CRR Model - Path Dependent Option Pricing

Product Overview: CRR Model for Option Pricing

Contents

- CRR_Model – MS Word Model Document

- CRR_Model – PowerPoint Guide

- CRR_Model – Excel Workbook

Extra Materials

- CRR_Model – C++ Code

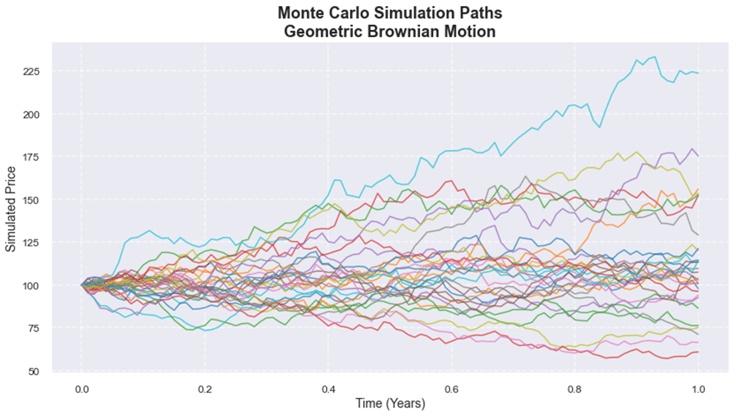

- CRR_Model – Python Jupyter Notebook

CRR Model for Path Dependent Option Pricing

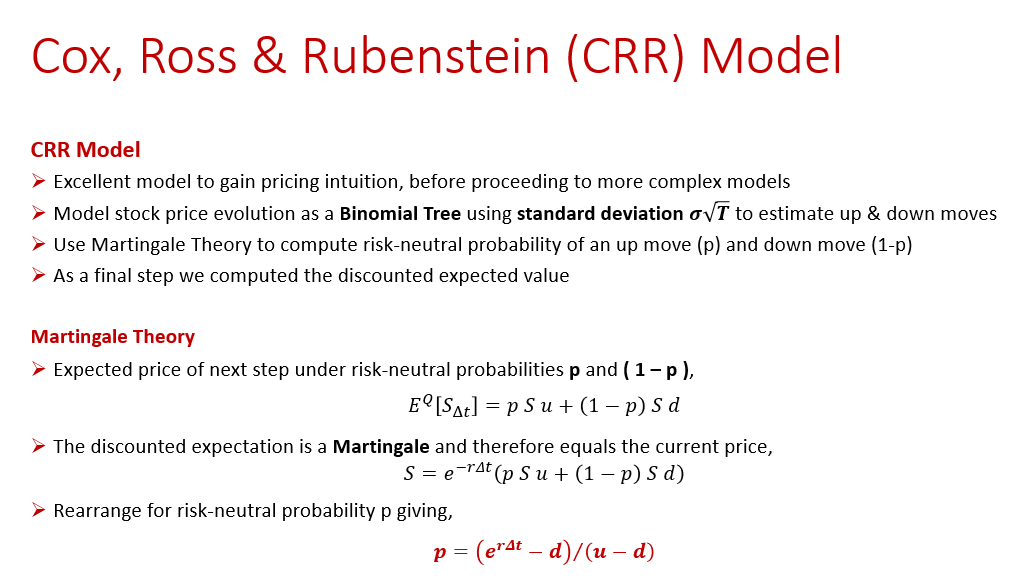

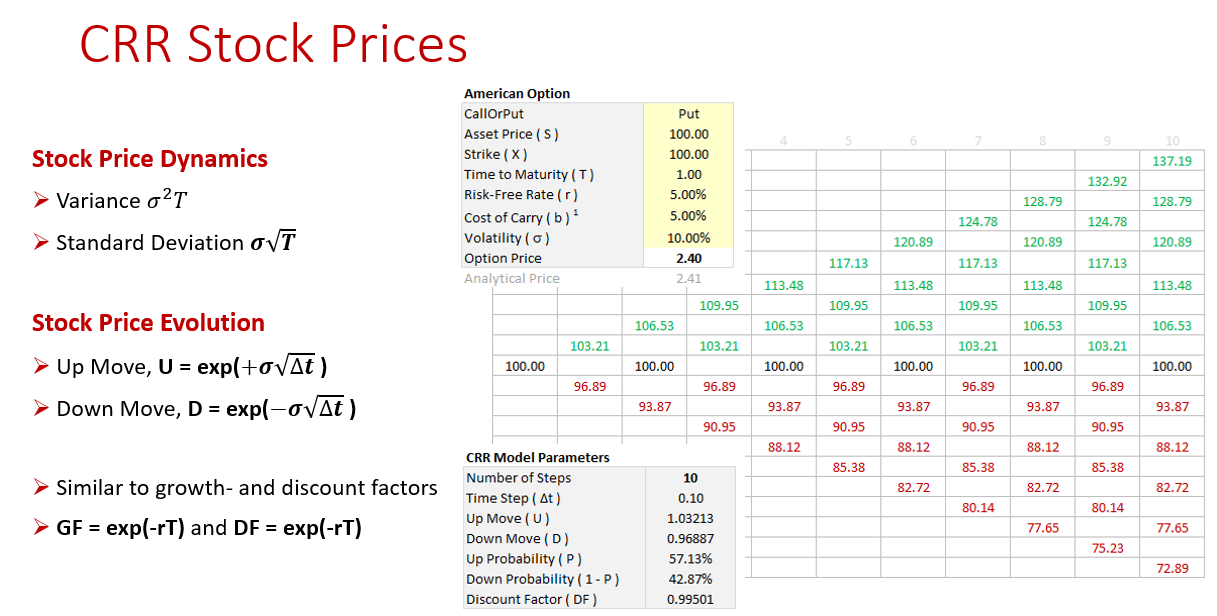

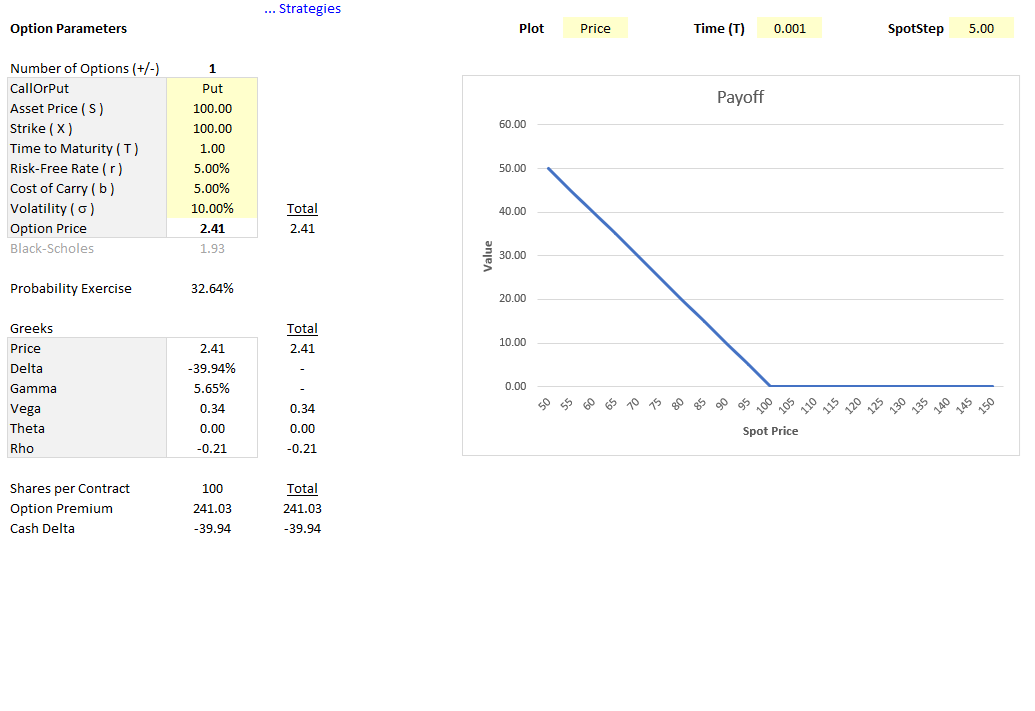

