Bond Futures & Cash Futures Basis Trading

Bond Futures Theory, Pricing and Practice

Abstract:

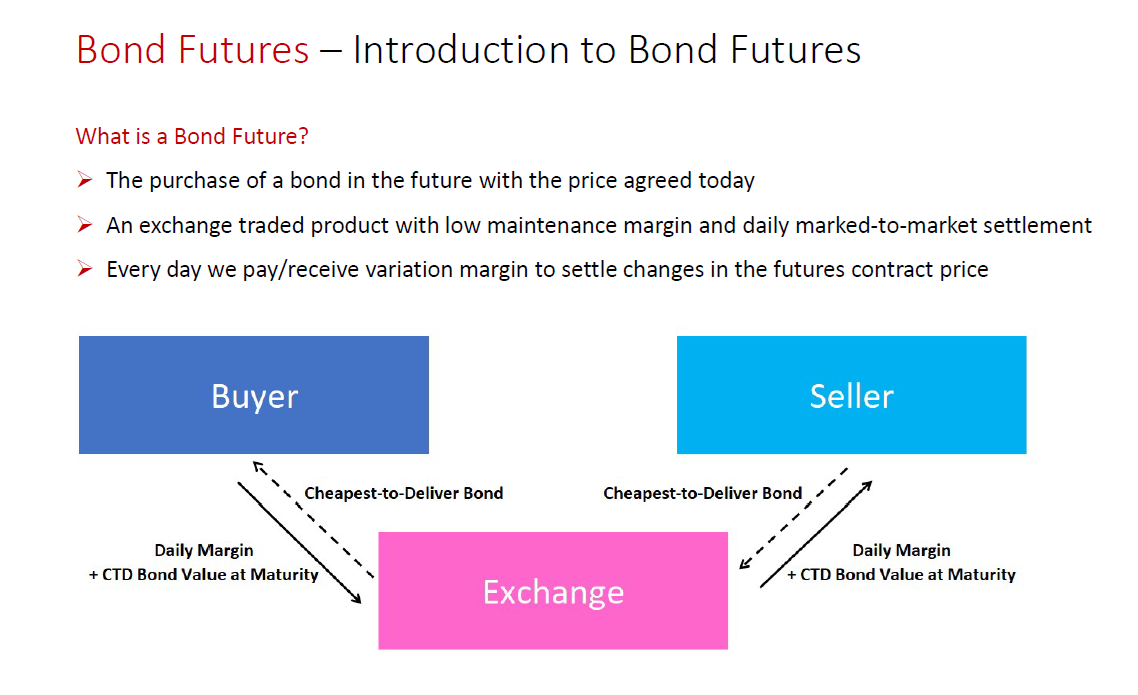

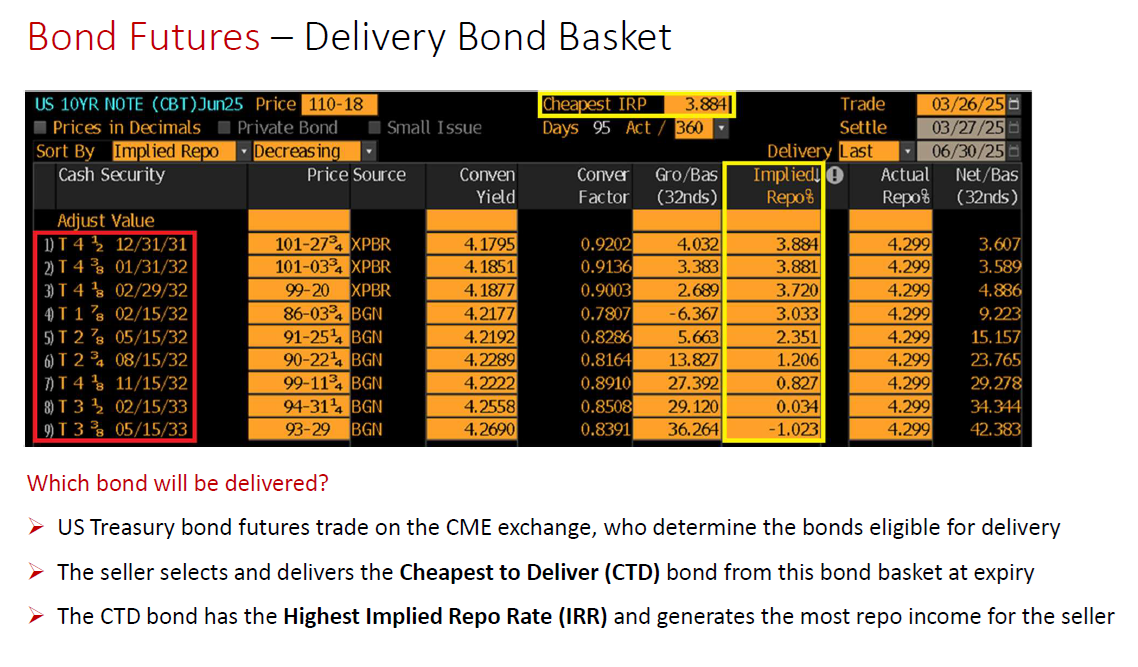

We pursue a rigorous exploration of bond futures, integrating both theoretical foundations and practical applications. The first section, "Theory," introduces the fundamental concepts underpinning bond futures, discusses the motivations for trading these instruments, and outlines key contract specifications. The aim is to establish a solid conceptual understanding the structure and function of bond futures within financial markets.

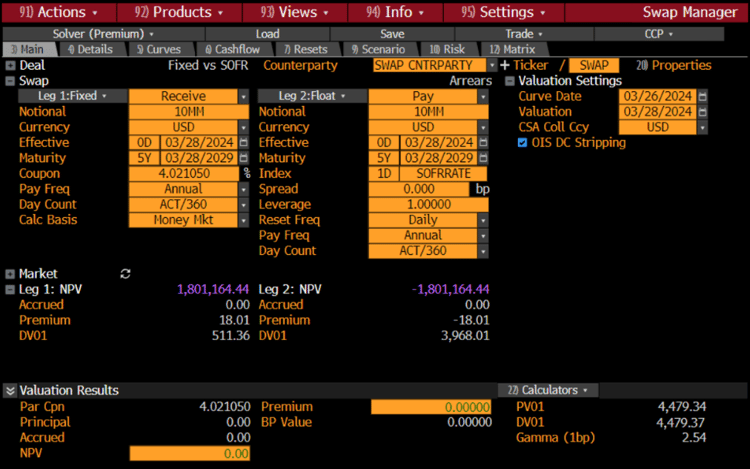

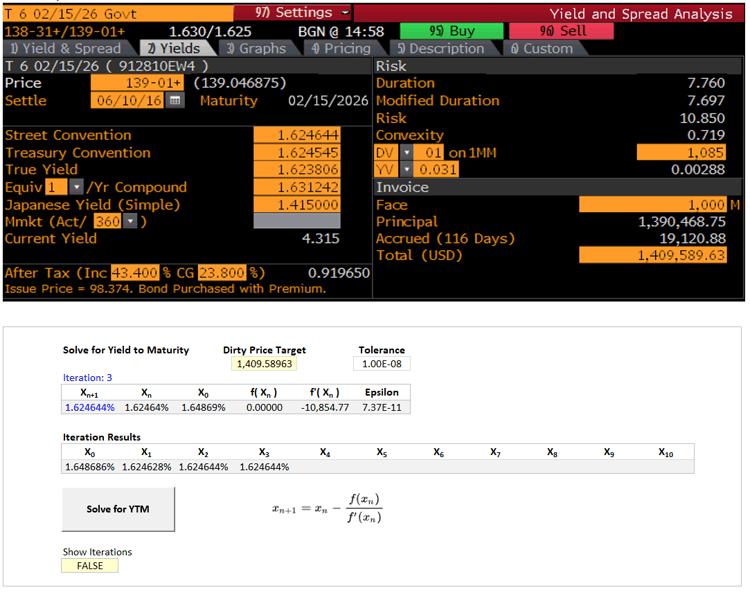

The second section, "Pricing & Practice," transitions to applied topics and empirical analysis. It covers the derivation and use of pricing and implied repo rate formulae, presents a detailed case study, and examines the valuation of delivery and switch options embedded in bond futures contracts. The section concludes with an review of the cash-futures basis trading strategy, highlighting both the practical considerations involved in exploiting basis opportunities.

Keywords:

Bond Futures, Implied Repo Rate, Delivery Option, Switch Option, Cash-Futures Basis, Cheapest-to-Deliver, Conversion Factor, Futures Pricing, Fixed Income Derivatives, Arbitrage, Repo Financing, Carry, Basis Trading