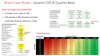

Quanto Credit Default Swaps

Excel Workbook & Guide

Contents

- Quanto CDS - Excel Workbook

- Quanto CDS - PowerPoint PDF Guide

PowerPoint Training Slides & Excel Workbook

This exciting financial training guide and Excel workbook delves into the complex world of Quanto Credit Default Swaps (CDS), exploring their theory, pricing, and practical application through intriguing case studies. Quanto CDS has gained significant attention in recent times due to regulatory changes allowing such transactions for the first time in emerging markets such as Brazil.

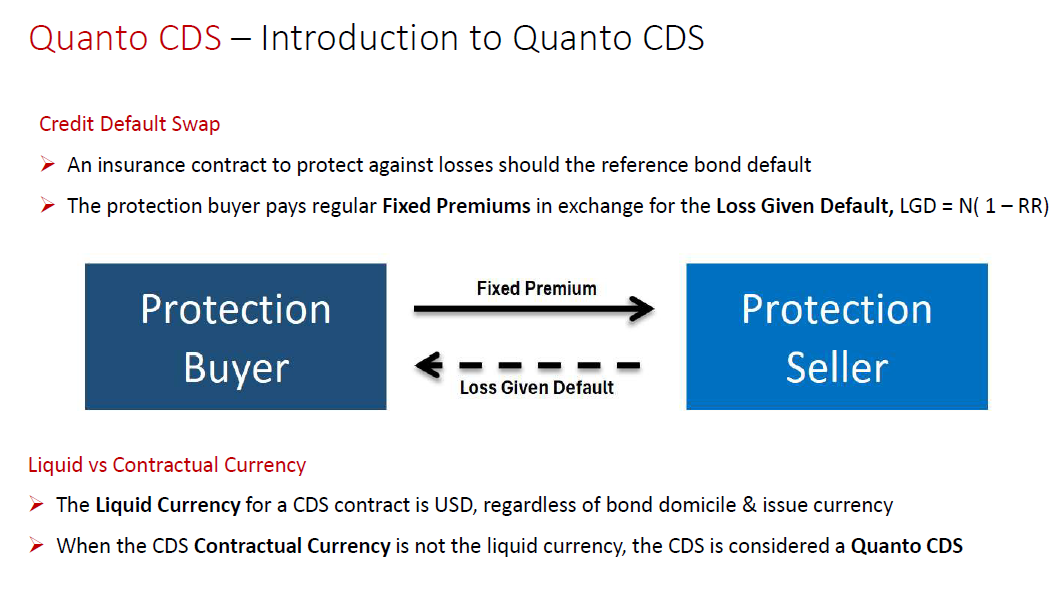

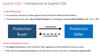

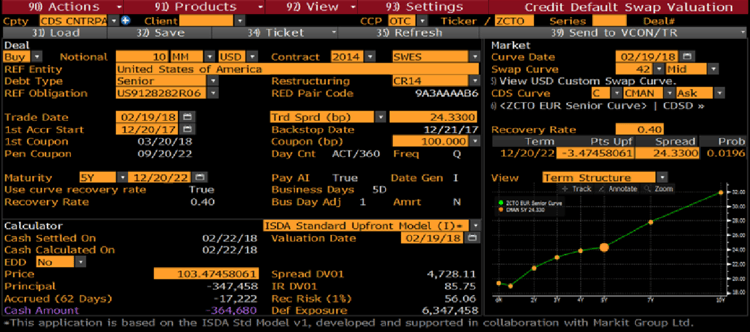

The research paper begins with a comprehensive introduction to Quanto CDS, shedding light on its intricacies and the difficulties associated with its pricing. Quanto CDS is a financial instrument that allows investors to transfer credit risk between two parties, with the added complexity of exposure to foreign exchange (FX) rates. This FX exposure, combined with the inherent risks of credit default, makes Quanto CDS a particularly challenging instrument to price accurately.

