US Treasury Bonds

Excel Workbook & Guide

Contents

- US Treasury Bond - Excel Workbook. Shows how to exactly match the Bloomberg market price

- US Treasury Bond - PDF Document. Outlines the valuation procedure for US Treasury Bonds

Excel Workbook & PDF Training Guide

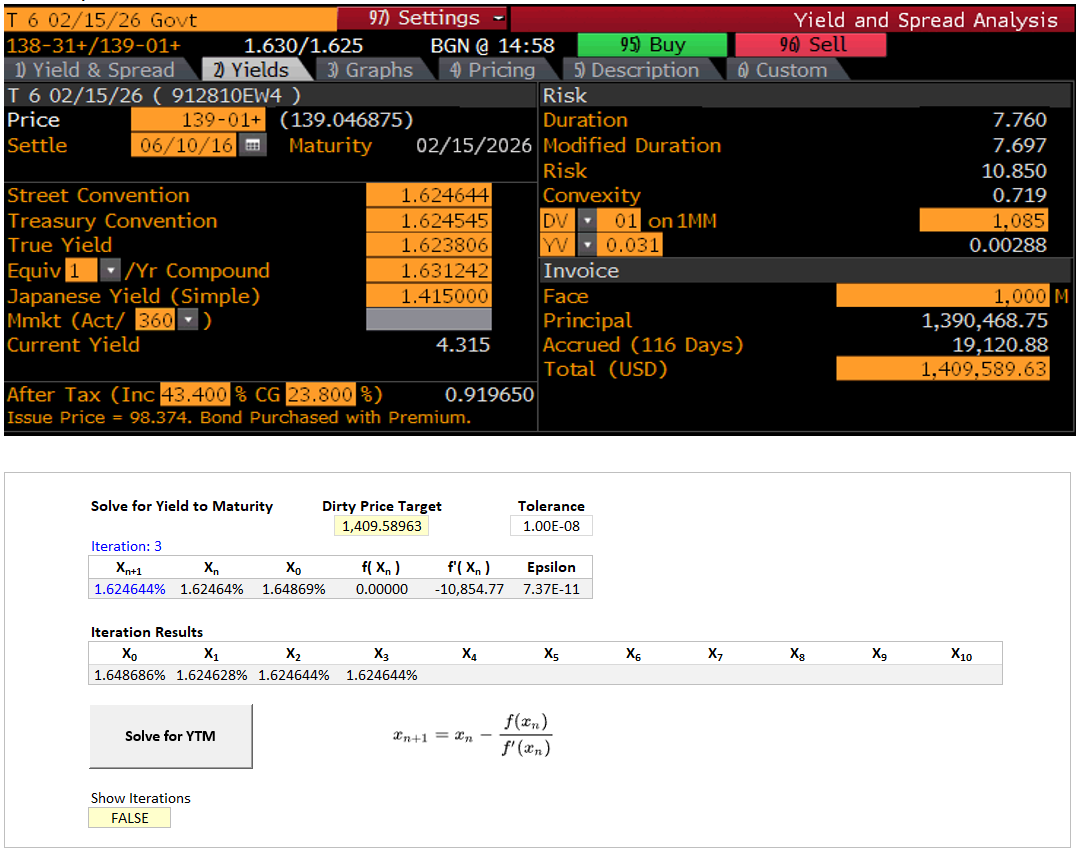

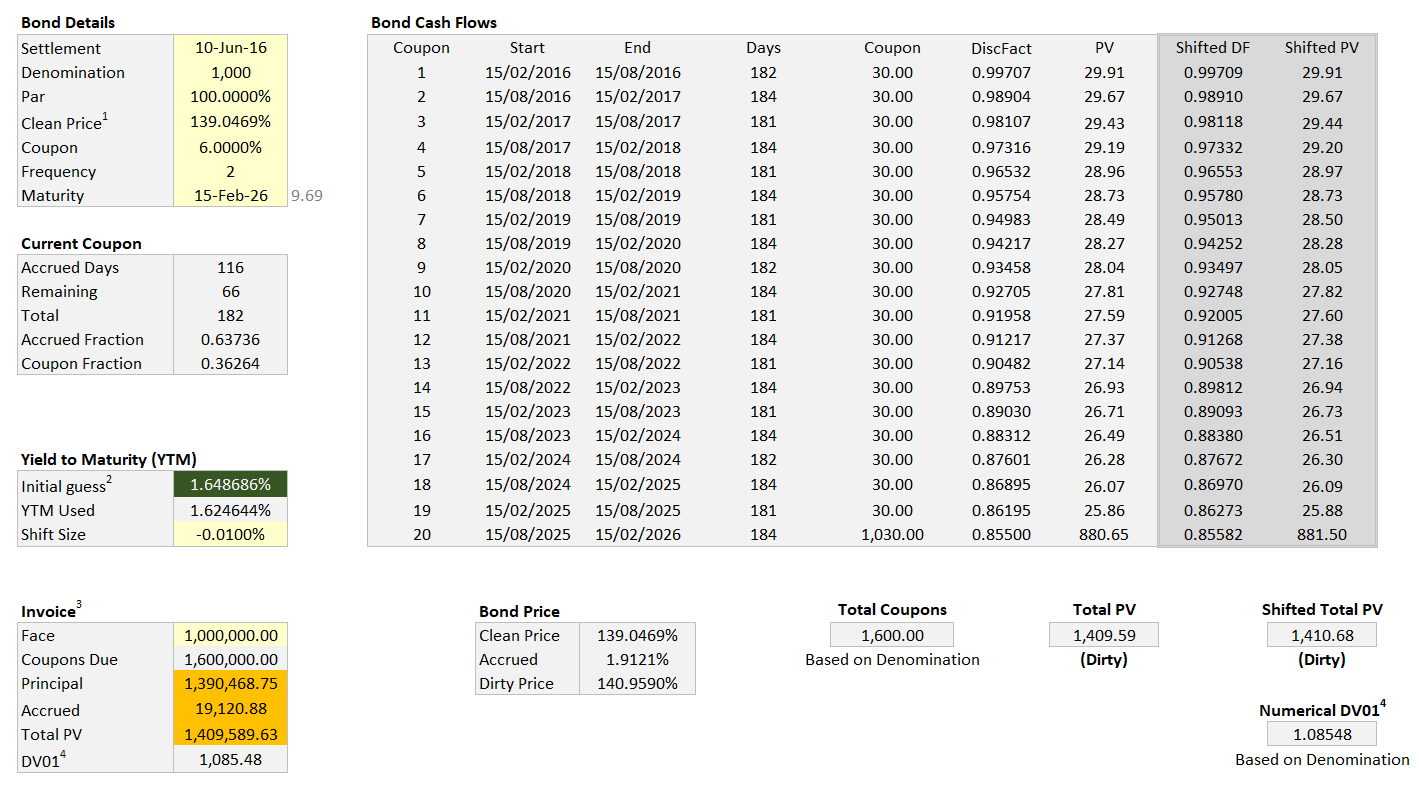

This Excel spreadsheet demonstrates how to price a US Treasury Bond and exactly match live tradable Bond price shown in Bloomberg. Using a live market example we also compute the accrued interest, clean- and dirty price of a US treasury bond. We also show how to solve for its yield to maturity and compute the present value of the bond cash flows.

To be able to evaluate bond cash flows and compute their present value we must compute the yield to maturity (YTM) or the internal rate of return (IRR) of the bond. There is no closed-form analytical solution. Therefore, it must be solved for using an optimization algorithm such as Newton-Raphson. This requires an initial guess for the YTM. In this workbook, we present a highly accurate approximation formula for the YTM, which can be used as a good initial guess for low latency calculations.

With this information we show how to compute the present value of any cash investment in this underlying bond and assess the DV01 risk, that is the change in value of the investment for a one basis point fall in the bond yield.

Keywords: Bond, dirty price, clean price, accrued interest, yield to maturity, internal

rate of return, cash flows, optimization, Newton-Raphson, low latency, DV01