-to-day living (WANTS)

Ex. Eating out, self-care, shopping, takeaways…

SEVEN ESSENTIAL TIPS TO FOLLOW BEFORE YOU START YOUR BUDGET

- Gather together all bank statements, bills and payslips;

- Be as accurate as possible with your figures;

- Identify your financial goals;

- Calculate your monthly income and add it to the “income section”

- List your monthly expenses;

- Fill in your fixed and variable expenses section;

- Fill in the summary section & your monthly progress

Start 2026 by using this Premium Budget Planner!

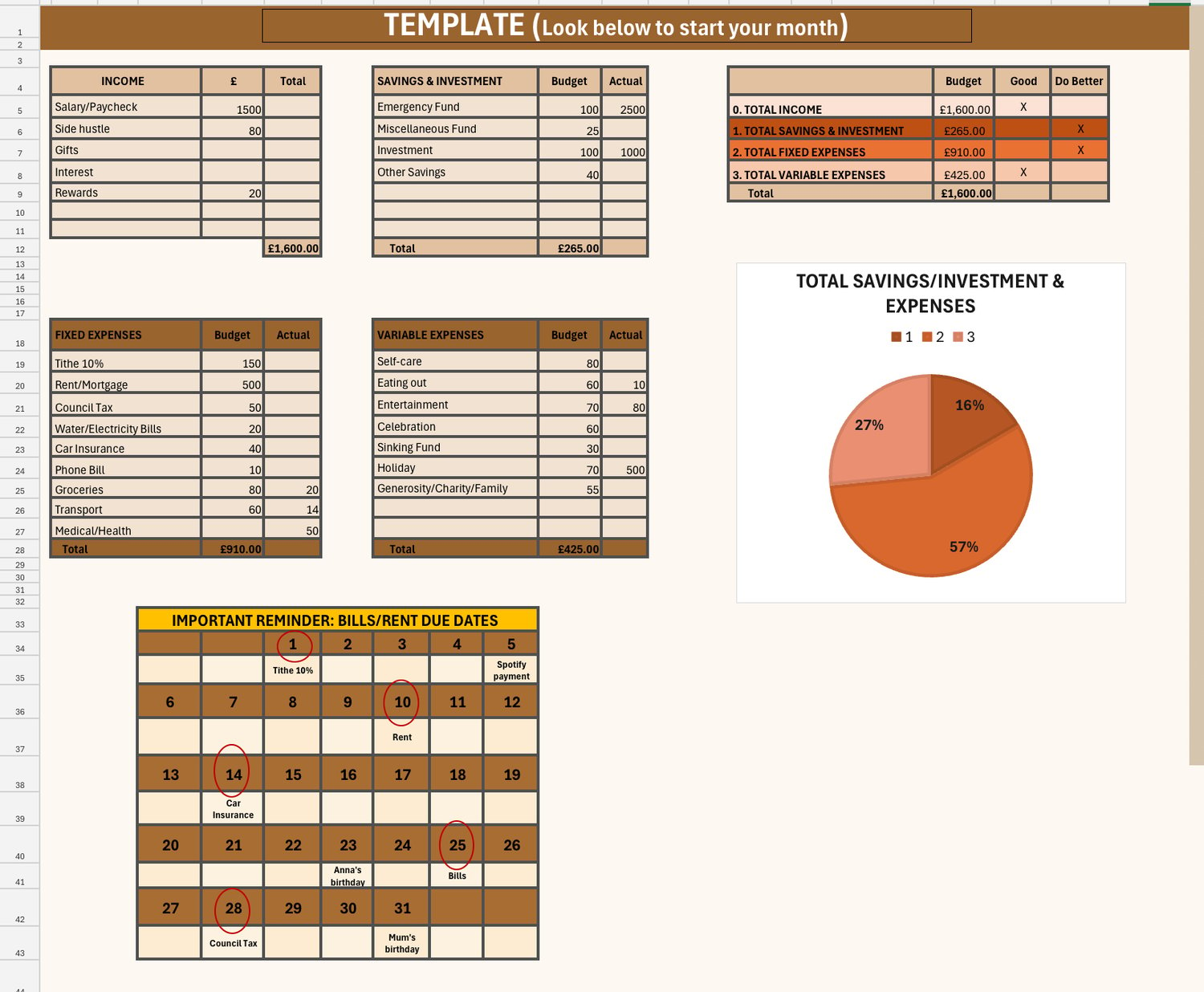

[With the Excel platform, you’ll receive a sheet divided into 5 sections: income, savings, fixed expenses, variable expenses, and summary expenses.]