Content

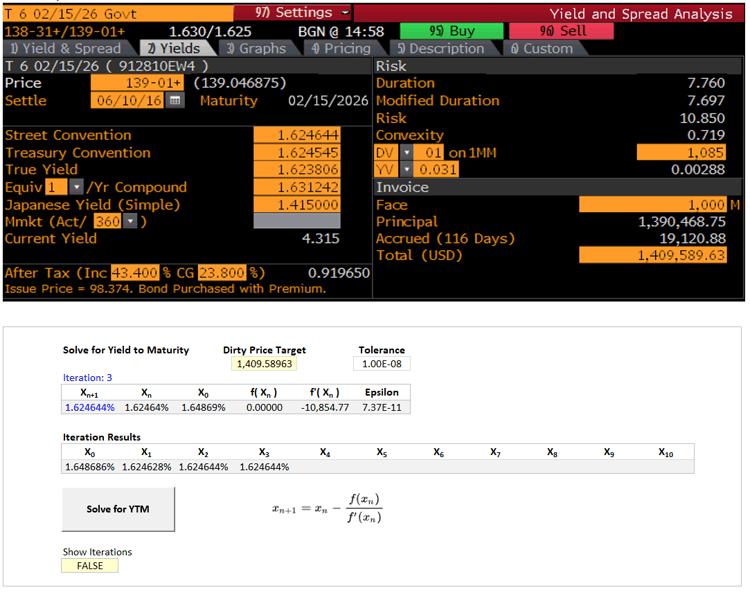

- US Treasury Bond Pricing

- Bond Total Return Swaps

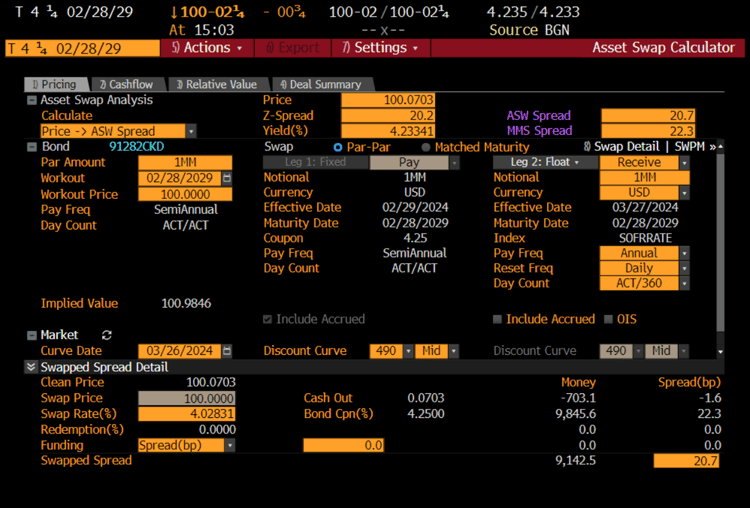

- Asset Swaps

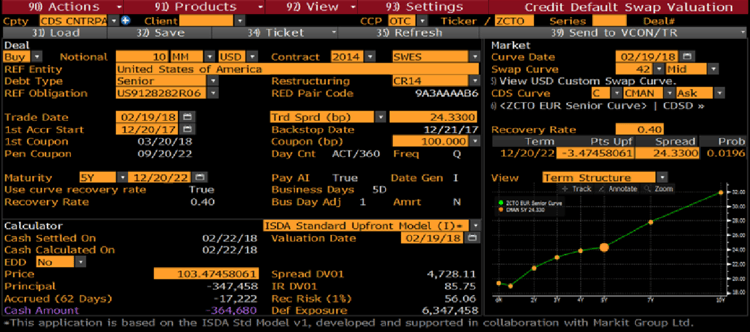

- Credit Default Swaps

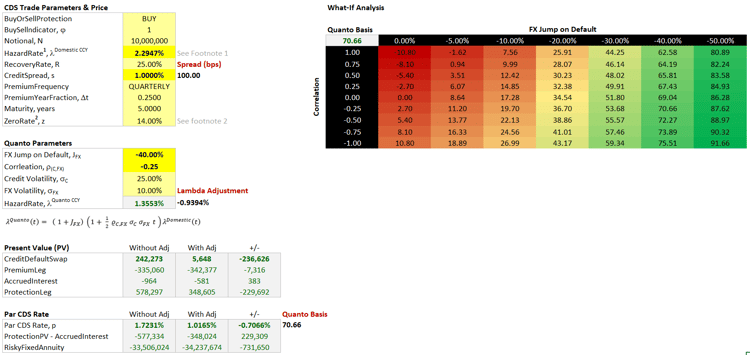

- Quanto Credit Default Swaps

Fixed Income Training Bundle

This training bundle offers a clear and practical overview of key fixed income products. You’ll learn how to price US Treasury Bonds accurately and match real market prices, as seen on trading venues such as Bloomberg. The bundle also covers Bond Total Return Swaps which are often used for building synthetic Money Market and Bond ETFs. We also review asset swaps, which enable investors to borrow funds and invest in bonds simultaneously. You’ll also gain practical insights into pricing Credit Default Swaps and Quanto Credit Default Swaps—essential tools for managing credit risk in bond portfolios. Together, these modules provide a solid foundation for understanding the fixed income markets.

Bundle Includes

Here are all the products that are included in your bundle