Cross Currency Swaps

Excel Workbook & Guide

Contents

- Cross Currency Swap - Excel Workbook

- Cross Currency Swap - PDF Documentation & Guide

- Cross Currency Swap - PowerPoint PDF Presentation

Important Note for Consideration When Purchasing this Product

The training materials focus on IBOR index rates, which have largely been replaced by risk-free rate benchmarks (RFRs) such as USD SOFR, EUR €STR, and GBP SONIA. In some Asian markets, IBORs are still in use. For learning purposes, the fundamental mechanics of Cross Currency Swaps (CCS) remain unchanged, although interest rate fixing dates and reference rates differ.

For more details on the LIBOR transition to RFRs, see LIBOR transition to RFRs.

Excel Workbook & Guide

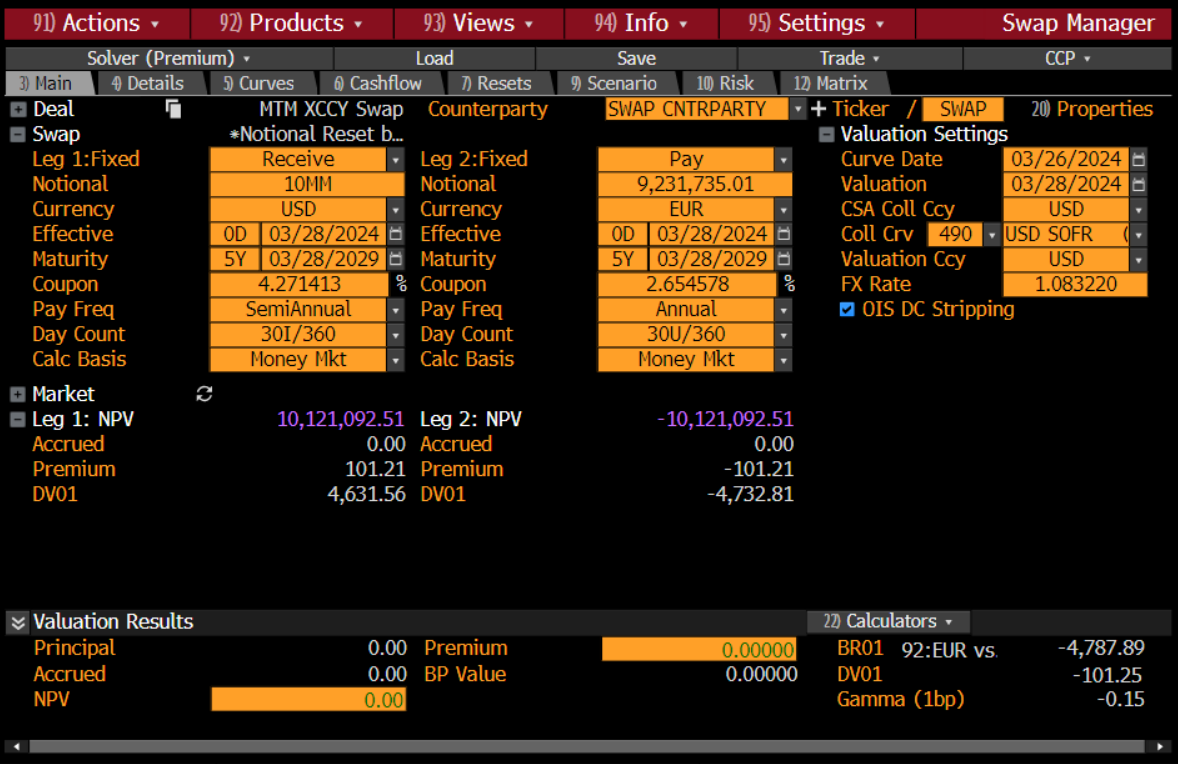

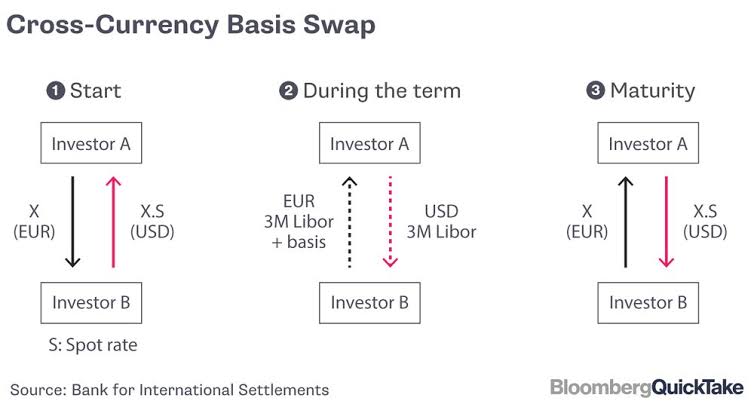

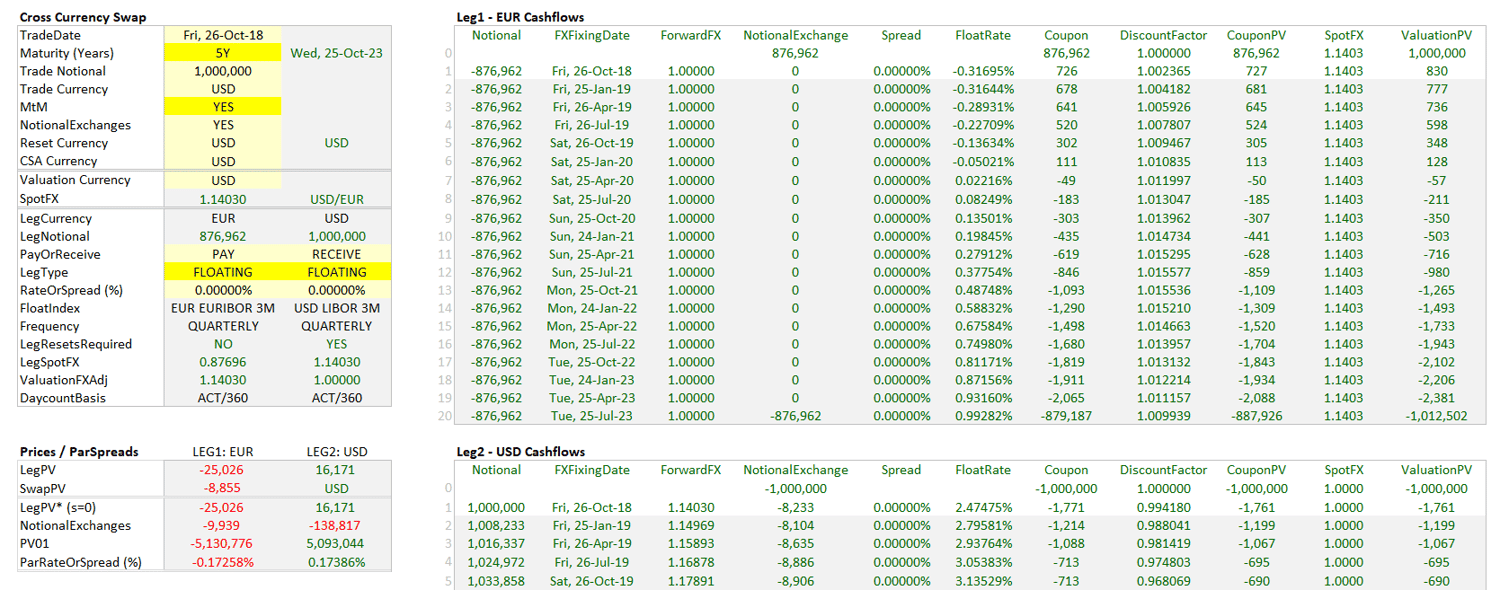

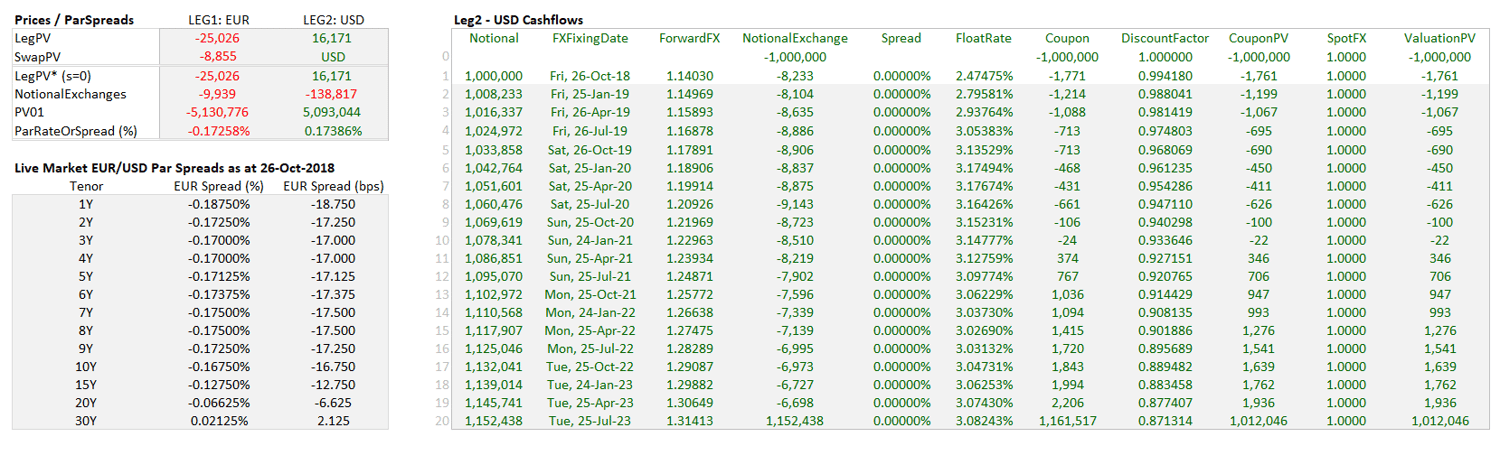

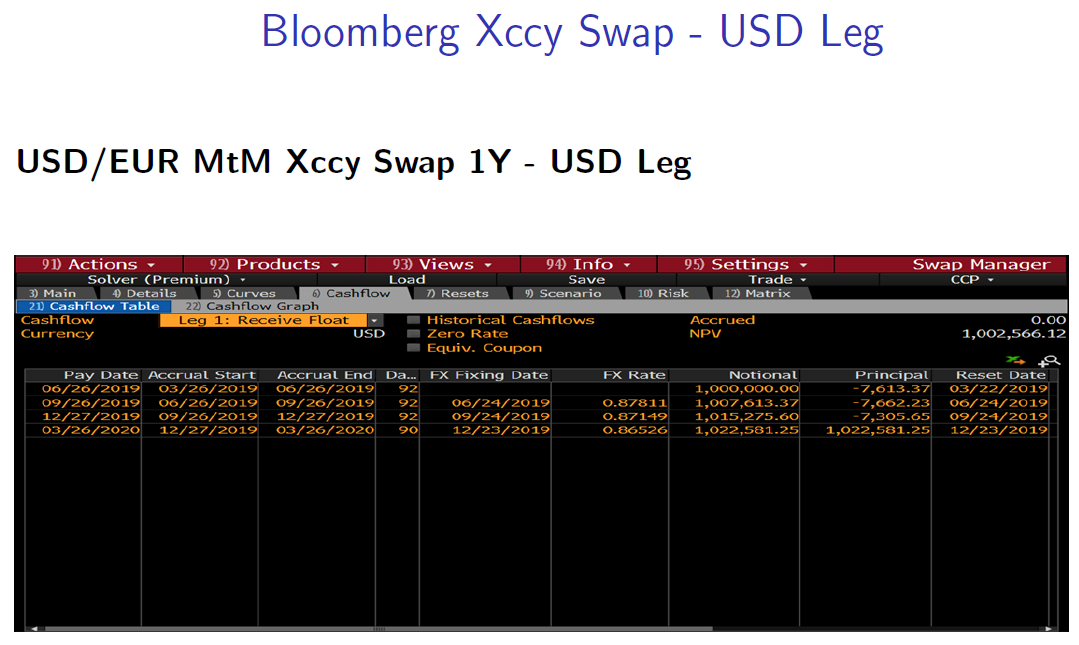

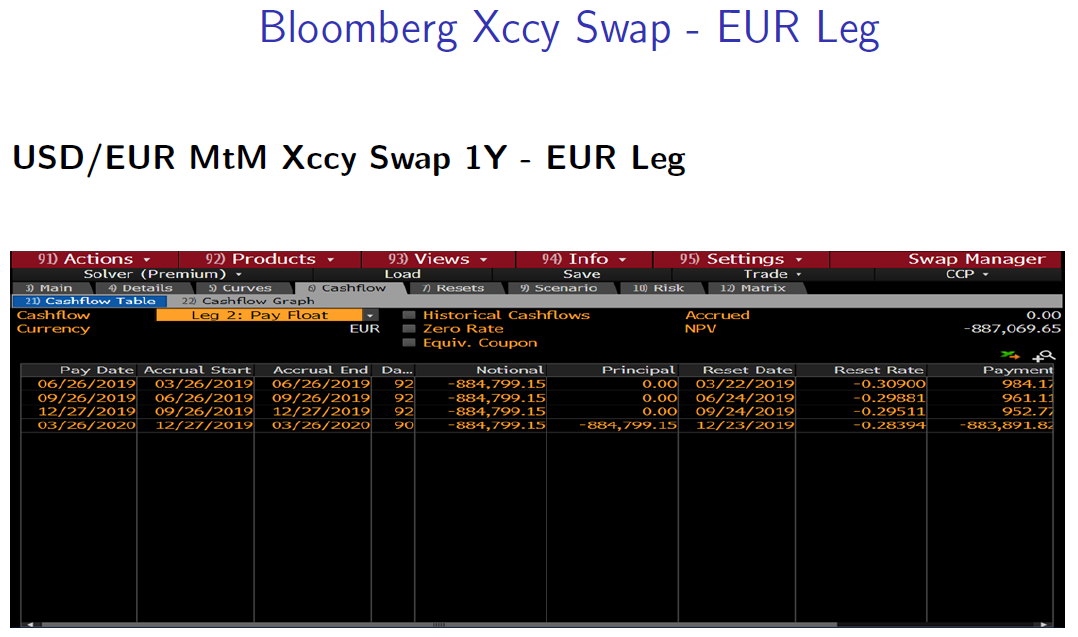

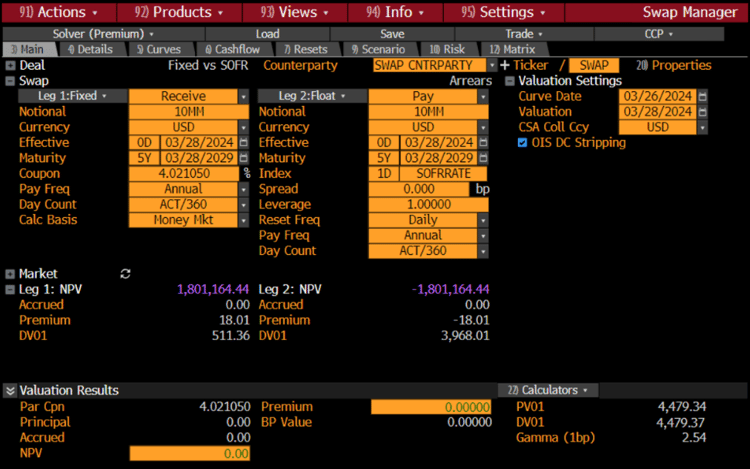

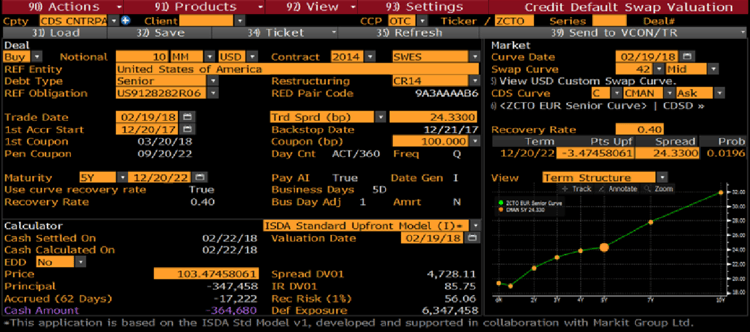

A Cross Currency Swap (CCS or XCCY) is a financial derivative similar to an interest rate swap (IRS), but it allows investors to exchange a series of cash flows in one currency for equivalent cash flows in another currency, commonly USD. CCS are widely used for: securing cheaper funding, hedging FX exposures, managing liquidity risk and speculative trading.