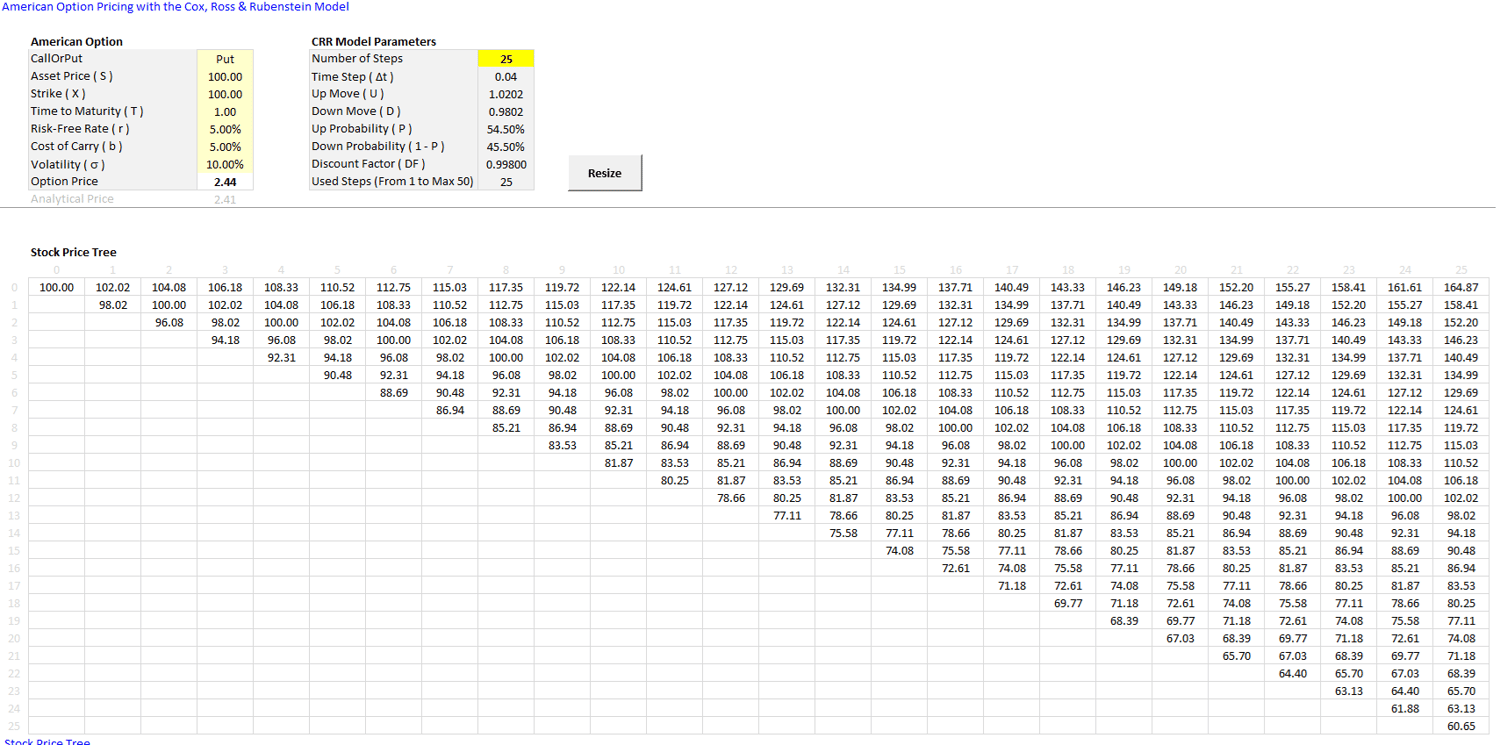

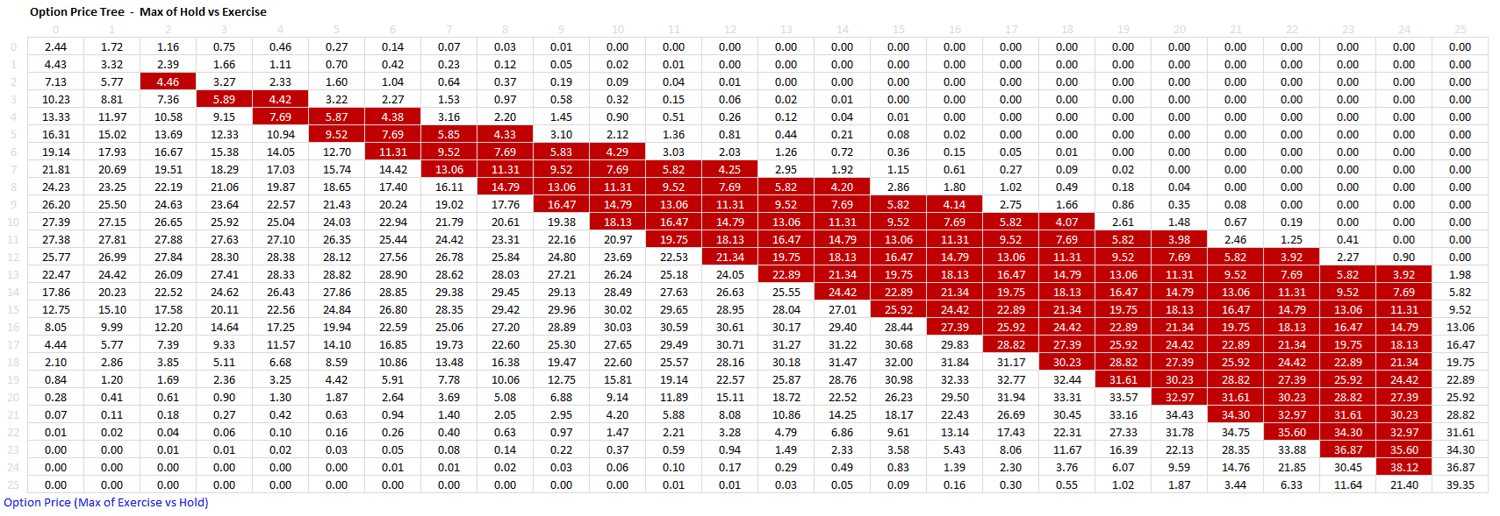

The Cox-Ross-Rubinstein (CRR) model is a foundational tool for valuing both vanilla and path-dependent options using a discrete binomial tree framework. Unlike closed-form approaches such as Black-Scholes, the CRR model excels in pricing American-style options—which can be exercised at any time before expiry—and accurately handles features such as early exercise, path-dependent payoffs, and varying dividend yields.

