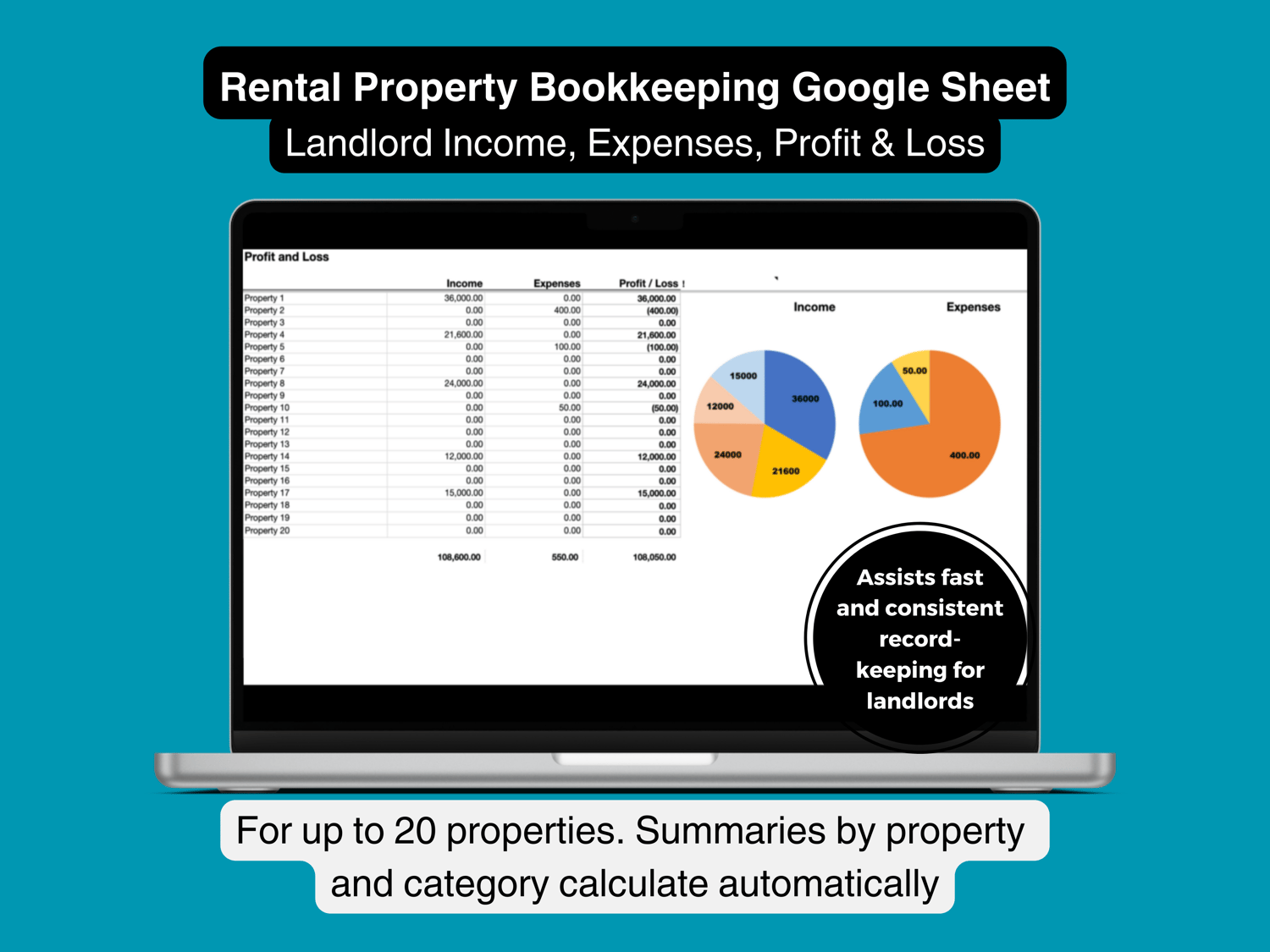

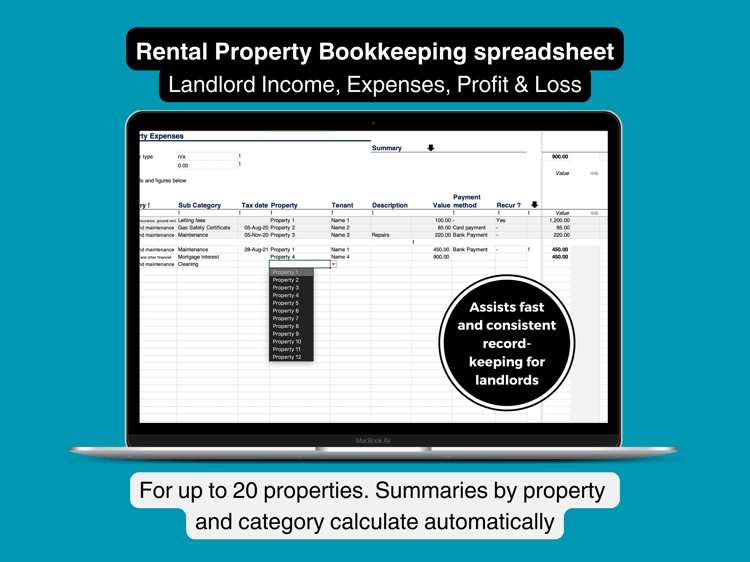

Landlord / Rental Property Bookkeeping / Accounts spreadsheet. Record your income, expenses and profit with ease. Google Sheets template

Manage your landlord / lodger / spare room accounts for up to 20 properties. Make short work of your bookkeeping and tax return filing while also providing you with a clear overview of the income and costs for each of your properties.

