Professional Training - Real-Time USD SOFR Curves & Risk

Video Training, Excel Workbook & Guide(s)

Content

- USD SOFR Curve - Excel Workbook

- Yield Curves - PDF Documentation

- Risk Jacobians - PPT Presentation

Overview

This comprehensive digital download is designed for finance professionals, quantitative analysts, and advanced market practitioners looking to deepen their understanding of yield curve construction, interest rate swap (IRS) pricing and risk management. The centrepiece is a fully-worked Excel workbook that demonstrates advanced techniques for building a USD SOFR yield curve, pricing swaps, and managing interest rate risk—all in a practical, hands-on format.

Video Training

This three-part video series starts with the fundamentals of quant models progresses to advanced concepts for yield curve construction followed by bonus content covering professional techniques used for the computation of real-time curves and risk in both interest rate and credit markets.

Video Links

1. Quant Models Theory & Practice (19 mins)

https://youtu.be/htWT1Mc_lfA?si=_n7mUrYnsV0YU7yH

2. Advanced Yield Curves for Electronic Markets (32 mins)

https://youtu.be/ErWlhxbXE_M?si=aSX8h6dKtu9AyUzM

3. Real-Time Models & Risk (48 mins)

https://youtu.be/s-HFPpm3MjE?si=Xa6ORDv4ba2S7jBj

Excel Workbook - Yield Curve Construction, Swap Pricing & Risk

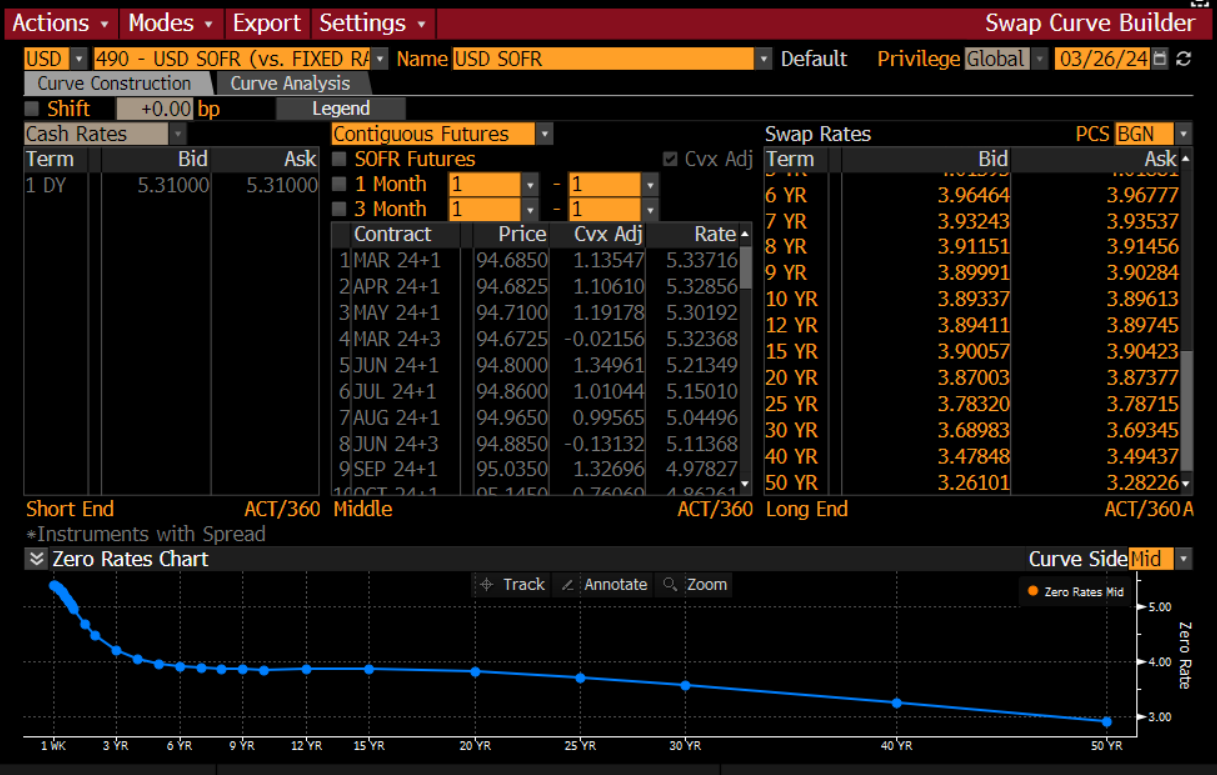

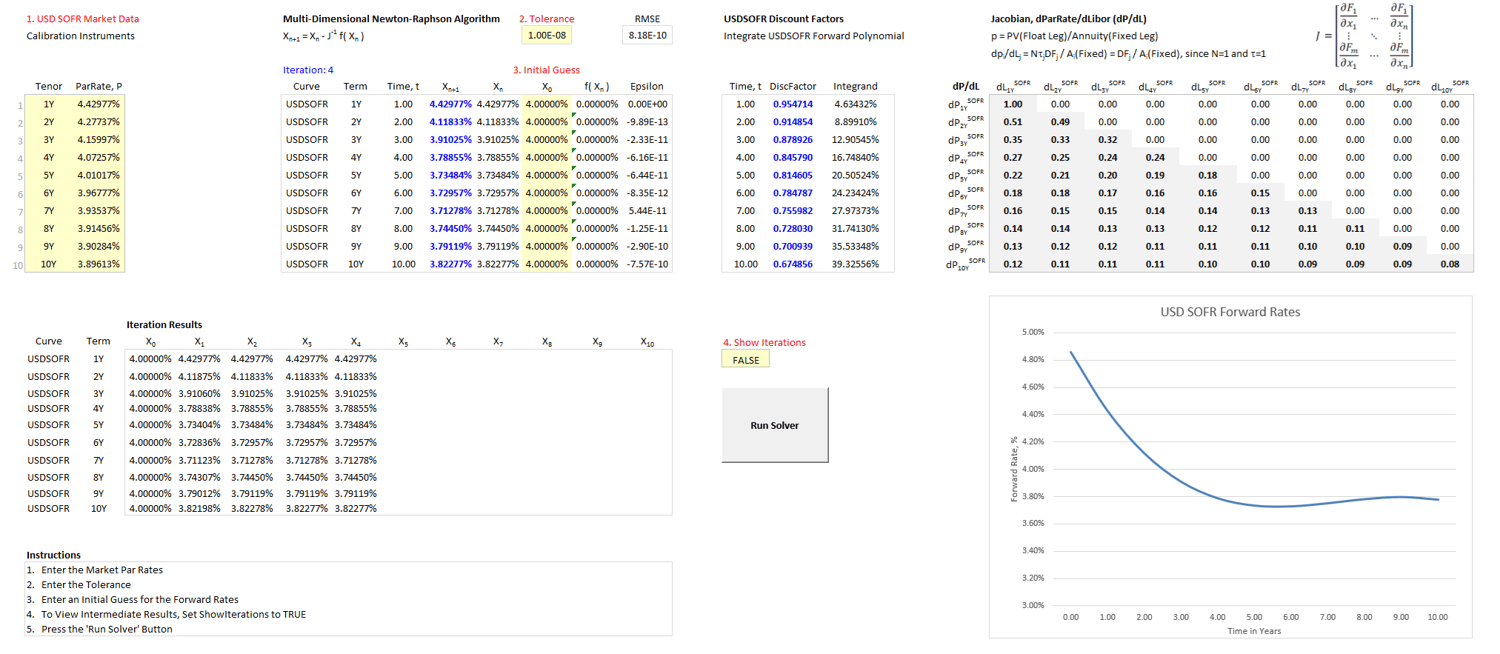

The Excel workbook takes real-world swap par rates as input and calibrates a USD SOFR discount and forward rate curve using robust, industry-standard methods:

- Newton-Raphson Solver: Implements an iterative solver to achieve accurate calibration of the curve, supporting rapid convergence even with complex, real-world data.

- Smooth Interpolation: Applies a custom interpolation algorithm, ensuring the resulting forward rates and discount factors are both smooth and finance-theoretically consistent.

