Interest Rate Swaps

Excel Workbook & Guide

Contents

- Interest Rate Swap - Excel Workbook

- Interest Rate Swap - PDF Documentation & Guide

- Yield Curves & LIBOR Reform - PDF Documentation

- Yield Curves & LIBOR Reform - PowerPoint Presentation

Important Note for Consideration When Purchasing this Product

The training materials reference IBOR index rates, which have largely been replaced by risk-free rate benchmarks (RFRs) such as USD SOFR, EUR €STR, and GBP SONIA. In some Asian markets, IBORs are still in use. For learning purposes, the fundamental mechanics of Interest Rate Swaps (IRS) remain unchanged, although interest rate fixing dates and rate conventions differ. For more details on the LIBOR transition to RFRs see the additional training materials and documentation on yield curves and IBOR reform included in this digital download bundle.

Excel Workbook & Guide

Interest rate swaps (IRS) are among the most widely used financial derivatives in global markets. An IRS transaction involves one party paying a fixed interest rate while receiving a floating rate-typically referenced to benchmarks such as SOFR, LIBOR, or ESTR-while the other party does the opposite.

IRS are used to serve several key purposes:

- Risk Management: They allow entities to hedge against adverse movements in interest rates, such as converting floating-rate liabilities to fixed, or vice versa.

- Cost Optimization: Swaps can help achieve a lower effective borrowing cost by exploiting comparative advantages in different debt markets.

- Market Speculation: Some participants use swaps to express views on the future direction of interest rates without trading the underlying bonds or loans.

At inception, swaps are typically priced so that the present value of the fixed and floating legs are equal, resulting in a net present value (NPV) of zero for both parties. The fixed rate agreed upon is known as the "swap rate" or "par rate", and the collection of swap rates across maturities forms the swap curve-an important benchmark in modern finance.

Interest rate swaps are foundational instruments for managing interest rate exposure, shaping debt profiles, and facilitating efficient capital markets.

