LongTradeShortTradeStrategy

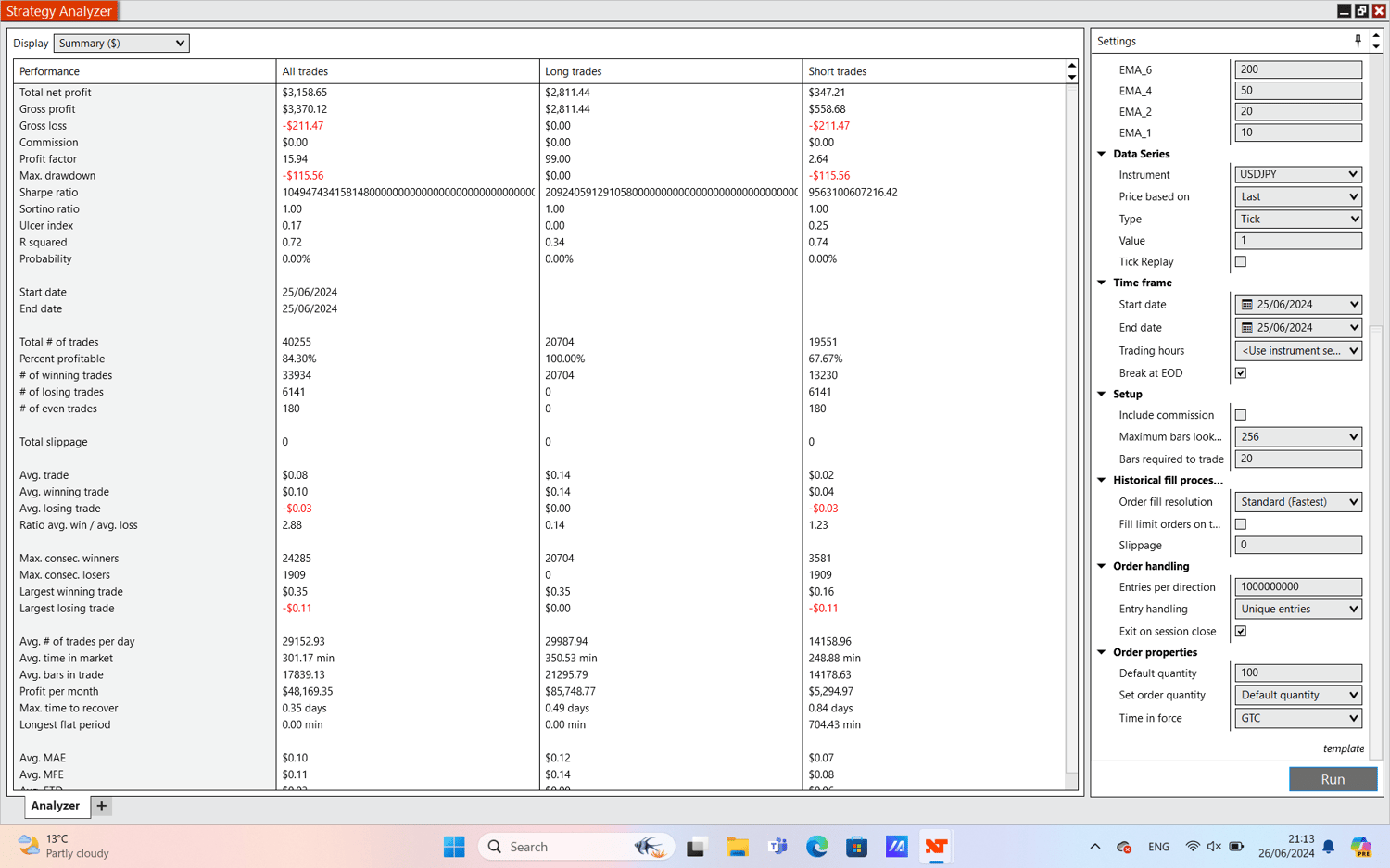