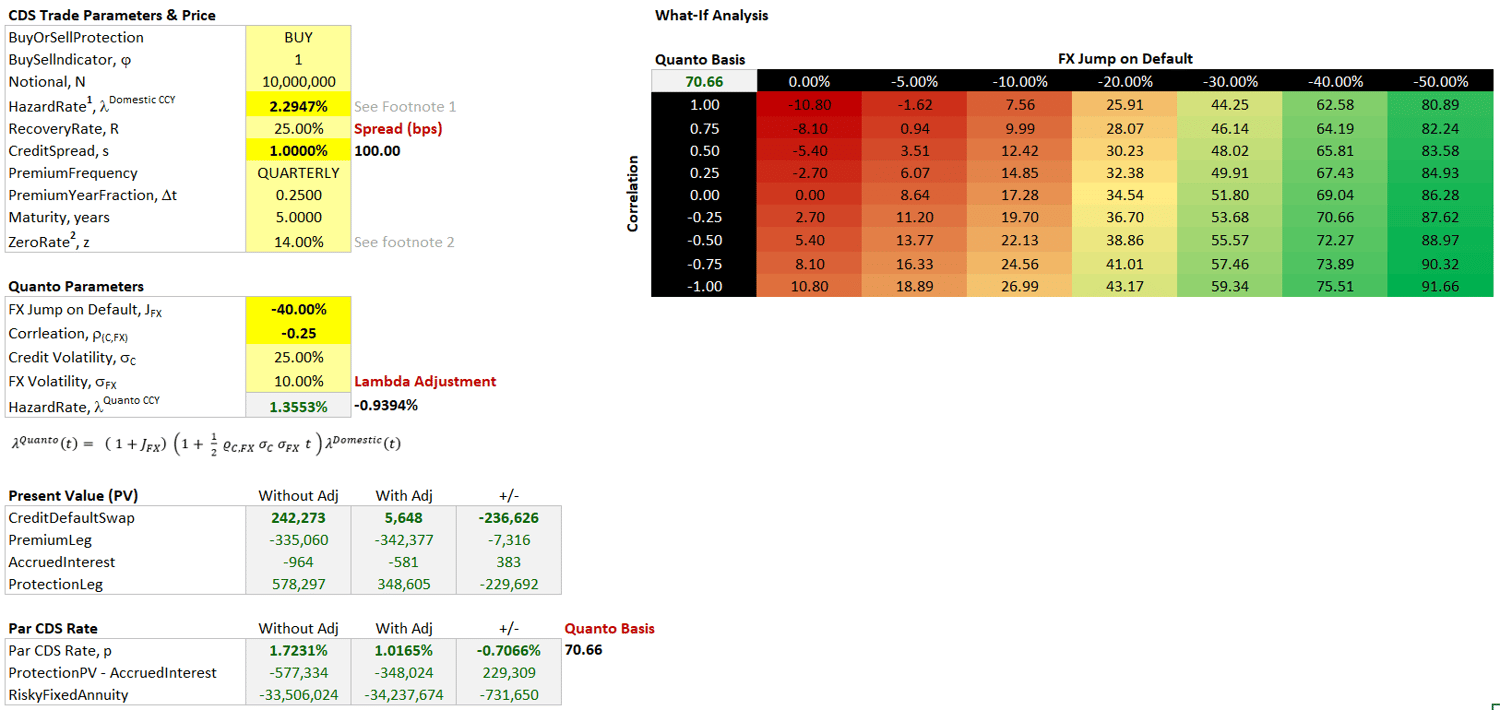

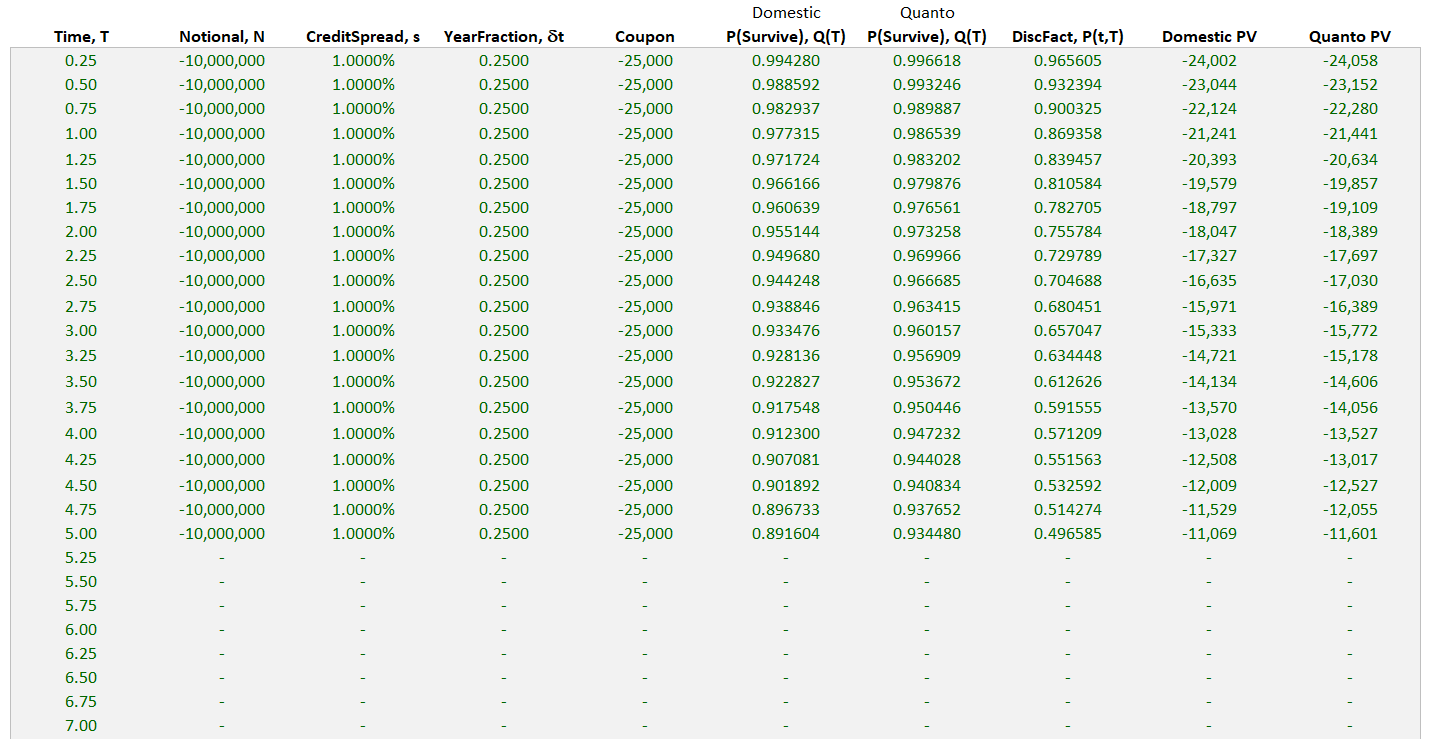

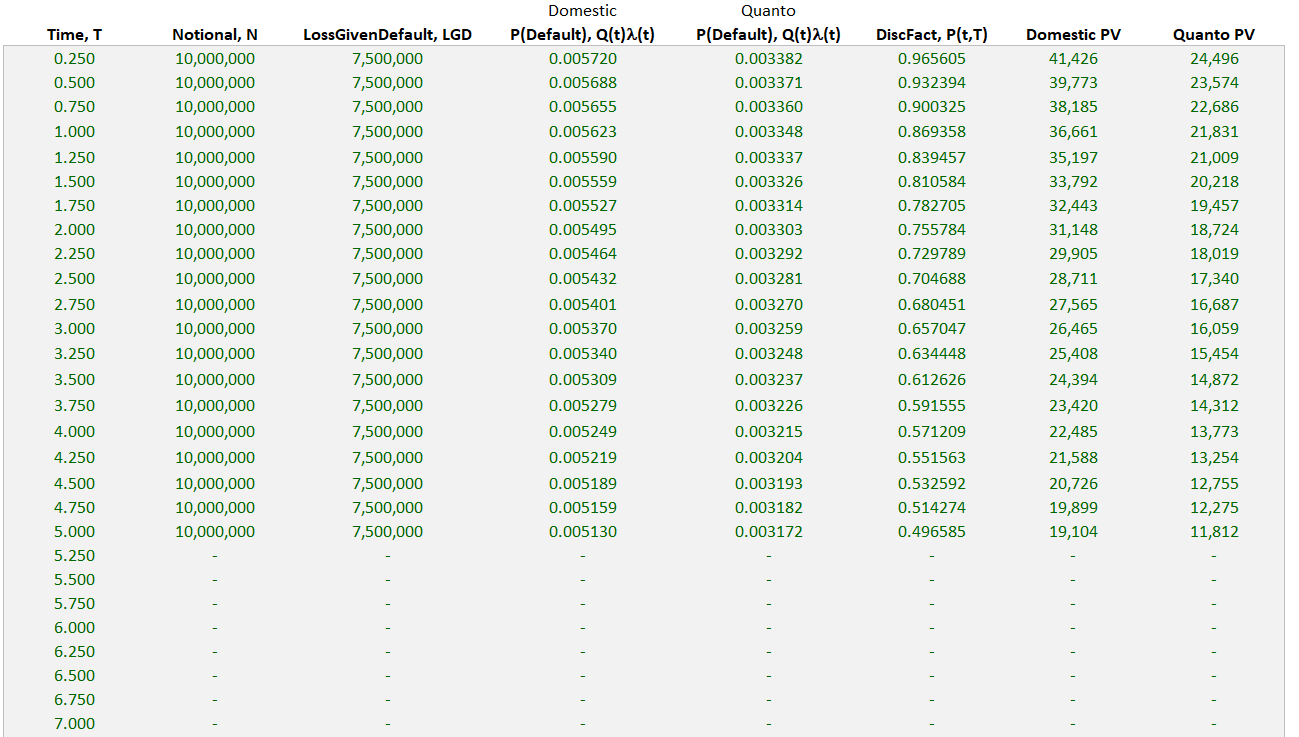

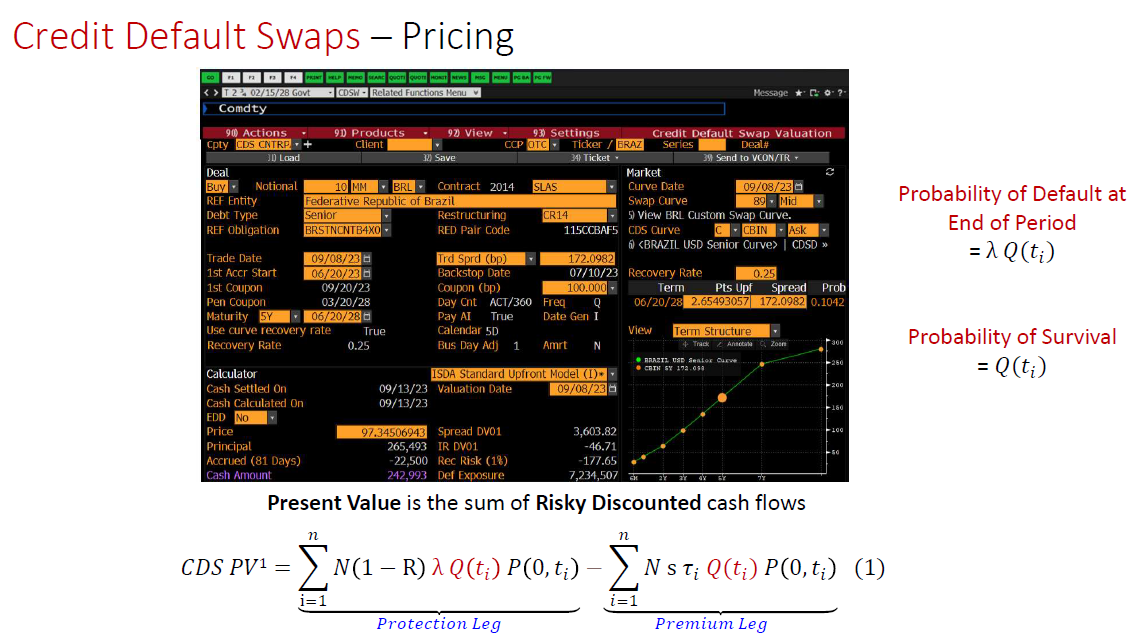

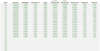

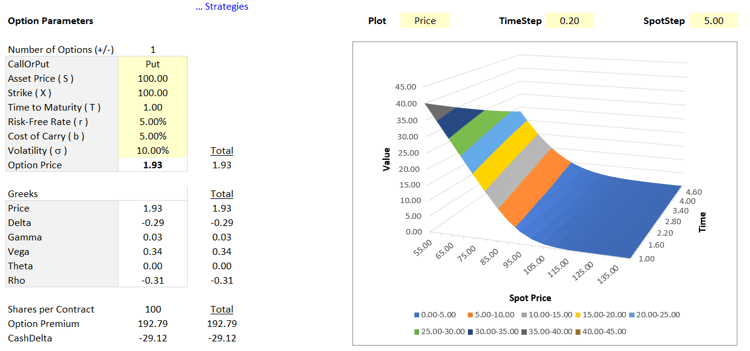