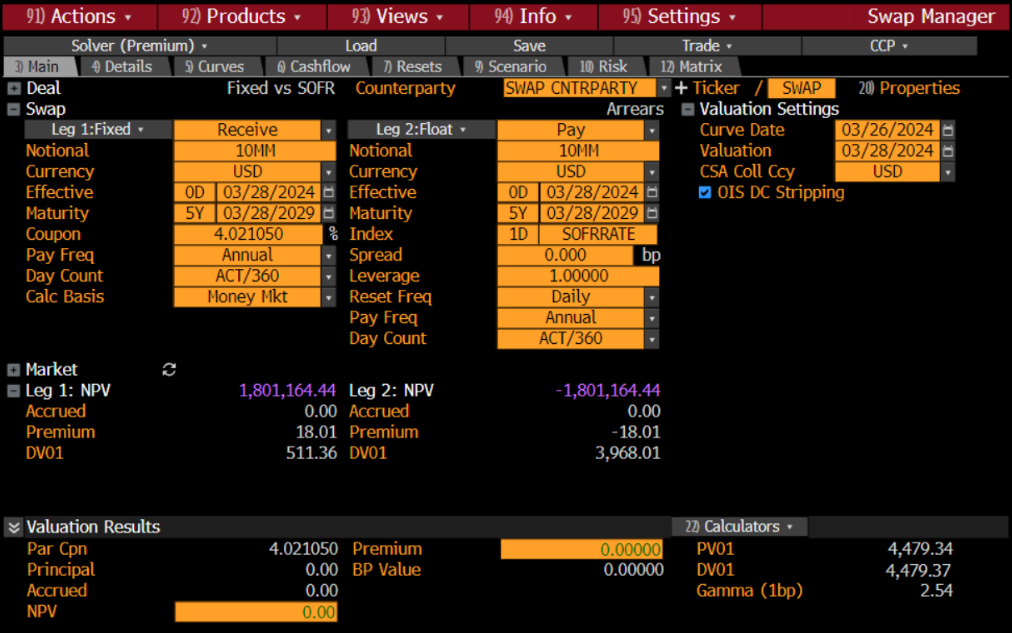

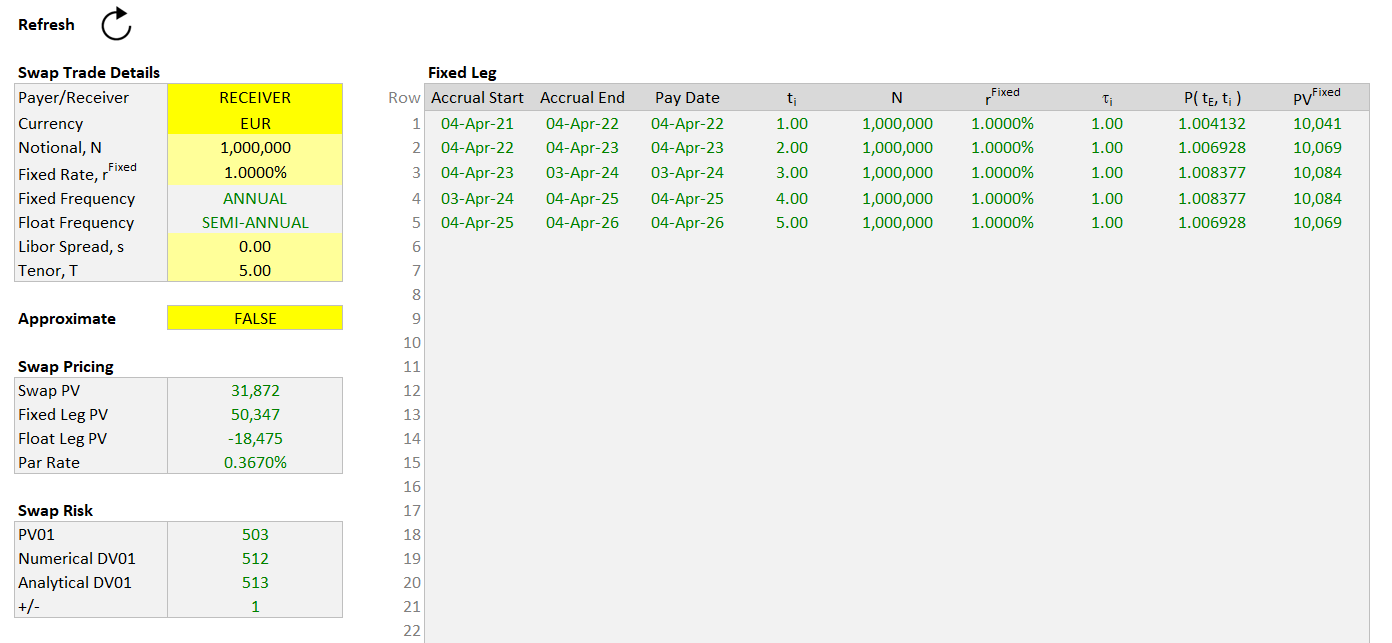

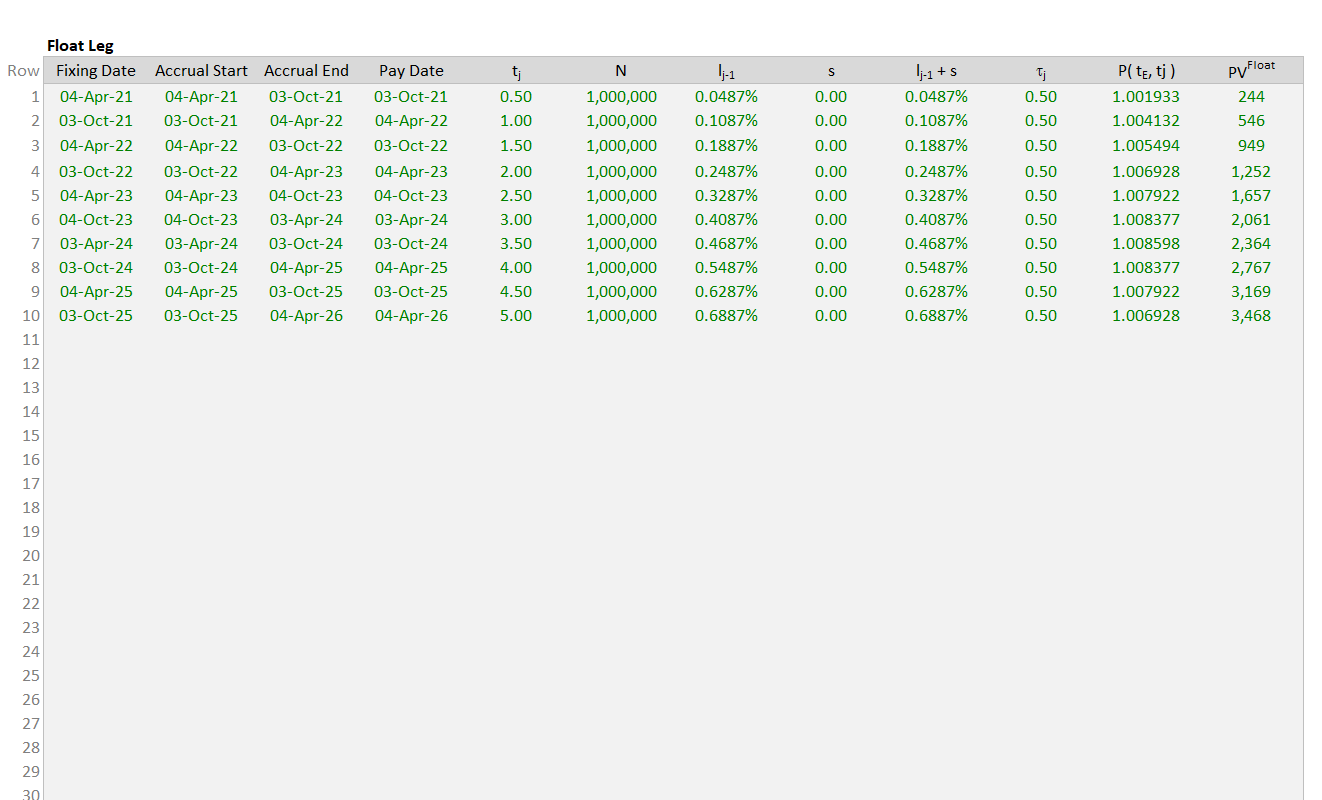

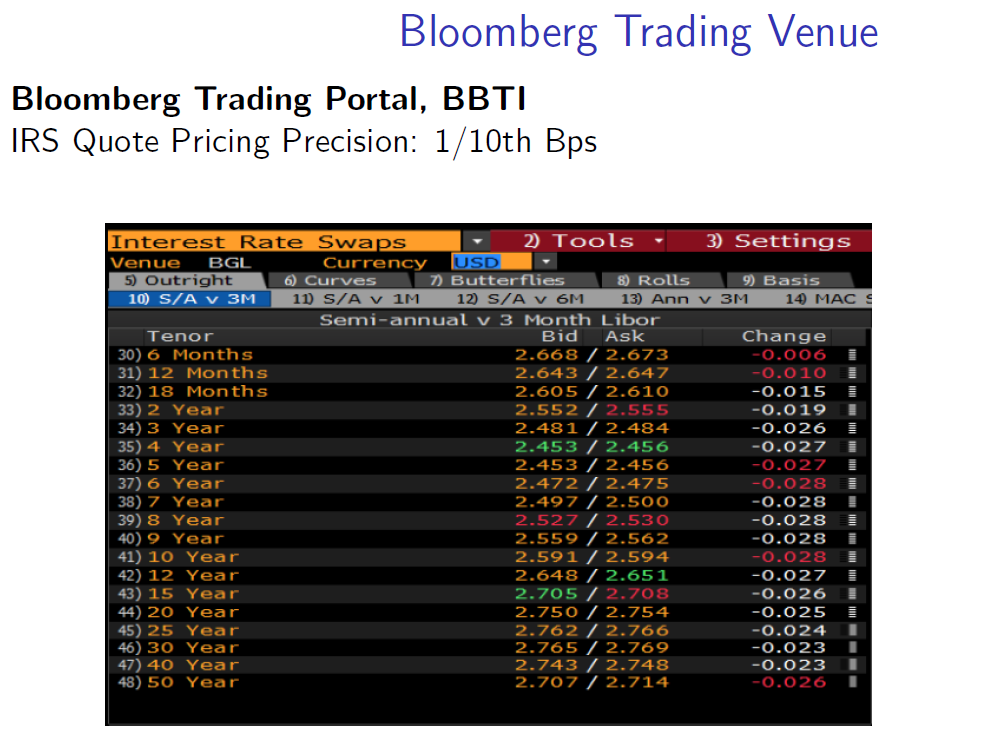

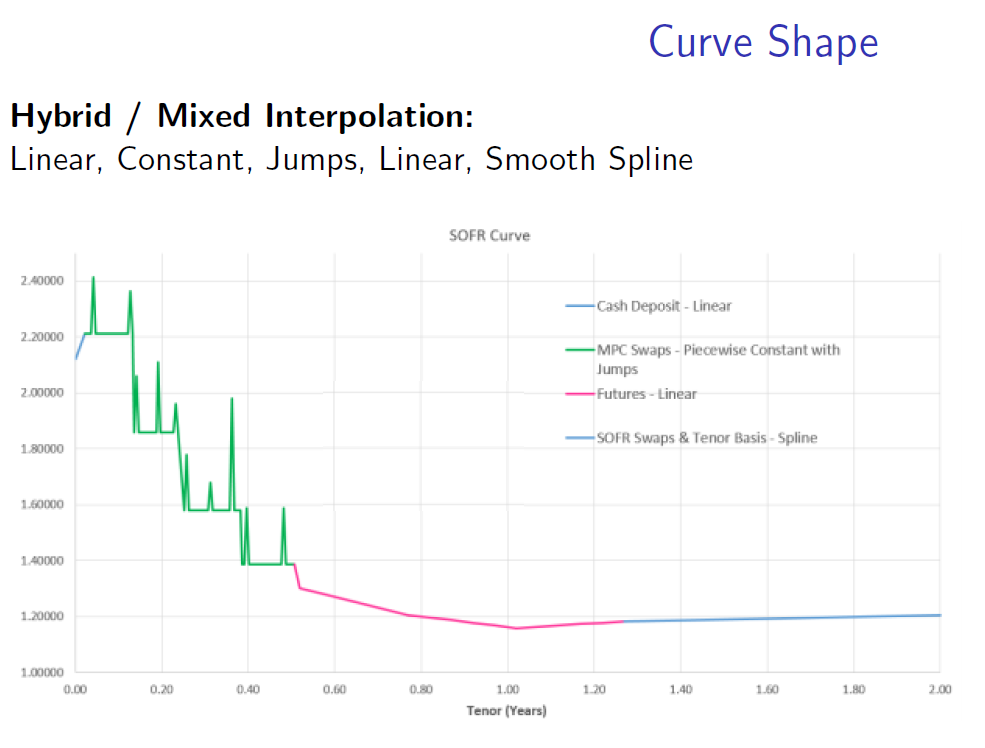