Workbook and Guide Objectives

This Excel workbook and accompanying documentation are designed to help you:

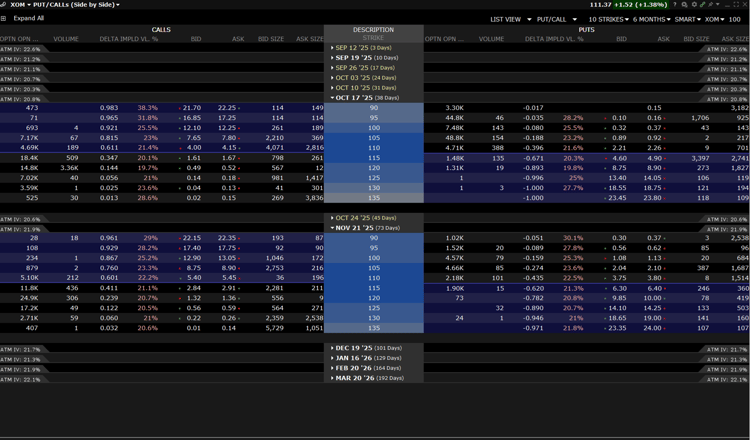

- Understand the features and risks of Cross Currency Swaps

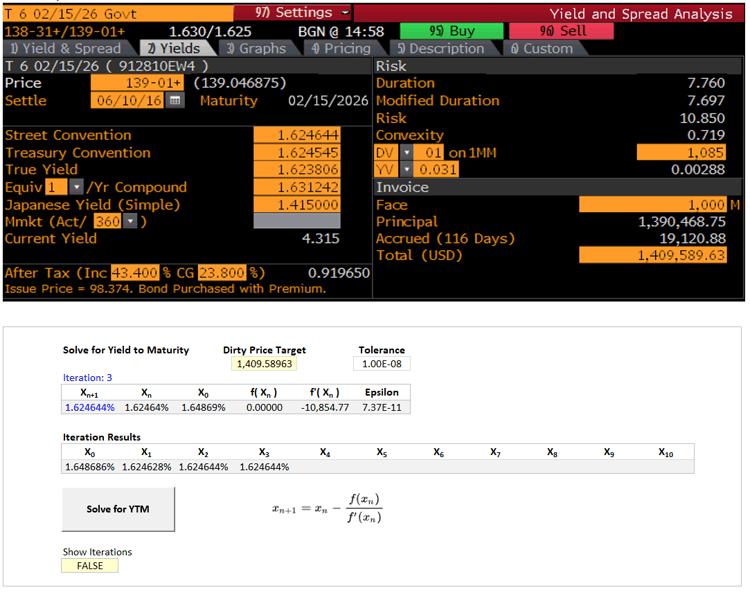

- Learn how to price CCS, with clear mathematical formulae, examples, and illustrations

- Calculate the CCS Basis Spread, which is the standard market quotation for CCS

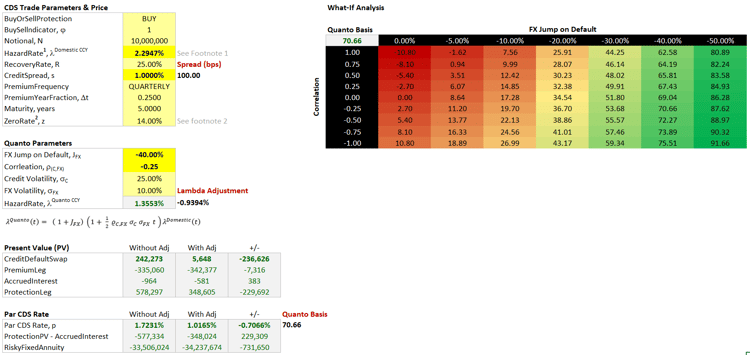

Keywords: Cross Currency Swaps, Marked-to-Market, Notional Resetting, Counterparty Credit Risk, CSA, Collateral Posting, FX Forward Rates, Present Value, Pricing, Par Spread, Basis Spread