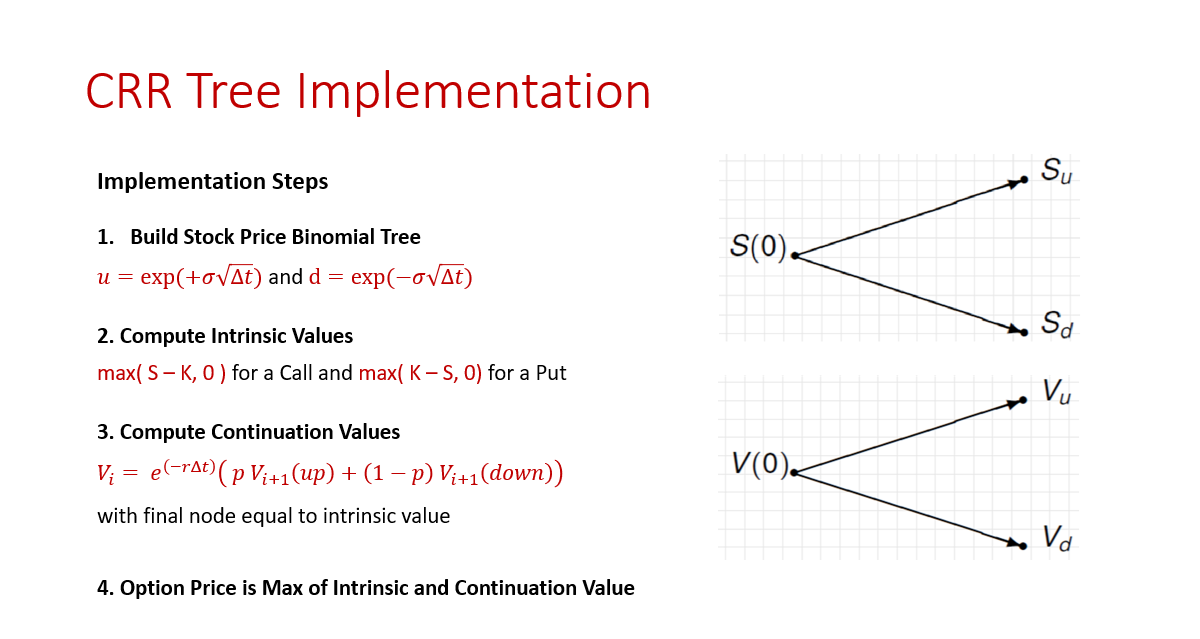

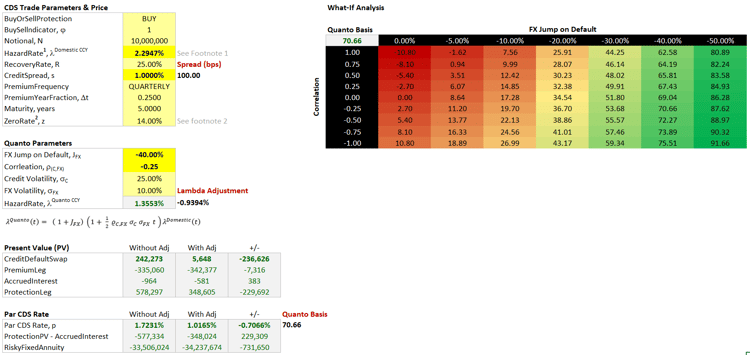

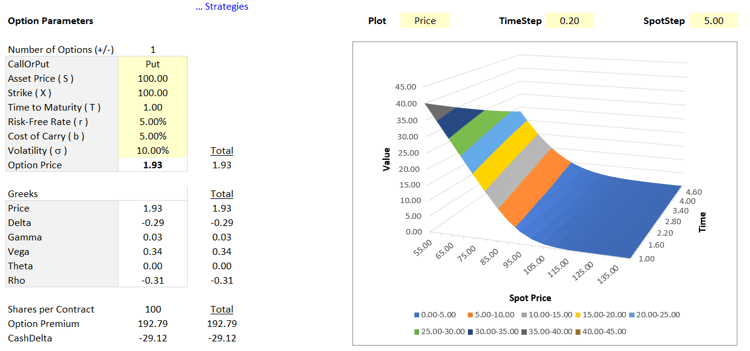

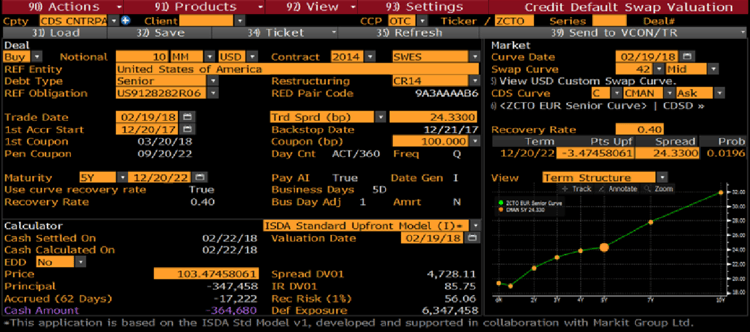

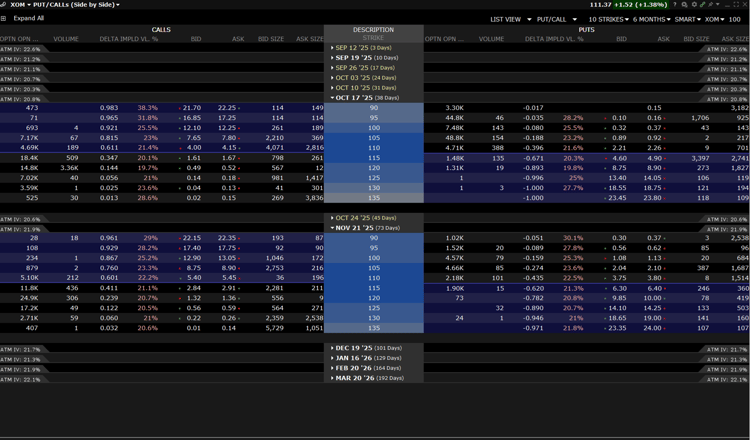

This product provides a complete, practitioner-ready toolkit for implementing the CRR model across asset classes. The Excel workbook features a transparent, step-by-step construction of stock price and option value trees, enabling interactive scenario analysis for calls, puts, American and European contracts. The companion documentation and PowerPoint guide deliver a clear theoretical overview and actionable instructions for users at all technical levels.

Programmers benefit from supplied C++ source code and a Python Jupyter Notebook for integration into analytics pipelines or further customization.

Why choose this product?

- Real-world versatility: Price American, European, and path-dependent options on equities, commodities, currencies, and more.