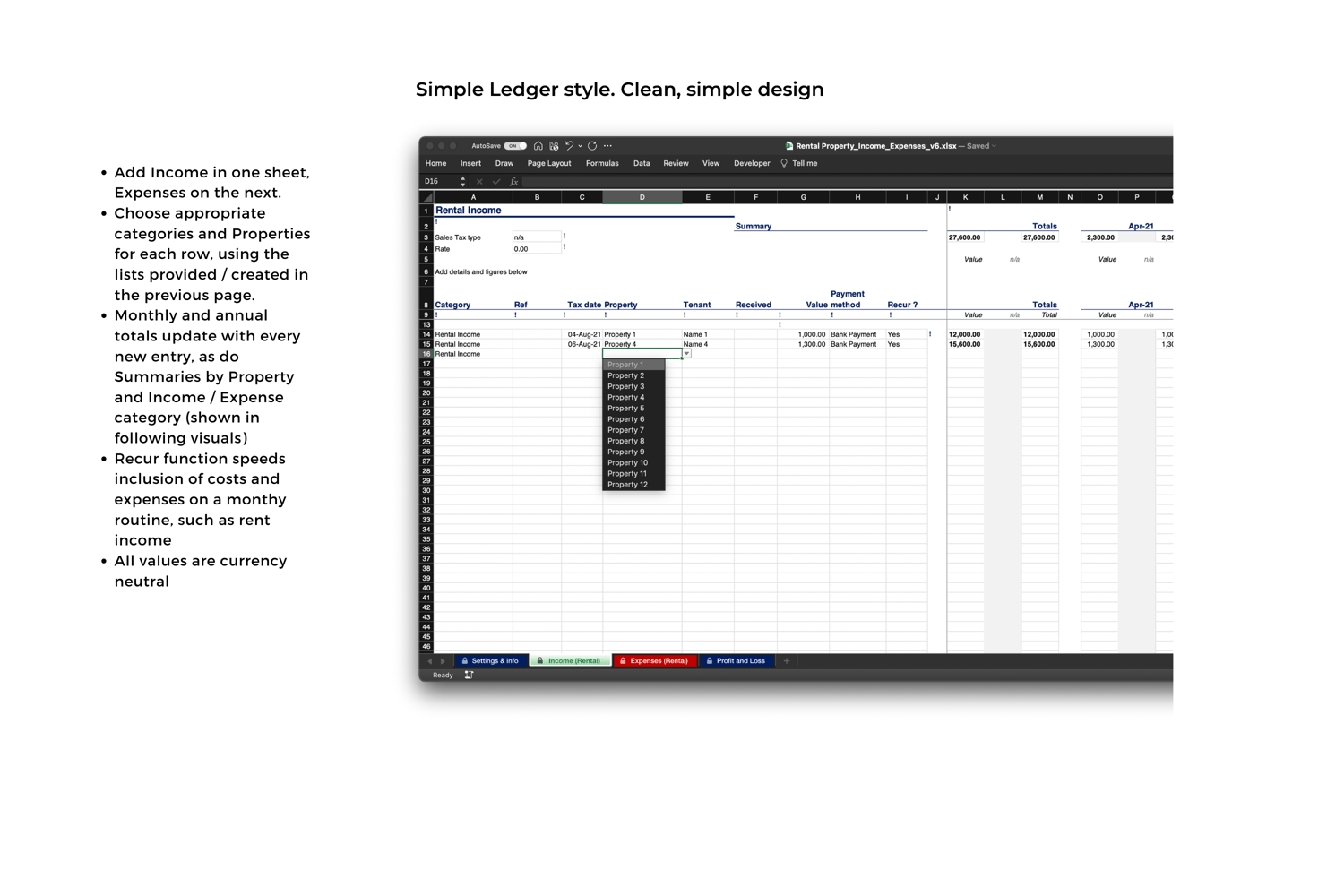

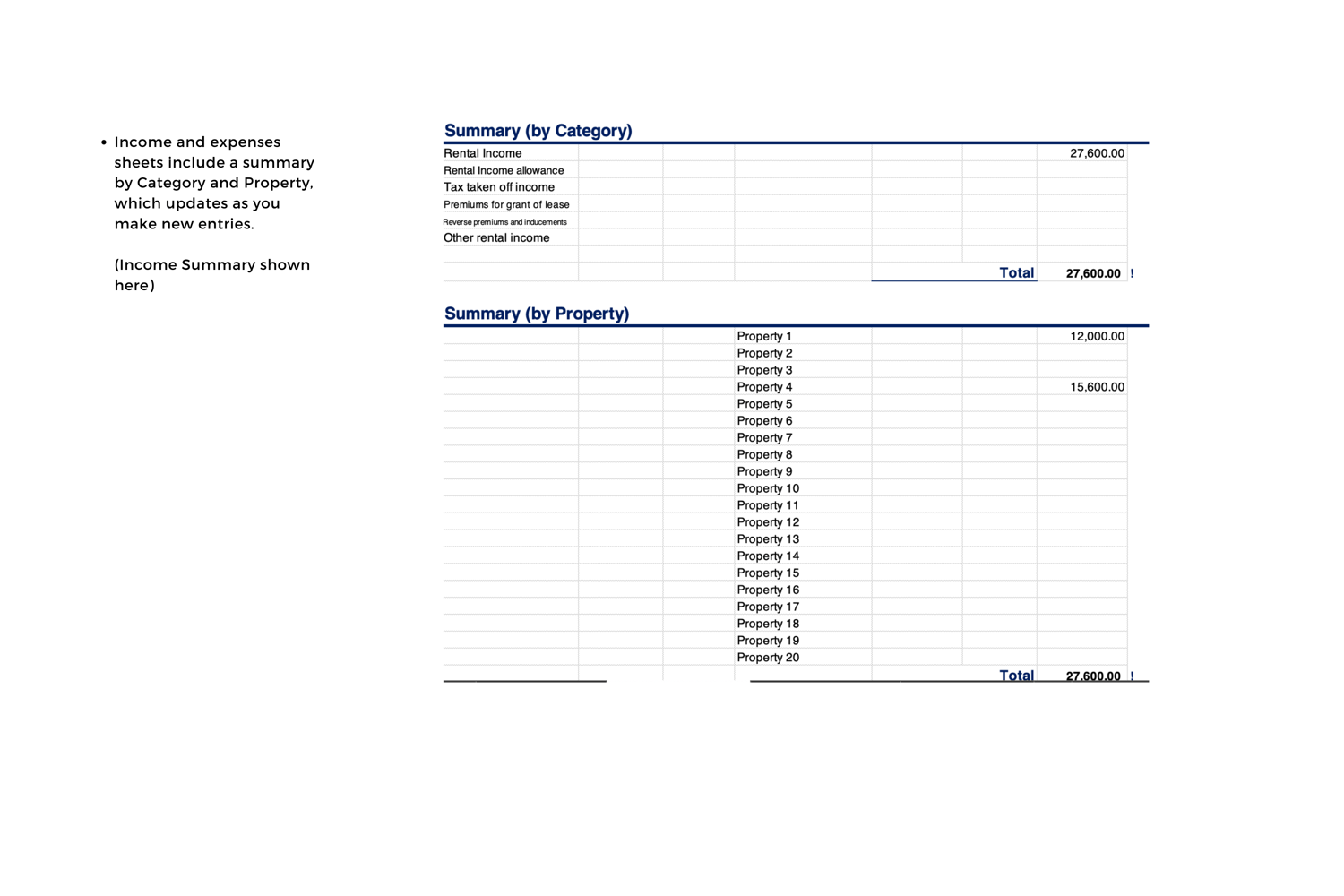

