In this report I will review the key points of my trading this week, focusing on the actual trades I took.

This Weekly Trade Report is published every Saturday.

When you read it together with Trade Scenarios, which I post every Sunday, I believe it will give you a useful reference for how I think in advance and how I actually execute trades based on those scenarios.

This is not advice saying “you should trade like this,” nor am I claiming that this is the correct answer.

It is not about showcasing individual winning or losing trades, nor is it about recommending a specific strategy based on those results.

My purpose is to show, at a practical level, how I repeatedly follow a consistent process based on pre-defined scenarios, and to offer that as a reference for your own strategy building and for achieving consistency in your process.

The outcomes I show are nothing more than my personal results, and they do not guarantee your future profits.

Please keep that firmly in mind, and when it comes to your own trading, make sure you carry out your own testing and preparation, and trade entirely under your own responsibility.

My trading is based on buying pullbacks and selling rallies on the 4h timeframe.

If you are interested in my pullback and rally strategy, please read my past blog posts on Dow Theory and multi-timeframe analysis.

Now, please take a look at the following charts.

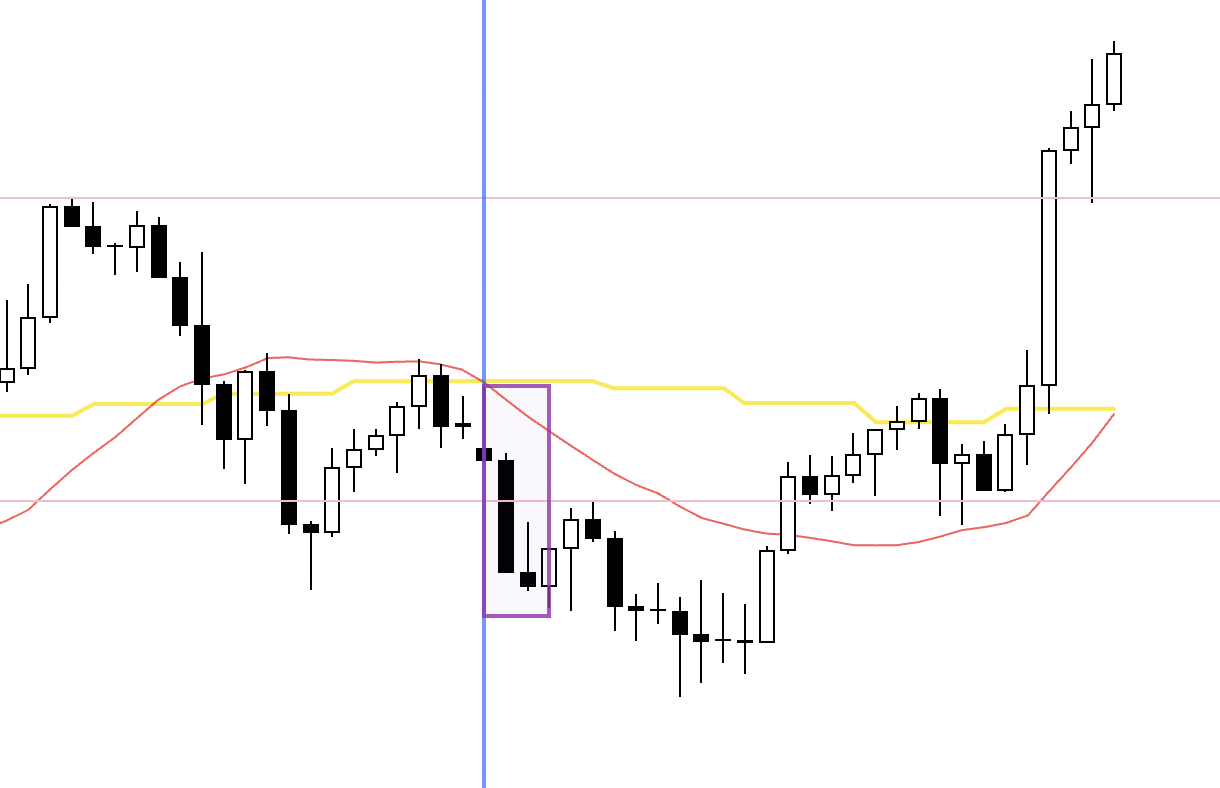

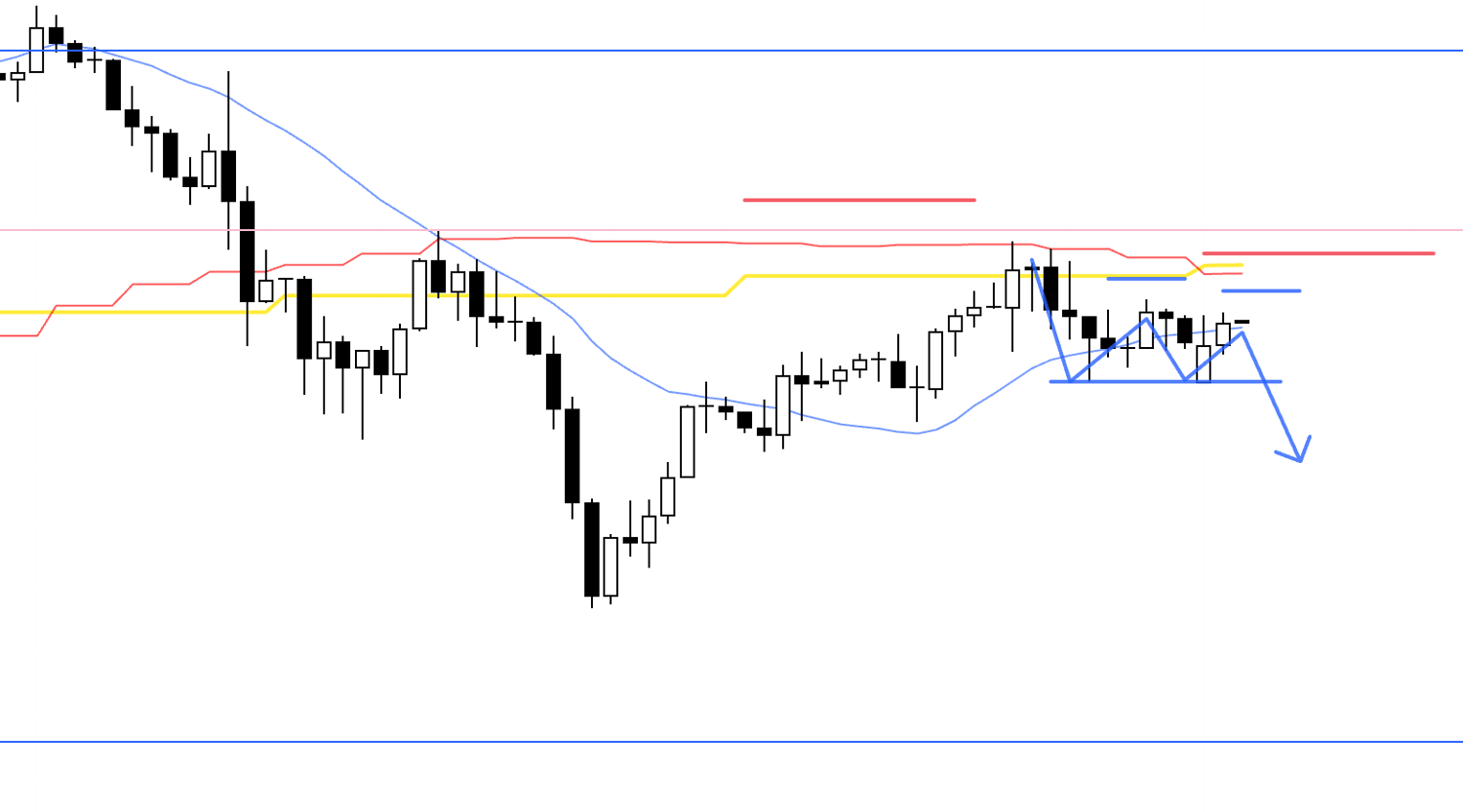

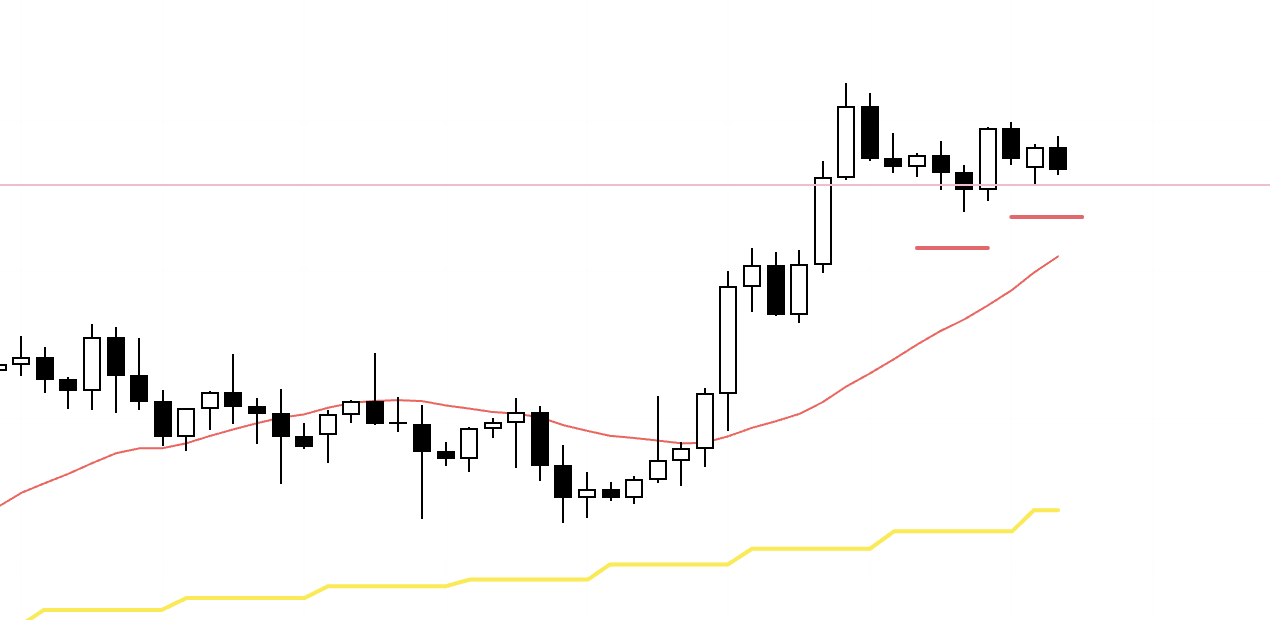

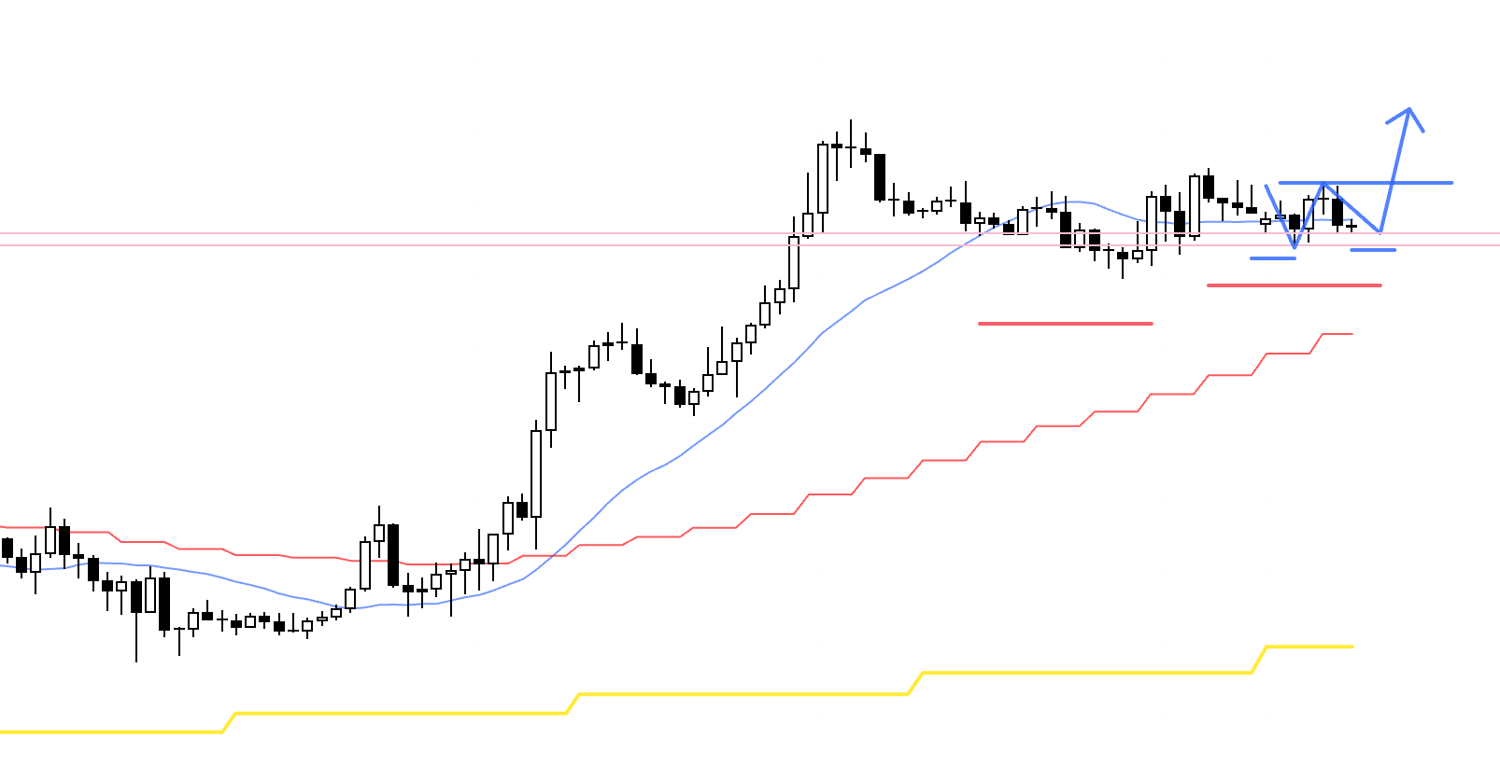

USDJPY 4h

Here is the 4h chart for USDJPY.

This week’s price action starts from the blue vertical line marked on the chart.

For USDJPY, I had sell orders placed at the area boxed on the chart this week, but I couldn’t enter because the entry conditions broke down mid-way.

