FINANCIAL DERIVATIVES

I wrote this book Financial Derivatives with the following objectives.

· To demonstrate to readers that the subject of Financial Derivatives simple to understand, relevant in practice and interesting to learn.

· To help managers appreciate the logic for making better financial decisions.

· To explain the concepts and theories of financial derivatives in a simple way so readers could grasp them very easily and be able to put them in to practice.

· To provide a book that has a comprehensive coverage for financial derivatives and their analysis.

· To create a book that differentiates itself from other books in terms of coverage, presentation.

This book useful to Students, Job Interviews, Investors, Financial advisers, Financial managers and Fund managers to relate theories, concepts and data interpretation to practice.

This book Financial Derivatives aims to assist the reader to develop a thorough understanding of the concepts and theories in a systematic way. To accomplish this purpose, the recent thinking in the field of financial derivatives has been presented in a most simple, and precise manner.

The main features of the book are simple understanding and key concepts.

The book contains a comprehensive analysis of topics on financial derivatives i.e. Forwards, Futures, Options, Warrants and Swaps with a view that readers understand financial decisions thoroughly well and are able to evaluate their implications for investors and traders.

This book begins with the discussion of fundamental concepts of Derivatives. With this foundation, readers can easily understand the derivatives.

The text material has been structured to focus on financial derivatives and discusses the theories, concepts and assumptions.

It is hoped that this will facilitate a better understanding of the subject matter.