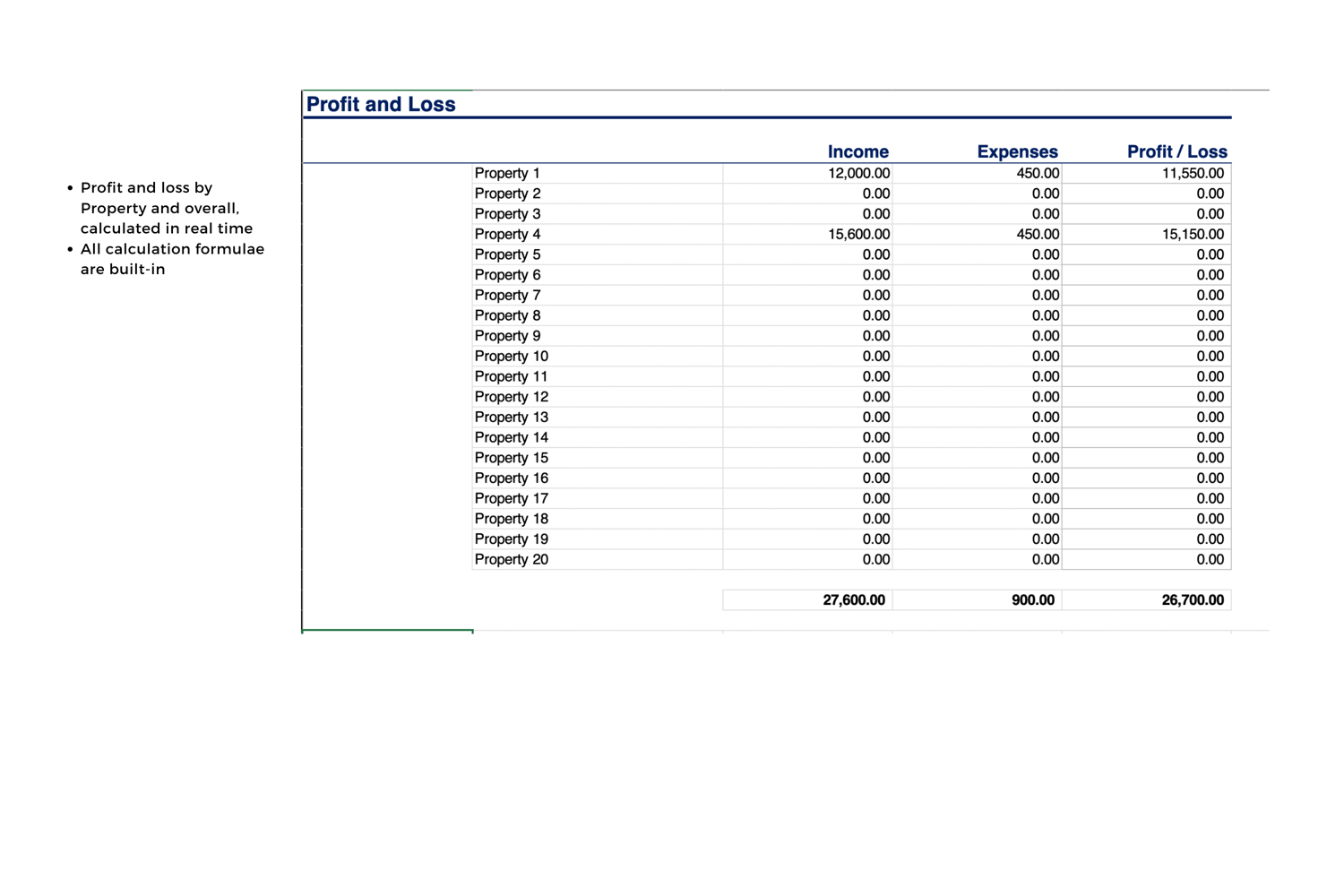

Add Income and Expenses in a ledger structure (see visuals). Simple and easy to use.