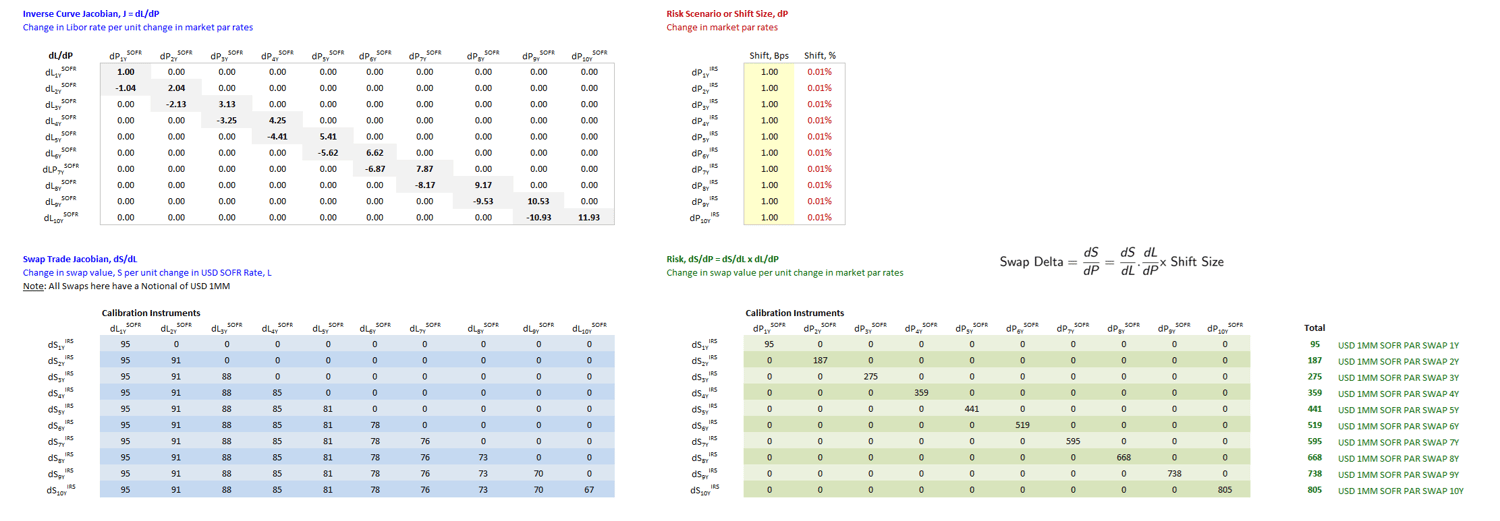

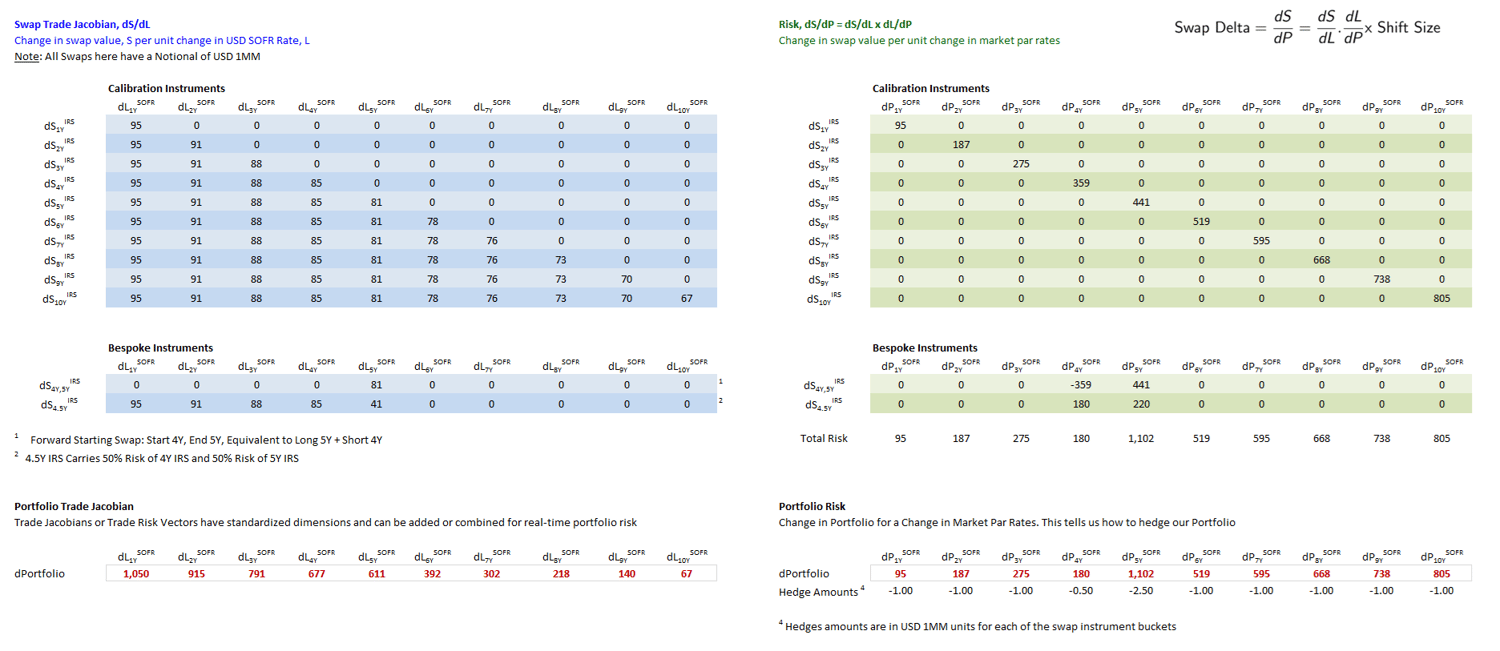

- Risk Jacobian: The advanced calibration process captures the risk Jacobian, a matrix that quantifies how forward rates and discount factors shift in response to underlying market swap rates—a critical element for real-time risk management and model calibration.

Within the workbook, you will learn to:

- Calibrate a USD SOFR yield curve from market swap quotes

- Generate forward rates and discount factors for pricing

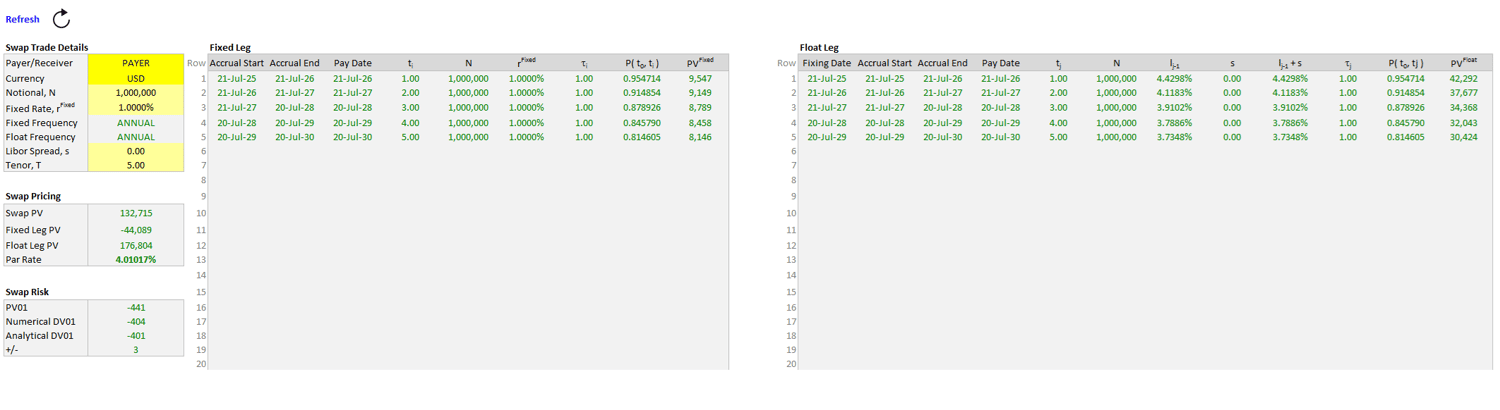

- Price interest rate swaps directly from your curve

- Compute and interpret swap risk metrics using the curve’s Jacobian—essential for real-time risk and model sensitivity analysis

PDF Guide - Supporting Documentation, Formulae & Methodology

The included PDF guide walks users through:

- The core calculation steps: formulas for bootstrapping discount factors and forwards, Newton-Raphson mechanics, and interpreting swap pricing outputs

- Detailed explanations of the mathematical underpinnings, including step-by-step screenshots from the actual Excel tool

- Additional tips for using and adapting the Excel framework for bespoke curve construction and pricing scenarios