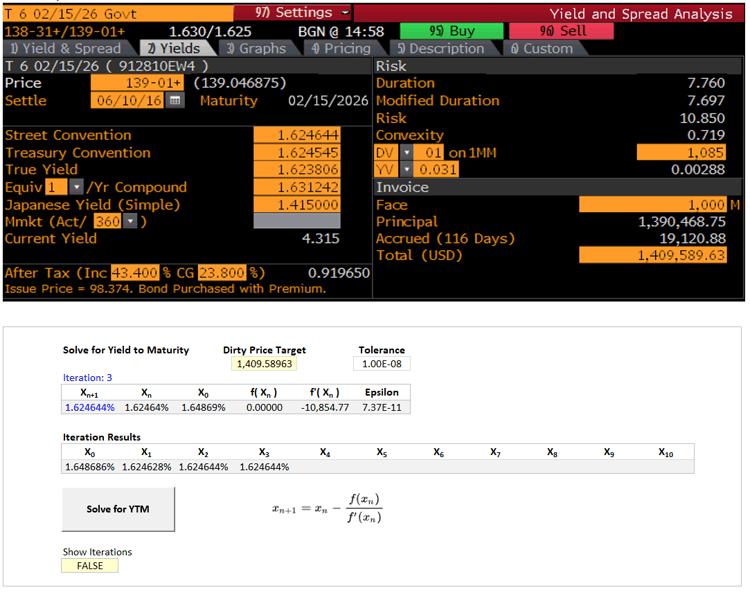

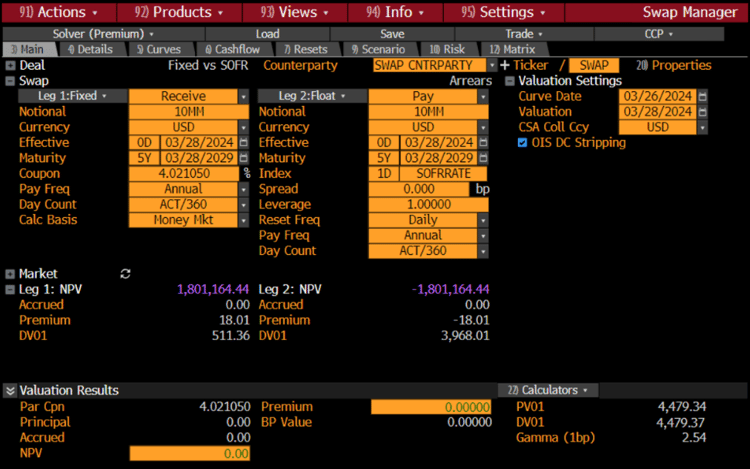

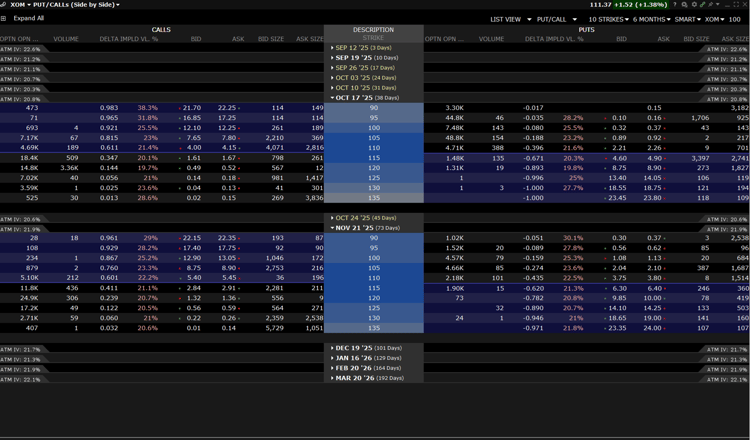

Part one of the article focuses on the theoretical aspects of Quanto CDS, covering essential topics such as CDS pricing, par spread, Quanto market data problems, Quanto FX risks, and Quanto hazard rates. The authors provide in-depth explanations and insights into these concepts, offering a solid foundation for understanding the complexities of Quanto CDS.

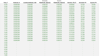

Part two of the article delves into pricing and practice, employing captivating case studies to illustrate the application of Quanto CDS in real-world scenarios. The case studies include:

• Eurozone: Quanto Effect

Analyzing the impact of Quanto CDS on the Eurozone market.

• Italy: CDS Par Spreads, EUR vs. USD

Examining the differences in CDS par spreads between the Euro and US Dollar for Italian entities.

• Japan: Sovereign & Corporate Basis Spreads

Investigating the basis spreads for sovereign and corporate entities in Japan.