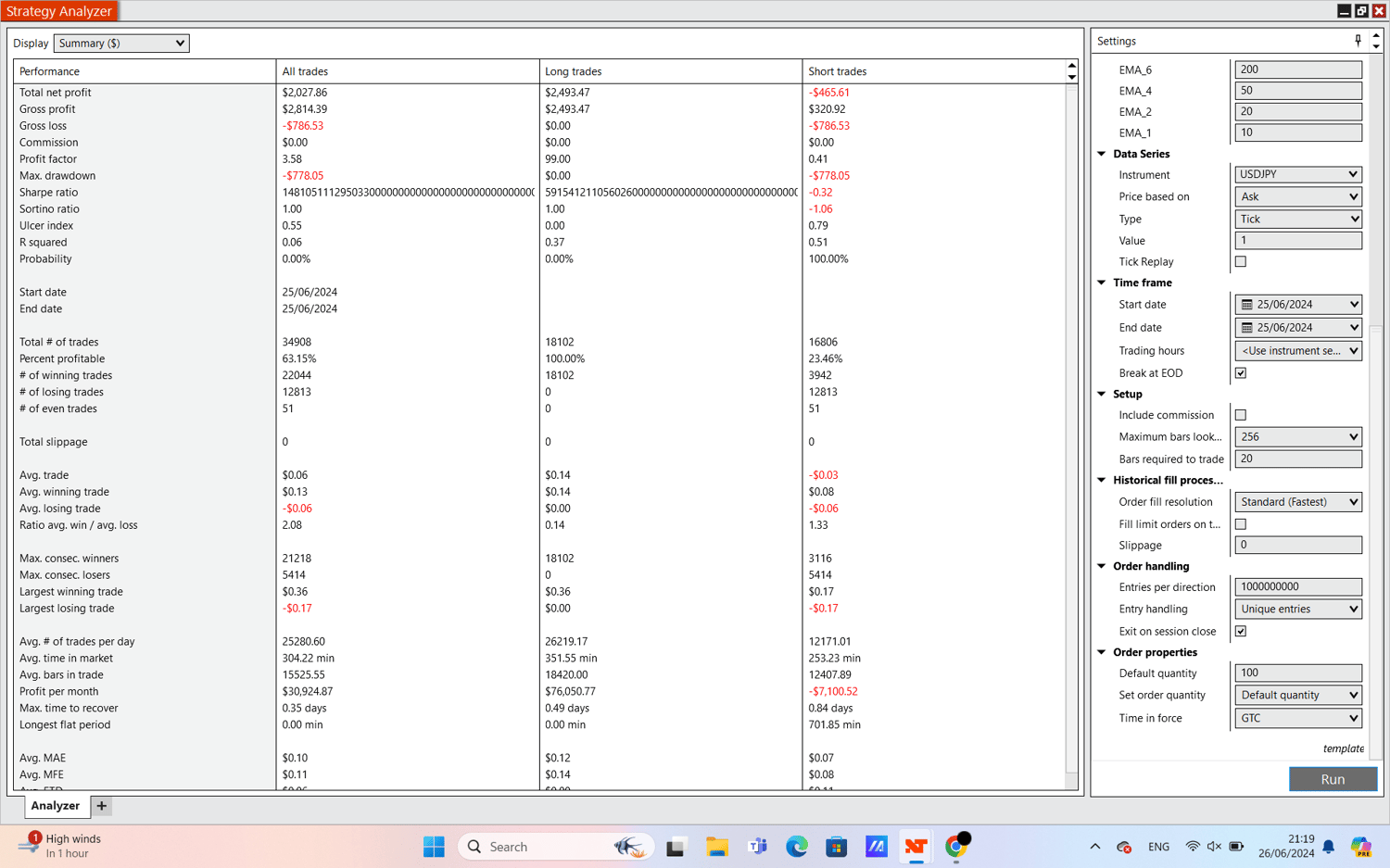

This is a very basic trading strategy that:

1- Buys low, sell high

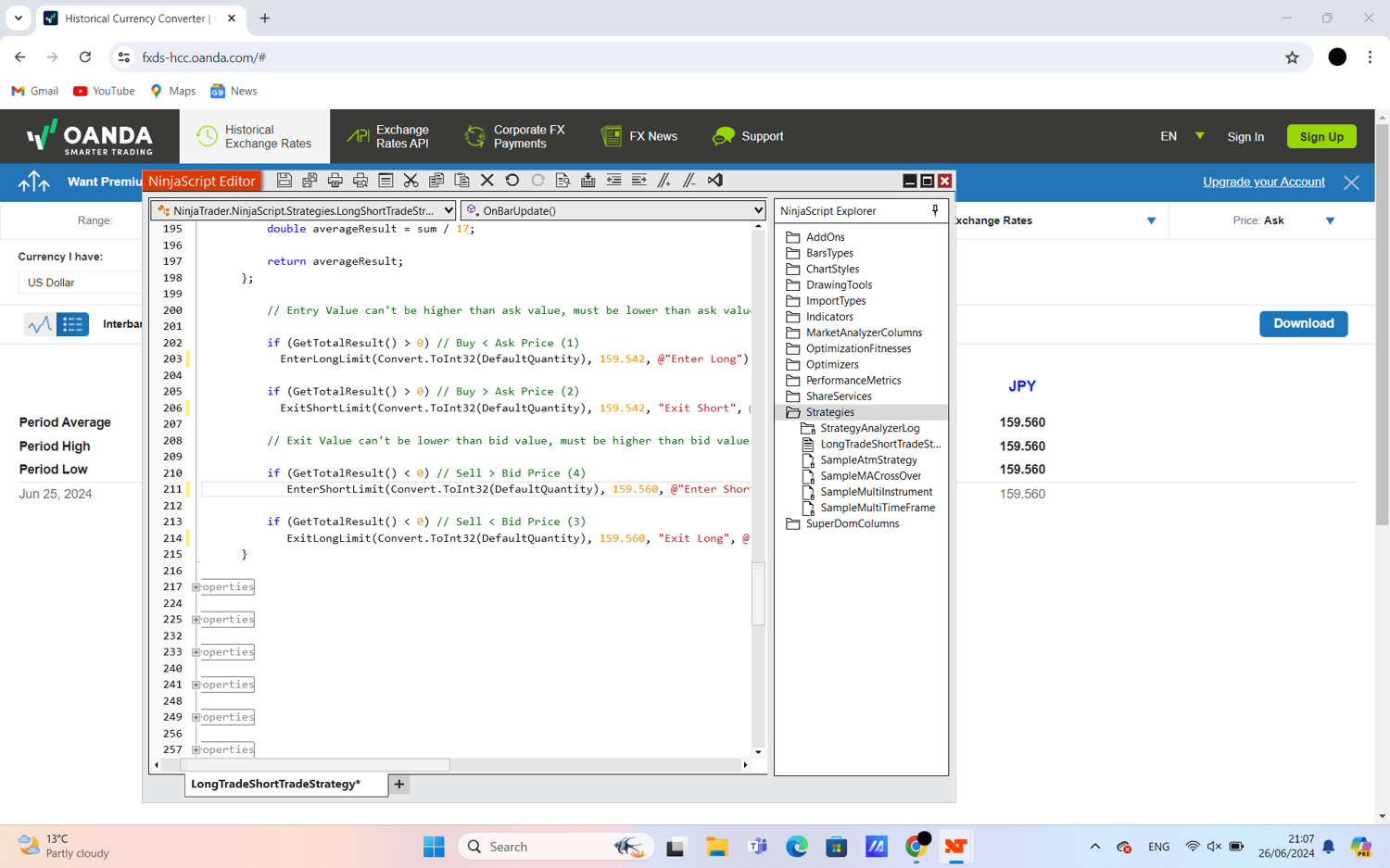

2- Follows market trends with its collection of MA and oscillator strategies

3- Utilizes limit order when entering/exiting long or short trades to get the best price possible.