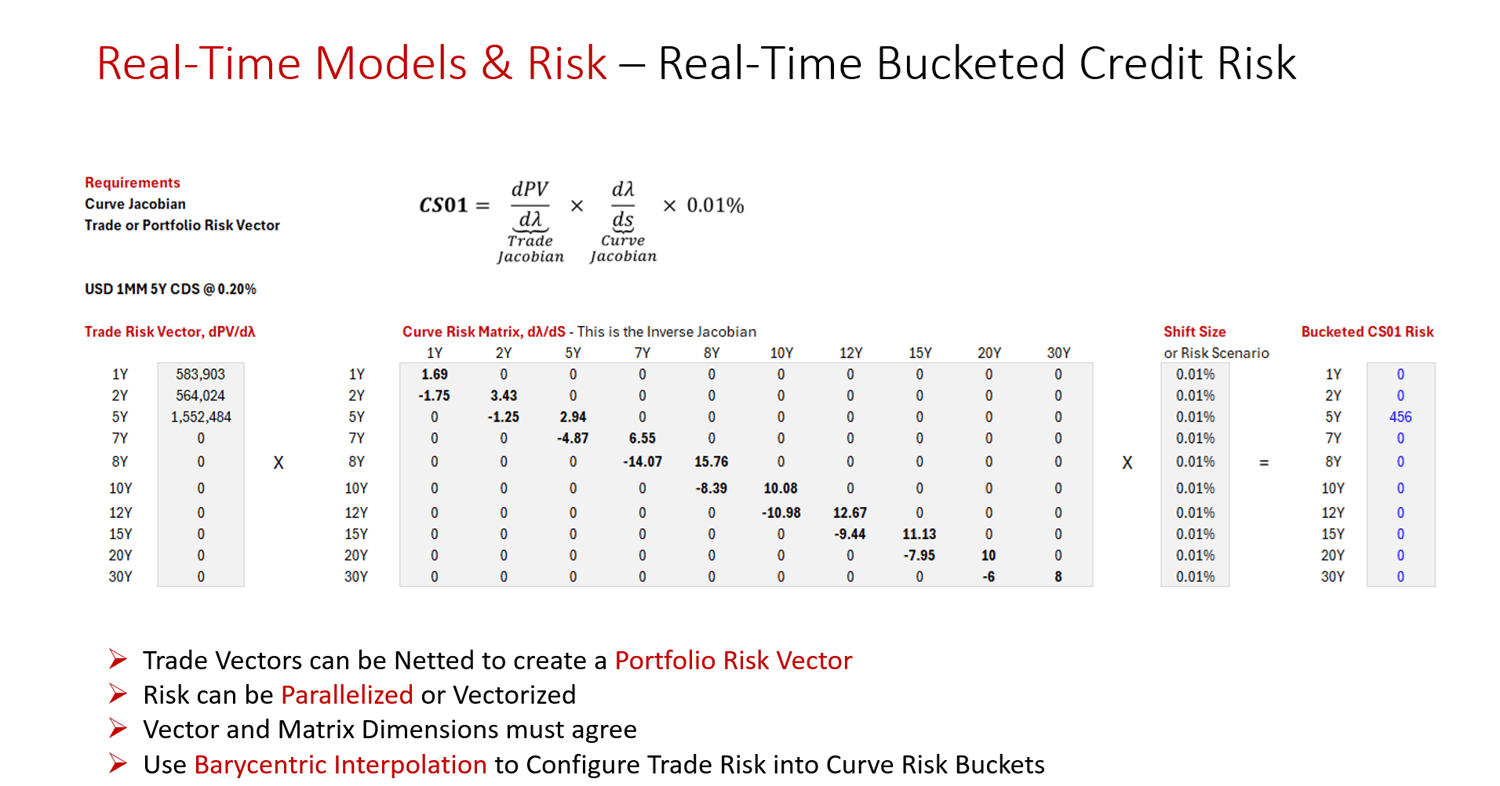

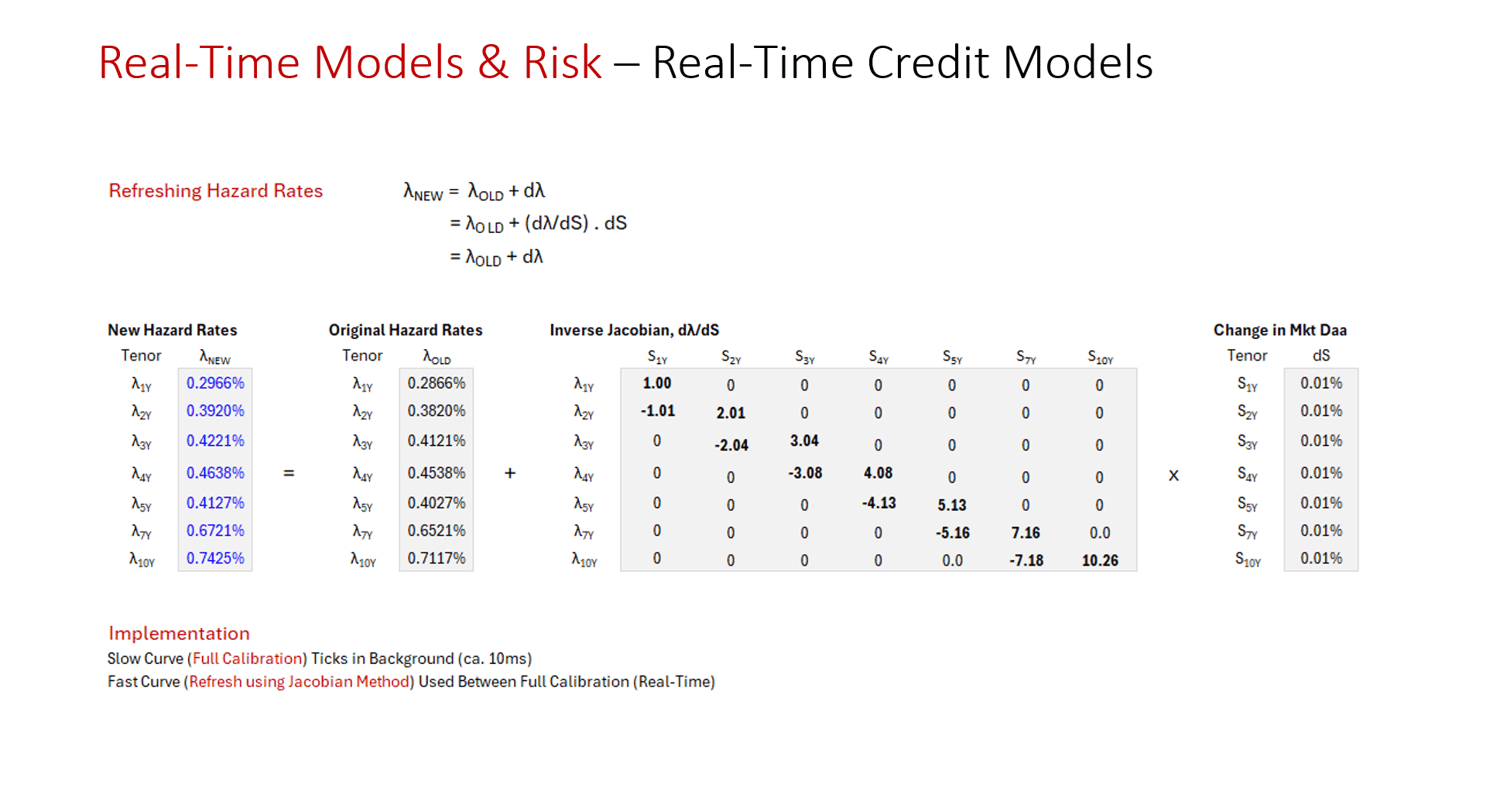

PowerPoint Guide - Advanced Risk Applications & Case Study

The presentation outlines:

- The use of the curve risk Jacobian for low-latency risk and hedging, with practical examples from both interest rate and credit markets

- Real-world user scenarios: calibrating quant models to shifting market data, managing instantaneous risk in high-frequency settings

- Best practices for integrating such analytics into electronic trading and portfolio management workflows

Intended Use & Limitations

This product is a training and reference tool for analytic and teaching use by quants, risk professionals, and market technologists. All calculations are designed for transparency and educational insight; the focus is on clarity of methodology and hands-on learning, not on including every possible market convention or real-time handling of all product nuances. Perfect for building intuition, prototyping, and upskilling with cutting-edge risk methods, but not designed for live trading or full market compliance out of the box.

Your purchase includes instant download access to all files—start exploring professional USD SOFR curve analytics and swap pricing today.

Keywords

USD SOFR, Yield Curve, Interest Rate Swaps, Discount Factors, Swap Par Rate, Newton-Raphson, Curve Calibration, Swap Pricing, Forward Rates, Risk Jacobian, Real-Time Risk, Hedging, Electronic Markets, Quantitative Finance, Advanced Excel Training