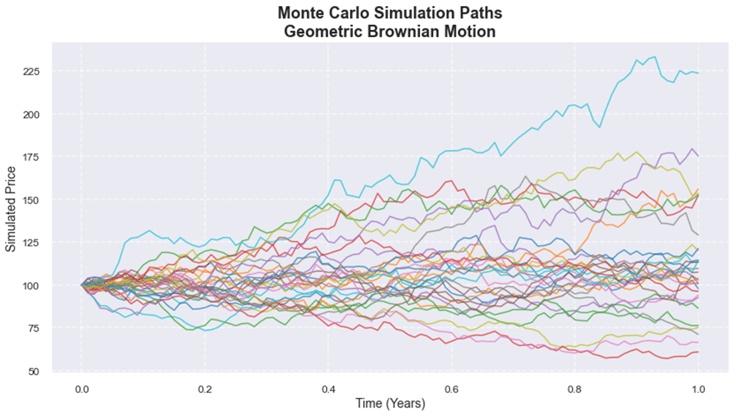

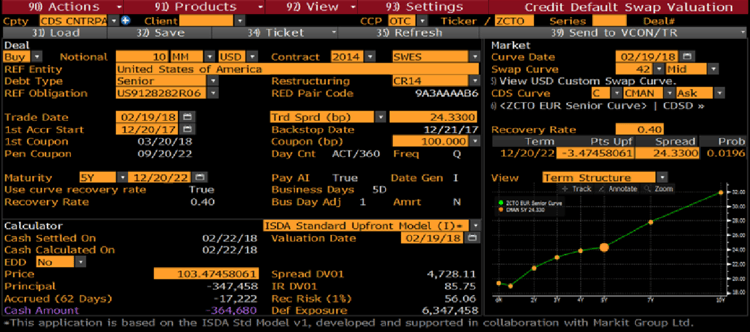

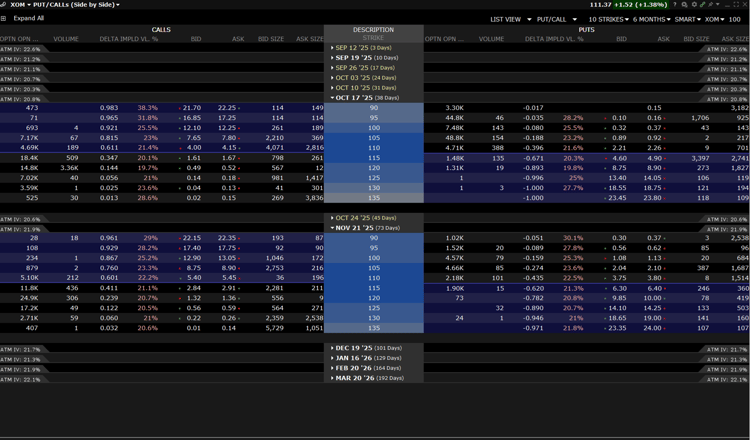

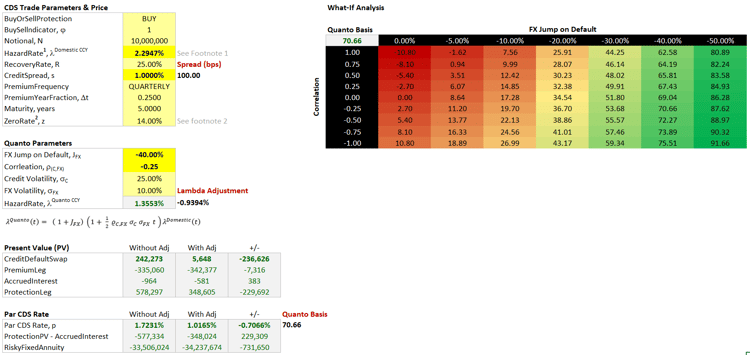

Throughout the documentation I give screenshots of market quotes