The Purge

The Purge within Banking Risk Management

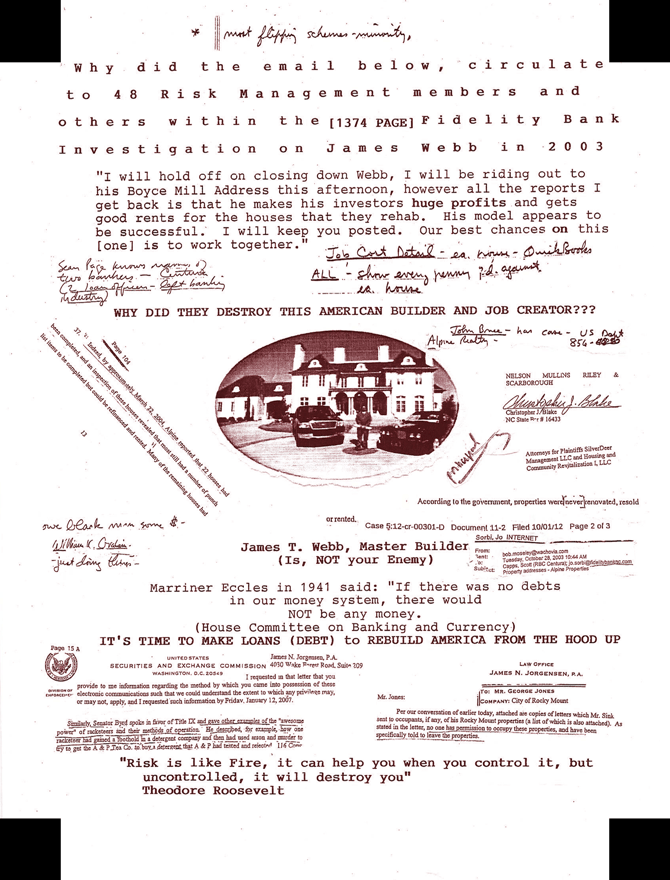

Attention CEOs of Bank Holding Companies and Financial Holding Companies: It appears that you need James T. Webb Master Builder as much as he needs you! “You must teach your lower level employees what is ‘important.” Free James T. Webb Affordable Housing Builder. ( Home Loans on quality rebuilt homes for First Time Homebuyers) The Bank Holding Company Act of 1956 has prohibited affiliations between banks and insurance companies. These “firewall” restrictions are eliminated under the powers of given to financial holding companies by the 1999 Act. A Bank Holding Company qualifies as a Financial Holding Company if its banking subsidiaries are “well capitalized” and “well-managed,” and it files with the Federal Reserve Board a certification to such effect and a declaration that it elects to become a Financial Holding Company. For such a declaration to be effective, at the date of the election, all the subsidiary insured depository institutions of the Bank Holding Company [must have received a satisfactory or better Community Reinvestment Act (CRA) rating.] (The 1977 CRA requires that banks lend in the communities from which they obtain deposits.)

Attention CEOs of Bank Holding Companies and Financial Holding Companies: It appears that you need James T. Webb Master Builder as much as he needs you! “You must teach your lower level employees what is ‘important.” Free James T. Webb Affordable Housing Builder. ( Home Loans on quality rebuilt homes for First Time Homebuyers) The Bank Holding Company Act of 1956 has prohibited affiliations between banks and insurance companies. These “firewall” restrictions are eliminated under the powers of given to financial holding companies by the 1999 Act. A Bank Holding Company qualifies as a Financial Holding Company if its banking subsidiaries are “well capitalized” and “well-managed,” and it files with the Federal Reserve Board a certification to such effect and a declaration that it elects to become a Financial Holding Company. For such a declaration to be effective, at the date of the election, all the subsidiary insured depository institutions of the Bank Holding Company [must have received a satisfactory or better Community Reinvestment Act (CRA) rating.] (The 1977 CRA requires that banks lend in the communities from which they obtain deposits.)