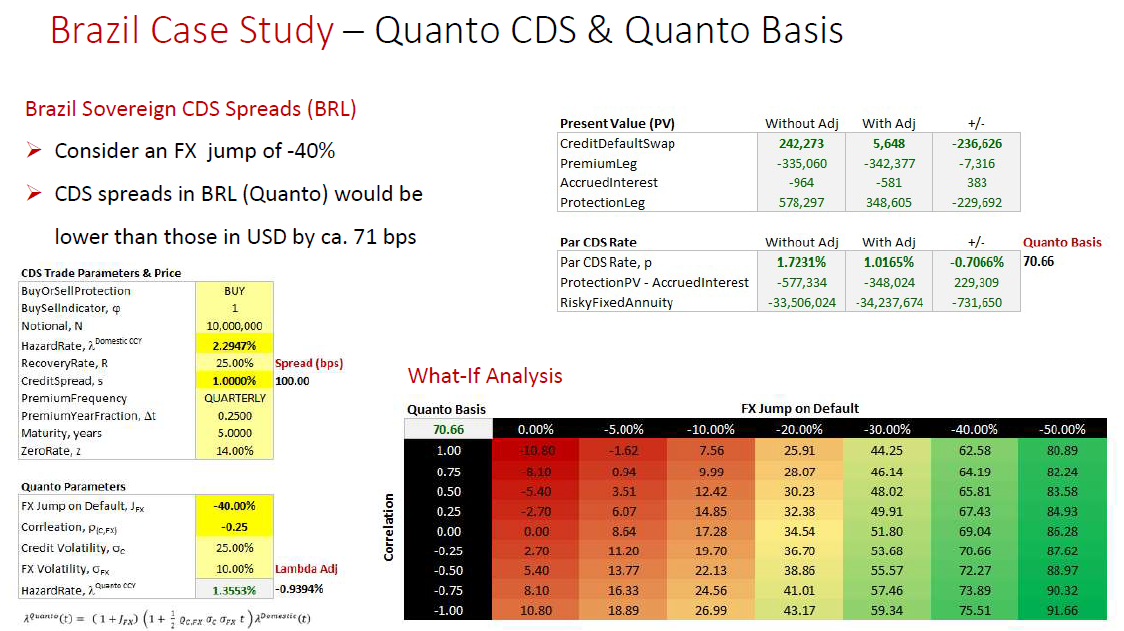

• Brazil: Quanto CDS & Basis

Exploring the relationship between Quanto CDS and basis in the Brazilian market.

• Brazil: Corporate Implied FX Jumps

Understanding the implied FX jumps for Brazilian corporate entities.

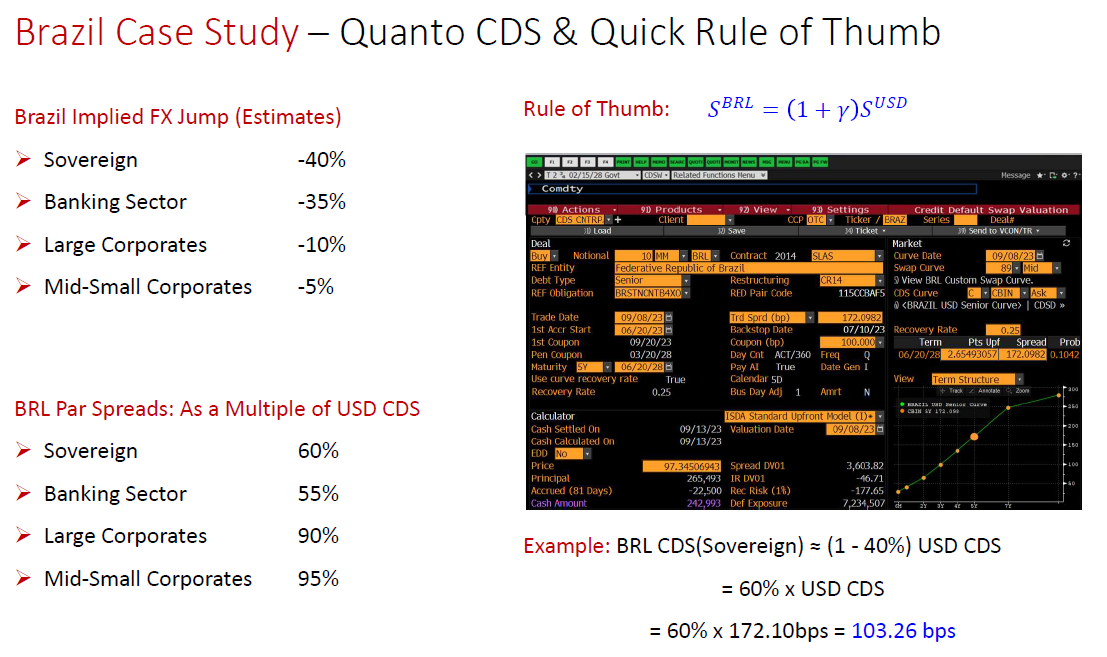

• Brazil: Quick Rules of Thumb

Providing practical rules of thumb for Quanto CDS in the Brazilian context.

Through these case studies, we aim to enhance the reader's understanding of Quanto CDS pricing and its application in various global markets. The paper's engaging and informative content makes it a valuable resource for financial professionals, researchers, and students seeking to unravel the complexities of Quanto CDS.

Keywords: Credit Derivatives, Credit Default Swaps, CDS, Quanto CDS, Par Spread, Market Data, Quanto FX Risks, FX Jump Risk, Hazard Rates, Quanto Effect, Quanto Basis, Implied FX Jumps, Eurozone, Japan, Brazil, Emerging Markets