and trading screens to help understand the IRS market. Furthermore, the Excel workbook is a useful tool to study market dynamics, pricing and risk.

Keywords: Interest Rate Swap, Asset Swap, Par Rate, Swap Rate, PV01 , DV01, Duration,

Convexity, Credit Risk, Asset Swap Spread, Yield-Yield Method, Par-Par Method, Par Adjustments,

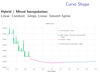

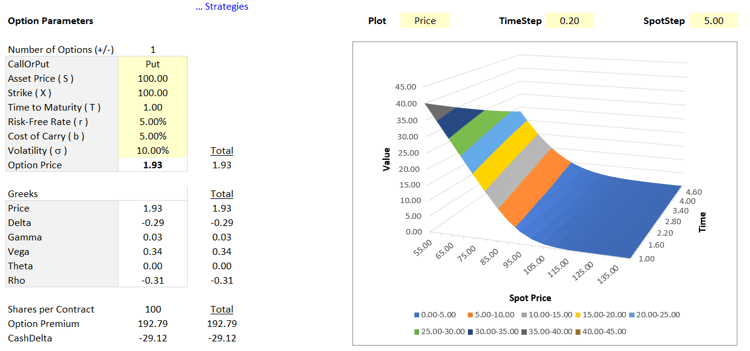

Excel Pricing & Risk