CONTENTS

INTRODUCTION TO FINANCIAL DERIVATIVES

OVER-THE-COUNTER DERIVATIVES

HISTORY OF DERIVATIVES MARKET

USES OF DERIVATIVES

INVESTING VS TRADING

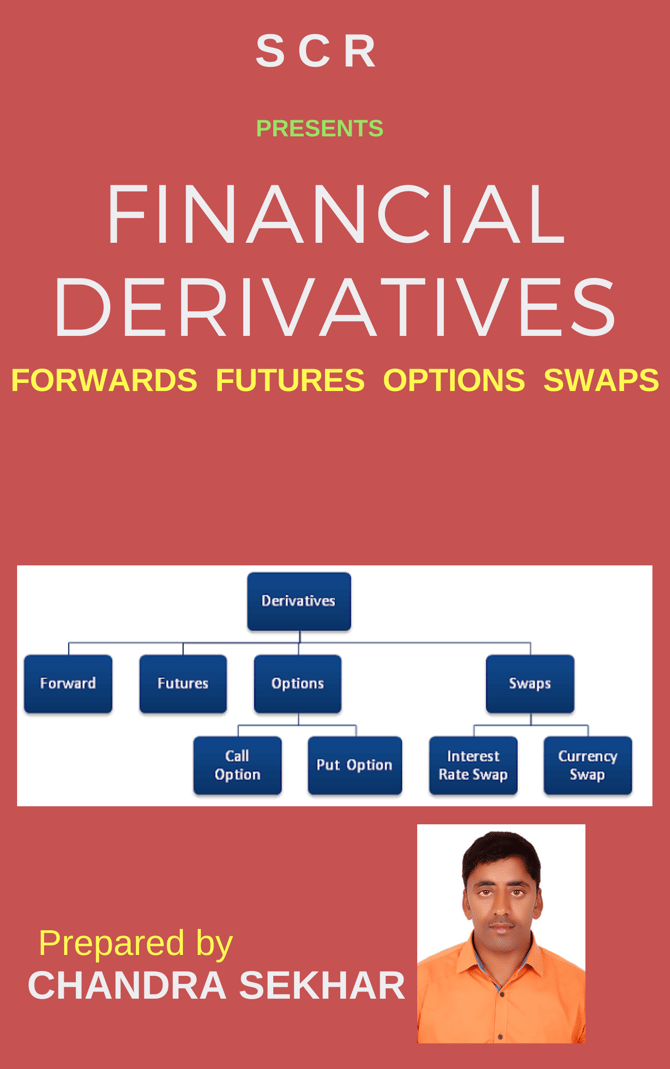

TYPES OF DERIVATIVES

1. FORWARDS

Introduction

Features of Forward contract

Limitations of Forward contract

2. FUTURES

Introduction

Features of Future contract

Limitations of Future contract

Types of settlement in Futures

(i) Cash based settlement

(ii) Delivery based settlement

When to buy or sell Futures

Vanilla vs. Exotic Derivatives

Short Selling

Open interest

Basis

3. OPTIONS

Introduction

Call option

Put option

Strike Price

Spot price

Expiration date

American option and European Option

Option premium

In-the-money, At-the-money & Out-of-the-money

Intrinsic value

Extrinsic Value

Factors affecting Option value

Profit profile of Option buyer or seller

Speculative view – Option market participants

Option classes and series

Option Greeks

(i) Delta

(ii) Gamma

(iii) Vega

(iv) Theta

(v) Rho

Relationship – Option Delta & type of Option

Standard deviation

Volatility

Alpha

Beta

Option spread Strategies

(i) Bull call spread

(ii) Bull put spread

(iii) Bear call spread

(iv) Bear put spread

(v) Long Butterfly spread

(vi) Short Butterfly spread

(vii) Long Straddle

(viii) Short Straddle

(ix) Long Strangle

(x) Short strangle

4. WARRANTS

5. SWAPS

Introduction

Types of Swaps

(i) Interest rate swaps

(ii) Currency swaps

(iii) Commodity swaps

(iv) Equity swaps

(v) Asset swaps

(vi) Liability swaps

(vii) Total return swaps

PARTICIPANTS IN DERIVATIVES MARKET

1. Hedgers

Perfect hedge

Imperfect hedge

Cross hedge

Short hedge

Long hedge

2. Speculators

3. Arbitrageurs

Hedging with Swaps

Hedging with Options

· To demonstrate to readers that the subject of Financial Derivatives simple to understand, relevant in practice and interesting to learn.

· To help managers appreciate the logic for making better financial decisions.

· To explain the concepts and theories of financial derivatives in a simple way so readers could grasp them very easily and be able to put them in to practice.

· To provide a book that has a comprehensive coverage for financial derivatives and their analysis.

· To create a book that differentiates itself from other books in terms of coverage, presentation.

This book useful to Students, Job Interviews, Investors, Financial advisers, Financial managers and Fund managers to relate theories, concepts and data interpretation to practice.

This book Financial Derivatives aims to assist the reader to develop a thorough understanding of the concepts and theories in a systematic way. To accomplish this purpose, the recent thinking in the field of financial derivatives has been presented in a most simple, and precise manner.

The main features of the book are simple understanding and key concepts.

The book contains a comprehensive analysis of topics on financial derivatives i.e. Forwards, Futures, Options, Warrants and Swaps with a view that readers understand financial decisions thoroughly well and are able to evaluate their implications for investors and traders.

This book begins with the discussion of fundamental concepts of Derivatives. With this foundation, readers can easily understand the derivatives.

The text material has been structured to focus on financial derivatives and discusses the theories, concepts and assumptions.

It is hoped that this will facilitate a better understanding of the subject matter.

CONTENTS

INTRODUCTION TO FINANCIAL DERIVATIVES

OVER-THE-COUNTER DERIVATIVES

HISTORY OF DERIVATIVES MARKET

USES OF DERIVATIVES

INVESTING VS TRADING

TYPES OF DERIVATIVES

1. FORWARDS

Introduction

Features of Forward contract

Limitations of Forward contract

2. FUTURES

Introduction

Features of Future contract

Limitations of Future contract

Types of settlement in Futures

(i) Cash based settlement

(ii) Delivery based settlement

When to buy or sell Futures

Vanilla vs. Exotic Derivatives

Short Selling

Open interest

Basis

3. OPTIONS

Introduction

Call option

Put option

Strike Price

Spot price

Expiration date

American option and European Option

Option premium

In-the-money, At-the-money & Out-of-the-money

Intrinsic value

Extrinsic Value

Factors affecting Option value

Profit profile of Option buyer or seller

Speculative view – Option market participants

Option classes and series

Option Greeks

(i) Delta

(ii) Gamma

(iii) Vega

(iv) Theta

(v) Rho

Relationship – Option Delta & type of Option

Standard deviation

Volatility

Alpha

Beta

Option spread Strategies

(i) Bull call spread

(ii) Bull put spread

(iii) Bear call spread

(iv) Bear put spread

(v) Long Butterfly spread

(vi) Short Butterfly spread

(vii) Long Straddle

(viii) Short Straddle

(ix) Long Strangle

(x) Short strangle

4. WARRANTS

5. SWAPS

Introduction

Types of Swaps

(i) Interest rate swaps

(ii) Currency swaps

(iii) Commodity swaps

(iv) Equity swaps

(v) Asset swaps

(vi) Liability swaps

(vii) Total return swaps

PARTICIPANTS IN DERIVATIVES MARKET

1. Hedgers

Perfect hedge

Imperfect hedge

Cross hedge

Short hedge

Long hedge

2. Speculators

3. Arbitrageurs

Hedging with Swaps

Hedging with Options