Digital Marketers' Quick-Start Tax Guide

A simple, beginner-friendly mini guide to understanding your tax obligations as a digital entrepreneur.

The Digital Sellers’ Quick-Start Tax Guide is your high-level introduction to the tax responsibilities that come with selling digital products online. Designed specifically for new or growing digital entrepreneurs, this guide breaks down complicated tax rules into clear, digestible language you can actually use.

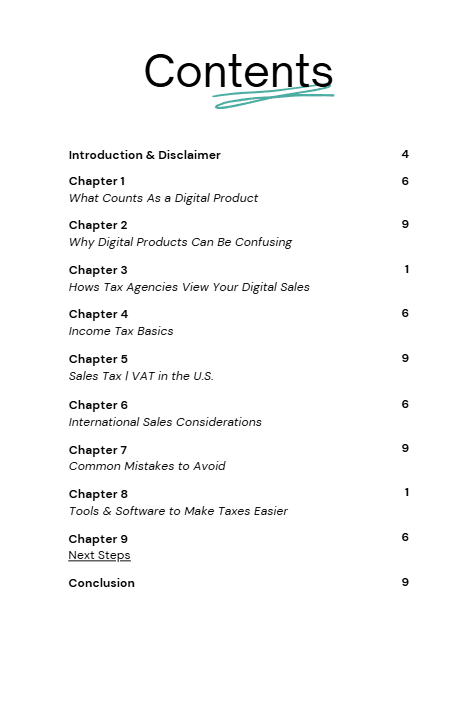

Inside, you’ll learn:

- The core tax categories that affect digital sellers

- What income you must report (and what you can deduct)

- When sales tax applies to digital products

- How to determine whether you have “nexus” in a state

- International considerations if you sell globally

- What records you must keep to stay compliant

Whether you sell eBooks, templates, courses, digital downloads, or MRR/PLR products, this guide gives you the foundational understanding you need to get started with confidence.

This mini guide is perfect for:

✔ New digital product creators

✔ Digital marketers building their first online income stream

✔ Side hustlers wanting to get things right from day one

✔ Anyone feeling confused or intimidated by tax rules

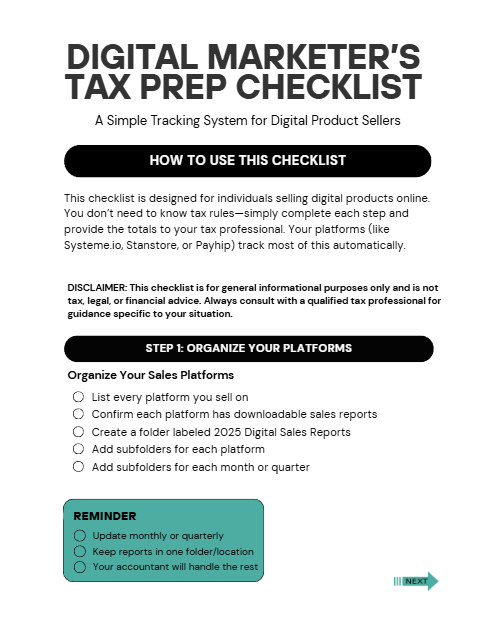

Use this guide to gain clarity—and then take your next steps with confidence using the Digital Product Tax Prep Checklist and the full Digital Marketer’s Tax Playbook.

Stay compliant. Stay confident. Build your business the right way.

DISCLAIMER: THIS PRODUCT IS NOT FOR RESELL.