Choose appropriate categories and the relevant property as you make new entries. Summaries by Property and Income / Expense category as well as monthly, quarterly and annual totals calculate automatically.

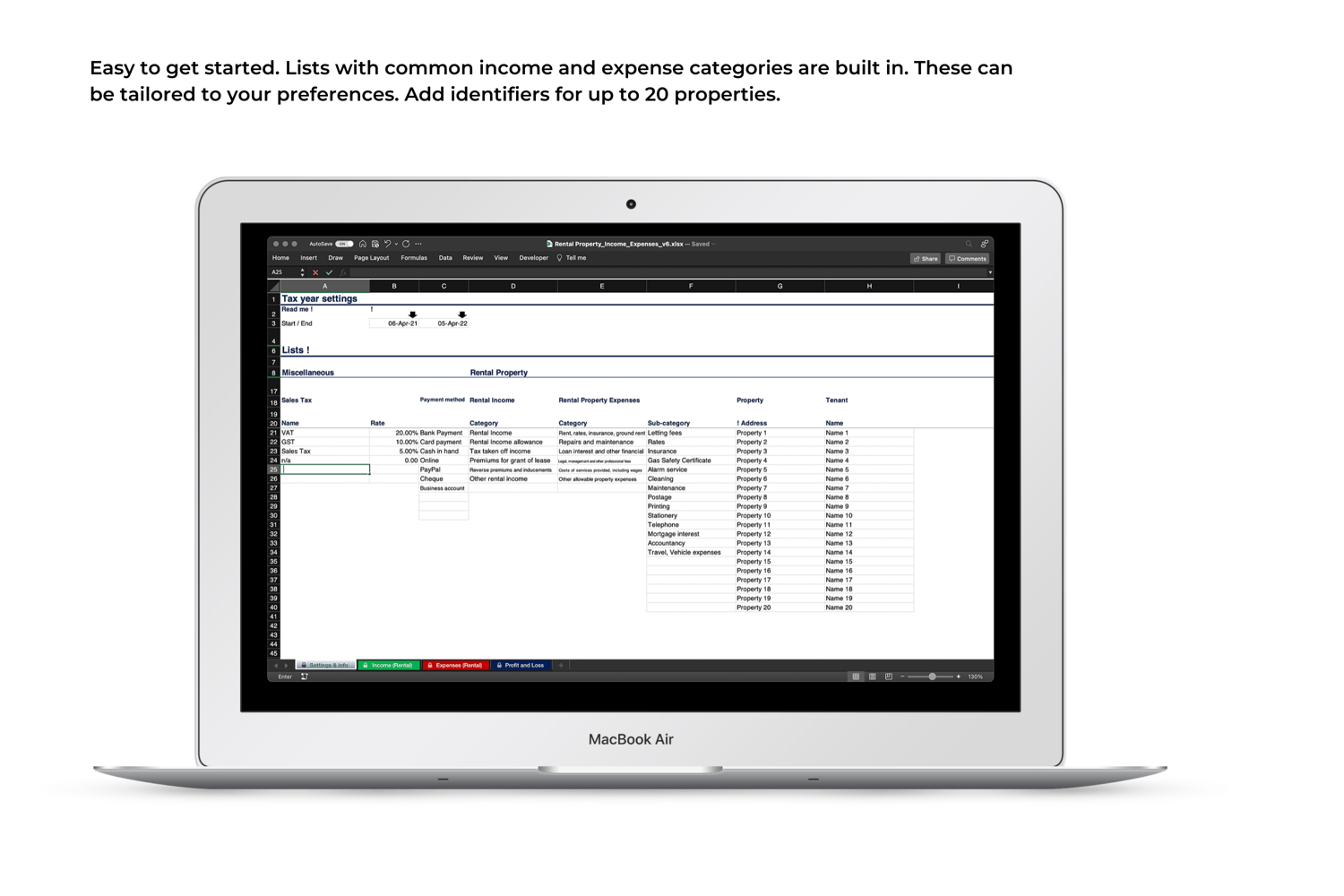

Lists of common income and expense categories are built in. These can be tailored to your preferred breakdown. The categories feed into pull-down lists from which you can select as you add figures, supporting you in fast and consistent bookkeeping for your accounts.