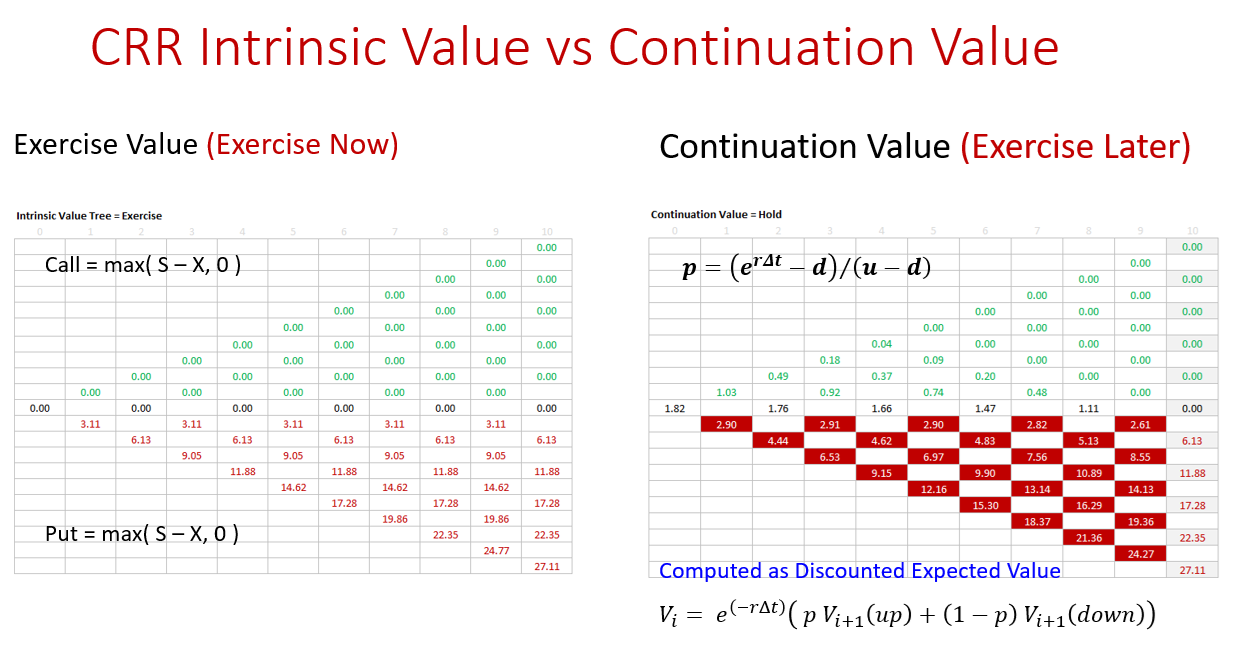

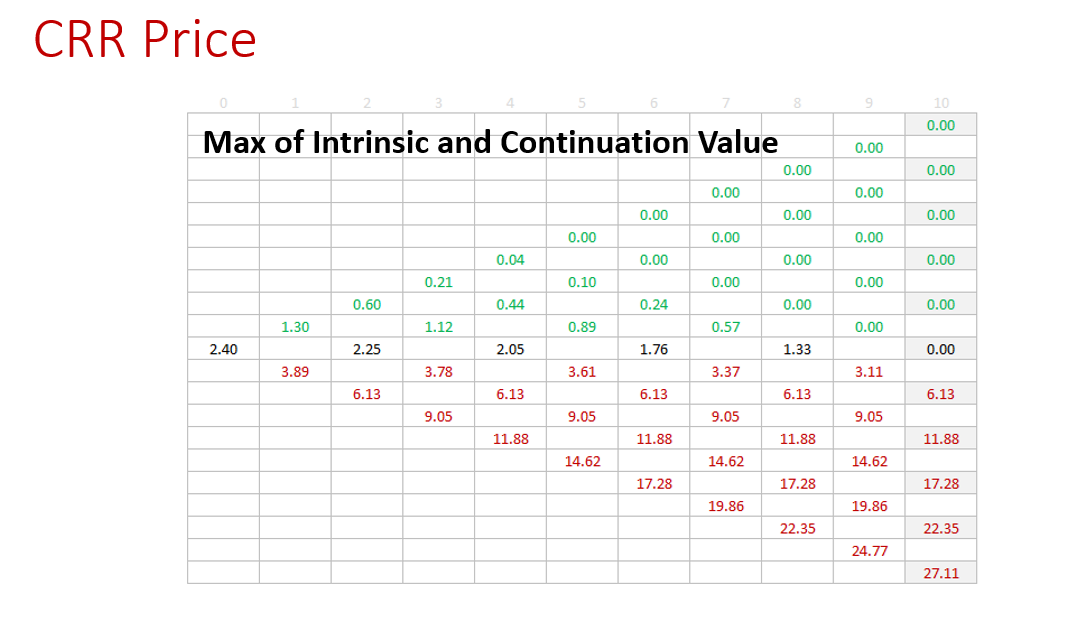

- Optimal exercise insights: Analyze early exercise regions with clear distinction between intrinsic and continuation values at each node.

- Risk-neutral, arbitrage-free: The model leverages risk-neutral pricing theory to ensure consistent, arbitrage-free results.

- Transparent and customizable: All step logic, parameters, and outputs are exposed for learning or adaptation—suitable for education, prototyping or production.

- Cross-platform implementation: Parallel examples in Excel, C++, and Python allow seamless transition from theory to code.

This comprehensive CRR product is ideal for quants, analysts, students, and practitioners seeking robust, intuitive, and flexible option pricing and risk analysis tools.

Keywords: CRR Model, Cox Ross Rubinstein Model, American Options, Pricing, Path Dependent Options, Optimal Exercise, Exercise vs Hold, Continuation Value, Risk-Neutral Pricing, Arbitrage-Free