Credit Default Swaps

Excel Workbook & Guide

Contents

- CDS - Excel Workbook

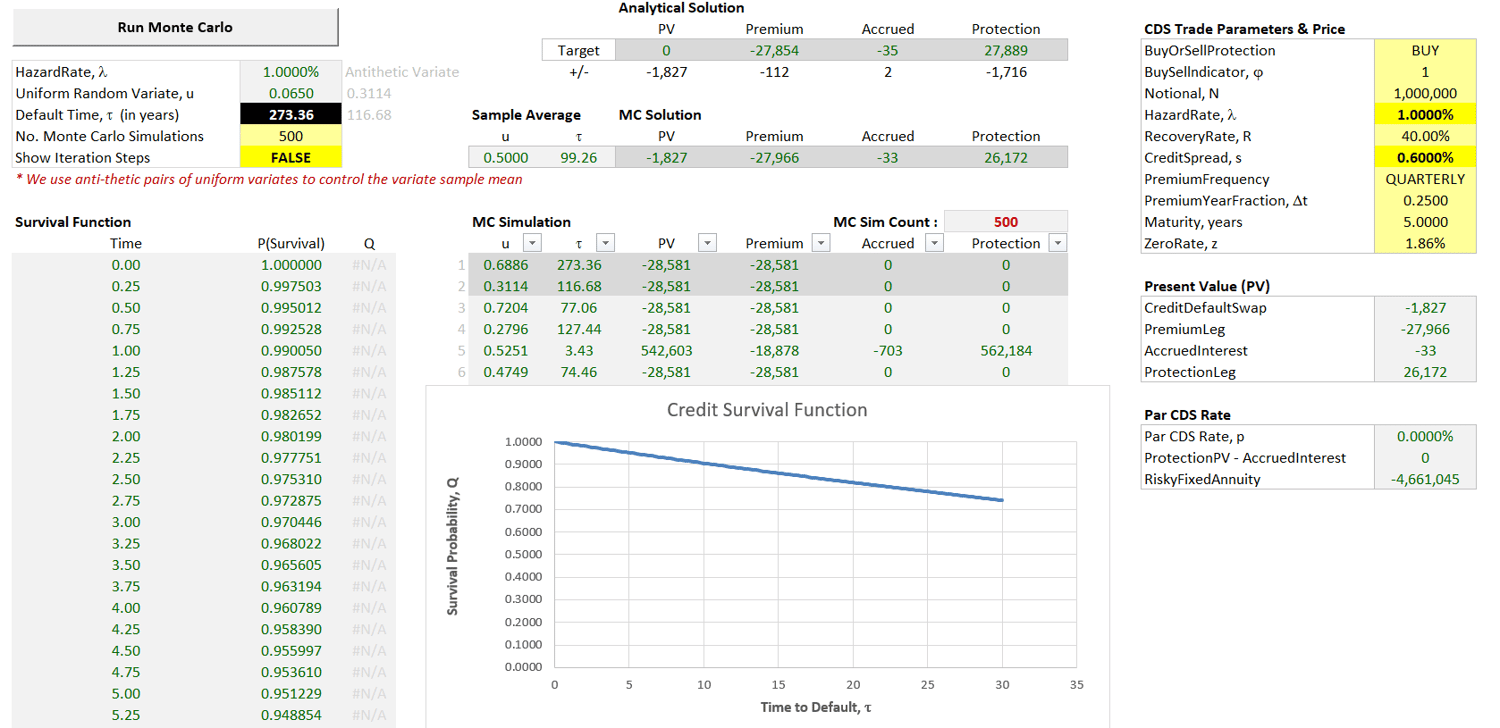

- CDS using Monte Carlo - Excel Workbook

- CDS - PDF Guide

Excel Pricing Workbook & PDF Overview

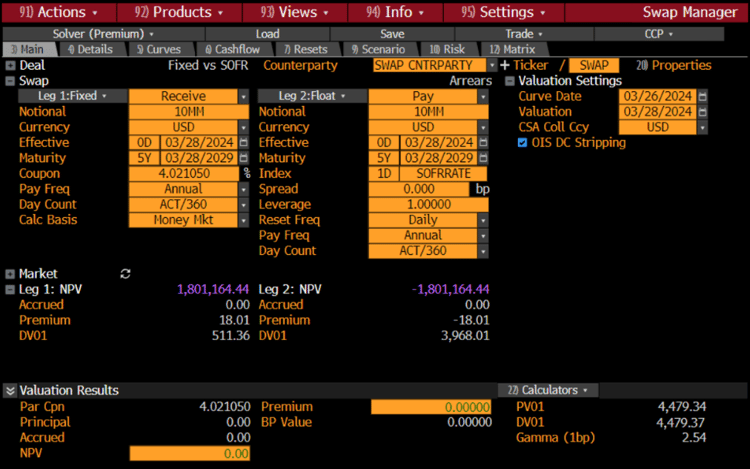

We review the pricing and model calibration of Credit Default Swaps referring to both the International Swaps and Derivatives Association (ISDA) CDS contract and credit model standardization guidelines. Furthermore we provide an Excel pricing workbook to supplement the materials discussed. The main goal is for these materials to act as a credit primer and to review the impact and purpose of ISDA contract and model standardization on credit pricing and modelling techniques.

We review the Credit Default Swap (CDS) product highlighting contract specifications, terminology

and how the product has been standardized for increased liquidity and XVA capital cost

reduction. We perform a fundamental review of probability and credit modelling, outlining

standard market assumptions and techniques used by traders and other market practitioners.

Furthermore we demonstrate how to price CDS contracts, calibrate credit models and discuss

the ISDA Standard Model, ISDA Fair Value Model and Bloomberg Fair Value Models in particular.

Finanlly, we discuss CDS liquidity, the need for credit index proxies to hedge credit

risk and outline liquidity alternatives to this such as the use of sector and index CDS contracts.

Keywords:

Credit Widening, Survival Probability, Default Probability, Hazard Rate, Loss Given

Default (LGD), Recovery Rate, ISDA Standardization, Credit Spread, Par Spread, Risky Annuity,

Risky Discount Factor, Credit Models, Reduced Form Intensity Models, ISDA Standard

Models, Model Calibration, Credit Proxy Curves, Bloomberg CDSW, Excel CDS Pricing.