Folder structure is provided to support your record keeping, with slots for a range of typical bills and statements.

‘Recur’ function included. This copies regular income (such as monthly rental income from tenancies) and any routine expenses through all the months of the year in one action.

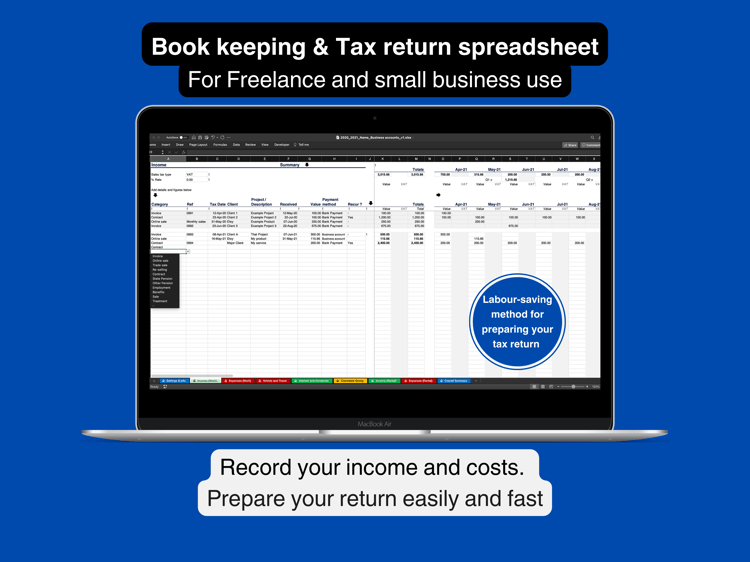

The categories included are based on those of the property element of UK tax return. These can easily be amended to reflect the requirements of your territory. All figures are presented in a currency-neutral style.

Please note that some of the visuals are from the Excel version of this product, also for sale from my shop. The functionality and layout is essentially the same but there may be small cosmetic variances between the two.

---

Limitations:

This product prompts the user to collate the core financials of the property element of a tax return. It provides some calculations but it not constitute a full tax assessment. Everyone’s finances are different and this spreadsheet does not claim to be able to cover every situation. I am not proposing it as a substitute for professional advice.

You should always consult an accountant, other form of tax expert or the tax authority for any further support you require to ensure your tax return is comprehensive and accurate.

Assumptions:

You will need a (free) Google account to download this spreadsheet and I assume basic Google Sheets skills on the part of the purchaser / user. You should be able to input figures and text into empty cells, edit content of cells and choose items from pull-down lists as required. You will need to navigate within and between separate pages and to be able to use the Save and Save as functions in order to manage your own versions of the worksheets as you progress with their use.

No skills with formulae are required. Calculations are built into the spreadsheets and are made automatically as you populate the relevant sections with your figures.

The template is designed to be re-used year after year, assuming the supplied template is kept intact.

---

Terms of use

I am here for your questions but I cannot provide detailed tuition as after-sales support. Google Sheets contains an in-depth Help facility. I am not able not provide refunds if you are unable to use it to the required standard.

If a formula or other feature appears not to work correctly you should revert to the downloaded template in the first instance. If the issue is present in the original version please contact me if you still feel anything is not functioning correctly. I am happy to address any bugs you may identify and re-supply an updated version.

These templates are strictly for personal use only. They are not to be modified, reproduced or sold in their original or modified form.

---

Technical spec / Compatibility

The spreadsheet is supplied as instructions for a Google Sheets download. Digital product. No physical material will be supplied.

This product been built and tested in Google Sheets. I cannot guarantee full functionality in Excel, Apple Numbers or any other spreadsheet package. I cannot offer advice or refunds based on problems using the sheet in packages other than Sheets.

The files supplied download as a zip archive. Please ensure you are able to open these on your computer. A double click will usually open the archive using software built in to most computers