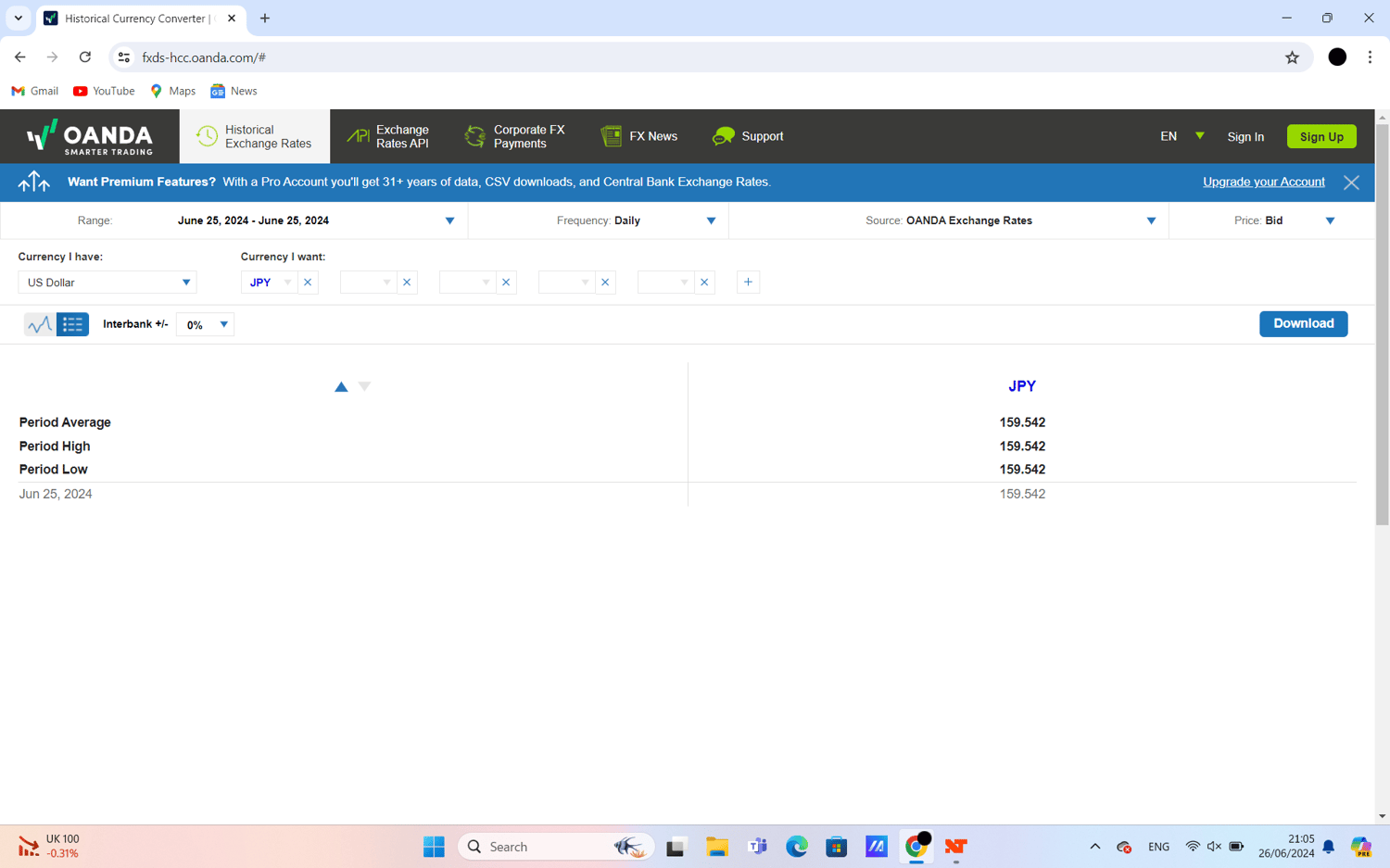

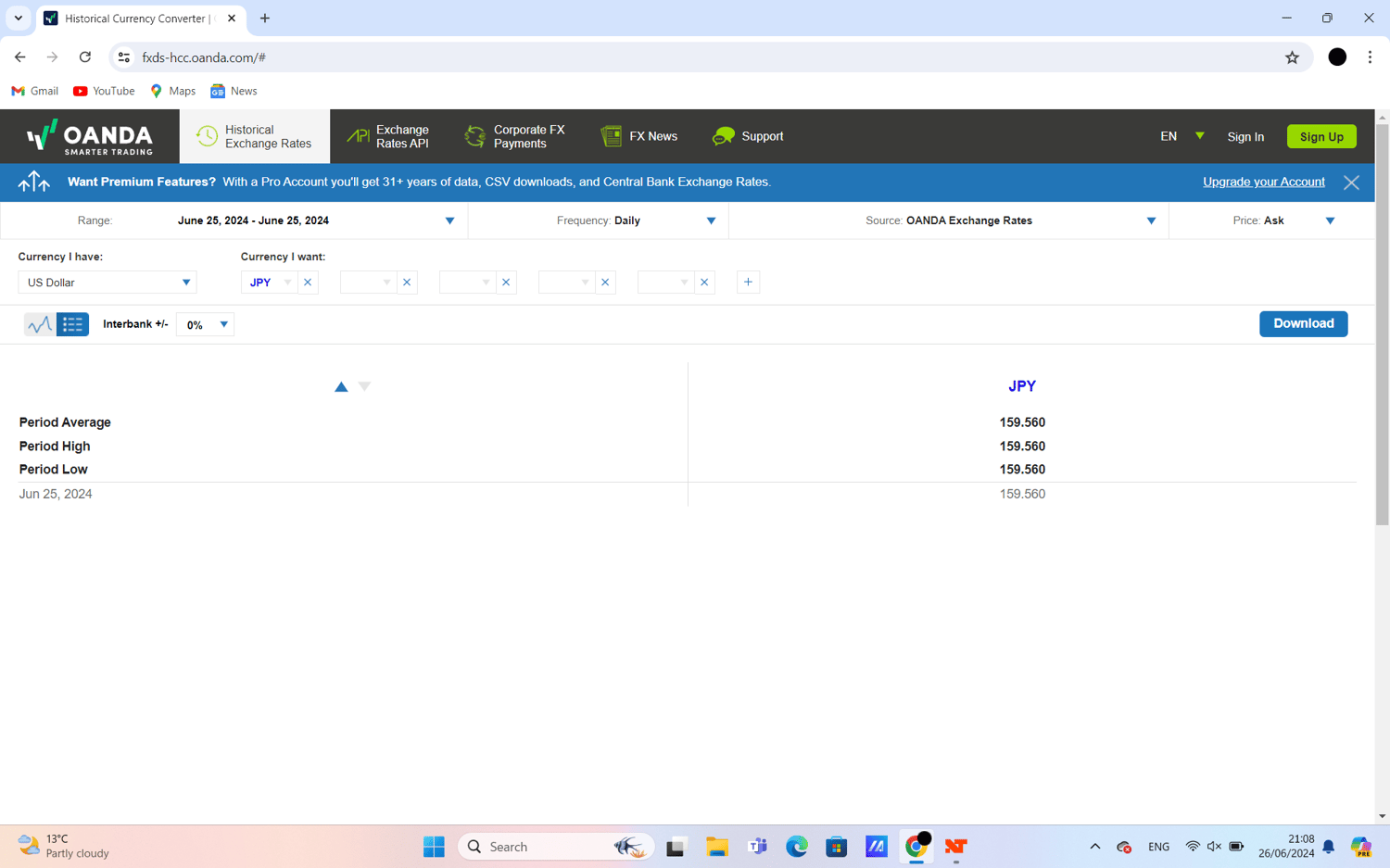

This NinjaTrader strategy, LongShortTradeStrategy, uses several indicators like moving averages and oscillators to automatically decide when to buy or sell stocks. It looks at these indicators compared to the current price of the stock to figure out if it's a good time to make a trade. When it sees indicators suggesting the stock might go up, it sets an order to buy at a price lower (buy limit order) than what others are currently willing to pay. If the indicators show the stock might drop, it sets an order to sell at a price higher than what others are offering (sell limit order). This strategy aims to make trades based on clear signals while adjusting its settings to try and do well in different market conditions.

******* THIS STRATEGY IS ONLY COMPLIANT WITH NINJATRADERS 8 **********

“NinjaTrader® is a registered trademark of NinjaTrader Group, LLC. No NinjaTrader company has any affiliation with the owner, developer, or provider of the products or services described herein, or any interest, ownership or otherwise, in any such product or service, or endorses, recommends or approves any such product or service.”

Risk Disclosure:

Futures and forex trading contains substantial risk and is not for every investor. An investor could potentially lose all or more than the initial investment. Risk capital is money that can be lost without jeopardizing ones’ financial security or life style. Only risk capital should be used for trading and only those with sufficient risk capital should consider trading. Past performance is not necessarily indicative of future results.

Hypothetical Performance Disclosure:

Hypothetical performance results have many inherent limitations, some of which are described below. No representation is being made that any account will or is likely to achieve profits or losses similar to those shown; in fact, there are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading program. One of the limitations of hypothetical performance results is that they are generally prepared with the benefit of hindsight. In addition, hypothetical trading does not involve financial risk, and no hypothetical trading record can completely account for the impact of financial risk of actual trading. for example, the ability to withstand losses or to adhere to a particular trading program in spite of trading losses are material points which can also adversely affect actual trading results. There are numerous other factors related to the markets Last updated June 13, 2019 in general or to the implementation of any specific trading program which cannot be fully accounted for in the preparation of hypothetical performance results and all which can adversely affect trading results.