I’m recording this section in real time while taking screenshots at the moment, so I’ll explain later exactly what I was thinking and how it went from placing the entry order to canceling it.

After that, the next pullback-sell area also didn’t form a tradable structure, so there was no trade.

And the late-week rise wasn’t a move I could trade either, because it was a daily pullback-sell zone and it coincided with major economic events.

Next, take a look at the EURUSD chart below.

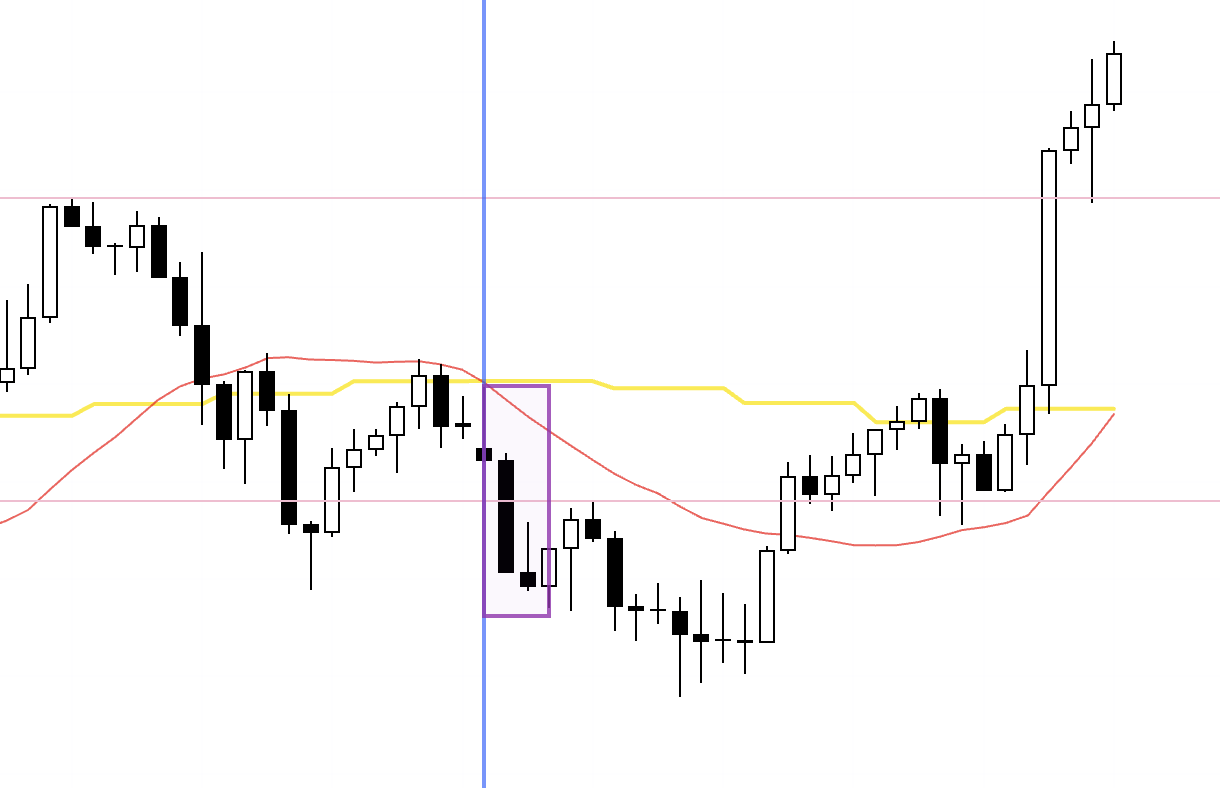

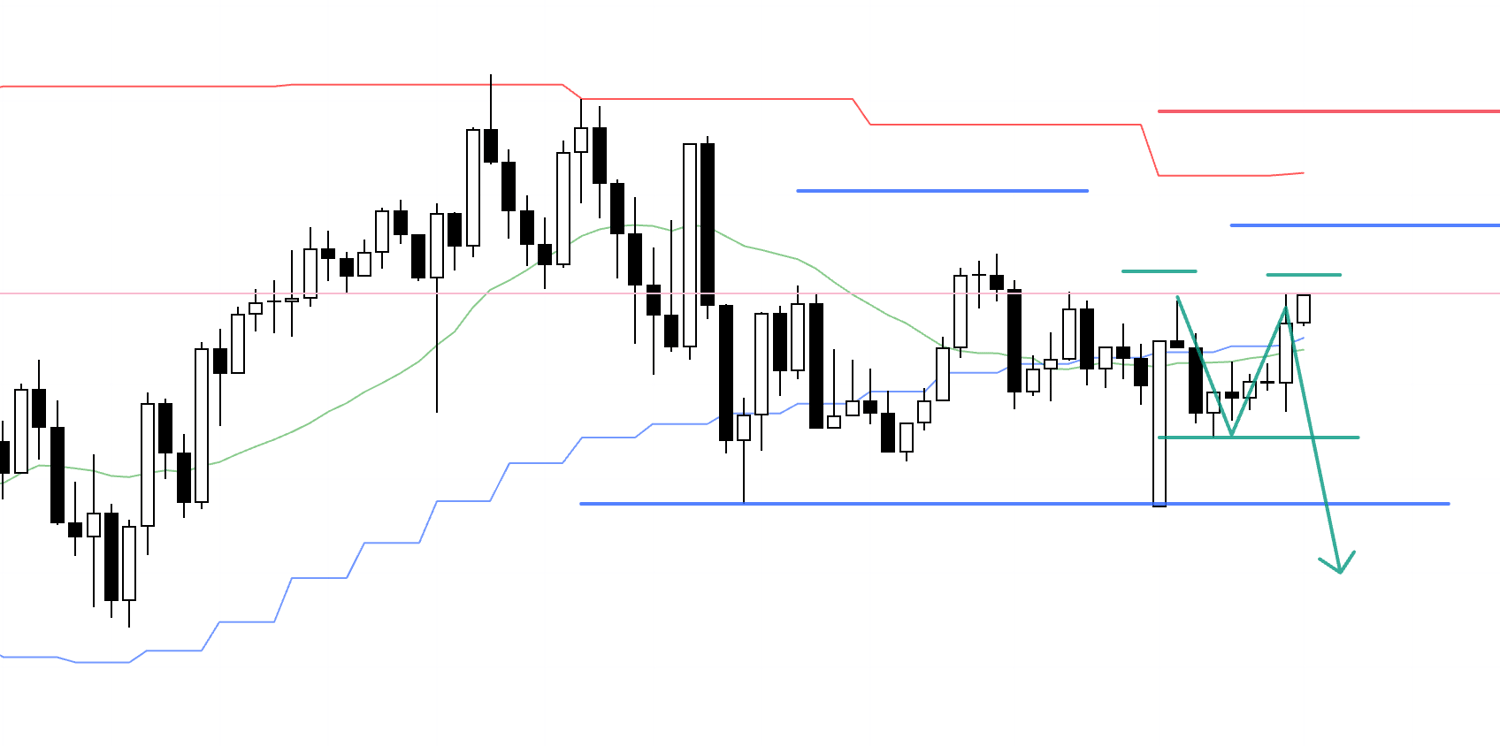

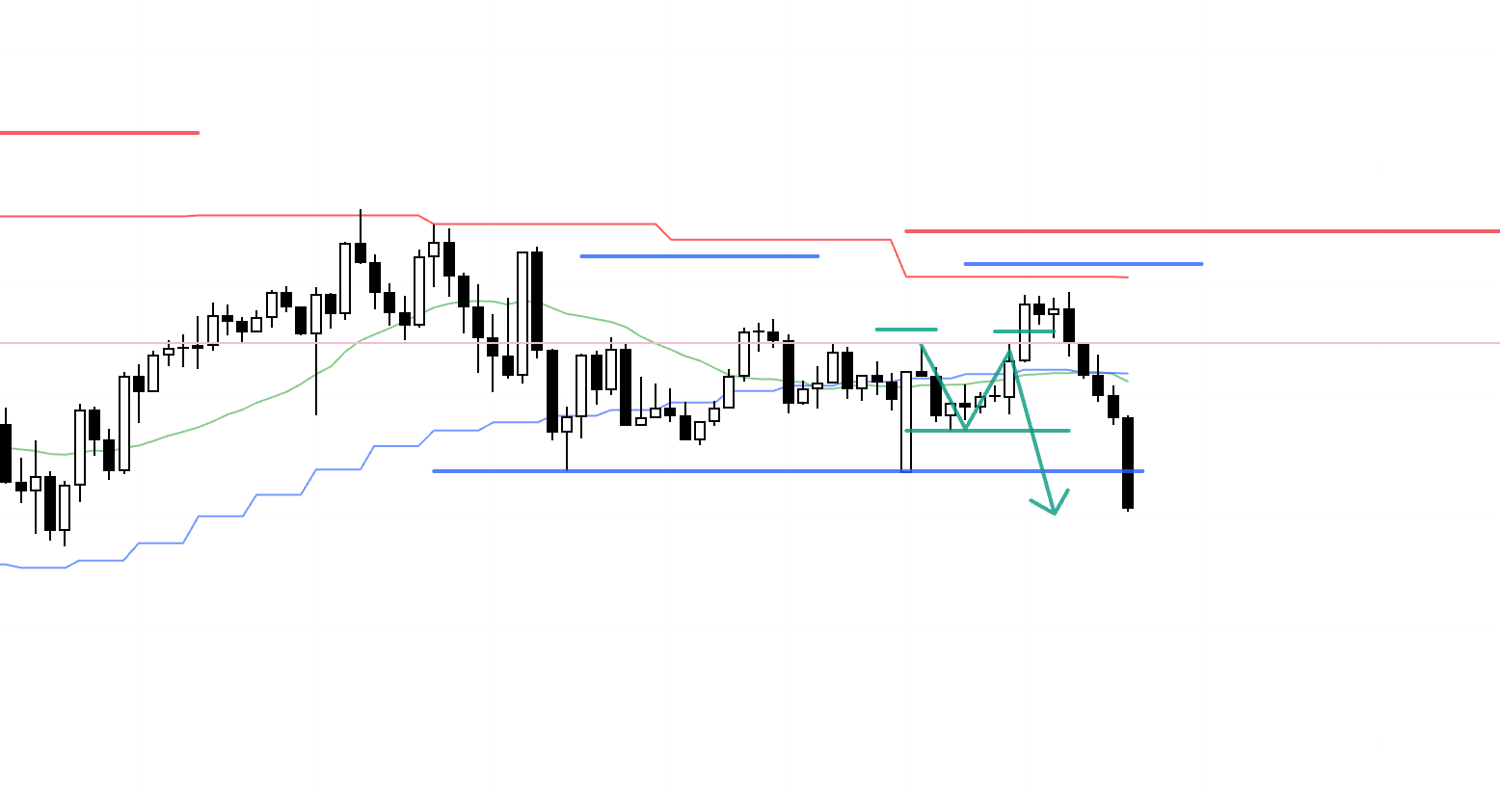

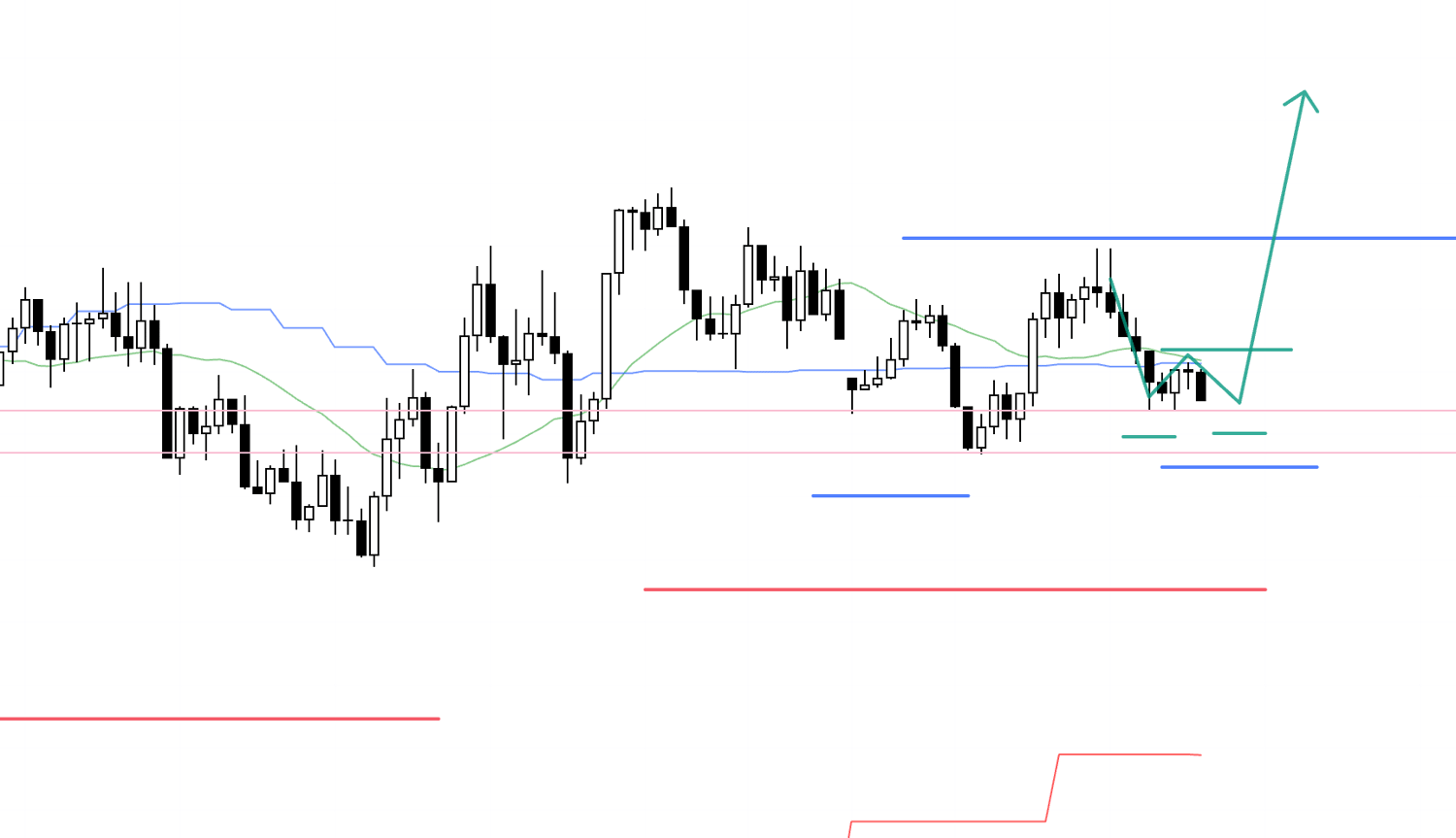

EURUSD 4h

This is the 4h chart for EURUSD.

