AT1 Contingent Convertible Bonds - Exotic Monte Carlo Pricing

On Sale

£50.00

£50.00

Python Code, Jupyter Notebook & Guide

Contents

- CoCo Bonds - Python Source Code

- CoCo Bonds - Jupyter Notebook

Jupyter Notebook & Guide

This notebook provides a practical, hands-on guide to AT1 Contingent Convertible (CoCo) Bonds. It combines financial modelling theory with Python code to illustrate the pricing of these exotic hybrid instruments using advanced Monte Carlo simulation.

Notebook and Guide Objectives

The notebook and accompanying documentation are designed to help you:

- Understand the features, mechanics, and risks of AT1 CoCo Bonds, including conversion triggers and issuer call options.

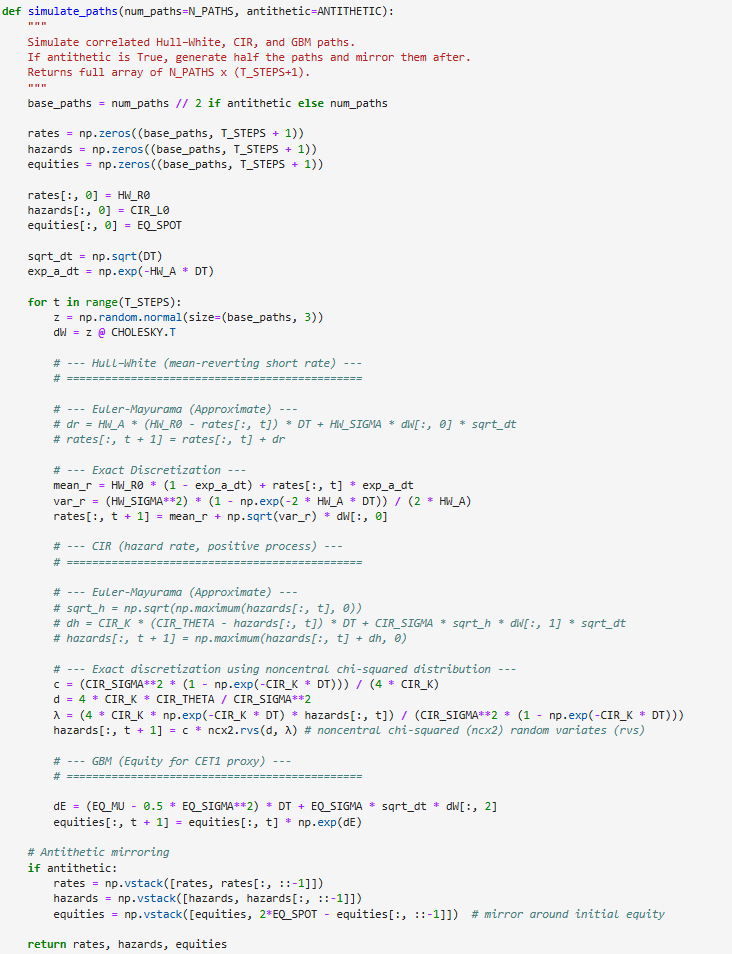

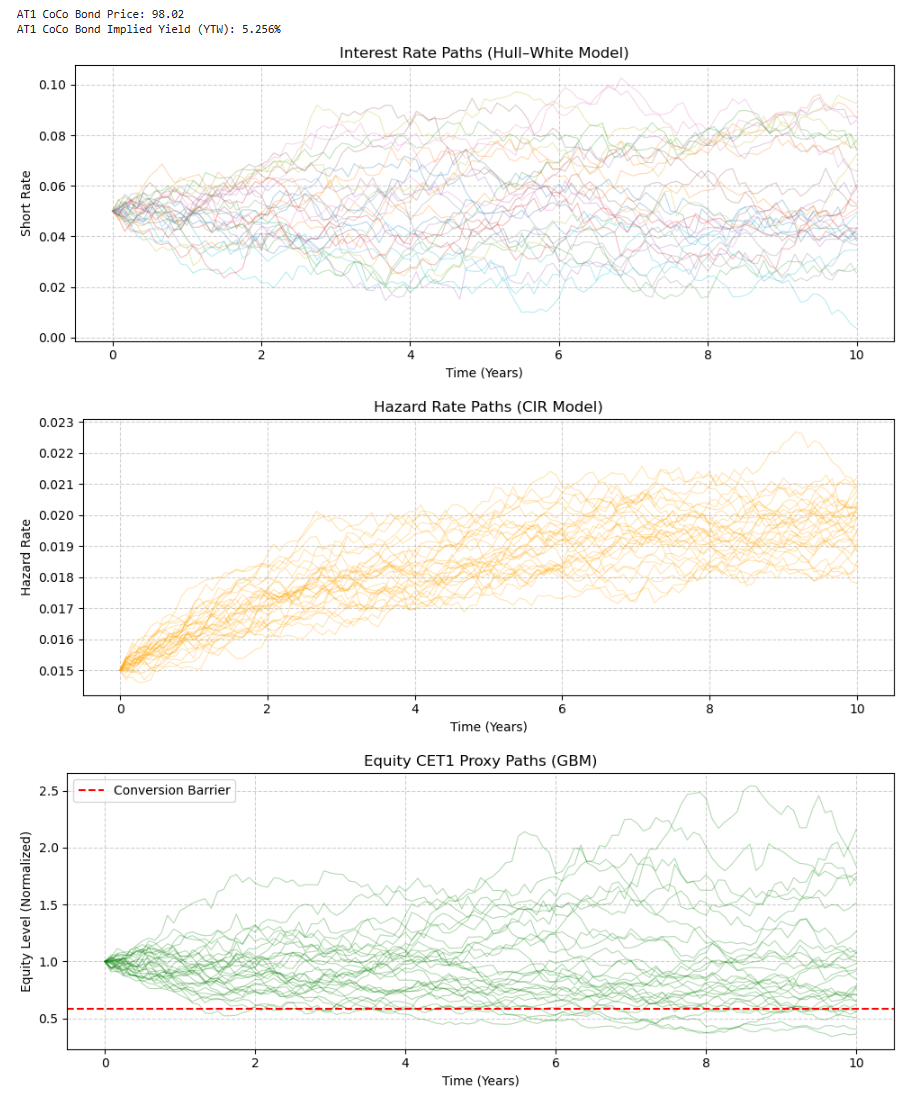

- Learn how to model multiple risk factors using a 3-factor framework:

- Extended Hull–White for interest rates

- CIR model for credit/hazard rates

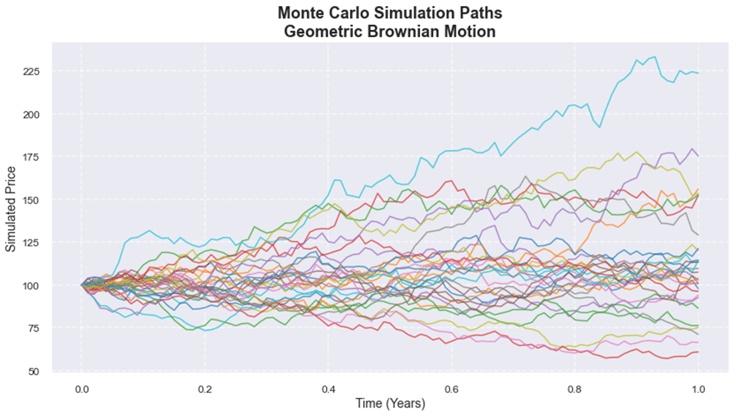

- Geometric Brownian Motion (GBM) for equity / CET1 ratio proxy

- Implement exact simulation Monte Carlo, correlating model drivers via Cholesky decomposition.

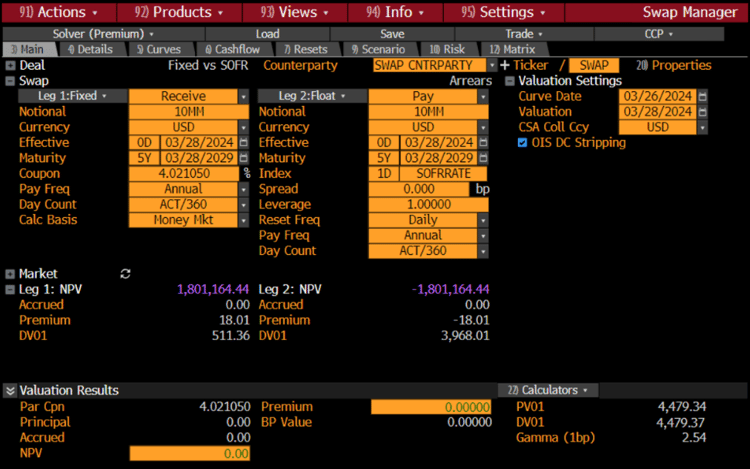

- Compute the Coco Bond PV, incorporating embedded issuer call and regulatory contingent options.

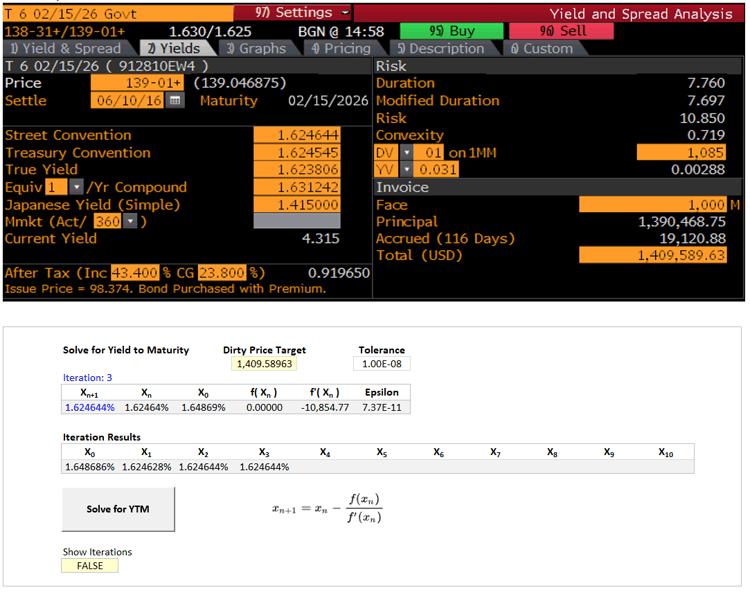

- Explore diagnostics and visualization: price convergence, path plots, and comparison against a vanilla fixed bond to understand exotic features.

Keywords:

- AT1 CoCo Bonds, Contingent Convertible Bonds, Monte Carlo Simulation, Hull–White, CIR Model, Equity Proxy, Exact Simulation, Cholesky Decomposition, Pricing, Yield Analysis, Embedded Options, Path-Dependent Instruments, Financial Risk.