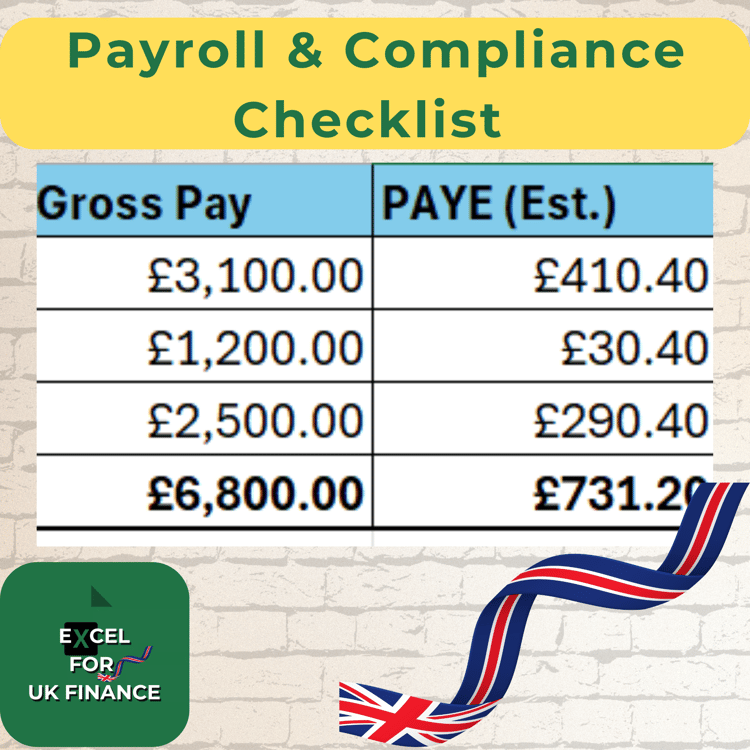

Managing Tax Codes in Excel – UK Payroll Template (2025/26)

Easily manage tax codes, PAYE calculations, and payroll setup in Excel for the 2025/26 UK tax year.

Full Description:

Take control of your UK payroll in Excel with this ready-to-use template designed for small businesses, schools, and finance professionals.

This template helps you manage HMRC tax codes, calculate PAYE automatically, and organise your payroll across clear, structured sheets.

🔎 Includes:

✔ Staff Setup sheet with dropdown tax code selection

✔ Built-in Tax Code Table for 2025/26

✔ Automatic PAYE calculations using XLOOKUP

✔ Monthly Payroll sheet with Gross to Net breakdown

✔ Optional Payslip Generator (auto-filled by employee)

✔ Optional Dashboard with PAYE + NIC summaries

✔ Fully editable and reusable every month

✔ No macros, 100% Excel formulas

✔ Built for UK payroll rules

📎 Suitable for:

- UK school bursars

- Small business owners

- Finance students or CIMA trainees

- Payroll beginners using Excel

📁 File Format:

Microsoft Excel (.xlsx)

📅 Tax Year:

2025/26 (with latest HMRC thresholds)