The point where I considered a trade on EURUSD is the boxed area.

But just like USDJPY, although I had an order in place, price broke the prior low and invalidated the conditions, so I canceled the order and couldn’t take the trade.

Now I’ll explain the points I worked this week, while showing my real-time notes from those moments.

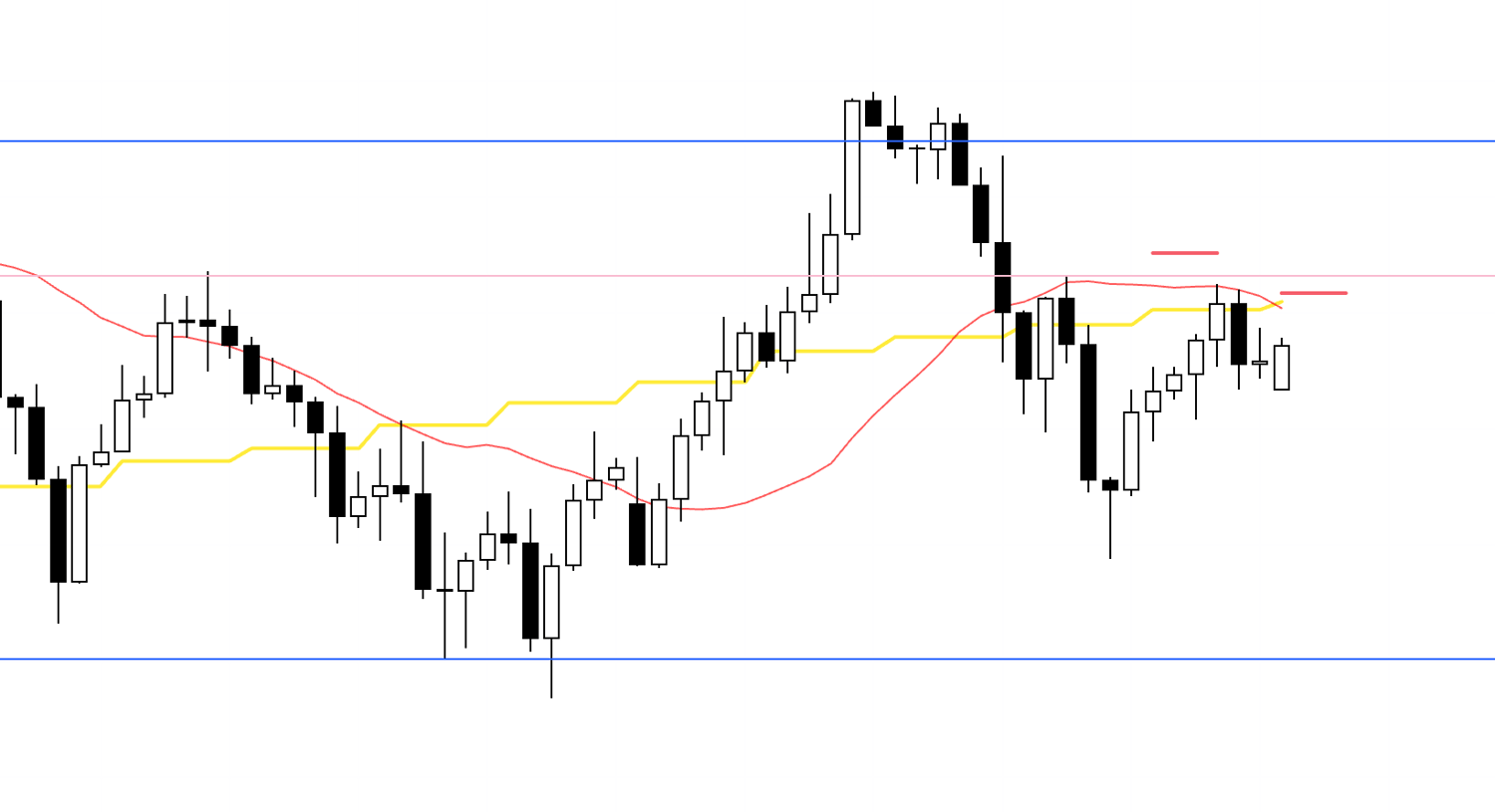

December 15 (Mon)

USDJPY

4h

This is a 4h pullback-sell area, so I’m waiting with a stop order set at the point where the lower-timeframe downtrend begins.

1h

On 1h, if price stops the prior uptrend like this, then prints lower highs and breaks to a new low, a fresh downtrend starts.

