European Options

Contents

Generalized Black Scholes - PDF Document

Generalized Black Scholes - Excel Workbook

European Option Pricing & Greeks

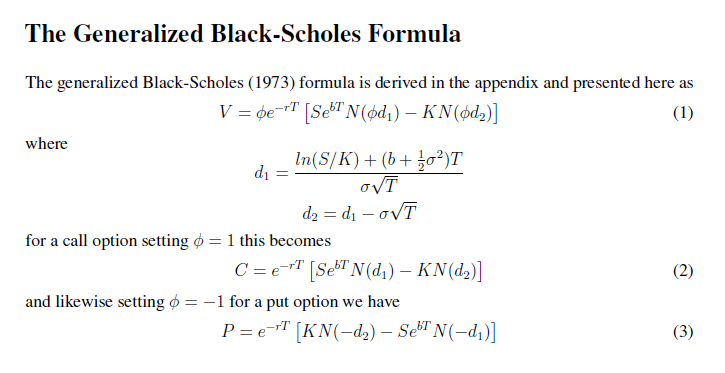

The Black-Scholes (1973) formula is well used for pricing vanilla European options. There are several different variations used by market practitioners dependent on the underlying asset being modelled. In the PDF document we present the generalized Black-Scholes representation, outline it’s derivation and review how to configure the model appropriately for different asset classes. In particular varying the cost of carry term incorporated in the model allows us to express the generalized Black-Scholes as the classical Black-Scholes (1973) formula or the canonical Black (1976) representation.

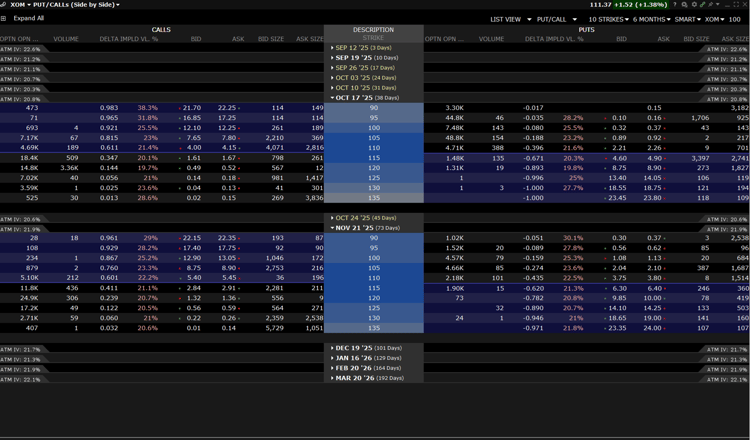

The Generalized Black-Scholes method is both versatile and generic, and has been implemented in the Excel workbook provided. This workbook can be used to price and compute the risks ('The Greeks') for equity options, interest rate options i.e. caplets and floorlets, commodity options, options on futures and currency options. Additionally, we can use the workbook to examine the payoff profiles of option strategies such as: straddles, strangles, risk-reversals, butterfly options and more. Furthermore, we can also plot option risk profiles in 3D.

Keywords: Generalized Black-Scholes, Derivation, Black Model, Cost of Carry, European Option Pricing, Put-Call Parity, Put-Call Super-Symmetry, Pricing, Greeks