That preceding rise exists to form the 4h pullback structure, so it’s not a rally to buy—it’s a rally "to wait for a sell."

If price can’t break above the previous 4h high and then rotates into a downtrend, that becomes the entry point for following the 4h pullback-sell leg, where the sell side gains edge.

15m

On 15m, it looks like I might be able to enter even a step earlier.

Before waiting for the 1h low break, if 15m forms a lower high and then makes a new low, I’ll take it as a 15m short.

The entry would be on a break of the green line.

15m

After that I waited, but price went on to make a higher high, so I canceled the order.

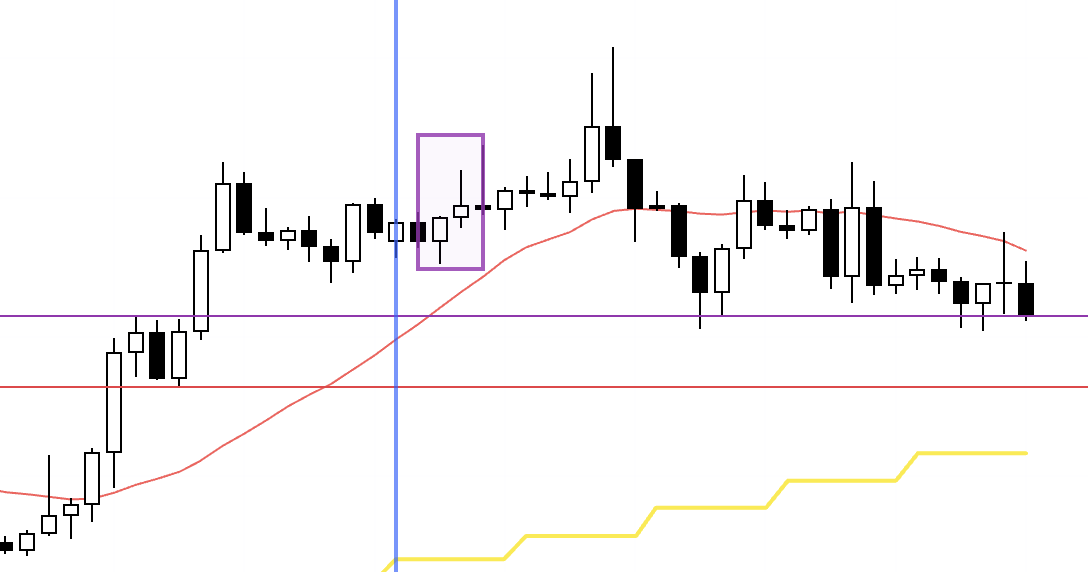

December 15 (Mon)

EURUSD

4h

A 4h higher-low structure has been forming here, so I set a buy order.

1h

On 1h, price first breaks the prior uptrend once, and then tries to restart a new uptrend by printing a higher low and breaking to a new high.

If price clears this 1h high, a new 1h uptrend begins, and because the 4h pullback-buy and the 1h trend reversal align, that’s where the long side gains edge.

15m

On 15m, it looks like I might be able to enter even a step earlier, but in this case the support line isn’t functioning cleanly and it doesn’t look very strong, so if price breaks even slightly below the low, I’ll pass.

I waited for the entry, but then price broke the low and invalidated the conditions, so I canceled the order.

That’s it.

In the end, I couldn’t take a single trade this week.

What many people tend to think in situations like this is: "If I had thought about it this way, I could’ve traded," or "I missed it."

Before the entry, no one can know whether that trade will end as a win or a loss.

All you can do is judge based on the information available at that moment, and if the chart in that moment breaks your conditions, then passing on the trade is the correct decision.

It’s extremely important to increase your sample size using only trades taken through correct decision-making.

Once you start getting pushed around by hindsight, trading quickly shifts from a probabilities game into a win-or-lose game.

As I wrote in last week’s scenario blog, both USDJPY and EURUSD were in a difficult market environment this week.

But if it’s clear "what would create edge for a buy," "what would create edge for a sell," and "what to be careful about when that happens," and you can build a scenario based on that, the "difficulty" disappears.

"Difficulty in market conditions" does not affect "difficulty in execution."

A trader’s key standard of value is: "Did I follow the rules of an edge-based system?"

Suffering begins when you redefine that as "winning the trade in front of me and making money."

That mindset clashes with market uncertainty, destroys consistency, and keeps generating endless suffering with no guaranteed answer.

Precisely because trading is a world of uncertainty, it matters not to demand answers from a single outcome, but to think in terms of a large sample size.

And it matters to consistently execute a system that you have thoroughly tested and practiced across a large sample size beforehand.

This isn’t just about understanding it intellectually—what matters is having experienced it through repeated practice and understanding it physically, at a gut level.

Thank you for reading to the end.

I hope my blog can offer hints to those who are about to build a strategy, and to those who are struggling because they can’t find consistency.

If this blog was helpful, my book will take your probabilistic thinking to the next level.

📚 Get your copy here.